Task

Ranking

已登录

Bee登录

Twitter 授权

TG 授权

Discord 授权

去签到

下一页

关闭

获取登录状态

My XP

0

0

+0

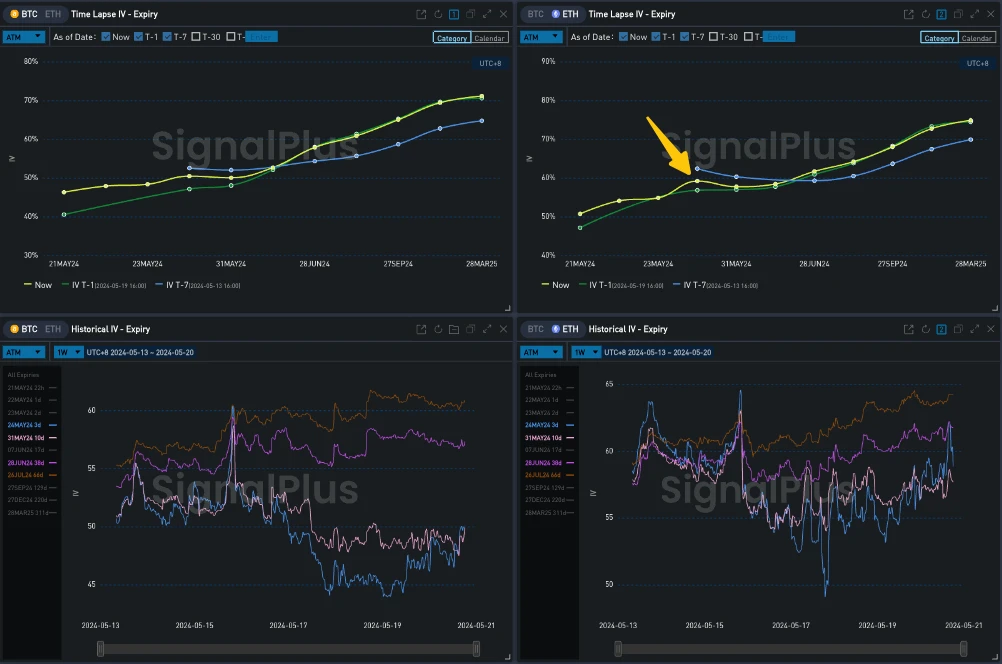

在數位貨幣方面,本周美國SEC預計將於當地時間5月23日公佈VanEcks ETH現貨ETF的最終決定,引發市場高度關注。從選擇權市場的波動定價可以看出,ETH 5月24日ATM成交量這幾天持續上漲,並形成局部高點。整體水準也較BTC Vol.5-10%高。由於前端的波動溢價較高,此期限的斜率也較平坦。對於加密貨幣社群來說,這無疑是一個重要時刻。雖然市場對ETH ETF的核准相對樂觀,但近期ETH的疲軟走勢似乎顯示市場已經消化了這次以太坊的拒絕。分析師認為,ETH ETF預計在明年獲得批准,這將為投資者提供更多的投資機會,推動整個加密產業的發展。

資料來源:SignalPlus、BTC ETH ATM 卷

來源:Deribit(截至 5 月 20 日 16:00 UTC+ 8)

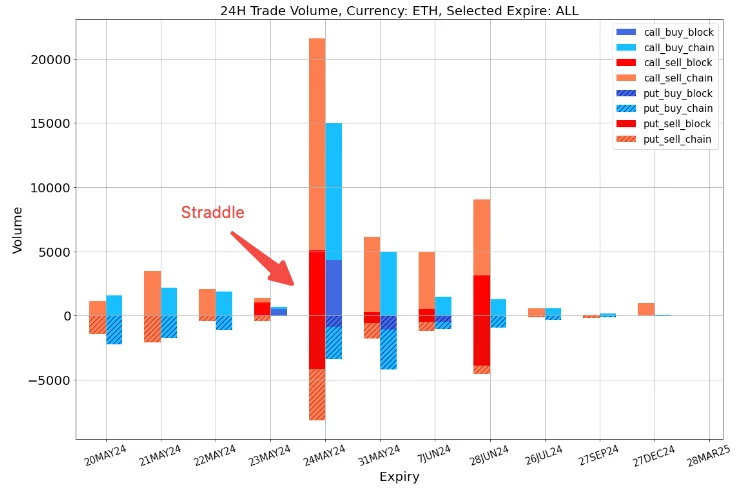

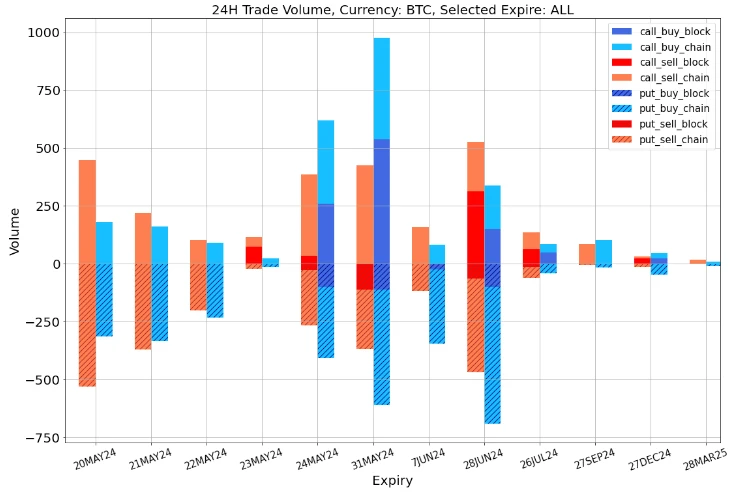

交易方面,ETH 24 MAY 由於局部 IV 高點的形成,吸引了一批每腿 3250 ETH 的 Sell Straddle 交易,押注 IV-RV 的溢價。 BTC方面,過去一天5月和6月出現大量多頭賣權交易,推動Vol Skew在此區間下跌。

資料來源:Deribit,ETH交易整體分佈

資料來源:Deribit,BTC交易整體分佈

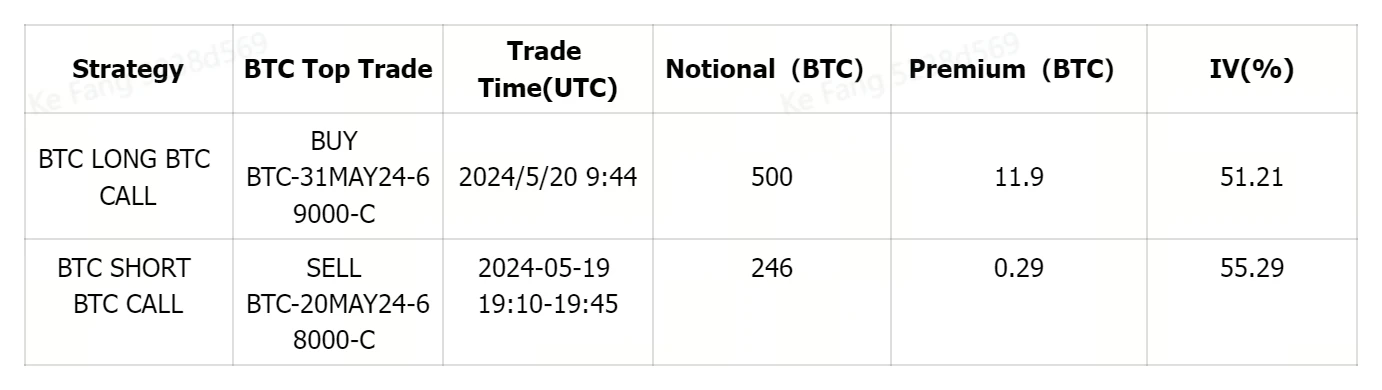

來源:Deribit 大宗交易

來源:Deribit 大宗交易

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

本文來源於網路:SignalPlus波動率專欄(20240520):本週ETF決議

簡而言之,Tron 價格一段時間以來一直試圖收在 $0.121 上方,更廣泛的市場線索可能會引發反彈。 MACD 和 ADX 目前都表現出潛在的看漲跡象。過去 24 小時內資金利率上升,顯示樂觀情緒高漲。未來幾天,波場 (TRX) 的價格可能會因更廣泛的市場線索和投資者的看漲情緒而上漲。問題是 TRX 是否能堅持到底,還是會中途停止。 Tron 投資者看到了潛力 Tron 的交易價格為 $0.118,觀察到了一些看漲線索,這些線索主要來自投資者。這在資產的融資利率中很明顯。加密貨幣中的資金費率是指交易者之間為平衡市場而支付的費用。積極的…