Task

Ranking

已登录

Bee登录

Twitter 授权

TG 授权

Discord 授权

去签到

下一页

关闭

获取登录状态

My XP

0

0

+0

早盤股價再次挑戰歷史高點後回落,而美國公債也出現看跌走勢,短期收益率因進口價格大幅上漲而小幅上漲(環比0.7% vs 環比0.11)預期為 TP9T)。

直到下週三英偉達財報發佈時,幾乎沒有什麼重要數據,選擇權意味著股價波動幅度為 +/-8%,略低於 2 月的兩年平均值 +/-8.4% 和 +10.9%。鑑於晶片巨頭在 SPX 中的權重過大,8% 的隱含波動率意味著對 SPX 的影響約為 0.4%,更不用說對該指數中其他相關股票情緒的溢出效應。

除了高於預期的進口價格之外,夏季駕車旺季期間油價的預期反彈可能會使 CPI 壓力持續到 8 月份,儘管通膨交易商仍然相信 CPI 將在年底前回落到 2.5% 以下。

對通膨的堅定信心和缺乏經濟風險使得市場純粹關注利率趨勢,導致自12月中旬以來美國公債殖利率與股價之間呈現完美負相關。換句話說,股票和債券價格在完美理想的繁榮中同步上漲,(再次)忽略了經濟進一步放緩、頑固的通貨膨脹或估值調整可能帶來的尾部風險。

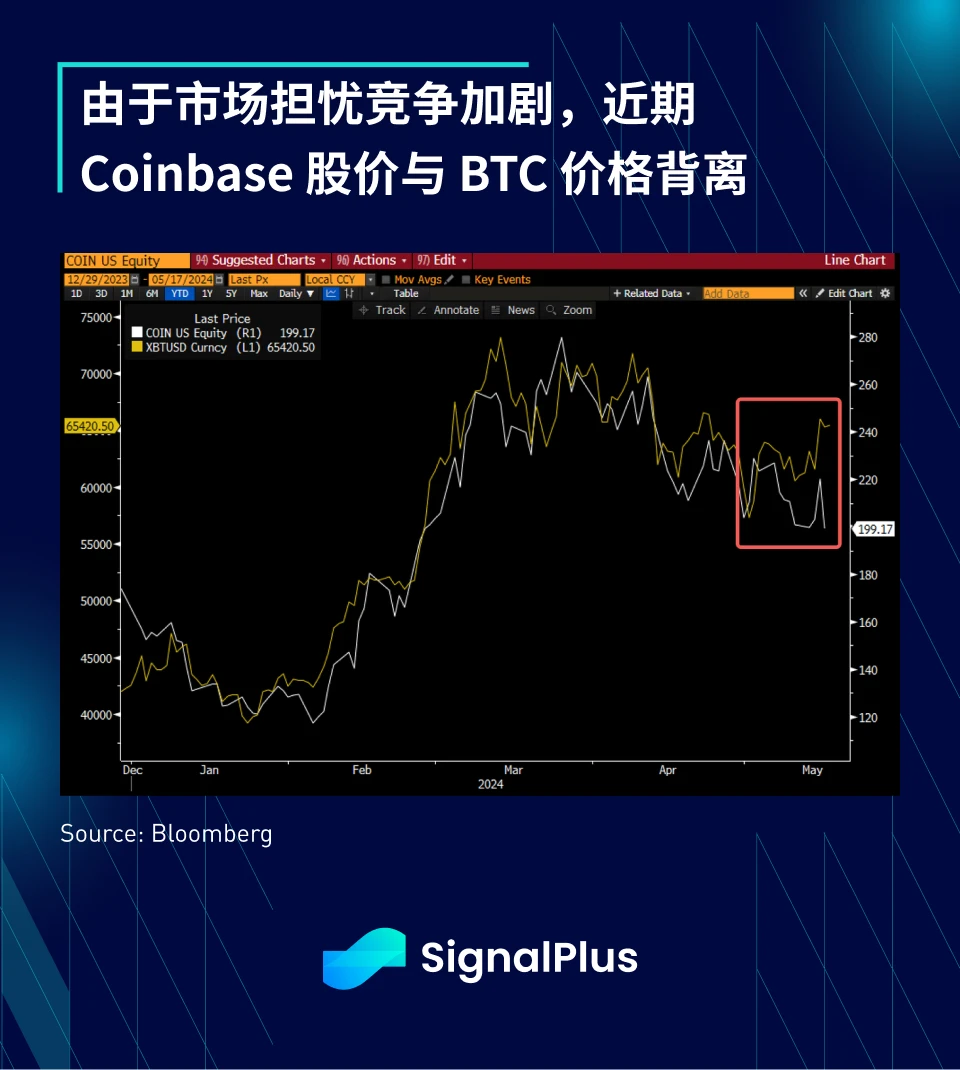

加密貨幣領域沒有太多值得關注的消息,BTC 穩定在近期高位,交易活動持平。然而,Coinbases股價昨日下跌9%,與BTC價格出現明顯背離,因投資人開始擔心CME等機構進入現貨交易業務將導致合規領域競爭加劇。 TradFi的進入無疑會帶來產業所需的資金流入,但也必將引發新的競爭。一兩年後加密貨幣市場會是什麼樣子?我們拭目以待。

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

本文源自網路:SignalPlus宏觀分析(20240517):完美的理想繁榮回報

相關:梅林鏈創辦人Jeff:產能擴張、生息與資產互換,梅林鏈原生創新如何實現

在5月的BitcoinAsia大會上,默林鏈創辦人Jeff發表了題為《從比特幣L1到默林鏈原生創新》的演講,深入探討了默林鏈原生創新如何賦能比特幣生態。他回顧了比特幣生態的演變,並深入探討了默林鏈原生創新將如何推動比特幣生態的發展。以下為演講全文,依現場錄音整理。在2023年之前,比特幣一直被視為價值儲存的數位黃金,沒有人圍繞比特幣創造新的概念和應用。但在 2023 年中期的 Ordinals 熱潮之後,越來越多的人開始在比特幣網路上創建 NFT 相關內容,發行 BRC-20、BRC-420、ORC-20 等資產,然後是 Atomicals…