過去24小時,市場上出現了許多新的熱門幣種和話題,很有可能就是下一個賺錢的機會。

- Sectors with strong wealth-creating effects are: mainstream currency sector, TON ecosystem, and MEME sector;

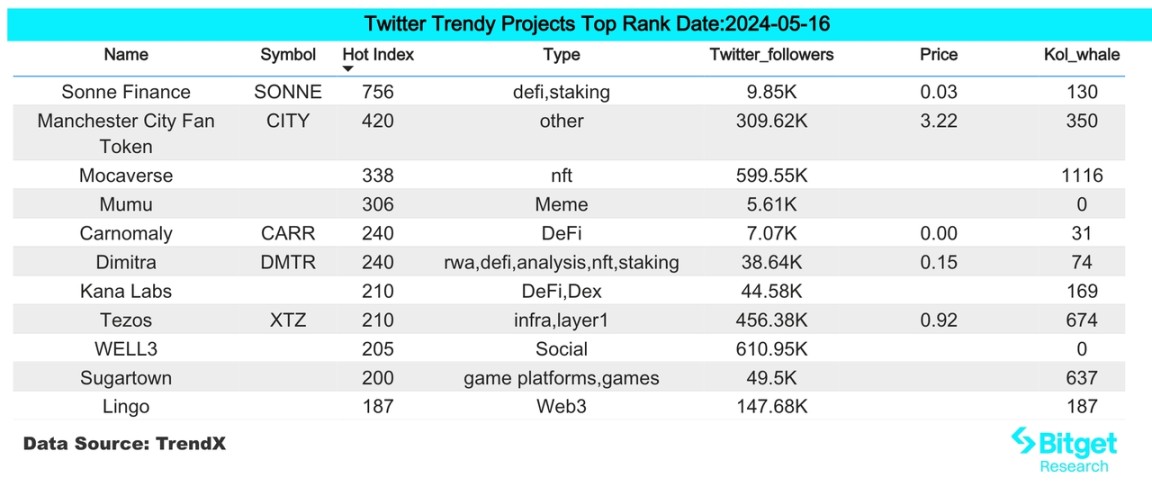

- Hot search tokens and topics by users: PIXELS, Sonne Finance, GME

- Potential airdrop opportunities include: Tonstakers, Bemo

Data statistics time: May 16, 2024 4: 00 (UTC + 0)

1、市場環境

Yesterday, the U.S. CPI data for April was released. The data was in line with expectations and showed a turning trend, which was generally interpreted as positive by the market. Traders generally bet on two interest rate cuts in 24 years. Market activity increased, and mainstream cryptocurrencies all saw a single-day increase of around 10%.

In terms of BTC ETF, the total inflow of funds yesterday was 303 million US dollars, showing that the capital market has shown an optimistic attitude towards the multiple interest rate cuts by the Federal Reserve this year. Similarly, in the recent information on BTC ETF holdings released by major institutions, more and more pension funds, top asset management companies, and banks have allocated BTC ETFs, and such institutions generally allocate gradually, indicating that the purchasing power of BTC ETFs will continue to grow in the future.

In the crypto industry, Blast confirmed its airdrop on June 26. At the same time, several larger projects have recently confirmed their token economy and are about to carry out airdrops or TGEs, including LayerZero, Orbiter, Debank, etc.

2. 致富領域

1) Sector changes: mainstream currency sectors (BTC, ETH, SOL)

Main reason: The core reason for the collective rebound of mainstream currencies yesterday was the cessation of the rise in CPI data, which was generally interpreted by the market as inflation being under control. Therefore, the market generally believes that the Federal Reserve is expected to cut interest rates twice this year. Capital markets and risk markets generally rose sharply, with Nasdaq, Dow Jones and SP 500 all hitting record highs. The mainstream assets of the crypto industry, BTC, ETH and SOL, also swept away the haze of the past two weeks.

Increase: BTC increased by 7.6% in the past 24 hours, ETH increased by 5.5%, and SOL increased by 13.75%;

影響後市的因素:

- Further positive news at the macro level: At present, the trend of mainstream crypto assets such as BTC basically shows a positive correlation with the liquidity of the US dollar. As the Federal Reserve gradually releases liquidity to the market, crypto assets will also gradually rise. However, in this process, investors should also pay attention to the Federal Reserves management of market expectations and keep up with the pace of policy;

- ETF approval and ecosystem development: For ETH, whether the ETF can be approved in the near future is an important factor in determining whether ETH can break out of the trend market. For SOL, whether the ecosystem can continue to prosper and gain more market adoption is the core factor that determines whether SOL can continue to rise in the future.

2)未來需要重點關注的板塊:TON生態系統

Main reason: TON ecosystem TVL has grown rapidly recently, and the current ecosystem TVL has reached 508 million US dollars. According to the development history of the public chain in the past, corresponding infrastructure projects have appeared on the TON chain, such as Liquid Staking, Swap, Lending, etc., and a head aggregation effect has gradually formed. Investors can participate in such projects, not only to reap higher APR in the early stage, but also to obtain potential airdrop opportunities.

具體項目清單:

- Tonstakers: This project is the largest liquidity staking service provider in the TON ecosystem. Users can stake TON in this protocol to earn an annualized return of 3.8%. At the same time, the project has not yet issued tokens, and there is an airdrop expectation;

- STON.fi: This project is currently the largest DEX in the TON ecosystem. Some LP pools also receive support from the TON Foundation. Users can provide liquidity in the DEX to earn income. At the same time, the project has not yet issued coins, and there is an airdrop expectation.

- EVAA Protocol: This project is the largest lending project in the TON ecosystem. Users can deposit tokens into the protocol to enjoy lending interest rates. The project has not yet issued tokens, but airdrops are expected.

3) Sectors that need to be focused on in the future: MEME sector

The main reason: With the return of RoaringKitty, American retail investors have become active again. RoaringKittys influence on the US retail investor group is evident. After the tweet, the US stocks GME and AMC both rose sharply, and this sentiment will also spread to crypto assets. Similarly, WSB has also been actively interacting with the currency circle recently, so it is very likely that some MEME assets will be used for speculation later.

具體幣種列表:

- PEPE: PEPE is the most suitable for the speculation group of American retail investors in terms of imagery. The group is easy to be sentimental. At the same time, PEPE is relatively active in trading, and its price is prone to surges and plunges.

- PEOPLE: The main feature of this project is that the project owner has almost given up on the project, but it still has a high hype popularity. The core reason for the recent surge in PEOPLE is the long squeeze.

- FLOKI: As an old-fashioned MEME, FLOKI has been quite active recently and is worthy of attention.

3.用戶熱搜

1) 流行的Dapp

PIXELS (Dapp): Pixels is a social casual Web3 game based on the Ronin network, with an open world game environment for exploration, farming, and creation. According to DappRadar data, Pixels UAW has reached 740,000, with a large user scale. A major feature of Pixels is that it combines the player earning (play-to-earn, P2E) function and farmland NFTs, aiming to provide a comprehensive gaming environment through PIXEL tokens, closely integrating currency use and gameplay, and is widely loved by players.

2)推特

Sonne Finance (Dapp): The project is a decentralized, non-custodial liquidity management protocol deployed on the Optimism and Base public chains. Yesterday, it was reported that Sonne Finance was hacked and had lost 20 million US dollars. The hackers attack method was a flash loan attack, borrowing VELO tokens and sending them to the soVELO contract through transfer, and then creating a contract to borrow Sonne Finance tokens. The continuous operation led to the theft of project funds. The risk of on-chain DeFi projects is relatively high, and it is necessary to pay attention to managing the interaction risks of on-chain projects.

3) Google Search Region

從全球角度來看:

GME (Shares, Token): The return of Keith Gill, a well-known Wall Street trader, has led to a sharp rise in GME (Gamestop) in the US stock market. The price has risen rapidly from US$17.46 to US$64, triggering 4 circuit breakers for individual stocks. The price began to fall sharply yesterday, falling 20% in a single day, and the market is paying close attention. The rise of GME has directly driven the market of MEME coins in the crypto market. Bitget has launched GME, and you can continue to pay attention to trading opportunities.

從各地區熱搜來看:

(1) Yesterday hot searches in the English-speaking region were mainly focused on GME, AMC, and PEPE:

GME, AMC, PEPE (Token): The tokens that have recently moved in the secondary market and DEX, the market of Meme coin is sudden and sporadic. The market of Meme coin is generally dominated by spot, and it is necessary to pay attention to the entry, stop profit and stop loss points from the technical indicators. It is recommended that users participate in transactions and be alert to risks and try to do intraday transactions.

(2) Pay attention to the overall market situation in Africa, Asia and other regions:

BTC Yesterday, the U.S. Department of Labor released the CPI data for April, which increased by 3.4% month-on-month, and the core CPI increased by 3.6% month-on-month, which was in line with market expectations. Compared with the previous month, the CPI data was slightly lower, which was interpreted by the market as the CPI peaking and falling. The U.S. dollar index and U.S. bond yields fell sharply, and BTC rose by $5,000 in a single day, attracting the attention of users in Africa, Asia and other places.

4. 潛力 空投 機會

噸斯塔克斯

Tonstakers is the largest liquidity staking service provider in the TON ecosystem. Users can stake TON in the protocol to earn an annualized return of 3.8%. The current project TVL is 240 million US dollars, and the potential valuation is relatively high.

該計畫受到了Ton基金會的關注,目前該協議有68,000名質押者。計畫與Ton核心開發商、Tonkeeper、OKX等機構合作,未來發幣將獲得支持。

具體參與方式: 1)造訪專案官網,點選立即質押; 2) 將 Ton 錢包連結到質押。

Bemo

Bemo is the second largest liquidity staking service provider in the TON ecosystem. Users can stake TON in the protocol to earn an annualized return of 3.9%. The current project TVL is 60 million US dollars. It is an early project in the TON ecosystem and has a large space.

The project official website has launched an airdrop operation, where Bemo application stakers can receive xtXP rewards, which can be exchanged for $BMO tokens in the future.

具體參與方式: 1)造訪專案官網,點選立即質押; 2) 將 Ton 錢包連結到質押。

Original link: https://www.bitget.com/zh-CN/research/articles/12560603809685

isclaimer he market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this is at your own risk.

This article is sourced from the internet: Bitget Research Institute: Cryptocurrency market rebounds across the board, Blast airdrop confirmed on June 26

相關:比特幣將增加五名新的 BIP 編輯器。這會對生態系的發展產生什麼影響?

Original author | CoinDesk Compiled by Nan Zhi from Odaily Planet Daily Bitcoin’s open-source development is often touted as one of its strengths, demonstrating the network’s resilience and elusive nature. But a closer look reveals that something as complex as developing, updating, and patching the blockchain in real time often presents challenges. One of the main problems over the past few years has been a bottleneck in editing BIPs (Bitcoin Improvement Proposals), which is a standard for proposing non-binding software updates that would change the Bitcoin protocol in some way. That’s about to change as the globally distributed Bitcoin development community has decided to nominate five new BIP editors. This is the first time in Bitcoin’s history that more than one person has held the position, a role that for…