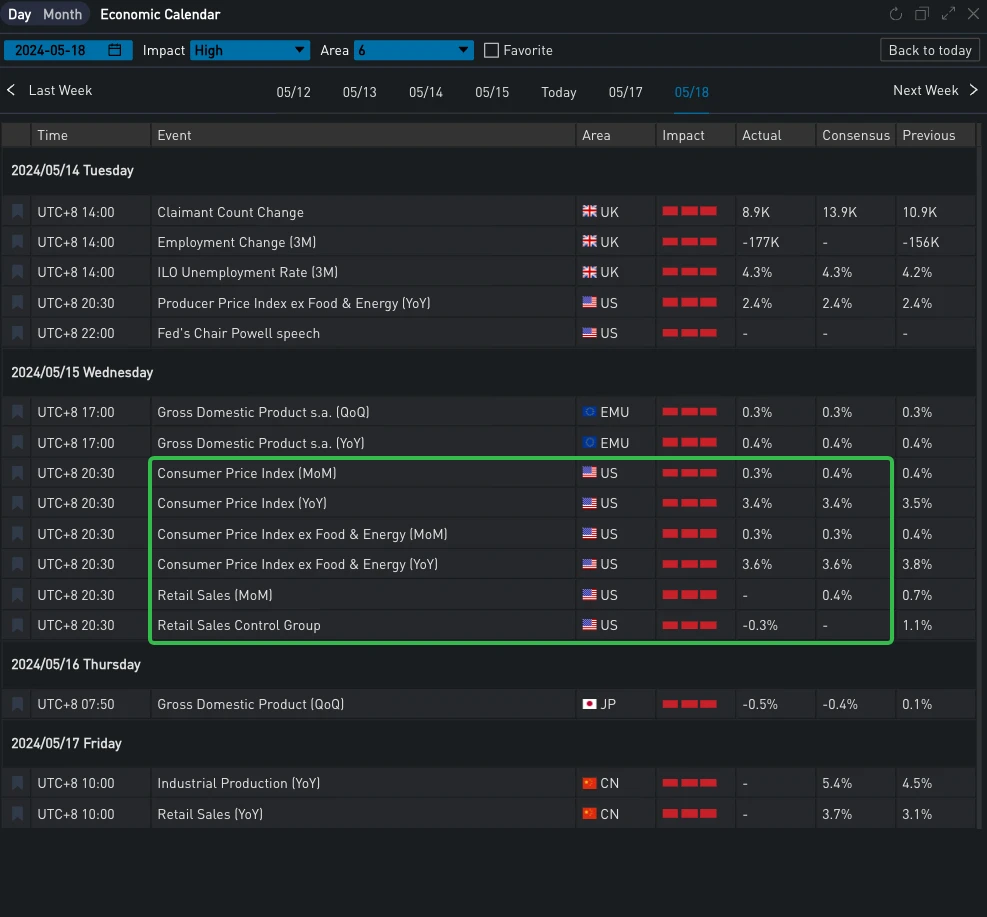

昨天(24年5月15日),重要經濟數據公佈。連日來,連續三個通膨數據超出預期,而美國CPI指數則大致符合預期;零售數據出人意料地持平,延續了近期消費者數據的疲軟態勢。儘管目前通膨水準和動能仍遠高於聯準會目標,但這兩項數據在一定程度上緩解了市場對物價重新加速的擔憂,恢復了市場對聯準會9月降息的信心,美債收益率下跌短期內。美股三大指數也收漲約1%,創下歷史新高。

資料來源:SignalPlus、經濟日曆

資料來源:投資

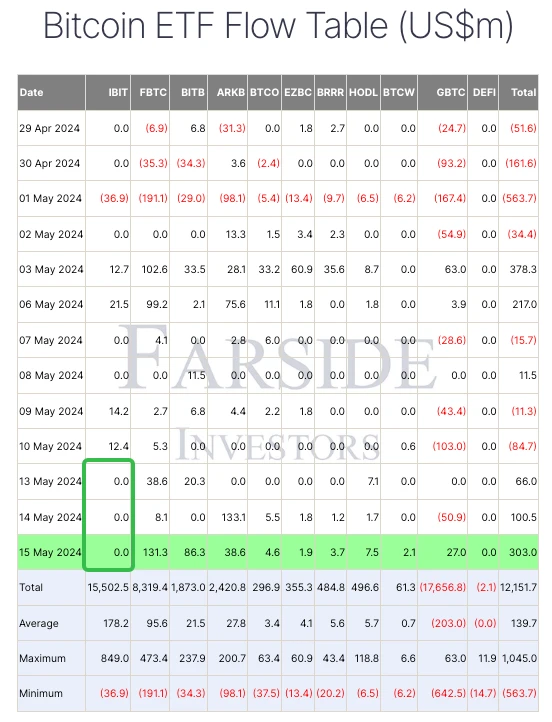

數位貨幣方面,受美國經濟數據疲軟提振,BTC價格一路上漲,突破66,000大關,引來社區狂歡。近期BTC現貨ETF的流入也比較健康。雖然IBIT不再有成長,但昨日單日總流入量達到303 $m,主要由FBTC和BITB貢獻。另一方面,從下面的比較圖可以看出,ETH在本輪行情中的表現相對較差。過去24小時內,BTC漲幅僅上漲一半,回到3,000美元附近。

來源:TradingView

資料來源:Farside 投資者

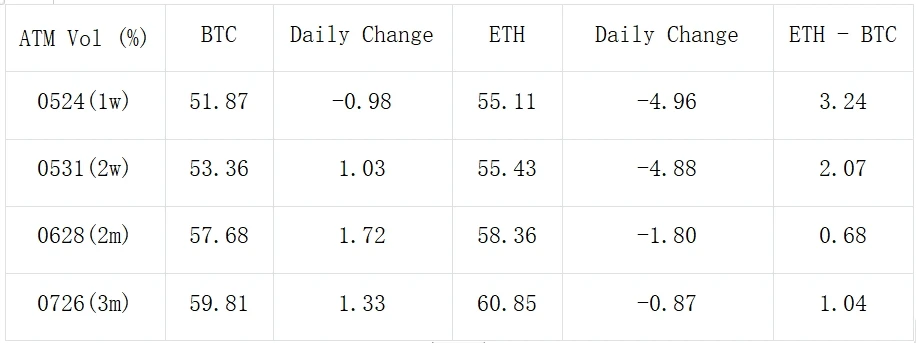

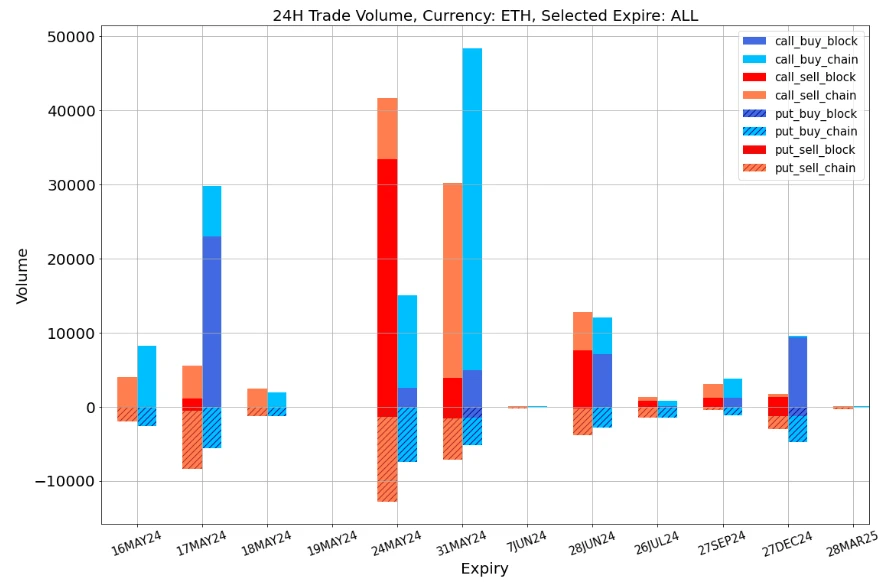

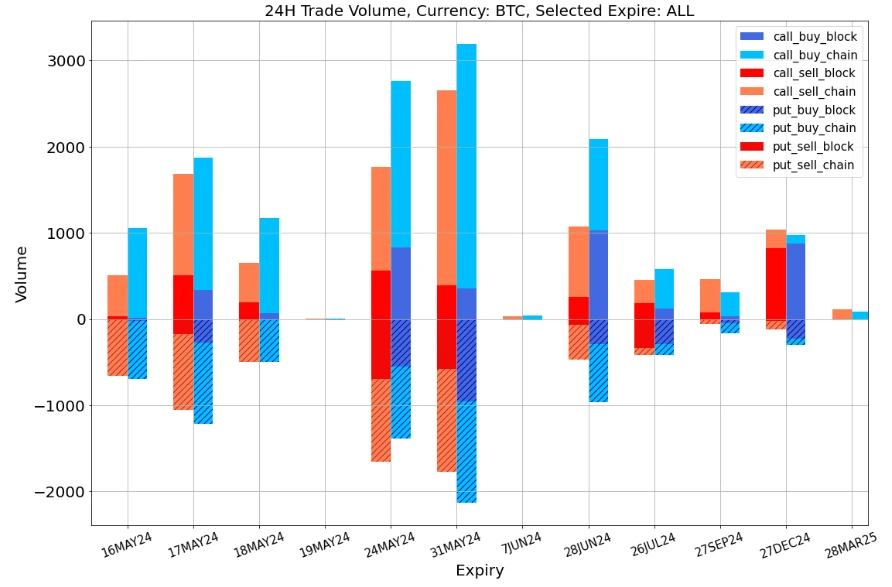

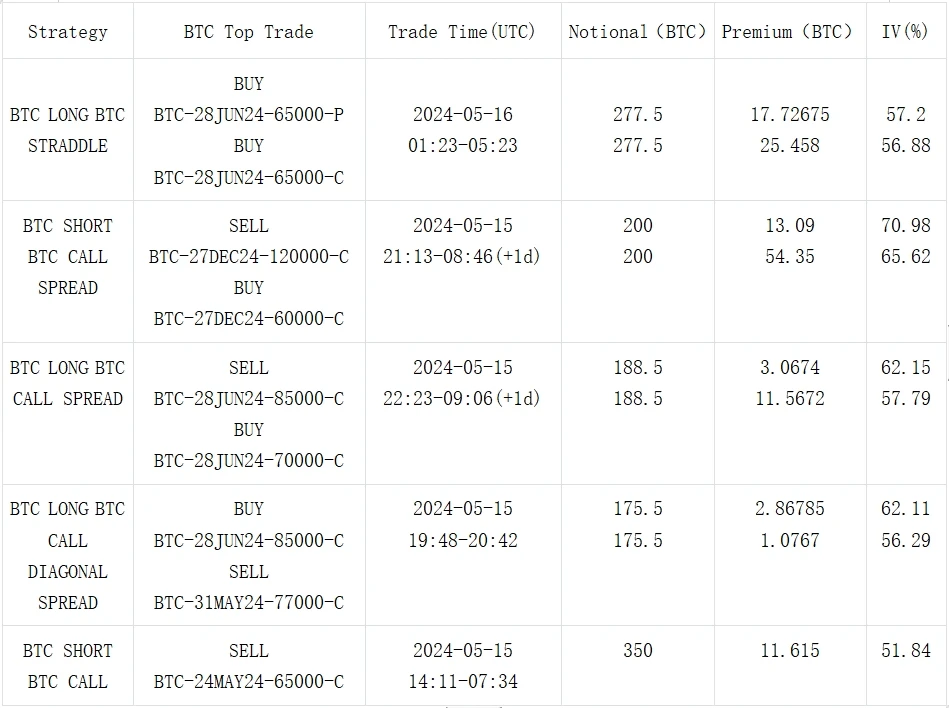

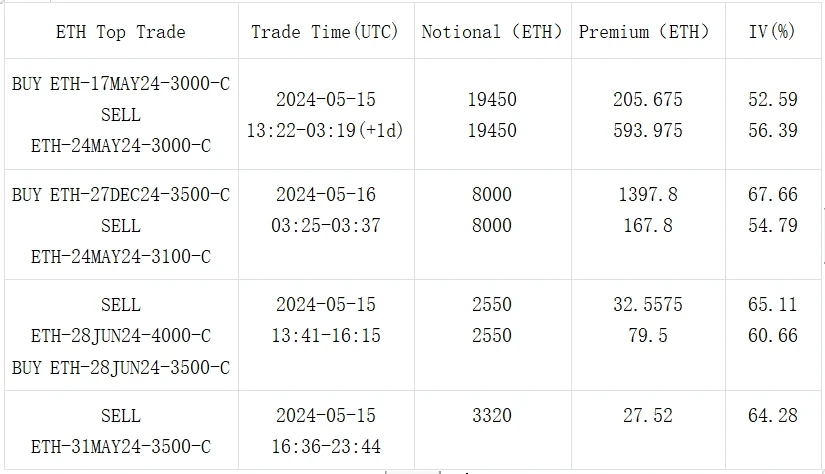

在選擇權方面,BTC和ETH的隱含波動率水準也呈現截然不同的變化。 BTC的主要變化體現在中長期IV的上行。近一日的大宗交易也主要分佈在中長期。最大的是每條腿 277.5 BTC 的多頭跨式期權 (Long Straddle),看漲 6 月底的波動性,以及賣出 5 月看漲期權和買入 6 月看漲期權的對角線價差。 ETH 前端 IV 大幅下跌,吸引了一批 5 月 17 日買入 vs 5 月 24 日賣出交易,每條交易量高達 19,450 ETH。同時,5月底選擇權鏈上也存在不少買權持股。儘管ETH近期表現相對較差,但仍有交易者為其下一個上漲空間買單。

資料來源:Deribit(截至 5 月 16 日 16:00 UTC+ 8)

來源:SignalPlus

資料來源:Deribit,ETH交易整體分佈

資料來源:Deribit,BTC交易整體分佈

來源:Deribit 大宗交易

來源:Deribit 大宗交易

您可以在ChatGPT 4.0的插件商店中搜尋SignalPlus來取得即時加密資訊。如果您想在第一時間收到我們的更新,請關注我們的 Twitter 帳號@SignalPlus_Web3,或加入我們的微信群(新增助手微信:SignalPlus 123)、Telegram 群和 Discord 社區,與更多朋友交流互動。 SignalPlus 官方網站:https://www.signalplus.com

本文來源於網路:SignalPlus波動率專欄(20240516):宏觀經濟向好,BTC重回66000

相關:Fantom (FTM) 價格預測:能否觸及兩年新高?

簡而言之,最近幾天,交易者手中的FTM供應量大幅減少,顯示中長期持有者有所增加。 FTM 7 天 RSI 目前為 77,低於上週的 81,仍顯示超買狀態。 EMA 線描繪出看漲情景,我們可能很快就會看到 FTM 價格觸及兩年高點。過去幾天交易者中 FTM 供應量的減少標誌著中期和長期持有者明顯轉向積累,這表明對 FTM 未來前景的信心增強。 FTM 價格受到積極的市場情緒的提振,其 7 天 RSI 表明儘管處於超買區域,但投資者的興趣很高。指數移動平均線 (EMA) 線所暗示的看漲趨勢暗示…