原文作者: 薩姆·凱斯勒 、CoinDesk

原文翻譯:Felix,PANews

關鍵點:

-

據知情人士透露,占主導地位的流動性質押協議 Lido 和風險投資公司 Paradigm 的聯合創始人正在秘密資助一家名為 Symbiotic 的新公司,該公司將在快速增長的「重新質押」領域展開競爭。

-

一個擁有強大資金支持的 re-stake 項目的出現,或許預示著一場重新定義 DeFi 格局的博弈即將開始。

以太坊上最大的流動性質押協議 Lido 的聯合創始人正在秘密資助 EigenLayer 的競爭對手。作為熱門的再質押協議,EigenLayer 在今年迅速崛起,成為 DeFi 領域的強勁力量。

據幾位知情人士透露,這個名為 Symbiotic 的專案不僅得到了 Lido 聯合創始人 Konstantin Lomashuk 和 Vasiliy Shapovalov 透過創投公司 Cyber Fund 的支持,還得到了 Lido 主要投資者之一 Paradigm 的支持。

CoinDesk 獲得的內部 Symbiotic 文件顯示,該專案允許用戶以 Lidos stETH 以及其他與 EigenLayer 原生不相容的流行資產進行重新質押。 Symbiotic 由先前創建 Stakemind 質押服務的團隊開發,將是一種無需許可的重新質押協議,為去中心化網路提供靈活的機制,以協調節點營運商和經濟安全提供者。

這些文件被標記為“初步”和“不公開披露”,但在新生的重新質押生態系統中建立的幾個團隊表示,他們已經在討論與Symbiotic 的整合(包括主動驗證服務和基於EigenLayer 的流動性重新質押服務) 。

城裡的新孩子

幾年前,Lido 在DeFi 領域引起了轟動,當時它開發了一種協議,允許用戶在以太坊上質押加密貨幣(本質上是鎖定它們),但仍然收到一個名為「stETH」的代幣進行交易。事實證明,該項目非常受歡迎,目前是以太坊上最大的 DeFi 協議,擁有價值 $270 億的存款。它已經獲得瞭如此重要的地位,以至於一些參與者擔心麗都的超級影響力所帶來的營運風險。

但最近,隨著用戶將資產轉移到 EigenLayer,Lido 一直在努力應對市場份額下降的問題,EigenLayer 允許用戶重新質押以太坊的原生代幣 ETH,以幫助保護其他網路的安全。 EigenLayer 是近年來加密貨幣領域最成功的項目之一,自去年向投資者開放以來吸引了約 $160 億的存款。

與 EigenLayer 類似,Symbiotic 將為去中心化應用程式提供一種稱為主動驗證服務(AVS)的方案,以共同確保彼此的安全。用戶將能夠重新抵押儲存在其他加密協議中的資產,以幫助保護這些 AVS(無論是 Rollup、互通性基礎設施還是預言機)以換取獎勵。

Symbiotic 和 EigenLayer 的主要區別在於,用戶可以直接將任何基於以太坊 ERC-20 代幣標準的資產存入 Symbiotic,這意味著該協議將直接相容於 stETH,以及數千種基於 ERC 的其他資產-20標準。 EigenLayer 只接受 ETH 代幣。

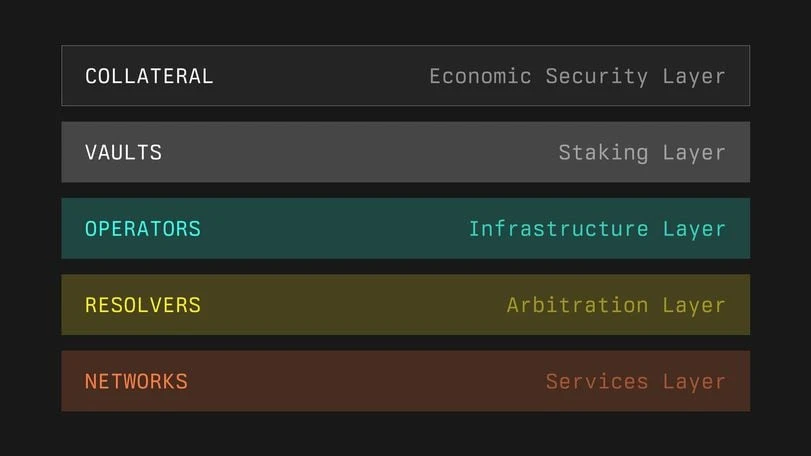

CoinDesk 獲得的內部 Symbiotic 文件的螢幕截圖,描述了該協議的「五個相互關聯的組件」。

諷刺的是,據幾位知情人士透露,當創投巨頭 Paradigm 向 EigenLayer 聯合創始人 Sreeram Kannan 尋求投資他的專案時,他拒絕了他們的資金,轉而支持 a16z。 Paradigm 告訴 Sreeram Kannan,他們將投資 EigenLayers 的競爭對手。

跑道足夠大,可容納多家公司

EigenLayer 潛在強大競爭對手的出現凸顯了機構和投資者對參與再質押領域的渴望,因為它已成為該行業的熱門話題。 Blockworks 在 4 月報導稱,另一家重新質押新創公司 Karak 已獲得 Coinbase 和其他公司的資金。

一位打算與 Symbiotic 整合的基礎設施營運商表示:「這條賽道足夠大,足以容納不只一家大公司。」但由於該專案仍處於保密狀態,因此要求匿名。 “我認為 Uber 和 Lyft 是最好的例子,在這裡,再質押市場也將是巨大的。”

由 Lido 聯合創始人領導的 Cyber Fund 和 Paradigm 的參與可能會使 Symbiotic 處於挑戰 EigenLayer 的有利地位。這也進一步證明,與 Lido 關係密切的人將 EigenLayer 視為對 Lido 統治地位的潛在威脅。

雖然 Lido 仍然是以太坊上最大的 DeFi 協議,但該項目圍繞重新質押的策略可能決定它是否(以及如何)保持在質押領域的領先地位。

將用戶資金存入 EigenLayer 的流動性重新抵押公司已經蠶食了 Lido 的 stETH 市場。兩個最大的流動性重新質押協定 Ether.Fi 和 Renzo 在過去 30 天內淨流入 $6.25 百萬。同時,麗都同期淨流出$75百萬。

本週,Lido DAO(控制 Lido 協議的治理機構)的成員公開提出了 Lido 聯盟,這是一個思考重新抵押的指導框架。提案指出:Lido DAO 將識別並認可具有相同價值觀和使命並能為 stETH 生態系統做出積極貢獻的項目。圍繞 stETH 開發一個與以太坊一致的生態系統將有助於網路的去中心化。

雖然 Lido 與 Symbiotic 沒有直接關係,但這家由 Lido 聯合創始人資助的重新抵押公司非常適合 Lido 聯盟框架。 EigenLayer 只接受 ETH 存款,而 Symbiotic 根本不接受 ETH 存款。相反,Symbiotic 將允許用戶直接存入任何 ERC-20 代幣,例如 Lido 的 stETH。

Symbiotic 的專案文件顯示:「Symbiotic 中的抵押品可以包括ERC-20 代幣、以太坊驗證者的提款收據或其他鏈上資產(例如LP 頭寸),但對於持有頭寸的區塊鏈沒有限制。

關於再質押項目的討論

CoinDesk 獲得的 Symbiotic 內部文件的螢幕截圖標題為:「使用 ERC 20 代幣的抵押品範例。什麼時候 用戶將資金存入金庫,抵押品的創建將被抽象化。

Symbiotic 的抵押方法與其成為「無許可」協議的雄心有關,這意味著在該平台上構建的應用程式在決定如何擴展平台以服務自己的用例時應該有很大的餘地。

「我對他們正在做的事情感到興奮。這看起來很有趣而且很有創意。 “他們似乎非常專注於建立完全無需許可且去中心化的東西。”

據知情人士透露,另一個流動性重新質押協議 Renzo 已經在討論在推出後與 Symbiotic 整合。

Symbiotic 尚未公開發布任何資訊或確認計劃何時推出,但本文諮詢的四位消息人士表示,他們預計該平台將在今年年底以某種形式發布。

本文源自網路:一篇文章了解共生:EigenLayers神秘對手,Lido與Paradigm暗中支持

相關:以太坊(ETH)價格預測:調整已經結束,還是預期會進一步下跌?

簡而言之,以太坊面臨顯著的修正走勢,穩定在 $3,107 附近 0.382 Fib 水準。好壞參半的指標表明,人們對潛在的看漲反彈持謹慎樂觀態度。日線圖的下行通道、四小時圖的死亡交叉以及對 BTC 的阻力都預示著可能的下跌。以太坊價格目前正在經歷顯著的修正運動,最近幾天已修正至約 $2,845 一個月前,BeInCrypto 表示,重要支撐位位於 50 日均線的 $3,215 左右以及 $3,107 和 $3 之間, 215 處於關鍵斐波那契水準。這一區間為以太幣提供了看漲反彈的有利機會。 ETH 找到支撐:價格穩定在 0.382 Fib 水平,約 $3,107 在月度圖表中,以太坊價格仍位於 0.382 Fibonacci 支撐位附近。潛在的看漲情景需要月度收盤價高於…