Original author: Smolresearcharc (summer period)

原文翻譯:TechFlow

A few days ago, @cryptowhail asked me an existential question at 5am in the morning: “Are we in an active period in the SOL market now?” This question made me start thinking about how the memes on the SOL chain have performed since the fourth quarter of last year.

We looked at the data. The data came from SOL memes posted by @CryptoKoryo over the past few months via the dune dashboard. It was a manual process of picking the memes and finding the data, but I think we did a pretty good job.

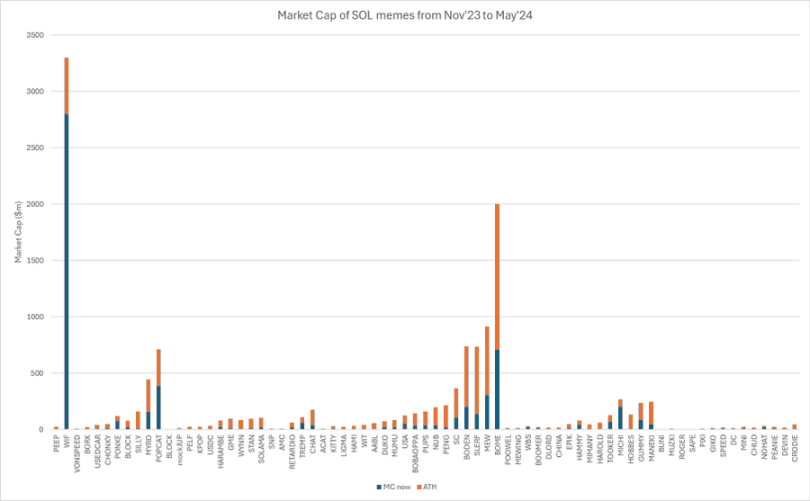

We plotted the current market cap (blue) versus the all-time high (orange + blue) over the past few months:

November 2023: PEEP, WIF

December 2023: VONSPEED to POPCAT

January 2024: BLOCK to SOLAMA

February 2024: SNP to CHAT

March 2024: ACAT to BOME

April 2024: POOWEL to MANEKI

May 2024: BUNI to CRODIE

Some observations

It is difficult to break through 300 million market value, let alone 1 billion. Only WIF, MYRO, POPCAT, SC, BODEN, SLERF, BODEN, MEW, and BOME have successfully broken through.

Currently, only WIF, POPCAT, and MEW (barely) have a market cap of more than $300 million. This shows how difficult it is to maintain a high market cap in this meme-saturated environment.

Quite a few memes have an ATH of over $100 million, but few can really maintain it. In addition to the above mentioned, we also have MYRO, SC (barely maintained), BODEN, SLERF, MICHI.

Most memes have huge drawdowns (see the ratio of orange to blue). Unfortunately, the data is skewed due to WIF and BOME, but the average drawdown rate from the highest point (ATH) for all memes is 72%. This shows that you have to chase winners very hard, or those with high liquidity (CEX liquidity like WIF, or new coins that don’t have much drawdown).

Notable callbacks include:

PEEP: Down 95% from ATH ($24m) – November 2023

VONSPEED: Down 92% from ATH ($8.2 million) – December 2023

SILLY: Down 91% from ATH ($161.4M) – December 2023

KPOP: Down 91% from ATH ($24.3M) – January 2024

WYNN: Down 96% from ATH ($84.2 million) – January 2024

AMC: Down 91% from ATH ($10.6m) – February 2024

ACAT: Down 91% from ATH ($8.3 million) – February 2024

AABL: Down 93% from ATH ($54.7 million) – March 2024

PENG: Down 93% from ATH ($213.8 million) – March 2024

MIMANY: Down 92% from ATH ($44.2M) – April 2024

HAROLD: Down 93% from ATH ($58.9 million) – April 2024

HOBBES: Down 97% from ATH ($132.6 million) – April 2024

DEVIN: Down 98% from ATH ($14.9M) – May 2024

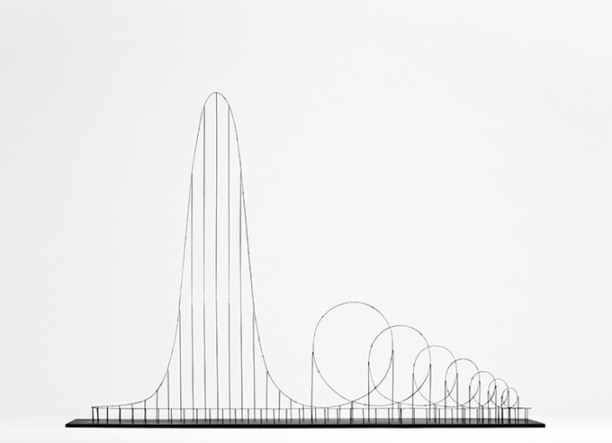

Interestingly, I would have thought the data would show us something like the following (cyclical decline), but there appear to be some outperformers (BOME has plenty of liquidity and insiders know it will be listed on Binance). It is worth noting that other than BOME and WIF, no other memecoins are listed on Binance.

What does the data tell us?

It’s very difficult to break through certain market cap levels: $30m/$100m/$300m, let alone sustain it after a big drop, it looks like this is still a trader’s market.

The drawdown from the ATH has been brutal. An average 72% drawdown and an average 3% liquidity (compared to the current market cap) means that if you got in at the top, it’s very difficult to get your initial investment out.

@cryptowhails comments about us entering the SOL meme active phase may not be as accurate as people think. For this to happen we need to see more winners in April/May that beat the likes of POPCAT or MYRO.

But for now, SOL is where your bet is. On-chain volume is up. Pump.fun plus multiple memes launching on SOL every day means everyone is glued to their bots and wallet trackers trying to catch the next winner (which by the way looks like there are fewer winners unless you want to make 2-3x). But we are in the trenches working hard for that miraculous 100x.

This article is sourced from the internet: Crazy 70% pullback: data reveals the other side of Solana Meme craze

Related: Injective’s Tokenomic Changes Aim for Unprecedented Deflation: Price Impact

The Injective community has approved transformative changes to its tokenomics, launching the Injective 3.0 system. This revision modifies INJ’s minting mechanics and introduces features designed to make it “one of the most deflationary assets in crypto.” These changes aim to quadruple the deflationary pressure on INJ over the next two years. Can Injective (INJ) Surge 45%? INJ is the native token of a Cosmos-based Layer 1 blockchain, managed by the non-profit Injective Foundation. The recent endorsement of the INJ 3.0 proposal, unveiled on April 19, is built on two main adjustments. Firstly, it revises INJ’s inflationary bounds by setting the lower and upper limits at 4% and 7%, respectively. These limits will be incrementally enforced and reassessed in the second quarter of 2026. Read more: Tokenomics Explained: The Economics of…