Cardano (ADA) is attempting to break out of a bullish pattern, which suggests a 25% rally is likely upon breakout.

While broader market cues are a barrier to this, investors’ confidence could drive the ADA price higher.

Cardano Holders Support Price Rise

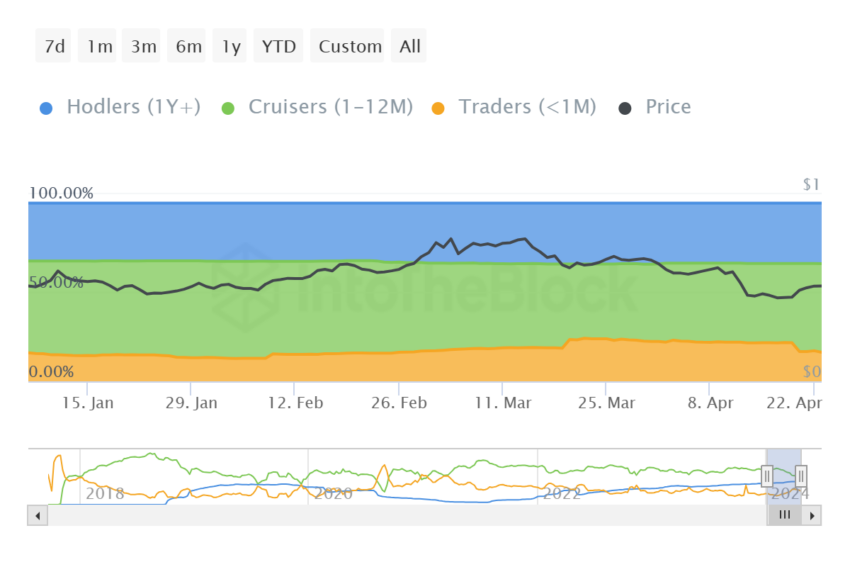

Cardano’s price notes bullish influence from the investors, particularly in the shift of supply from the short-term to the mid-term holders. The former are known to hold their assets for less than a month, while the latter hold for up to a year.

Generally, short-term investors tend to sell their assets, which makes their dominance on ADA supply a concern. However, over 4% of all circulating ADA has shifted to mid-term holders in the last four days alone.

This shows that Cardano investors are not looking to sell their holdings for now as they await further price increases.

Đọc thêm: Cách mua Cardano (ADA) và mọi thứ bạn cần biết

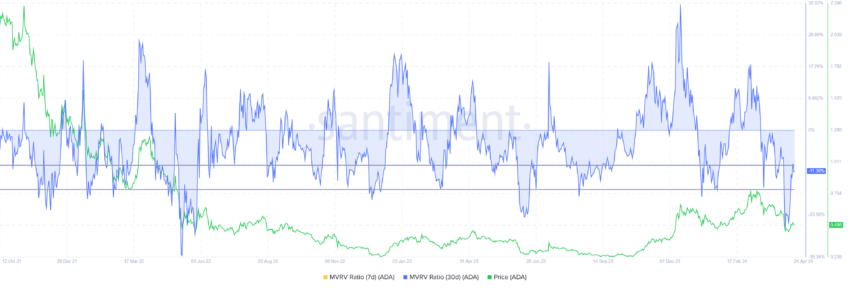

Secondly, ADA could also witness a surge in buying since the altcoin is in the opportunity zone based on the Market Value to Realized Value (MVRV) ratio. The MVRV ratio measures investor profit/loss.

Cardano’s 30-day MVRV at -11% signals losses, potentially prompting buying. Historically, ADA recovery occurs at -9% to -15% MVRV, labeling it an opportunity zone for accumulation.

Thus, the third-generation altcoin could witness a surge in price should ADA holders move to add more tokens to their wallets.

ADA Price Prediction: A Breakout Awaits

Cardano’s price at $0.49 failed to breach the upper trend line of the descending channel, and the altcoin has been stuck for nearly two weeks now. A descending channel is a bullish technical pattern where the price forms lower highs and lower lows, indicating a potential reversal.

According to the pattern, ADA’s target post-breakout is set at 25%, positioning it within the range between $0.62 and $0.66. Cardano’s price could successfully hit the target if the investors’ accumulation and confidence in a rally remain strong.

Đọc thêm: Dự đoán giá Cardano (ADA) 2024/2025/2030

However, if the breach fails and ADA loses the support of $0.47, a drawdown to $0.40 is likely. Falling through this would invalidate the bullish thesis, sending ADA to fall further.