Bitcoin Cash (BCH) price is making its way towards initiating a recovery with only one barrier standing in its way.

This resistance could be invalidated with the assistance of investors who could be returning to BCH.

Bitcoin Cash Is Ideal for Accumulation

Bitcoin Cash has been trading above $500 but has failed to breach $513 for the last few days. This could change now as the altcoin’s Market Value to Realized Value (MVRV) ratio is in the opportunity zone.

The MVRV ratio monitors investor profits and losses. With Bitcoin Cash’s 30-day MVRV at -17%, indicating losses, accumulation may ensue. Historically, BCH witnesses recovery at MVRV levels of -14% to -24%, marking it as an accumulation opportunity zone.

This accumulation could attract new investors to the asset, enabling BCH to witness further increases in price.

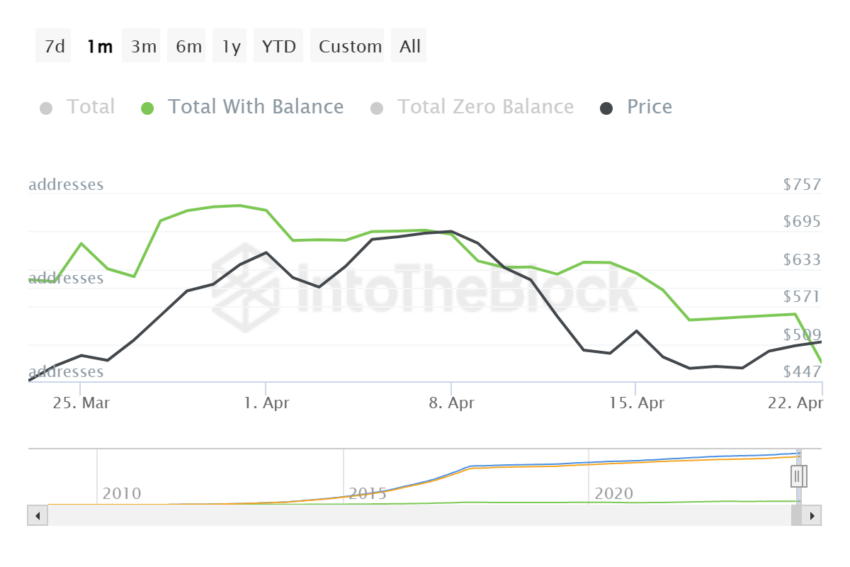

BCH has been observing its investors pulling away from the token. The total number of addresses holding any amount of BCH has declined by more than 390,000 since the beginning of the month.

Đọc thêm: Cách mua Bitcoin Cash (BCH) và mọi thứ bạn cần biết

This is because, following the rally in March, the altcoin was due for a correction as the market cooled down. Consequently, investors opt out of investing in the asset over bearing losses. This led to the total addresses falling from 25.16 million to 24.77 million.

With the cryptocurrency now exhibiting potential profits and being present in an accumulation zone, these investors could make a return. This would effectively help Bitcoin Cash’s price recovery.

BCH Price Prediction: The Key Resistance

Bitcoin Cash’s trading price at $504 is currently struggling to breach the resistance level marked at $513. This level is important because it is in confluence with the 23.6% Fibonacci Retracement of $709 to $452.

Flipping it into support will help BCH potentially note a recovery that has been due for the last ten days. The Bitcoin hard-fork token could subsequently attempt to breach the 38.2% Fib line at $550.

Đọc thêm: Dự đoán giá Bitcoin Cash (BCH) 2024/2025/2030

However, failure to breach the 23.6% Fib could result in Bitcoin Cash’s price falling through the support of $501. This could lead to BCH potentially testing $452 as support, invalidating the bullish thesis.