Story Protocol’s IP Token Logs Double-Digit Gains Amid $109 Billion Crypto Selloff

Story’s IP has maintained its streak as the market’s top gainer for the third consecutive day, bucking the broader downturn.

Despite the mật mã market shedding $109 billion in market capitalization over the past 24 hours, IP has continued its uptrend, posting double-digit gains during that period.

IP Mã thông báo Defies Chợ Slump

There has been a significant decline in crypto trading activity over the past 24 hours, reflected by the $109 billion capital outflow recorded during that period. At press time, the global crypto market capitalization is at $2.79 trillion, a low it last reached in November.

Despite this, the recently launched Layer-1 (L1) coin IP has bất chấped the broader market decline. It has continued to record new gains, driven by significant demand for the altcoin among market participants.

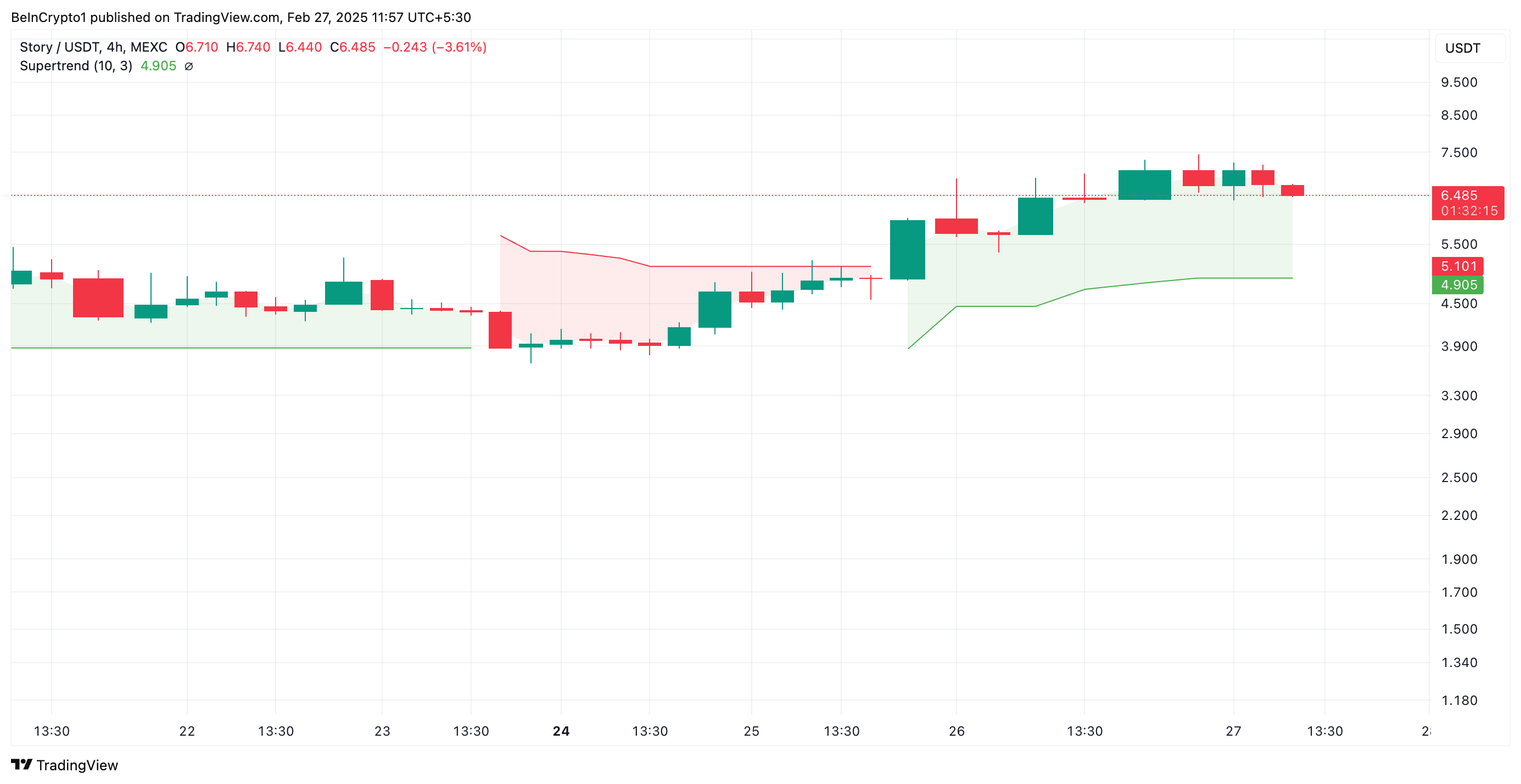

BeInCrypto’s assessment of its Super Trend indicator confirms IP’s bullish bias. At press time, the green line of this indicator forms a dynamic support level below IP’s price at $4.90, highlighting the market’s bullish pressure.

This indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the current market trend: green for an uptrend and red for a downtrend.

As with IP, when an asset’s price trades above the Super Trend indicator, it is in a bullish trend. This signals that buying activity exceeds selloffs among market participants and hints at a potential sustained rally.

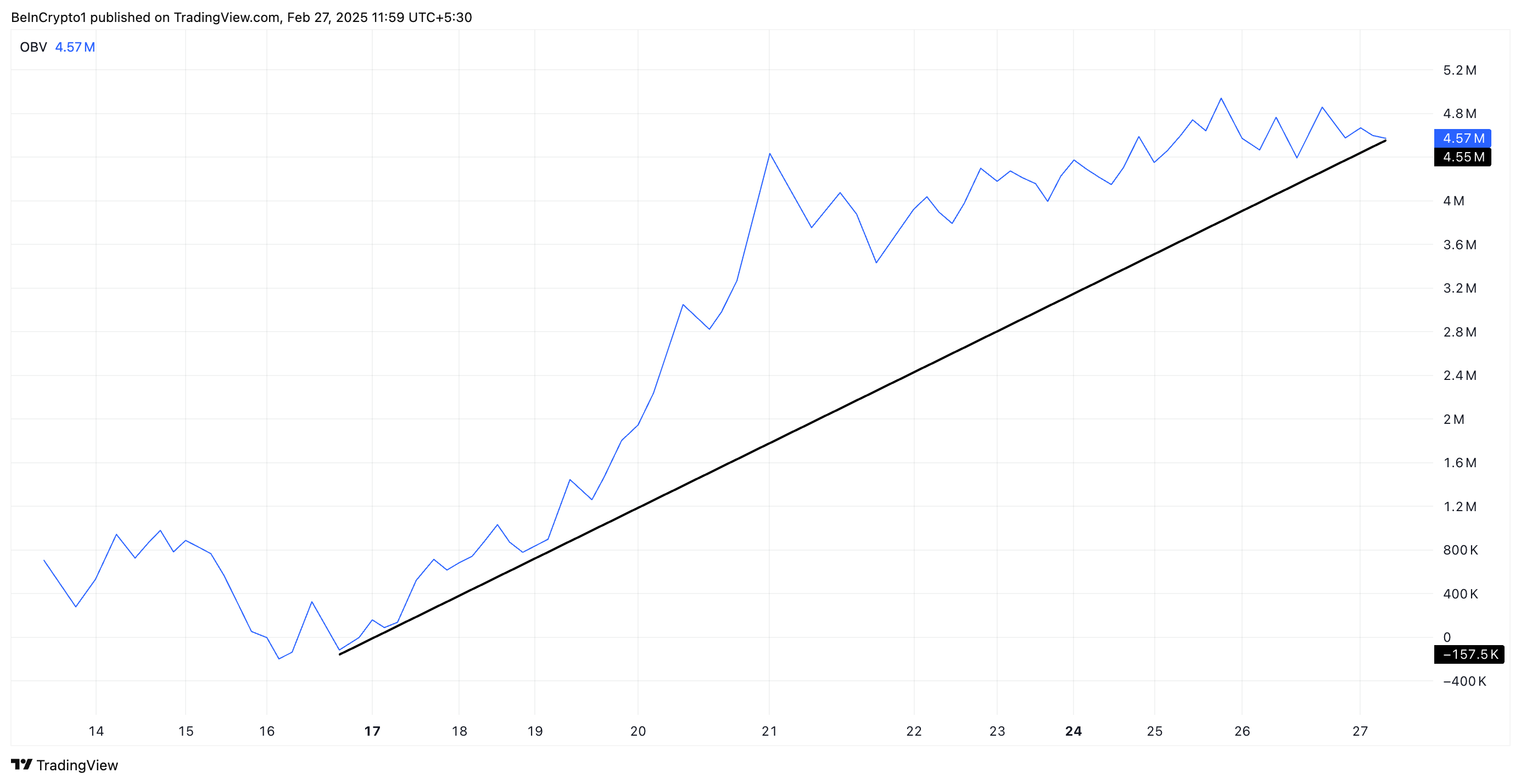

Furthermore, the coin’s rising on-balance volume (OBV) supports this bullish outlook. This momentum indicator has risen with IP’s price over the past few days, indicating the buying activity in its spot markets.

An asset’s OBV measures its buying and selling pressure by tracking cumulative trading volume in relation to its price movements. When it rises like this, it indicates strong buying pressure, suggesting that demand is outpacing supply, and the asset’s value may continue to increase.

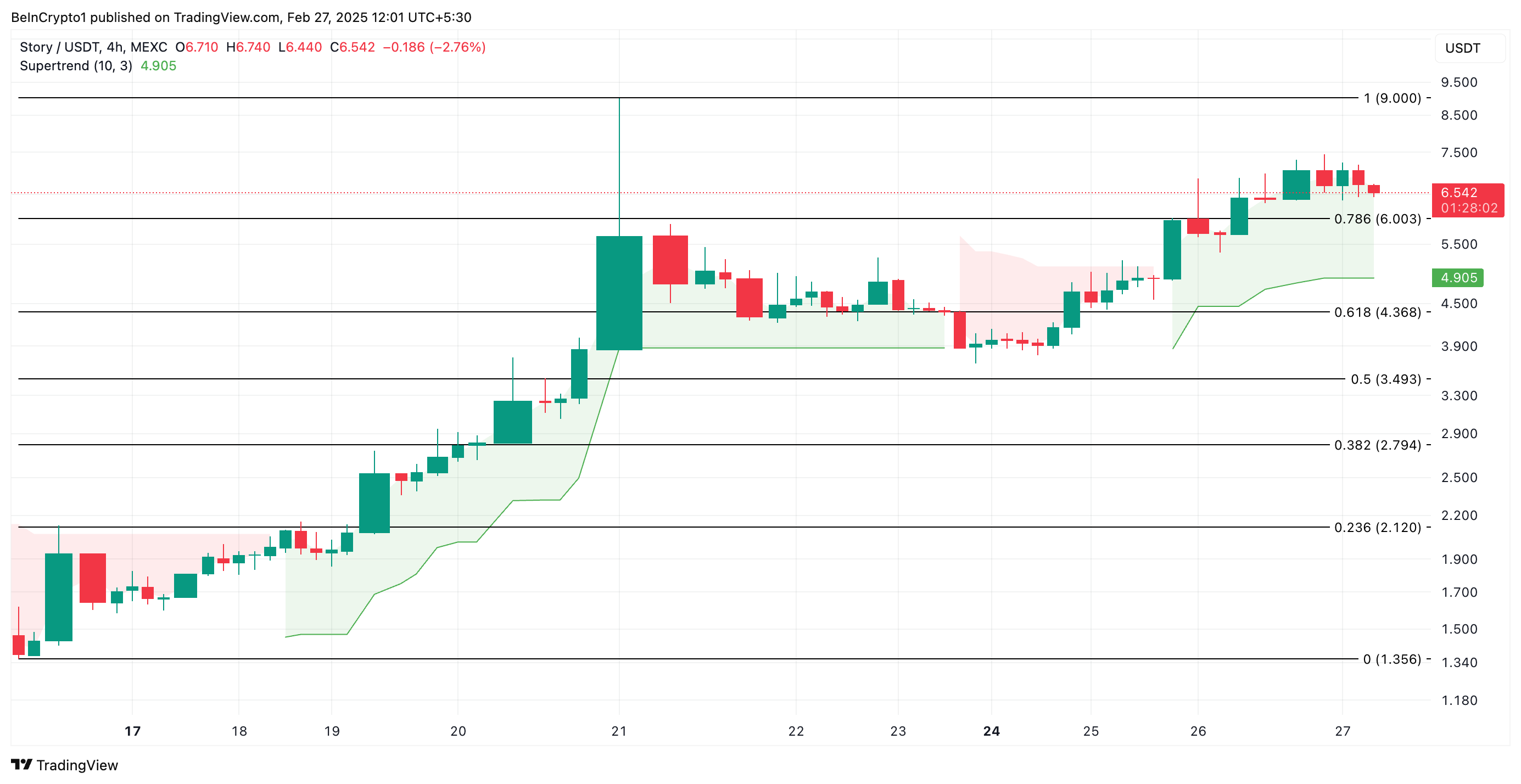

IP Holds Above Key Support at $6—Can It Reclaim $9?

IP currently trades at $6.54, just above the support formed at $6. If buying pressure gains more momentum, it could drive IP to its all-time high of $9, which was last reached on February 21.

However, a resurgence in coin selloffs would invalidate this bullish projection. In that case, the coin’s price could fall below the $6 support and trend toward the dynamic support at $4.90.

Nevertheless, IP’s price could slip to $4.38 if this level fails to hold.

Bài viết này được lấy từ internet: Story Protocol’s IP Token Logs Double-Digit Gains Amid $109 Billion Crypto Selloff

Related: Is short selling profitable forever? CEX has become the exit liquidity

Original author: Shaofaye 123, Foresight News Centralized exchanges performed poorly in 2024 and were mocked as the on-chain exit liquidity. According to a research report released by Animoca Digital Research, the average return rate of major exchanges in the first three quarters was negative. Entering 2025, the listing of coins on centralized exchanges is still a tombstone for new coins. Can short selling really make money forever? This article takes you through the listing of coins on major exchanges in January. Overview of new listings on various exchanges in January Major exchanges have started listing coins at the beginning of this year. From the data, OKX has the most conservative coin listing strategy, with only 4 tokens listed. Bitget has adopted a more proactive coin listing strategy, with 17 tokens…