Nine core indicators reveal the peak signal of the crypto bull market

How to accurately predict the peak of the bull market? You must master these 9 key indicators!

It鈥檚 almost impossible to accurately predict the peak of the mật mã market bull run, but you can use these data indicators to determine whether the market is close to the top.

If all five signs appear at the same time, then you have either accumulated enough wealth or you can only go back to work at McDonalds…

Now, let us uncover the secret of the end of the bull market.

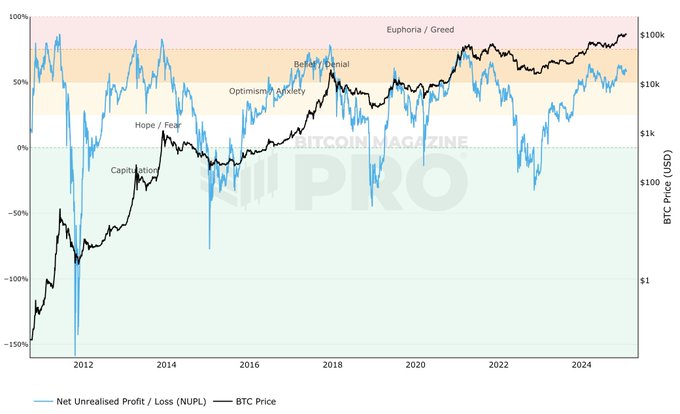

1. NUPL (Unrealized Net Profit/Loss)

Chợ Chỉ số tình cảm

When NUPL enters the mania/greed zone (over 75%), it usually means that the market is close to a top and investors are becoming overly optimistic.

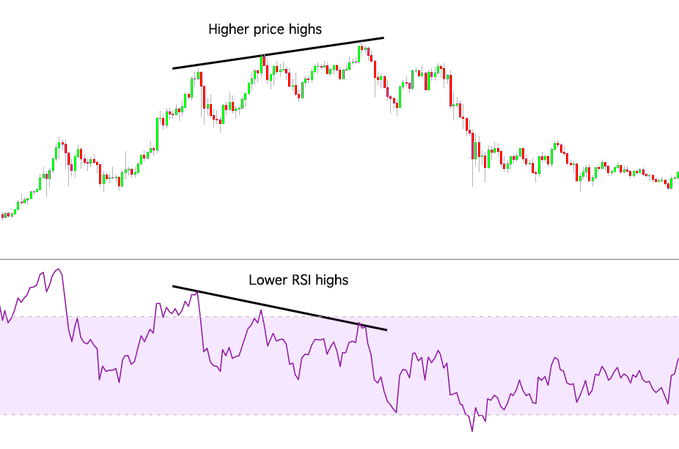

2. RSI (Relative Strength Index)

Short-term overbought signal

When the RSI exceeds 90, the market is usually in an extremely overbought state, and historical data shows that highs are usually formed within 4-7 weeks, followed by a pullback.

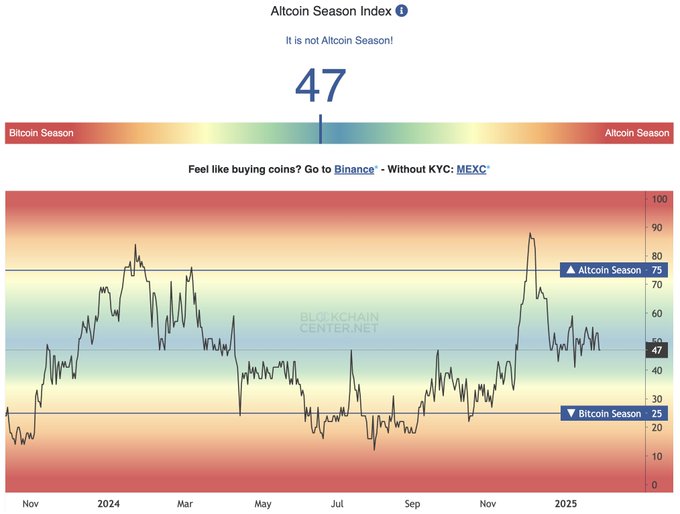

3. Altcoin Season Index

Altcoins vs Bitcoin

When the index exceeds 85, it means that altcoins as a whole are outperforming Bitcoin, which is usually a sign that the market has entered a frenzy phase.

4. MVRV Z-Score (Market Value vs Actual Value)

Determining whether the market is extremely overvalued

When the MVRV Z-Score exceeds 6, it indicates that the market may be close to the top and we need to be alert to the potential risk of a pullback.

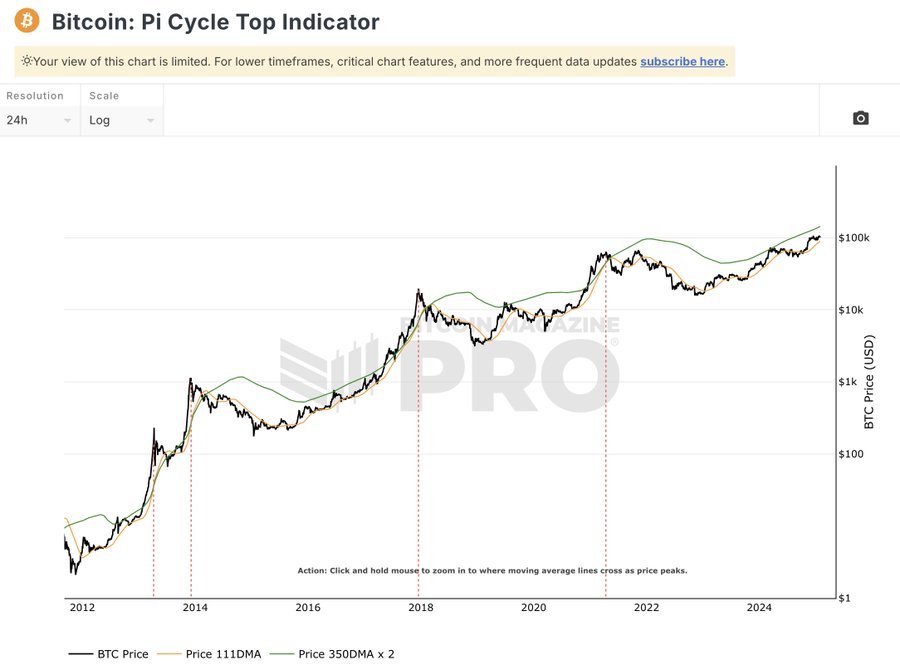

5. Pi Cycle Top Indicator

Accurately Identify the Peak of Bitcoin Bull Market

This indicator has successfully predicted major price highs for Bitcoin over multiple cycles.

When it sends out warning signals, it means the bull market is about to peak.

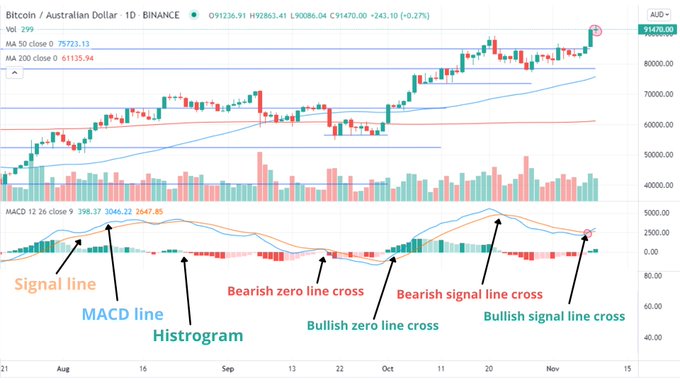

6. MACD (Moving Average Convergence Divergence)

Trend Change and Momentum Signals

When MACD forms a death cross, it means that market momentum is weakening and the trend may reverse.

7. MFI (Money Flow Index)

Buying and selling pressure monitoring

Similar to the RSI, but the MFI incorporates volume data and when it shows extreme overbought conditions, it often signals a market top.

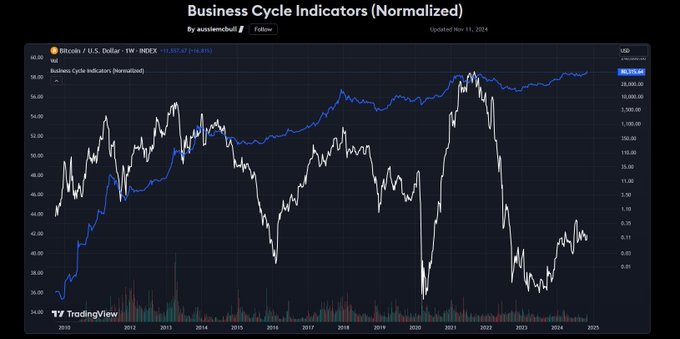

8. Composite Business Cycle Index

Macroeconomic impact

When the index exceeds 50, it indicates that the market may be about to enter a peak phase.

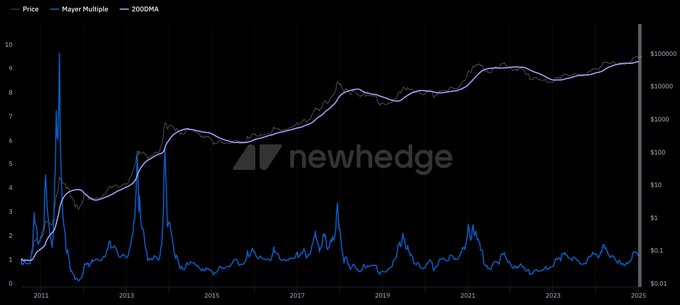

9. Mayer Multiple

Price vs 200 Day Moving Average

Historical data shows that when the Mayer Multiple reaches 2.4, Bitcoin is usually at the peak of a bull market.

Tóm lại là

Although it is difficult to accurately predict the market peak, these 9 indicators can help you evaluate the market position more scientifically. The bull market frenzy can make you a lot of money, but if there is no clear exit strategy, it may also make you return to the pre-liberation era overnight.

This article is sourced from the internet: Nine core indicators reveal the peak signal of the crypto bull market

Original title: Ethereum Acceleration Original article by: Georgios Konstantopoulos, Dan Robinson, Matt Huang, Charlie Noyes Original translation: Odaily Planet Daily Husband How Since its inception, Ethereum has been a pioneering force in the crypto space. Ethereum has paved the way for smart contracts, DAOs, and DeFi, and continues to innovate on cutting-edge challenges such as ZK and MEV. Ethereums community of researchers and engineers has laid a solid foundation for the next generation of decentralized applications. Everyone seems to forget that the first version of the Ethereum protocol was completed in less than two years – this fast development pace attracted many developers to the platform. However, we believe that Ethereum’s core protocol can progress much faster today, and that many high-impact improvements can be accelerated without sacrificing its core…

I want to share my experience regarding a Bitcoin investment scam involving Coinyee, where I lost over $375,000. Fortunately, I was able to recover my funds with the help of [www.BsbForensic.com] They are truly one of the rare services that can help in such situations.

If anyone is facing a similar issue, I highly recommend reaching out to them for assistance.