How to obtain stable high returns through DeFi in the bull market?

Bài viết gốc từ On Chain Times

Biên soạn bởi Odaily Planet Daily Golem ( @web3_con quỷ )

Although many investors have been busy looking for the next AI meme coin with a 100x return or trying to guess which old altcoins will pull up again without any warning, some people are focusing on the high-yield opportunities brought by DeFi in the bull market. The demand brought by the bull market has led to a surge in on-chain yields, which has also amplified some interesting DeFi strategies.

This article will delve into strategies for recycling sUSDe across different lending markets, how to use calculators to estimate actual returns, and how the JLP token works.

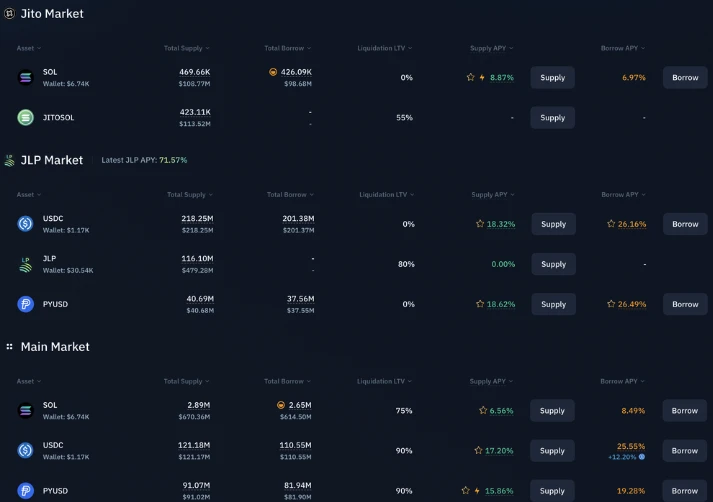

Kamino Finance (Odaily Planet Daily Note: Sponsor of the original article)

Tài chính Kamino is the sponsor of this article. Kaminos metrics, such as TVL and fees, continue to trend upward, and the protocol currently offers some of the highest yields on assets such as SOL, SOL LST, and stablecoins. These yields can be easily earned by depositing assets into the lending market, including:

-

USDC’s annualized rate of return is 18.3%;

-

PYUSD (Ethena market) has an annualized return of 27%;

-

USDS has an annualized rate of return of 15%;

-

SOL has an annualized rate of return of 9%;

Kamino’s more complex yield strategies include their Multiply product, which allows for leverage on SOL LSTs (effectively gaining leveraged exposure to SOL staking yields), as well as JLP. Currently, combining the JLP annualized yield and the USDC lending annualized yield, the annualized yield on JLP leveraged positions is over 100%.

To learn more about how the Kamino Multiply vault works and how it is designed to reduce liquidation risk, you can read the full hướng dẫn: Maximizing Solana Yields with Kamino Multiply .

Ethena’s sUSDe Cycle Trading Strategy

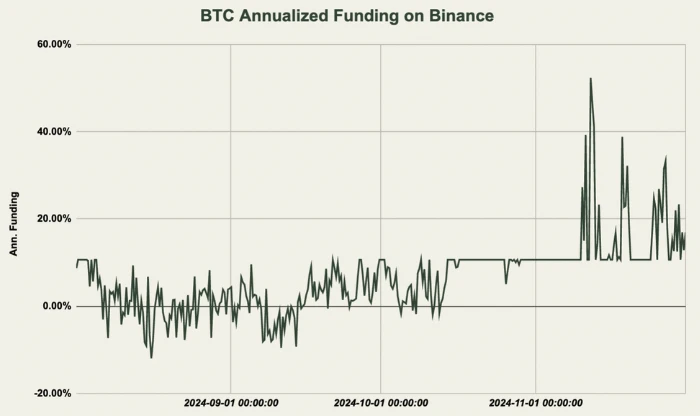

Funding rates on exchanges for assets like BTC and ETH have risen significantly since the election in early November:

Ethenas revenue and the annualized yield (APY) earned from holding sUSDe are positively correlated with these funding rates because the protocol hedges its spot exposure to the underlying asset by shorting futures contracts. As a result, sUSDes APY has risen significantly in the past few weeks and is currently around 21%. Here are a few ways to take advantage of this yield:

Aave

There are several ways to get high yields on sUSDe, and one of the newer strategies is to integrate sUSDe through Aave. The specific approach is:

-

Use sUSDe as collateral on Aave;

-

Borrow stablecoins such as USDC as collateral;

-

Convert USDC to sUSDe;

-

Repeat step 1…

In this way, you effectively get leveraged exposure to sUSDe earnings, with the actual return being the sUSDe earnings minus the USDC borrowing rate multiplied by the applied leverage multiplier.

Aave sUSDe Chợ

(Note: The deposit limit has been reached, but is expected to increase in the next few days, so if you wish to deposit, please keep an eye out for official announcements about it being reopened.)

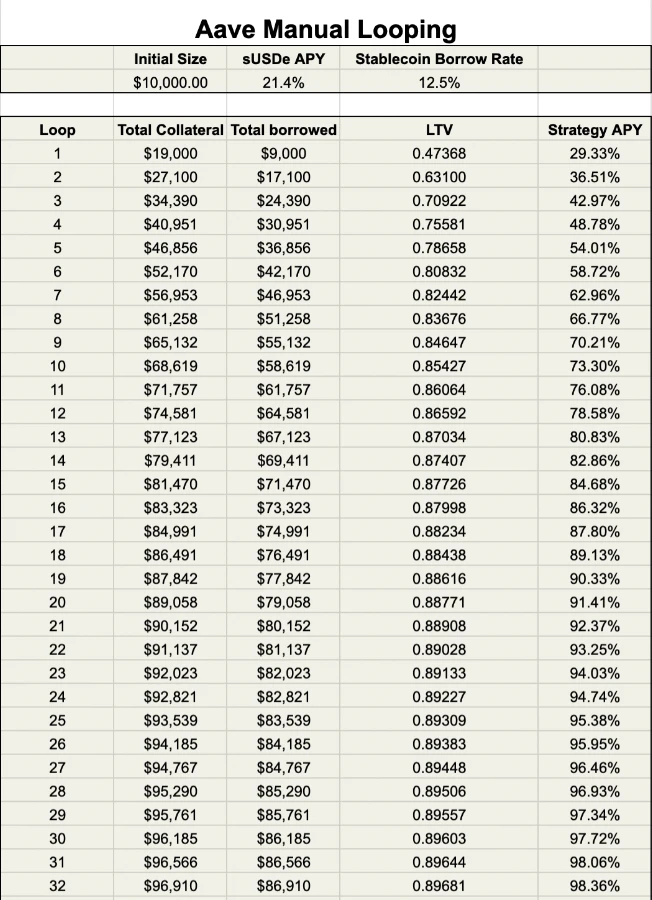

Since the maximum loan-to-value ratio (LTV) for E-Mode on Aave is 90%, depositors can take advantage of up to 10x leverage. The following table shows the returns of this strategy based on a 21% sUSDe APY and a 12.5% USDC borrowing rate in each cycle. In this example, $10,000 worth of sUSDe is used as collateral, $9,000 USDC is borrowed and converted to sUSDe, and then pledged again as collateral. The total collateral balance is now $19,000, $8,100 USDC is borrowed, and the total borrowed amount is $17,100. This process can be repeated up to 100 times, or until the strategy LTV reaches 90% (0.9). As you can see from the table, the more cycles, the higher the APY of the strategy.

Aave sUSDe revolving loan

Keep in mind that doing this manually requires some effort and multiple loops will incur high gas costs, so this approach only makes sense if the strategy is executed at a large scale.

For an automated method that consumes less gas, we can use Fluid.

Fluid

Fluid has recently gained a lot of attention for its DEX integration, which introduces smart debt and smart collateral. On Fluid, users can automatically leverage and deleverage, making the process faster and cheaper.

The maximum LTV of the sUSDeUSDC or USDT market on Fluid is also 90%, allowing up to 10x leverage. But compared to Aaves 3% liquidation penalty, Fluids liquidation penalty is only 2%, and the liquidation risk is significantly lower. Fluid uses smart contract pricing as an oracle for sUSDe, so even if sUSDe decouples in the short term due to a liquidity crunch, multiplier positions will not be liquidated due to price drops. Positions will only be liquidated if borrowing rates are high for a long time and users are not paying attention, or if the sUSDe contract is attacked.

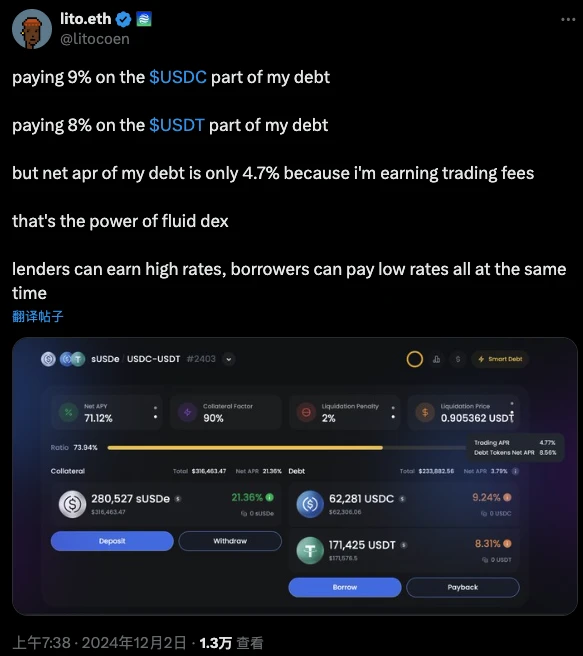

The introduction of Fluid DEX and Smart Debt allows users to borrow sUSDe using USDC/USDT liquidity pool positions as collateral , earning transaction fees. The debt will be a mixture of USDT and USDC, with borrowing costs reduced by the positive transaction fees earned by these assets. In the example shown below, the user actually pays an annualized interest rate (APY) of 8.56% -4.77% = 3.79%, rather than a borrowing cost between 8% and 9%.

This creates a higher annualized yield (APY) as long as the borrowing rate for USDT and USDC is lower than the APY for sUSDe. Based on the current interest rates shown in the tweet above, the strategy has an APY of 101.1% at 90% leverage.

Fluid sUSDe revolving loan (click here to access the real-time calculation table )

Please keep in mind that the sUSDeUSDC/USDT pool is currently at capacity, but is expected to increase soon. In the meantime, users can access the standard sUSDeUSDT hoặc sUSDeUSDC pools, which also offer automatic leverage and deleveraging.

In general, it is recommended to keep a close eye on borrowing rates when using these strategies, as they can fluctuate widely and could cause the strategy to become unprofitable. Also note that nothing is risk-free in the DeFi world, and the risks of smart contracts can lead to loss of funds, especially in the event of a vulnerability attack.

Note – How to calculate the actual sUSDe Annual Percentage Yield (APY)

Ethena distributes rewards to sUSDe contracts based on fees earned in the previous week. As a result, the APY displayed on the Ethena user interface is often different from the actual real-time APY. This difference is important because a change of a few percentage points can make the difference between a profit or loss in a cycle.

To calculate the actual APY, you can view the rewards sent to the sUSDe contract. Rewards are sent every 8 hours. By adding the last three transactions (rewards in the last 24 hours) and dividing by the total USDe supply (which can be viewed đây ), and then multiplying by 365 days, you can get the real-time sUSDe APY.

Remember, sUSDe gains are earned through sUSDe price appreciation, not through available earnings.

JLP

JLP has been discussed many times before. We took a deep dive into its underlying design earlier this year and concluded that JLP has outperformed most major mật mã assets from a volatility-adjusted perspective.

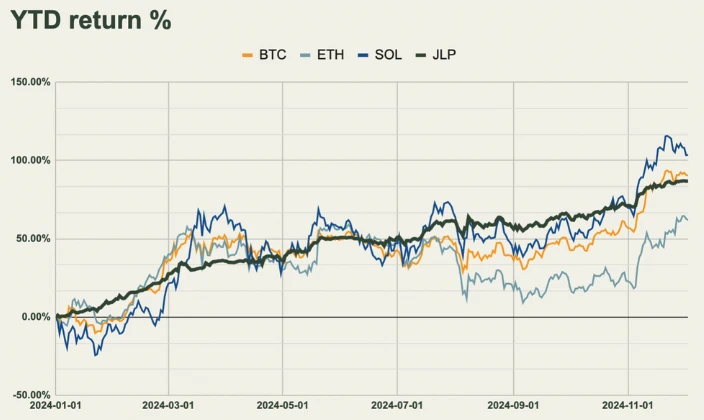

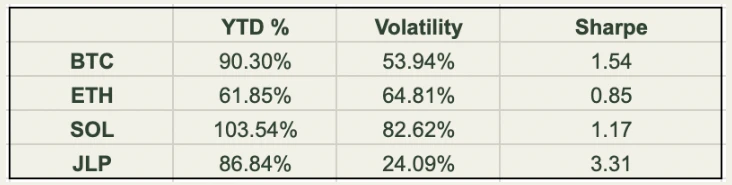

In terms of performance year-to-date, JLP has risen 87%, while BTC has risen 90%, ETH has risen 65%, and SOL has risen 104%. (Data as of December 4)

From a volatility-adjusted perspective, we calculated the Sharpe ratio, which takes into account volatility and the “on-chain risk-free rate” (set to 7% p.a. in this case). As shown in the chart, JLP outperformed BTC and other major assets by more than 2x after accounting for volatility.

JLP continues to outperform other assets primarily due to the large fees paid by perpetual traders on Jupiter, as shown in the chart below. More information on JLP can be found on the Gauntlet dashboard.

Tóm lại là

In this article, we have introduced two high-yield liquidity mining strategies. However, there are still other high-yield strategies to choose from, such as Pendles high fixed income, YT tokens, basis trading, etc. These strategies contain different degrees of risk and potential returns, which we will introduce in detail in the future.

This article is sourced from the internet: How to obtain stable high returns through DeFi in the bull market?