The power behind holdings: a perspective on Bitcoin institutionalization

Tác giả gốc: Chandler, Foresight News

As the price of Bitcoin continues to rise, its appeal gradually shifts from retail investors to large institutions with strong funds and resources. Unlike the previous bull market, where the prosperity of the ecosystem and the entry of institutions became the core driving force behind the surge in prices, in this round of market conditions, the in-depth layout of institutions has become an important variable in promoting market development. From the successful approval of spot ETFs to the frequent increase in positions by traditional financial giants and professional asset management institutions, institutionalization is reshaping the landscape of the Bitcoin market.

During this process, the investment logic of Bitcoin has also quietly changed – from a speculative asset that simply pursues price fluctuations to a long-term allocation tool with asset diversification and anti-inflation characteristics. At the same time, the changes in the holdings and profitability of major institutions have also attracted much attention from the market: Who is constantly increasing their investment in Bitcoin? Which institutions have already obtained considerable returns from this round of increases? Does the change in the size of holdings have a significant impact on market prices? This article will focus on the holdings of several top-ranked institutions.

Panorama of Bitcoin institutional holdings: ETFs become the dominant force in the market

According to data from BitcoinTreasuries.com, as of November 18, 2024, 92 entities (including companies and countries) publicly hold nearly 2.718 million bitcoins, accounting for 12.94% of the total supply of Bitcoin. It can be seen that as Bitcoin is gradually regarded as digital gold, institutional investment in Bitcoin is not only a response to price fluctuations, but also a long-term plan for asset diversification and hedging against inflation.

Overview of Bitcoin institutional holdings:

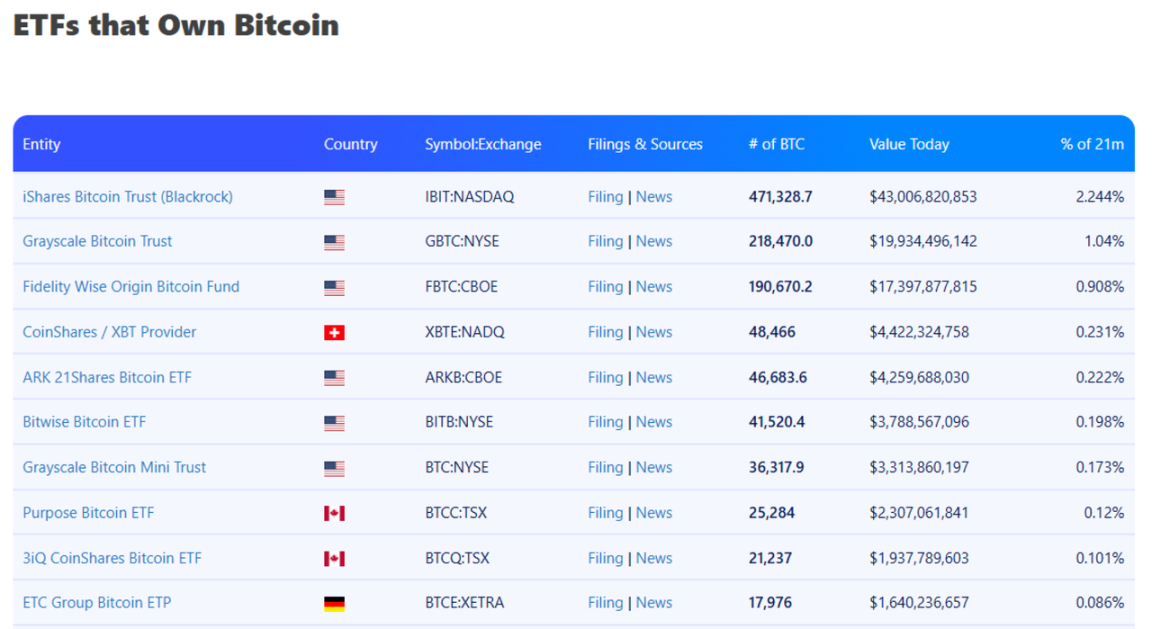

The most noteworthy of these is the proportion of Bitcoin ETFs, which account for 5.82% of the total supply of Bitcoin. Since the launch of the US Bitcoin spot ETF in January 2024, the process of traditional institutions eroding the Bitcoin market share has been accelerated.

ETF competition: BlackRock leads the way, Grayscale adjusts its strategy to diversify its layout

Bitcoin ETFs provide investors with a convenient way to invest in Bitcoin, especially the Bitcoin spot ETF in the United States, which has attracted a lot of attention as an emerging tool in the market. Since its launch in 2021, the ProShares Bitcoin Futures ETF has shown a certain inflow of funds, but its gap with the spot price of Bitcoin is large, mainly affected by the volatility of the futures market. In January 2024, the first Bitcoin spot ETF in the United States was officially approved, and Bitcoin investment entered a new stage.

With the launch of Bitcoin spot ETF, the participation of institutional investors has become more active, especially in the ETFs holding structure, the performance of the top-ranked institutions is particularly noteworthy.

Top 10 Bitcoin ETF holdings:

BlackRocks iShares Bitcoin Trust (IBIT: NASDAQ) ranks first in the Bitcoin ETF money-making list. Since it began holding Bitcoin on January 11, 2024, the trusts Bitcoin holdings have continued to increase. As of November 2024, the total number of Bitcoins held by the iShares Bitcoin Trust has reached 471,000, with a market value of over US$4.3 billion, accounting for 2.24% of the total supply of Bitcoin.

According to iShares purchase history, BlackRock increased its holdings by more than 1,400 and 2,500 bitcoins in October and November 2024, respectively, increasing its holdings by nearly 15,000 bitcoins in just a few months. Based on the market price of bitcoin of about $30,000 at the beginning of 2024, BlackRocks cost of increasing its bitcoin holdings was about $30,000 per bitcoin. The current price of bitcoin is close to $91,000, and BlackRocks holdings have achieved a return of nearly double, with a cumulative gain of about $2.1 billion.

In addition to the Bitcoin market, BlackRocks layout in the field of digital assets is also deepening. In March 2024, BlackRock and Securitize launched the tokenized fund BUIDL to expand its influence in the Web3 field. In addition, BlackRock is also promoting the launch of the Ethereum ETF to further strengthen its strategic layout in the field of digital asset investment.

As a veteran institution in the field of mật mã asset management, Grayscale has been continuously reducing its holdings of Bitcoin in the past year, from 654,600 at its peak to 218,400. Compared with the traditional institution BlackRocks continuous increase in investment, Grayscale has been continuously reducing its holdings of Bitcoin in the past year.

For Grayscale, which has been deeply engaged in crypto assets, a diversified crypto investment portfolio may have greater profit margins. In the past year, Grayscale has significantly adjusted its investment strategy and began to accelerate the layout of diversified crypto assets. Grayscale currently manages trust funds for 14 crypto assets, including Bitcoin, covering multiple digital currencies such as Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). In addition, Grayscale has also launched three major field funds, focusing on different types of crypto asset investments, such as DeFi (decentralized finance), smart contract platforms, and other emerging crypto assets.

Although the main venue for institutional investment is still mainly overseas, the Asian market is also worthy of attention. According to SoSoValue data, as of November 2024, Hong Kong has launched 6 spot ETFs including Bosera Bitcoin ETF and Huaxia Bitcoin ETF, among which the asset size of Hong Kong Bitcoin ETF has reached US$428 million.

Listed Company Holdings Focus: MicroStrategy Leads the Way

Although the Bitcoin holdings of these listed companies are far less than those of asset management companies, by classifying them we can see the diverse applications and strategic value of Bitcoin in institutions.

MicroStrategy is far ahead with 331,200 bitcoins, accounting for 1.58% of the global total, and is a benchmark for corporate bitcoin reserves. Marathon Digital, Riot Platforms, Hut 8 and CleanSpark in the United States represent major North American bitcoin mining companies, focusing on efficient and environmentally friendly mining. Marathon holds 25,945 bitcoins, ranking first among mining companies. Cryptocurrency trading and service providers such as Coinbase and Galaxy Digital hold 9,000 and 8,100 bitcoins respectively. Germanys Bitcoin Group holds 3,830 bitcoins and is an important player in the European market.

Top 10 holdings of listed companies:

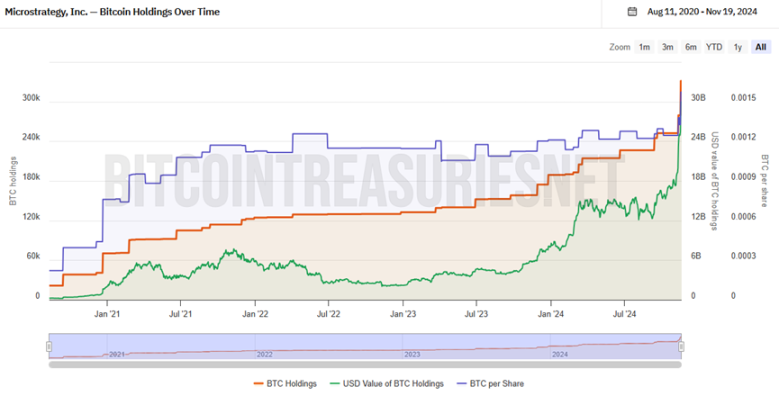

MicroStrategy (MSTR), a global business intelligence (BI) software company, seems to have become a Bitcoin Pixiu. In August 2020, MicroStrategy announced that it would spend $250 million to purchase 21,454 BTC, becoming the first public company to implement a BTC funding strategy.

In addition, MicroStrategy announced on November 19 that it plans to issue 0% convertible bonds totaling $1.75 billion, and also expects to grant initial purchasers the option to purchase up to an additional $250 million in notes within 3 days of the first issuance of the notes. The announcement stated that MicroStrategy intends to use the net proceeds from this offering to purchase more Bitcoin and for general corporate purposes.

According to its announcement, MicroStrategy used the proceeds from the stock sale to purchase another 51,780 bitcoins for $4.6 billion between November 11 and 17, 2024, with an average purchase price of $88,627. As of November 18, 2024, MicroStrategys bitcoin holdings have reached 331,200, with an average purchase cost of $49,874. Based on the current market price, the companys current bitcoin investment profit has reached 82.85%.

Except for MicroStrategy, a leader, and mining companies that continue to accumulate Bitcoin through mining, other listed companies are relatively cautious in their Bitcoin holdings and prefer to use it as part of a diversified asset allocation.

As the founder and CEO of Tesla, Musk has always been a focal figure in the cryptocurrency field. Tesla first announced in February 2021 that it would purchase Bitcoin for $1.5 billion and planned to support Bitcoin payments, a move that caused a huge response in the market. Although Tesla suspended Bitcoin payments in May of the same year due to environmental disputes, the company did not completely sell off its holdings, only selling 4,320 in March 2021 and further reducing its holdings by 29,160 in June 2022, and has maintained its holdings since then.

As of November 18, 2024, Tesla still holds 9,720 bitcoins, with a current market value of approximately US$914 million.

Institutionalization promotes the long-term value recognition of Bitcoin

In general, institutions are increasingly optimistic about Bitcoin as a crypto asset in the long term. As large institutions such as BlackRock and Grayscale continue to increase their holdings of Bitcoin and strengthen their strategic deployment in areas such as Web3 and Ethereum through diversified digital asset layouts, Bitcoin is expected to occupy a more stable position in global asset allocation in the future.

Although the trend of centralization of Bitcoin holdings may pose certain challenges to the decentralized nature of Bitcoin, this is not necessarily negative. On the contrary, with the participation of large institutions and enterprises, the Bitcoin market is expected to gain greater recognition and support and continue to play an important role in the global financial system.

On the one hand, the participation of large financial institutions and enterprises has brought more trust and stability to the Bitcoin market. The deep involvement of these institutions reflects their confidence in the long-term value of Bitcoin, further promoting the acceptance and adoption of Bitcoin worldwide. This trend can provide strong support for Bitcoin prices, while also increasing market liquidity and attracting more investors to the market. On the other hand, despite the increase in the concentration of holdings, Bitcoins decentralized network structure remains solid. Countless distributed nodes around the world ensure the independence and risk resistance of the Bitcoin network. The participation of large institutions helps to promote the development of Bitcoin technology and the improvement of network security, further consolidating its position as digital gold.

In addition, from the perspective of industry development, the deep involvement of institutions can, to a certain extent, establish a benchmark for Bitcoin as a legal investment tool, and at the same time promote the maturity and stability of the market. This trend may lead to a more positive regulatory attitude, create favorable conditions for the compliance and legalization of the digital asset market, and promote the development of the entire industry in a more stable direction.

This article is sourced from the internet: The power behind holdings: a perspective on Bitcoin institutionalization

Related: What is PayFi and why is Solana PayFi?

Original author: Will Awang Musks journey is to the stars and the sea. Similarly, for the 2 trillion crypto market that wants to move towards Mass Adoption, the 400 trillion to 600 trillion traditional financial market is also a starry sea. We can see some paths, such as the rise of tokenization, but the current RWA 1.0 early assets are migrating to the chain, but the relatively lack of liquidity model is not a long-term solution. Even if DePIN can revive the Internet of Things, it is still difficult to get to the core. So we see Web3 payments, which can promote the mass adoption of stablecoins, which is the core, especially for non-transaction scenarios. VISAs stablecoin report tells us: the total supply of stablecoins is about $170 billion, settling…