IOSG Ventures: Chúng ta hãy nói lại về kiến trúc thiết kế của Unichain. Tại sao nó lại cần thiết?

Nguồn gốc: IOSG Ventures

Lời nói đầu

Over the years, Uniswap has been continuously pushing for functional and innovative reforms to make exchanges more user-friendly and fair. For example, we have seen Uniswap Mobile, Fillers Network in UniswapX, ERC-7682 for unified cross-chain intent standards, and hooks for custom AMM pools in Uniswap V4.

On October 10, Uniswap announced their master optimistic Rollup, Unichain. The chain aims to become a one-stop liquidity center in the superchain ecosystem, providing traders with a near-instant exchange experience and lower spreads, while maximizing the privacy and integrity of MEV participants in the process, and using TEE in the process.

While these visions are impressive, users question the need for another L2, with some, including Vitalik, commenting that Unichain = “a copy of Uniswap on every Rollup.” In other words, he believes that launching a Uniswap clone on a new chain actually serves the same purpose as launching Unichain itself.

So, is Unichain a good thing or a bad thing? Today’s article will discuss the architecture of Unichain and understand the “necessity” of Unichain.

1. What is Unichain?

Unichain is an optimistic rollup that aims to execute near-instant transactions while using privacy technology TEE to minimize potential impact on on-chain LPs and exchangers.

Because Unichain is built with the same properties and standards as other optimistic rollup chains, it can now leverage interoperability within the hyperchain ecosystem and access shared liquidity across the entire network.

To this end, Unichain brings 4 major innovations:

Separation of Rollup-Boost and Sequencer Builder

Block construction in TEE

Flashblock

Unichain Verification Network (UVN)

1.1 Rollup Boost: Sequencer Proposer Separation (SBS)

Block Building is the key to solving the MEV problem.

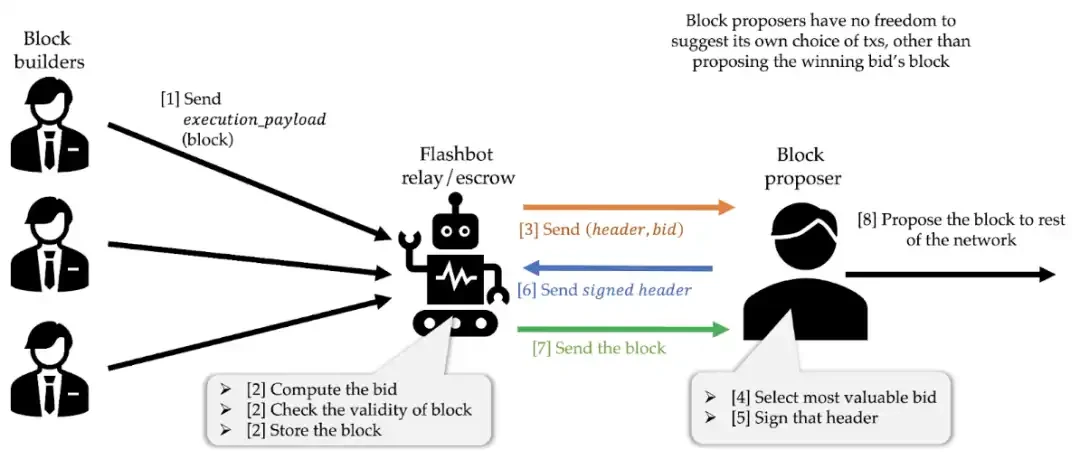

Before MEV Boost, Ethereum was plagued by censorship risks and poor user experience. Users faced high transaction fees and front-running issues due to fierce competition among searchers for profit-driven order inclusion. To address these issues, flashbot built MEV-boost.

MEV Boost separates the roles of block builders and proposers by introducing relayers to aggregate them and submit the most profitable blocks to proposers for signing. This design effectively decentralizes the MEV extraction process and democratizes MEV profits between validators and professional builders.

The concept of Rollup Boost is similar to MEV Boost, where the L2 with SBS (Sequencer Builder Separation) enabled can separate the block building process from the sequencers execution engine through a system called Block Builder Sidecar.

In short, there are 4 main components inside the system:

OP-node

OP-geth

· Sidecar / Blockbuilder Sidecar

External Block Builder

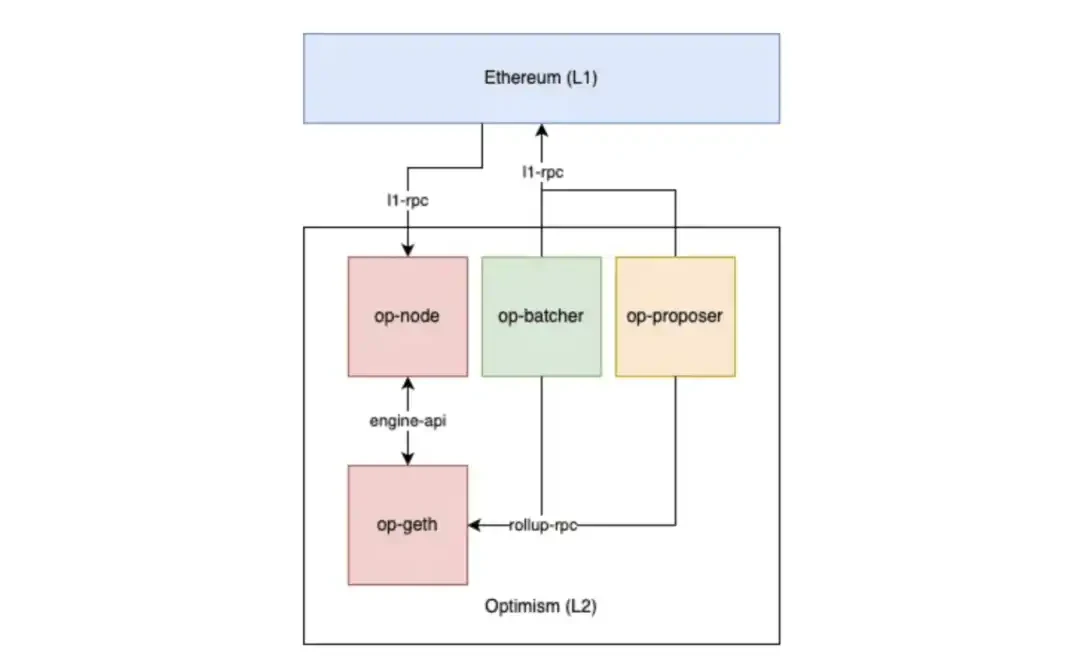

Below is the optimism architecture diagram, we can see that the sequencer node (also known as op-chain) consists of Op-geth and Op-node.

In order to distinguish the roles of block building and proposal in the sorter, a component called Sidecar was added. Sidecar enables OP nodes to receive blocks from external builders, thus creating a market between block builders and proposers.

The workflow is as follows:

1. The OP node sends updates to the sidecar.

2. Sidecar acts as a middleman to forward updates to op-geth

3. When the OP node requests a block from OP-geth, the sidecar intercepts the request.

4. The sidecar then forwards the request to the external block builder, which is the gap where the external builder can bid and compete.

5. After receiving the external/winner block, the sidecar sends it to the OP node.

6. If no block is received, the sidecar will forward the locally generated block.

The main benefit of the block builder sidecar is that upgrades do not require modifications to the OP chain client, while allowing for more flexible, simplified, and censorship-resistant transaction ordering rules. However, some delays may occur due to the addition of an intermediary (sidecar).

1.2 Rollup Boost: Sequencer Proposer Separation (SBS)

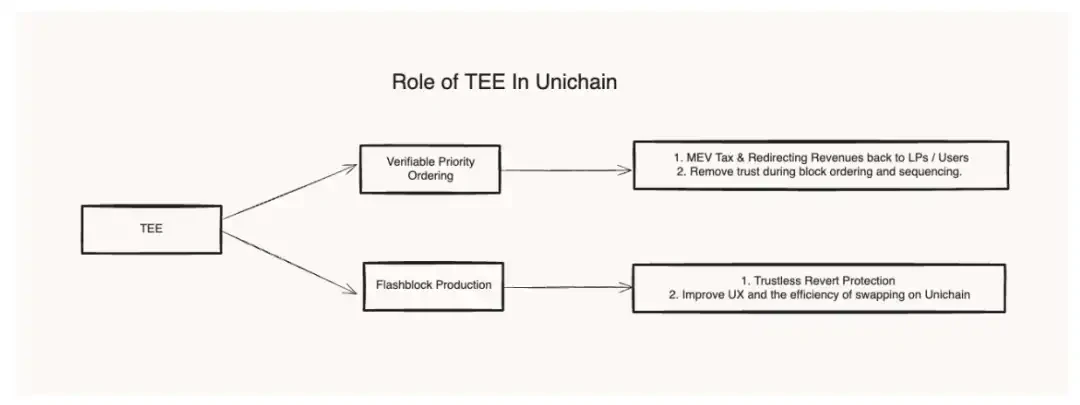

Rollup Boost takes this a step further by introducing a Trusted Execution Environment (TEE) into the block building process to ensure the integrity of transactions. Real-time performance is possible thanks to the latest hardware advancements such as Intel TDX.

For those who are not familiar with TEEs, they are secure areas within a processor or hardware that provide enhanced privacy by preventing unauthorized entities from reading internal data. At the same time, TEEs maintain a high level of integrity because the code within the TEE cannot be modified or replaced.

In the context of Rollup Boost, Unichain will use TEE builders to reduce the risk of MEV leakage. This means that when a bundle or transaction is sent to a TEE block builder, the integrity aspect of the TEE guarantees that the order in which the transactions arrive at the builder cannot be affected by an external party trying to extract more MEV.

Additionally, TEEs provide trustless rollback protection, which protects users from failed transactions because the TEE can run simulations and will be detected and eliminated before any rollback transactions are processed. This not only increases the efficiency of the AMM (since no failed transactions will go through), but also improves the overall user experience, especially during periods of high transaction volume.

To increase transparency in the ordering and block building process, proof of execution will be made public to users after the block is generated. This proof is essential to verify the prioritization, a concept that will be explained in the following paragraphs.

1.3 Flashblock and verifiable block construction

Ethereum’s average block time is 12 seconds, which is too slow to meet today’s demands for an acceptable transaction experience. In addition, slow block times expose the network to more MEV opportunities and make it vulnerable to network congestion under spam attacks.

L2 aims to improve Ethereums scalability by bundling off-chain transactions and submitting proofs to verify computational correctness. To provide a smoother trading experience, Unichain aims to achieve a block time of 250 ms. However, to achieve this, Unichain needs a system that can continuously transmit blocks with low latency and near-instant confirmation times. Solana can process 440M in parallel, but in order to achieve such speed, a certain degree of decentralization is sacrificed.

Previously, in most L2 block proposal processes, delays in serialization of data and state root generation made fast block times infeasible.

To solve this problem, flashbot created flashblock, the idea of which is to break down blocks into smaller shards, thereby shortening the time between blocks to maximize UX/LP advantages.

Flashblocks are pre-confirmations issued by the TEE block builder for partial but fast confirmation.

First, transactions are streamed into the TEE block builder. If L2 has SBS enabled, the block builder will be separate from the sorter. After sorting and bundling, transactions will be gradually formed into partial confirmations called Flashblocks. Flashblocks will be broadcast from the sorter every 250 milliseconds to other nodes for verification.

Since latency is caused by state root generation and serialization in L2, Unichain amortizes the cost of the block construction process by computing the state root and consensus only once over multiple partial blocks, significantly reducing latency.

In short, Flashblock is powerful because:

Shorter block times reduce the risk of adverse selection costs for LPs.

Flashblock provides early execution status of existing state, making wallet and front-end integration easier.

Fast transactions provide excellent user experience (UX).

Additionally, since TEEs can enforce prioritization within each Flashblock, applications and smart contracts can now impose MEV taxes, hijack prioritization for their own benefit, and redistribute MEV to LPs and users.

As Dan Robinson highlighted in his tweet, allowing applications and users to “control” their MEV is one of the main functions/purposes of Unichain.

Even better, prioritization can be verified through public execution proofs in the TEE. This allows users to verify exactly how their transactions were executed. This is very important because it is the only way for users to ensure that prioritization was performed fairly.

1.4 Unichain Verification Network (UVN)

Today, most L2 sorters are centralized, and the behavior of a single sorter can affect the fairness of MEV, the liveness or finality of blocks, etc. For example, if a sorter publishes an invalid block and a fraud proof is submitted to challenge it, the resulting chain reversal can actually affect the speed of the chain.

To address potential single points of failure in the sequencer, Unichain introduced the Unichain Verification Network (UVN).

UVN adds an extra layer of finality by focusing on validating blocks by proving the canonical chain (Ethereum) validators when proposing a block. This process is actually similar to parallelization, where different stages of block construction can occur simultaneously in a single epoch.

However, without further details from the document, it is too early to make assumptions about the pros and cons.

1.5 $UNI Mã thông báo

The $Uni token is now more than just a governance token, it is also a utility token.

To become a validator, operators must first stake $Uni as collateral on the mainnet. The smart contract will track the balance and update the state through Unichain’s native bridge.

At the beginning of each epoch, the current staked balance is snapshotted and fees are distributed proportionally by stake weight. Validators with the highest $UNI stake weight will be selected as the active set, and they can publish proofs to receive a portion of the validation rewards. Validators who miss or do not publish proofs will not receive rewards, and rewards will be carried over to the next epoch.

Based on the limited public information, we can infer that the validation rewards will be:

(L2 fees paid by Unichain users – MEV taxes imposed by applications – cost of submitting bundles to layer 1)

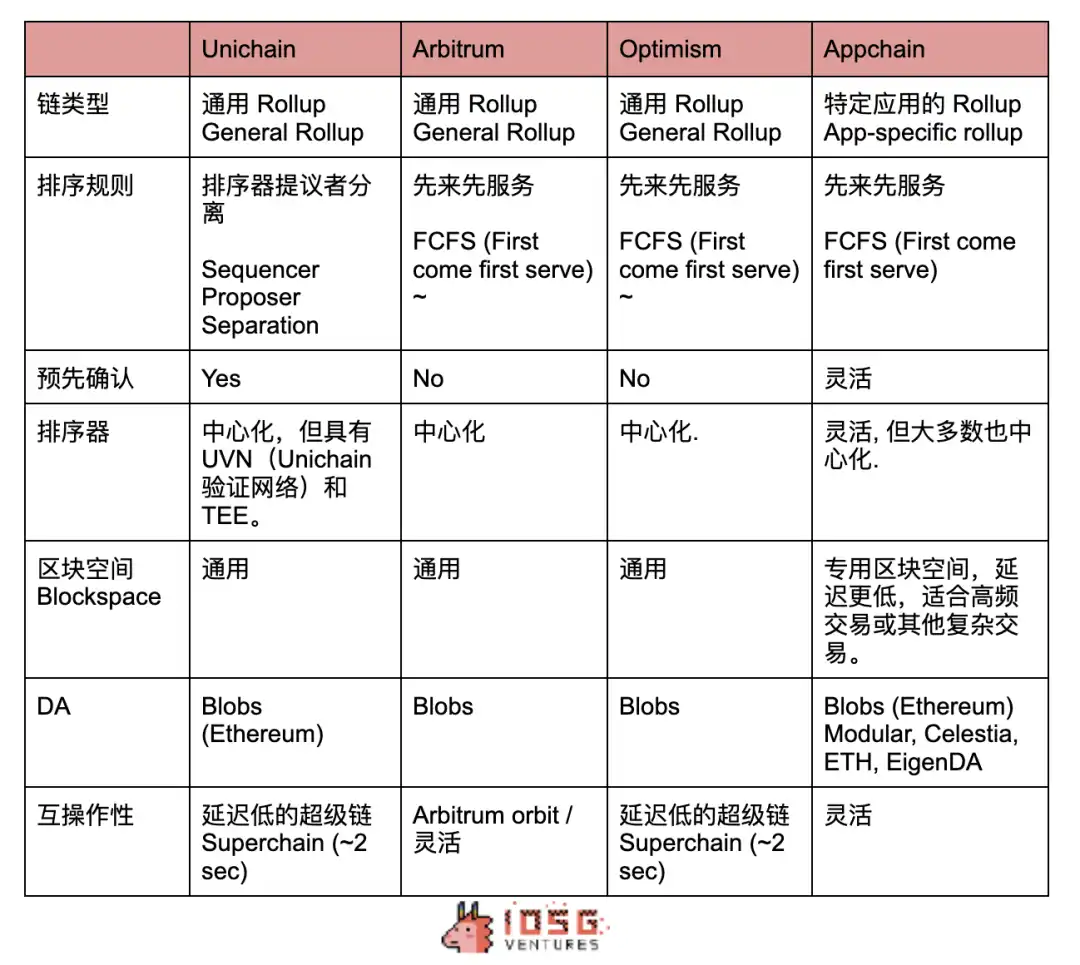

2. Unichain vs Appchain vs General Rollup

The main differentiating factors between Unichain/Universal Rollup and Application Chain are MEV, pre-confirmation and block space competition.

Since application chains can flexibly customize their architecture, they can implement different MEV mechanisms to mitigate issues such as eliminating censorship risks or reducing MEV leakage.

At the same time, due to the integrity properties provided by TEE, Unichain mitigates and reorganizes MEV by ensuring that the order of transactions cannot be influenced by any third party. Verifiable prioritization also ensures MEV fairness and has the potential to redistribute MEV revenue to users and liquidity providers.

Most sorters on the market are centralized, allowing them to extract the most value from order flow. In contrast, Unichain takes a more public interest approach, as its MEV redistribution mechanism somewhat limits the amount of MEV that the original sorter can capture.

Unichain is built on OpStack, a unified standard for optimistic chains, which enables Unichain to read messages and transfer assets on the hyperchain through secure messaging, thereby achieving low latency (about 2 seconds) through its native optimistic interoperability design. On the other hand, the application chain can take advantage of different interoperability solutions, such as joining the IBC ecosystem or building L3 on Arbitrum Orbit (although this is not common for OpStacks L2).

3. Kết luận

Unichain is an interesting concept that not only provides users with a smooth transaction experience with pre-confirmation, but also minimizes the MEV utilization window due to the shorter block times enabled by flashblocks. This innovation also reduces the adverse selection risk of LPs and allows users/LPs to benefit from lower slippage, etc.

On the other hand, the integrity and privacy properties of the Trusted Execution Environment (TEE) ensure that users on the chain can enjoy guaranteed transactions with fair, verifiable or application-managed MEV redistribution, thanks to the priority sorting on Unichain.

Unichain’s validation process also protects the sequencer from a single point of failure, and validators play an important role in quickly and finally validating blocks while turning $Uni tokens into a productive asset with a yield.

However, by enabling MEV redistribution, the sequencer actually loses the potential to capture the maximum amount of MEV, but more of the proceeds are being returned to LPs/users on the chain.

While some may argue that Unichain may not be attractive enough for assets to migrate to new chains, I believe that as the L2 ecosystem continues to grow, interoperability between operating chains will enable Unichain to tap into larger liquidity pools, such as those from Base.

Furthermore, in addition to Grants (which Unichain can also provide in the form of USDC after Uniswap DAO), new DeFi apps have enough motivation to build on Unichain because they can benefit from customized MEV redistribution strategies. At the same time, assets within the ecosystem can benefit from TEEs to mitigate MEV leakage.

Therefore, with its speed, the fairness of MEV redistribution, and the interoperability that the chain may provide, Unichain has the potential to become the next hub of DeFi.

This article is sourced from the internet: IOSG Ventures: Let’s talk about Unichain’s design architecture again. Why is it necessary?

Original author: Glenn Hodl Compiled by Odaily Planet Daily ( @OdailyChine ) Translator 锝淎zuma ( @azuma_eth ) Editor鈥檚 Note: The trend of the cryptocurrency market is still confusing, but Microstrategy (MSTR), which is strongly tied to Bitcoin, has recently set a record high in its stock price. U.S. stock quotes show that on October 9, MSTR once approached the $200 mark, reaching a high of $198.35. 聽 Recently, overseas KOL Glenn Hodl gave his own analysis on Microstrategys strong performance. Glenn believes that even if the price of Bitcoin stops growing, Microstrategy can use the differences in the markets valuation models for commodities and companies to create a perpetual motion machine that can sustainably increase its own market value, which will eventually make Microstrategy the worlds largest company by market…