Nghiên cứu BitMEX: Khám phá cấu trúc trái phiếu của MicroStrategy, khi nào nó sẽ bị thanh lý?

Tác giả gốc: BitMEX

Tóm tắt: This article will focus on the structure of MicroStrategy bonds and analyze whether MicroStrategy may be forced to sell Bitcoin to repay bondholders if bondholders demand cash redemption. Based on the current debt structure, we believe that the possibility of forced liquidation is extremely low. However, given the sharp fluctuations in Bitcoin prices, anything is possible.

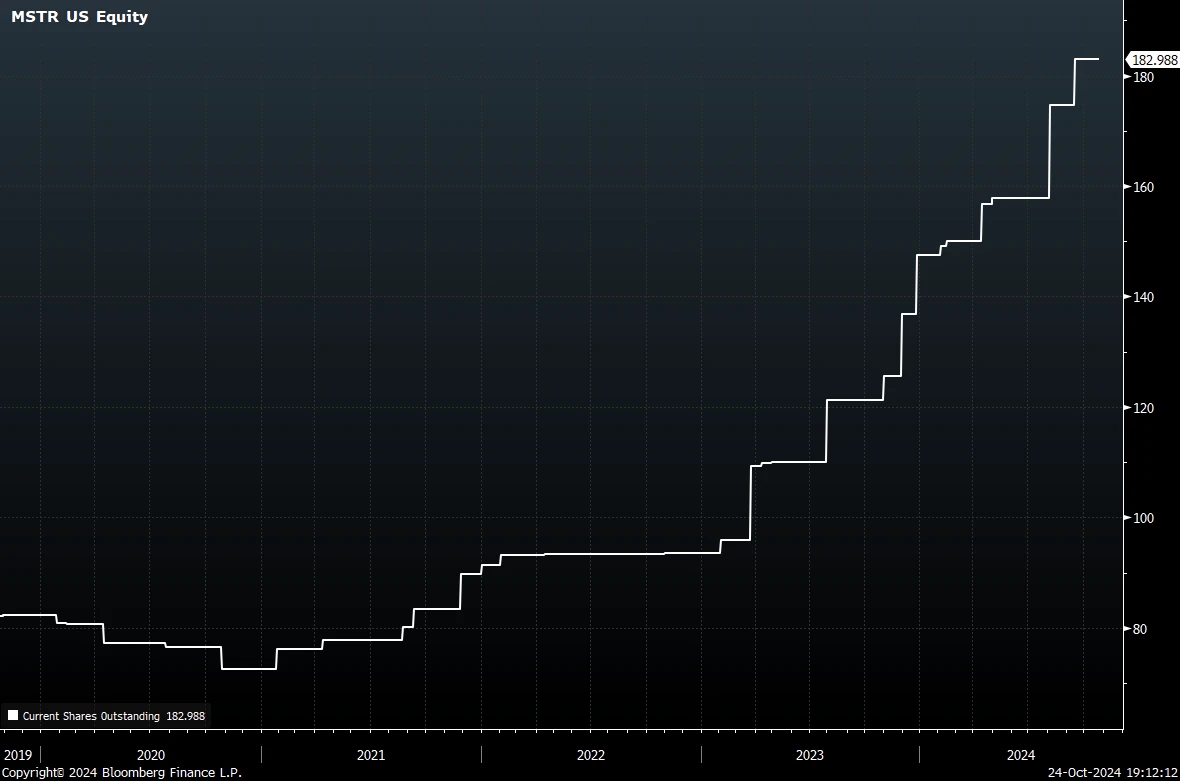

MicroStrategy holds more than 250,000 bitcoins, and its stock price is at a significant premium to its net asset value (NAV). This is reminiscent of the similar high premium that Grayscale Bitcoin Trust (GBTC) experienced in the last cycle before it was converted to an ETF, which attracted a large influx of funds. However, we are puzzled and cannot give a reasonable explanation for why these two investment vehicles can trade at such a high premium. What is even more confusing is that MicroStrategy can even issue a large number of shares at a premium valuation to purchase more bitcoins, thereby pushing up the book value per share. This seemingly unlimited funds cycle operation is puzzling. Since launching its Bitcoin strategy, MicroStrategy has announced five equity issuances, raising a total of $4.4 billion.

MSTR shares outstanding (millions)

History seems to be repeating itself. MicroStrategy boss Michael Saylor is considered by many to be a “bad guy” in the Bitcoin space for some of his controversial positions. These include: his apparent hostility to supporting Bitcoin developers, his opposition to privacy technology, and his brief but outspoken opposition to self-custody. Similarly, Mr. Barry Silbert, who controls Grayscale, has been controversial for being the main organizer of the 2017 “New York Agreement”, which proposed a doomed proposal that the industry abandon Bitcoin in favor of an alternative coin “SegWit 2x” based on the flawed and vulnerable BTC 1 client.

As MicroStrategy has accumulated a large amount of Bitcoin, with a market value approaching $50 billion, concerns have begun to arise. In particular, some have asked whether MicroStrategys debt will force it to sell Bitcoin to the market, triggering a downward price spiral? Unfortunately, due to the complexity of the debt structure, there is no simple yes or no answer to this question. Nevertheless, we have reviewed the relevant documents and will do our best to answer this question in this article.

Tuyên bố miễn trừ trách nhiệm

We would like to add a disclaimer to this article by stating that we are not bond traders, bond market experts or lawyers. The corporate debt market can be complex and difficult for non-professionals to navigate. This article is likely to contain many errors. In addition, this article oversimplifies the product and does not comment on many conditions and complexities. Please do not rely on any information in this article and feel free to point out any errors.

MicroStrategy Bonds

As far as we know, MicroStrategy has issued seven publicly traded convertible bonds since announcing its Bitcoin strategy, as shown below.

The first thing to note is that two of the bonds have been redeemed in full and therefore have no relevance to outstanding debt. Therefore, MicroStrategy has five outstanding bonds with a principal value of $4.25 billion. Therefore, we will review these five bonds.

Redemption and conversion options

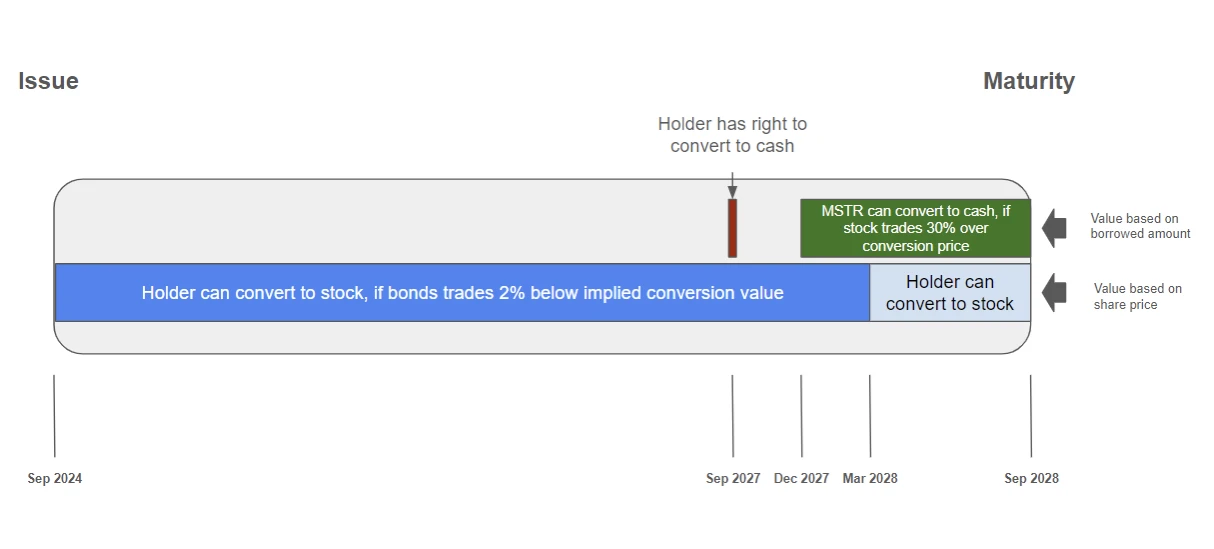

The structure of the bonds is relatively complex and, as far as we can tell, there are four different types of conversion options before maturity. The chart below summarizes these conversion options for the latest instrument (the bonds due in 2028).

MicroStrategy 0.625% 2028 Bond Schedule:

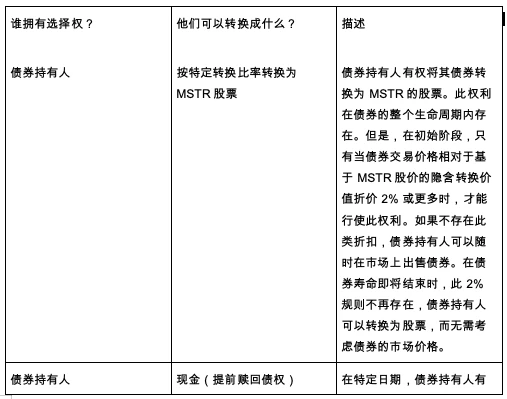

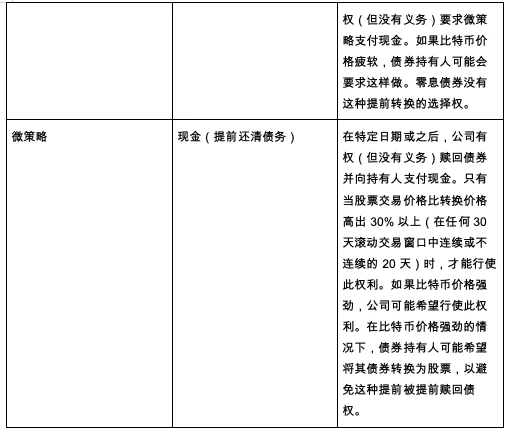

Sorting out convertible bond options:

As far as we know, except for the zero-coupon bond issued by MicroStrategy in September 2021, the remaining four convertible bonds have basically the same mechanism, only the price and date are different. The holders of the zero-coupon bonds do not have the right to redeem the cash before the maturity date unless there is a fundamental change in the business. This may be crucial if the price of Bitcoin falls.

The following table sets out the key dates relevant to the cash conversion options for the five bonds:

Source: Bond issuance documents

Note: *The stock must trade at least 30% above the conversion price within 20 consecutive or non-consecutive days in any 30-day rolling trading window

MicroStrategy’s Conversion Rights

It is important to note that for the zero coupon bond, MicroStrategy has already passed the cash option date in February 2024. The conversion price is $143.25, and a 30% premium to that is $186.23. MSTR stock is currently trading at $214, well above this price. However, it has only been above this price 11 of the past 30 trading days. Therefore, the option is about to become effective, but is not exercisable yet. Exercising this option would create value for MSTR shareholders, however, the bondholders will likely be able to prevent this from happening by exercising their conversion rights.

These complexities make bond valuation quite difficult because convertible bonds have multiple potential outcomes. However, many creditors are likely to be experienced professional bond investors who have models to perform these calculations.

Bond interest payments

Four of the five outstanding bonds carry interest payments. These coupons are cash liabilities, and MicroStrategy could theoretically be forced to sell Bitcoin to meet its payment obligations. However, given relatively low interest rates and the fact that its traditional software business generates ample free cash flow to cover interest costs, even a sharp drop in Bitcoin prices would not be enough to force the company to sell Bitcoin to pay the bond interest. In summary, we do not believe that interest costs will cause MicroStrategy to be forced to sell Bitcoin.

Tóm lại là

MicroStrategy có khoản nợ $4,25 tỷ, được tính dựa trên số tiền gốc vay. Trong khi đó, cổ phiếu của công ty hiện được định giá ở mức $43 tỷ và số Bitcoin nắm giữ của công ty có giá trị $17 tỷ. Điều này cho thấy trái phiếu không chiếm tỷ trọng lớn trong cơ cấu vốn của MicroStrategy.

However, if the price of Bitcoin falls sharply, for example to around $15,000 per coin, and MicroStrategy is unable to raise further debt, analysts may need to consider the forced liquidation of Bitcoin. However, the timing of this potential forced liquidation will be concentrated on the expiration dates and option exercise dates mentioned in this article, which are scattered between 2027 and 2031, and the timing is very clear. Therefore, even if Bitcoin does fall to around $15,000, we believe that the probability of MicroStrategy being forced to sell Bitcoin to repay bonds is still low.

Although it is unlikely that MicroStrategy will be forced to sell Bitcoin, we think it is more likely that MicroStrategy will actively sell Bitcoin for the sake of maximizing shareholder interests. Currently, MicroStrategys stock price is at a huge premium to its net asset value. Once this premium disappears or even becomes a discount (which is almost inevitable), and the bonds are about to mature, selling Bitcoin to raise funds to repay the debt will become the best option in the interests of shareholders. However, as long as the stock price remains at a premium, MicroStrategy can use this to continue to do this kind of revolving loan operation, and there is no reason to sell Bitcoin. Of course, this huge premium state cannot last forever.

It is also important to note that if MicroStrategys stock price can continue to maintain a premium and the market demand for MSTR bonds remains strong, the company may issue more debt. This will cause its debt risk to rise and increase the possibility of forced selling when the price of Bitcoin plummets. But for now, MicroStrategys leverage ratio is low and the risk of liquidation is also at a low level.

This article is sourced from the internet: BitMEX Research: Uncovering the bond structure of MicroStrategy, when will it be liquidated?

Có liên quan: OKX Star: Ngành công nghiệp sắp bước vào giai đoạn tài chính tiền điện tử

Vào ngày 10 tháng 10 năm 2024, OKX chính thức công bố tại sự kiện chủ đề Dubais New Choice: OKX and the Future of Blockchain Innovation được tổ chức tại Bảo tàng Tương lai Dubai rằng họ đã trở thành nền tảng giao dịch tiền điện tử đầu tiên trên thế giới nhận được giấy phép hoạt động đầy đủ tại UAE. Cột mốc này không chỉ đánh dấu vị trí dẫn đầu của OKX trong quy trình tuân thủ toàn cầu mà còn thiết lập một chuẩn mực mới cho sự phát triển tuân thủ của ngành công nghiệp tiền điện tử, trở thành một trang đáng nhớ trong lịch sử của ngành. Thành tựu này chắc chắn đã truyền sức sống mới vào các hoạt động tuân thủ của thị trường tiền điện tử toàn cầu và cũng cung cấp kinh nghiệm và nguồn cảm hứng quý giá cho con đường tuân thủ của ngành công nghiệp tiền điện tử trong tương lai. Giám đốc điều hành OKX Star đã có bài phát biểu quan trọng có tựa đề Kỷ niệm Lễ ra mắt OKX Dubai tại…