Ethereum chưa thắng cuộc chiến, L1 và L2 đang định hình lại bối cảnh tương lai

Original author: @DefiIgnas

Original title: L2s Are the New Old L1s—And Why ETHs Price Is Stuck.

Bản dịch gốc: zhouzhou, BlockBeats

Editors Note: This article explores the current situation and challenges in the blockchain field: L1s that fail to adapt to innovation (such as Cosmos) are facing serious difficulties, while emerging L1s (such as Sui, Sei, and Aptos) still need to continue to innovate in order to gain a foothold in the long run despite gaining some attention in the short term. At the same time, the newly emerged L2 is similar to the L1 of the past, lacking differentiation and innovation, and facing survival pressure. Although some diversified trends are beginning to emerge in the market, overall, Ethereum has not won the L1 war. Instead, alternative L1 and L2 are working hard to create a new future of their own.

Sau đây là nội dung gốc (để dễ đọc và hiểu hơn, nội dung gốc đã được sắp xếp lại):

Has Ethereum won the L1 war?

If you ask me this question now, my answer is obviously no, which is also a big reason why the $ETH price has stagnated. However, during the bear market, the view of ETH as the L1 winner was widely circulated.

We all know that the bull run will eventually come, so many people sold their other L1 assets and turned to increase their positions in two assets that we believe will not disappear: BTC and ETH.

All other L1 assets are considered to disappear for two reasons:

First, other L1s compete for similarly yield-hungry investors by offering liquidity mining rewards, using essentially the same protocol as Aave and Uniswap V2. With the exception of Ethereum, there is little innovation at the application layer.

Avalanche, BNB Chain, Polygon… they are all similar. The only difference between them is:

1. Lower transaction fees

2. Faster speed

3. Brand Image

4. The number of tokens that can provide liquidity mining rewards

Secondly, a new narrative for Ethereum is gradually taking shape with the rise of L2s such as Optimism and Arbitrum, which promise to bring scalability without compromising security. They have performed quite well during the bear market, while other L1s continue to lose total locked value (TVL) and users.

Solana is a huge blow to Ethereum maximalists.

Although SOL was hit hard by the FTX crash, it not only recovered successfully, but also broke the illusion that Ethereum’s rollup approach is the only viable scaling solution. As more and more L2s come online, the fragmentation of liquidity and user experience becomes more serious. With each L2 launched, Solana’s monolithic structure approach becomes more attractive.

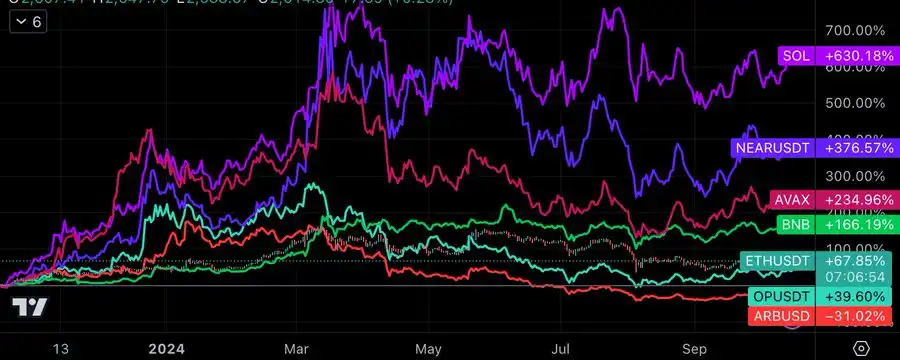

The emergence of the modular vs monolithic debate ended the narrative that “Ethereum won the L1 war.” Investors who had increased their ETH holdings during the bear market are now continuing to sell ETH to buy SOL and other L1s.

Other L1s are also innovating, and now have a clearer and richer vision than they did a few years ago.

Avalanche: Just launched Avax9000, which allows permissionless L1 (not L2) release based on application needs.

Compared to Ethereum L2, Avalanches L1 benefits from unified cross-chain communication. In addition, Avalanches value-added to the main chain is more clear. Avalanches biggest victory is the Off the Grid game, which shows that its vision is being realized. This can also revive the narrative of the former GameFi.

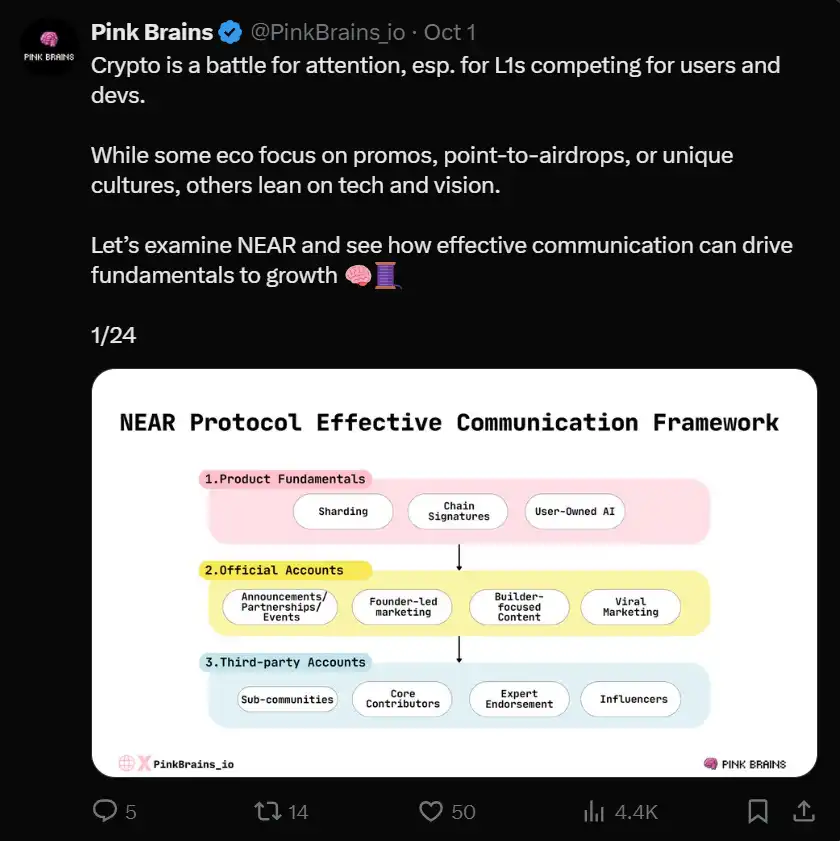

Near: is establishing its position as a monolithic and modular blockchain. Near also provides chain abstraction for L2 through a unified user interface (BOS), supports L2 account aggregation, and implements the sharding technology abandoned by Ethereum.

BNB Chain: opBNB L2 was launched to reduce fees, but the more important upgrade is BNB Greenfield, which focuses on data finance (DataFi) to monetize data and intellectual property, and decentralized artificial intelligence (LLM training under privacy protection).

Fantom: Further strengthening the monolithic design through the Sonic upgrade, it aims to achieve 2,000 transactions per second (TPS) without sharding or L2, with the goal of attracting a new generation of decentralized applications (dApps).

Gnosis: Building the financial dApp that I use on a daily basis.

L1s that fail to innovate and adapt are facing difficulties, and the most obvious example is Cosmos. Once a pioneer in modular blockchains, it is now losing users, liquidity, and market attention. The trading price of $ATOM has fallen back to the level before the 2020/21 bull run.

Meanwhile, emerging L1s like Sui, Sei, and Aptos are still relying on the old “new shiny L1” strategy, and while they have gained some attention in the short term, they must innovate and differentiate themselves if they want to thrive in the long term.

Today’s new L2s are similar to the L1s of the past, with almost no transaction fees and little differentiation outside of branding. They have attracted some forked protocols for airdrops, but lack real innovation. As the airdrop craze fades and the total locked value (TVL) declines, L2s must diversify and attract unique decentralized applications (dApps) to survive, and their token economic models are relatively poor.

Projects that fail to adapt to market changes may be eliminated, just like some of the EVM chains that emerged during the DeFi summer of 2020.

Despite this, there are still some signs of diversification in the market: L2 interoperability alliances (such as OP Super Chain, zkSync Elastic Chain, etc.) are developing, Base is also benefiting from Coinbase, and zkSync is investing millions of dollars to attract unique dApps.

Overall, Ethereum has not won the L1 war, and the value added of all L2s is still unclear. However, this is a good thing for the industry as a whole. Even as Ethereum faces challenges, alternative L1s are working hard to build their own future and provide use cases that Ethereum may not be suitable for.

Now, the time has come for L2 to prove its value.

This article is sourced from the internet: Ethereum has not won the war, L1 and L2 are redefining the future landscape

Tác giả gốc: Thor Hartvigsen, Thlither, hyphin Bản dịch gốc: LlamaC (Danh mục đầu tư: DAYBREAKER, Giới thiệu về Tomo: Họa sĩ minh họa cho eth Foundation) “Khuyến nghị: Polymarket là một trường hợp thành công trong không gian tiền điện tử, mang lại những lợi thế rõ ràng so với các nền tảng tập trung. Tìm hiểu cách Domer, với tư cách là một nhà giao dịch hàng đầu tại Polymarket, đã tích lũy được kinh nghiệm trong trò chơi đối đầu, giao dịch chứng khoán và giao dịch sự kiện, cũng như những hiểu biết độc đáo của anh ấy về tâm lý giao dịch và dự báo thị trường để đạt được thành công trong giao dịch. giới thiệu Polymarket đã trở thành một trong những câu chuyện thành công nổi bật nhất trong không gian tiền điện tử trong năm nay, thu hút hàng chục nghìn người dùng hoạt động hàng ngày và tạo ra hàng trăm triệu đô la khối lượng giao dịch mỗi tháng. Là thị trường dự đoán lớn nhất được hỗ trợ bởi blockchain, nó phổ biến hơn các lựa chọn thay thế tập trung. Nó có những lợi thế rõ ràng và chứng minh rằng tiền điện tử có thể mang lại…