Bonk ra mắt BONK Trust: Có bao nhiêu token có thể bị “khóa”? Điều gì hấp dẫn người dùng không phải là vòng tròn?

Bản gốc | Odaily Planet Daily ( @OdailyTrung Quốc )

Tác giả|Nan Zhi ( @Sát thủ_Malvo )

In 2023, the most outstanding Meme token on Solana besides WIF is BONK. The main upward trend of the token began around the beginning of November 23. After one and a half months, the market value rose from US$20 million to US$1.5 billion in mid-December, an increase of 75 times.

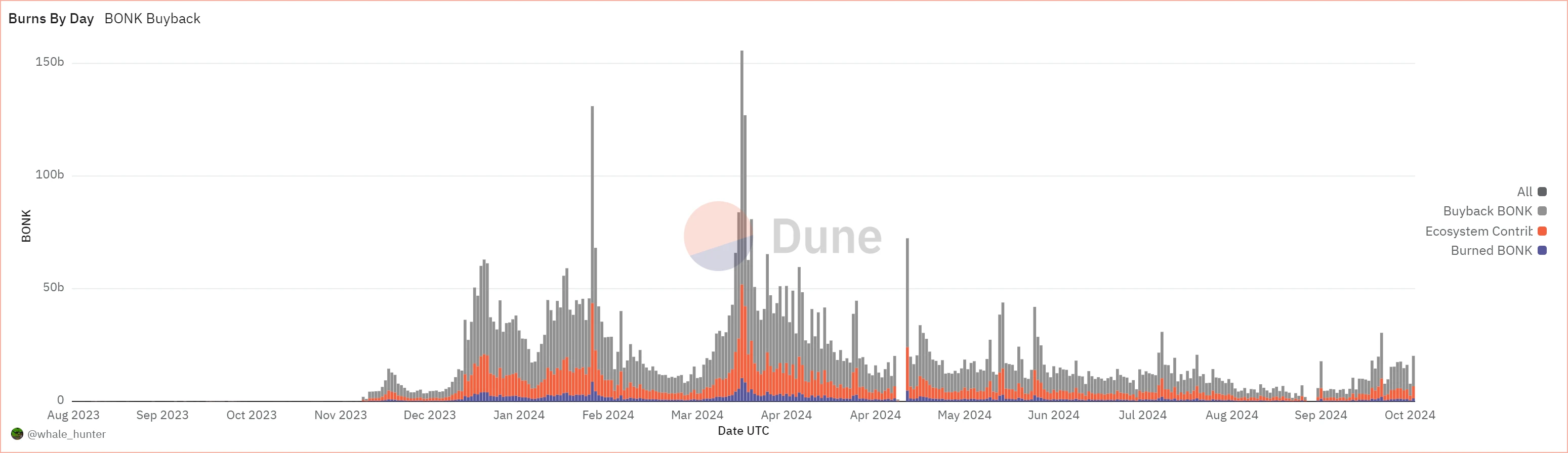

Unlike other tokens, BONK does not rely solely on community building to achieve its growth, but has begun to move from virtual to real . In August 2023, Bonk launched the Telegram trading Bot of the Solana network, burning BONK tokens by charging Bot service fees, and has burned a total of more than US$10 million worth of BONK.

Hôm nay, Bonk announced the launch of the BONK ETP Osprey BONK Trust , which will accept the first batch of qualified investors. It aims to provide qualified investors (rich people) with a simple, cost-effective way to obtain BONK. Odaily will analyze it in this article.

Osprey BONK Trust Interpretation

Bonk stated on its product introduction page that the Osprey BONK Trust is designed to provide simple and secure BONK investment, becoming a way for qualified investors to invest in BONK without a wallet or private key.

How many tokens are locked?

Osprey BONK Trust has a strict definition of qualified investors, including:

-

Individual annual income must exceed $200,000 (or combined annual income with spouse must exceed $300,000), and net assets must exceed $1 million ;

-

Investment professionals, such as licensed associates of broker-dealers and investment advisors;

-

The entity must have $5 million in liquid assets or all beneficial owners must be accredited investors.

Another key element in the Osprey BONK trust terms is that the trust will not provide BONK redemption for the time being, and investors can only sell shares through the secondary market in the near future. In summary, from the perspective of tokens, the purpose of launching this trust is to attract high-quality funds from outside the circle to purchase BONK and lock the tokens in the trust .

So under the current terms, how many BONK tokens will the Osprey BONK Trust lock up at most?

The terms state that each trust share represents 216,999.02 BONKs, and the initial circulation (Shares Outstanding) is 9,792,000 shares, so a maximum of 216,999.02 × 9,792,000 = 2.12 trillion BONKs will be deposited in the trust. The current unit price of the token is 0.00002273 USDT, equivalent to a locked position of 49.3 million US dollars, accounting for 3% of the total tokens, which is considerable.

In addition, the trust will have an annual management fee of 2.5%, but whether it is used to destroy BONK or other methods of increasing the price of the coin has not been disclosed.

Why is it attractive to funds from outside the circle?

Some of the discussion content and official responses in the comment section under the announcement of the launch of the trust revealed that the launch of the Osprey BONK trust has other meanings.

User A commented below the announcement and asked, what are the advantages of purchasing BONK through a trust compared to purchasing BONK directly on the chain?

@ R89 Capital responded, “Memecoin sized gains from tax advantaged accounts.” BONK officials agreed with the response , and another BONK official @oskyment said, “Being able to invest using your 401 K for example.”

(Note from Odaily Planet Daily: 401k is a retirement savings plan provided by American employers that allows employees to have a portion of their salary deducted in advance and deposited into an account for investment.)

How to understand? Simply put, by purchasing a BONK trust through an account such as 401K, you can enjoy the benefits of tax deferral and pre-tax investment deductions , and may obtain certain potential tax incentives.

To expand on this, through 401K account investments, investment income such as interest, dividends and capital gains will not be taxed immediately in the account until the user withdraws these funds at retirement. In addition, after the user invests other pre-tax income in accounts such as 401K for investment, this part of the income will be exempt from tax calculation.

However, the author believes that in the face of a 2.5% management fee, even with short-term tax benefits, real appeal still requires stable and reliable coin price performance to support it, which corresponds to Bonks other core revenue business, BonkBot.

Risk Warning

But it is worth noting that the Osprey BONK Trust states in its terms that none of the Funds has been registered under the Securities Act, the Investment Company Act of 1940, or any state securities laws . Shares purchased directly from the Funds are private placements made pursuant to the Securities Act … and other similarly important exemptions under state and local laws and are offered and sold only to accredited investors.

Therefore, shares purchased from the Funds are restricted and are subject to significant limitations on transfer and resale. Prospective investors purchasing directly from the Funds should consider these liquidity restrictions very carefully before making any investment decisions, including the fact that none of the Funds currently offer redemption programs.”

From virtual to real

For most memes, stripping away the outer shells of community, culture, and consensus, their essence is still a capital pool and attention economy, and all profits come from users who enter the market later. In particular, newly born memes are more focused on creating events and attracting attention, rather than considering development in terms of practicality.

However, it is difficult for the old Meme to attract more incremental users, so some tokens have begun to move from virtual to real. Floki launched the RWA product Mã thông báoFi (TOKEN), and Bonk launched BonkBot, etc. BonkBot burns about 20,000 to 30,000 US dollars of BONK every day. Since its launch, it has burned 10.53 million US dollars worth of BONK, becoming an anchor to stabilize its price.

2024 is the big year for Meme, with memes with market capitalizations of hundreds of millions or even billions of dollars emerging one after another. However, many popular memes have fallen sharply after losing the attention of investors and have disappeared from the public eye. Therefore, the transition from virtual to real direction pioneered by BONK and FLOKI may become one of the core choices for the new generation of Memes to seek long-term survival in the next few years.

This article is sourced from the internet: Bonk launches BONK Trust: How many tokens can be “locked”? What is the appeal to non-circle users?

Khách mời của tập này: Stewart, Giám đốc Nghiên cứu Đầu tư tại First Class Warehouse, Twitter: @Jindouyunz Là một người hâm mộ lâu năm của Toudest Warehouse, tôi đã mời giám đốc nghiên cứu đầu tư của công ty, cũng là bạn cũ của tôi là Jindouyun, để nói về cách họ đã đầu tư 1.000 lần vào aave trong chu kỳ trước và những thay đổi trong khái niệm đầu tư giá trị trong chu kỳ này. Tôi cũng đã thảo luận về phương pháp luận tìm Alpha trong chu kỳ này và tóm tắt một số điểm khiến tôi ấn tượng. * Văn bản sau đây chỉ để chia sẻ và không cấu thành bất kỳ lời khuyên đầu tư nào. TL;DR 1. Chiến lược đầu tư Quy mô quỹ và tỷ lệ phân bổ: Tổng quy mô của quỹ first class warehouse là khoảng hàng chục triệu đô la và có quy định nghiêm ngặt rằng mỗi nhà quản lý đầu tư không được quản lý quá 10…