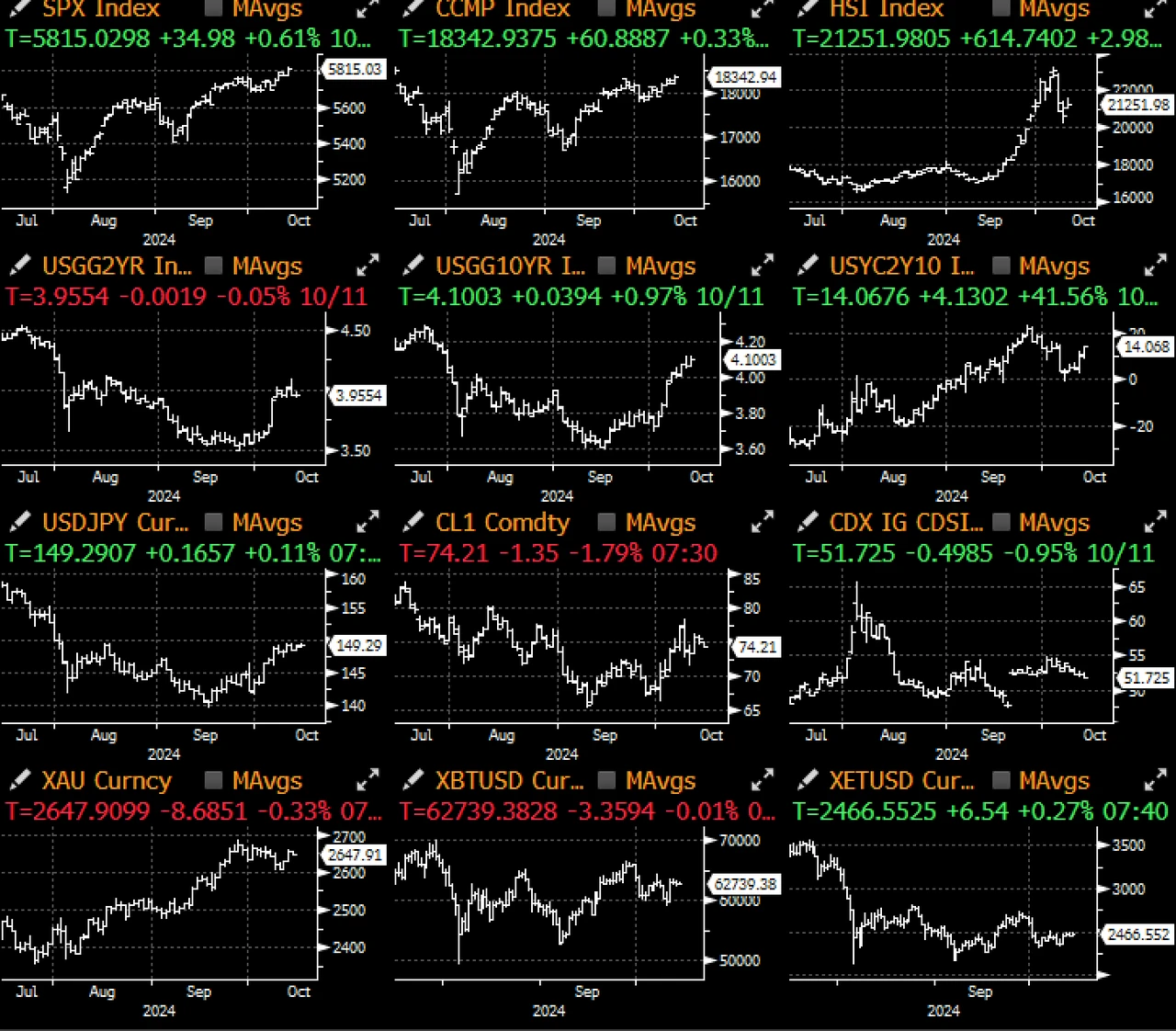

Last week, US economic data was relatively strong, with both CPI and PPI strengthening. The market was initially a bit hesitant about the impact of the data, but ultimately determined that the trend of core inflation remained unchanged, and the trend of the yield curve steepening continued. The US stock market hit a record high, high-beta stocks and foreign exchange broke further, and the market still expected a 25 basis point rate cut in December with a probability of more than 85%. Citis macro strategists expressed extreme bullishness on stocks, while Goldman Sachs has been raising its target prices for US and Chinese stocks in the past few weeks.

In China, the much-anticipated weekend Ministry of Finance press conference was mixed, with no clear mention of the specific stimulus policy size, a general lack of implementation details, and no announcement of measures to stimulate retail consumption. Although iron ore, crude oil and A shares fell in early trading on Monday, prices have rebounded strongly before the lunch break, and Chinese retail funds may still maintain strong momentum to buy on dips in the short term.

In the US stock market, JPM kicked off the third quarter earnings season with a very strong performance. The banking giants stock price rose 5% after it announced an unexpected increase in interest income and raised its revenue forecast. The overall KBW Bank Index also rose to its highest level since April 2022. It is expected that the steepening trend of the yield curve will also further drive revenue growth in the banking industry in the coming quarters.

On the crypto side, while the SPX has been hitting new highs, cryptocurrencies are doing the exact opposite, with prices still struggling to break out of a range. The U.S. stock market is doing its best to push crypto prices higher, but we still believe the road to higher prices will be long before a more exciting narrative emerges. While prices are stuck in a range for a long time, traders still prefer to sell volatility and generate gains.

With BTC prices indeed jumping above $64,000 this morning as Chinese stocks rebound from weekend disappointment, risk sentiment may remain in “buy everything” mode until things change. As we enter the final weeks of the campaign, last Friday’s strong BTC ETF inflows may be a positive sign, though patience may still be needed before prices set new highs.

Bạn có thể sử dụng chức năng vane giao dịch SignalPlus tại t.signalplus.com để biết thêm thông tin về tiền điện tử theo thời gian thực. Nếu bạn muốn nhận thông tin cập nhật của chúng tôi ngay lập tức, vui lòng theo dõi tài khoản Twitter @SignalPlusCN của chúng tôi hoặc tham gia nhóm WeChat (thêm trợ lý WeChat: SignalPlus 123), nhóm Telegram và cộng đồng Discord của chúng tôi để giao lưu và tương tác với nhiều bạn bè hơn.

Trang web chính thức của SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Record #45

Related: In-depth analysis of the development status of wBTC, Ordinals and Runes

Original author: xparadigms wowitsjun_ ( hashed_official ) Original translation: TechFlow * This is the third in a four-part series exploring current solutions for scaling the Bitcoin ecosystem. In the overall cryptocurrency market, Bitcoin has the most valuable brand and assets, and its asset class is not limited to its native BTC. Bitcoin can not only be wrapped and sent to other blockchains for use, but also includes Bitcoin-inscribed assets such as Ordinals and Rune protocols. In addition, Bitcoin also has an expanding NFT market, which is issued through the Ordinals protocol. In this opinion piece, we will explore the asset classes within the Bitcoin ecosystem and how each has performed. 1. Background – Bridging BTC and Bitcoin Token Protocol 1.1 Bridging BTC As of 2024, Bitcoin remains the largest cryptocurrency…