Hệ sinh thái TON đang ngày càng trở nên phổ biến. Hướng ứng dụng nào có tiềm năng lớn hơn?

Tác giả gốc: Howard | Building on TON

Bản dịch gốc: TechFlow

In recent months, the ecosystem has flourished with a large number of applications emerging. Although many projects are following similar paths – which is a good sign – our goal remains to maximize your investment, both in time and money, in order to get greater returns with less effort.

Relying on the tried and true 80/20 rule, focus on the top 20% (or fewer) of projects in any field, concentrating traffic and capital on the best projects.

Given your background and experience, choosing a niche with less competition may significantly improve your chances of success. This article is intended to help you adjust your direction and establish some key milestones and themes, especially as there are many opportunities to develop in the @TON_Blockchain ecosystem.

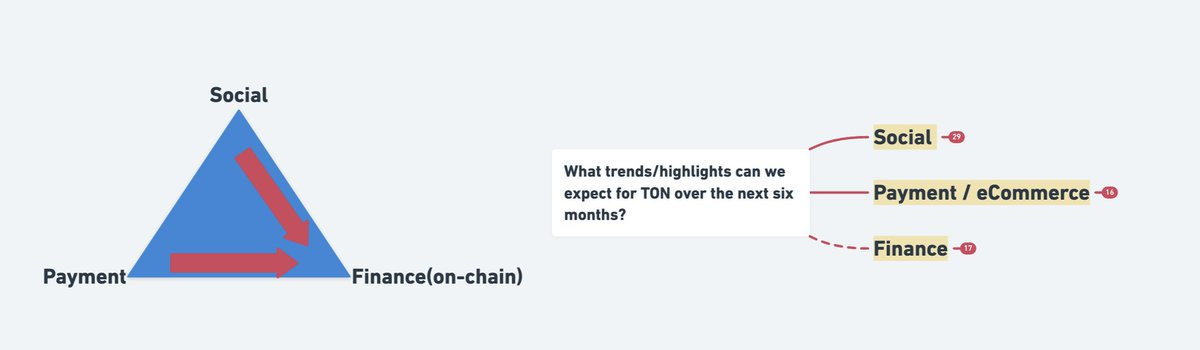

1. The main value of TON

You may have seen this chart in my previous article: TON is just a part of the whole ecosystem. So, if you have problems with your Telegram account, please consult đây .

The wallet ( t.me/wallet ) takes care of the financial side of things, while Telegram (aka TApps — t.me/tapps ) is the messaging layer that makes accessing content and web pages a breeze. ( @tappscenter / @wallet_tg )

The TON blockchain ( t.me/toncoin , t.me/ton_blockchain ) gives you control over your assets. Together, these three modules form a powerful ecosystem with unique advantages.

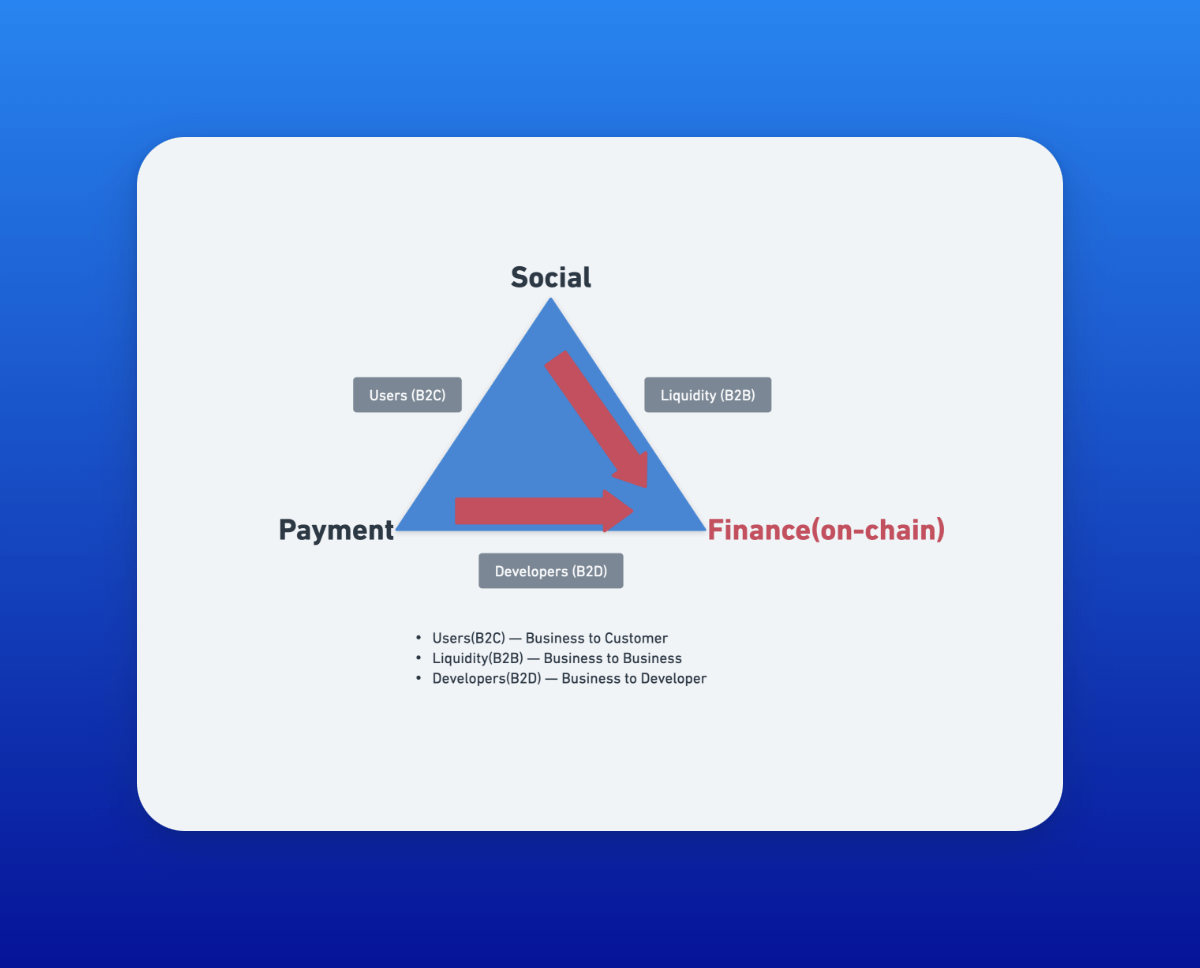

Among L1 blockchains, TON stands out with unparalleled potential and creative possibilities. At its core, TON and Telegram should always revolve around three pillars: social, payment, and finance.

When planning your project, filter through these three lenses and ask yourself, “What problem are you really solving?”

Here’s how.

tiếp xúc xã hội

Social interaction is what Telegram is good at – valuable information is exchanged back and forth in real time. But imagine if that value could exist on the blockchain. Imagine being able to show your uniqueness through on-chain assets, or to encourage your friends to take action. Thats fun, right?

Take Calvin ( @calchulus ) for example. He recently asked: “If I split my node sales with you, how much would you invest?”

That’s social; that’s referral.

We encounter similar scenarios every day, from casual questions to heated Telegram group discussions. It is undeniable that our trading habits are significantly influenced by the people around us, and recommendations drive most transactions.

Of course, questions like Calvin’s can be stressful — no one wants to disappoint a friend by not responding. But this is exactly where prediction market products, Pump.fun , and other platforms that allow you to place bets with your friends should fit seamlessly into social networks.

There are experts who can dive deeper when we talk about the sociology of managing relationships or how Telegram is so deeply intertwined with “social”. These are interesting topics worth exploring in depth.

Payment

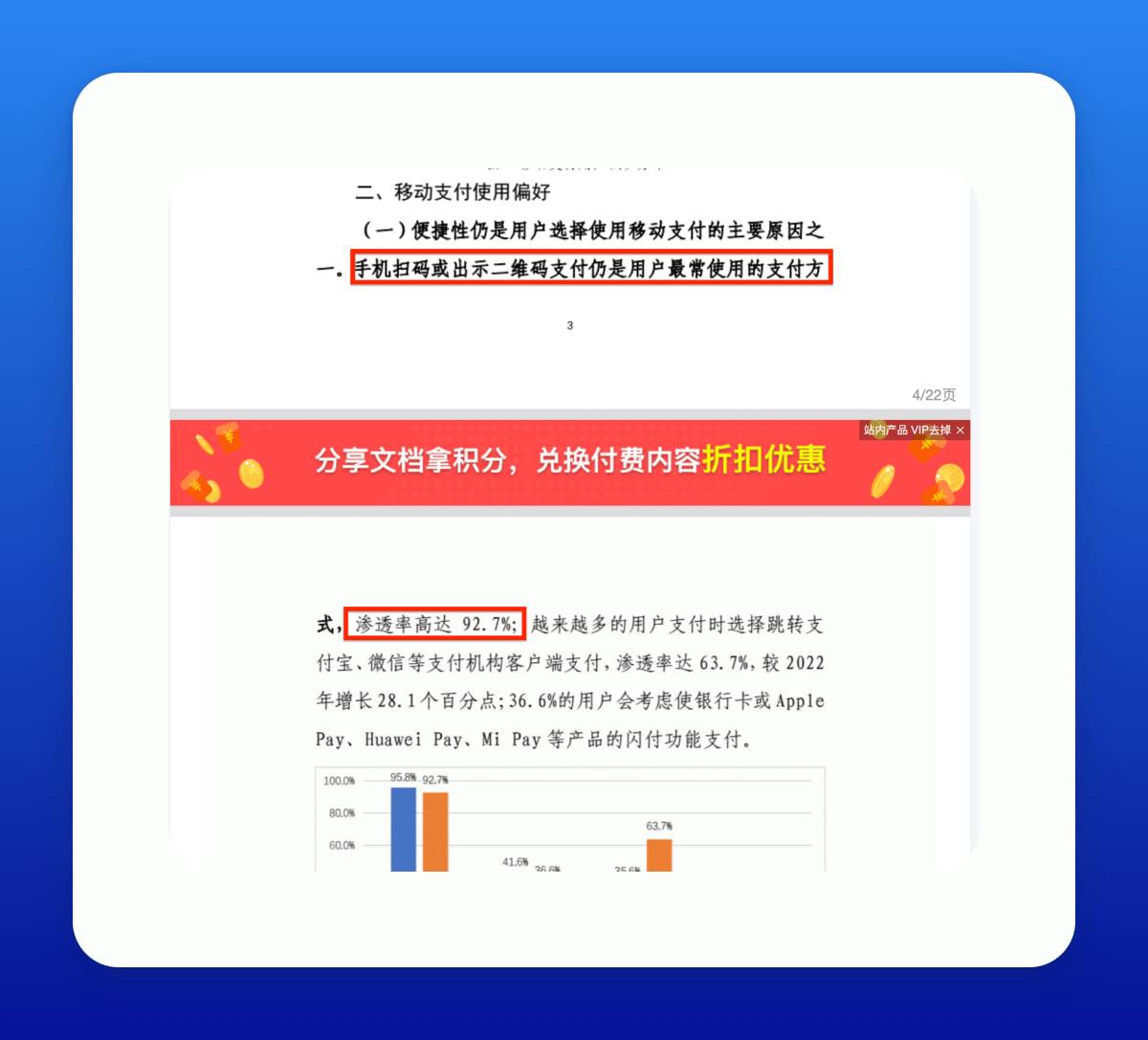

When I talk about payments, I emphasize the disruptive business value of seamless transactions — think e-commerce, online shopping, and the ubiquitous WeChat Pay in China, which is enabled by QR codes.

( Image source )

*Reports show that more than 90% of financial transactions in China are now digital.

This digital transformation is changing everything. WeChat Pay has not only revolutionized offline transactions, but has also spawned new business models, making payment processes more efficient while also revitalizing the economy. This paved the way for large e-commerce giants such as Alibaba, Tmall/Temu, and JD.com.

And we must not forget that we already have USDT on the TON blockchain.

-

How can you take advantage of this?

-

How can you help business owners solve more problems or increase payment conversion rates?

The goal is to provide a smooth user experience for payments that benefits both suppliers and consumers. About 1 million users have made cryptocurrency transactions on the Ethereum mainnet, while TON’s potential market is 1 billion — a 1,000x difference in scale.

Serving billions of users around the world is an exciting challenge.

Our payment research aims to make digital payments accessible to a large user base, whether through custodial or non-custodial wallets. TONs market potential is 1,000 times that of Ethereum, and the network effect is impressive.

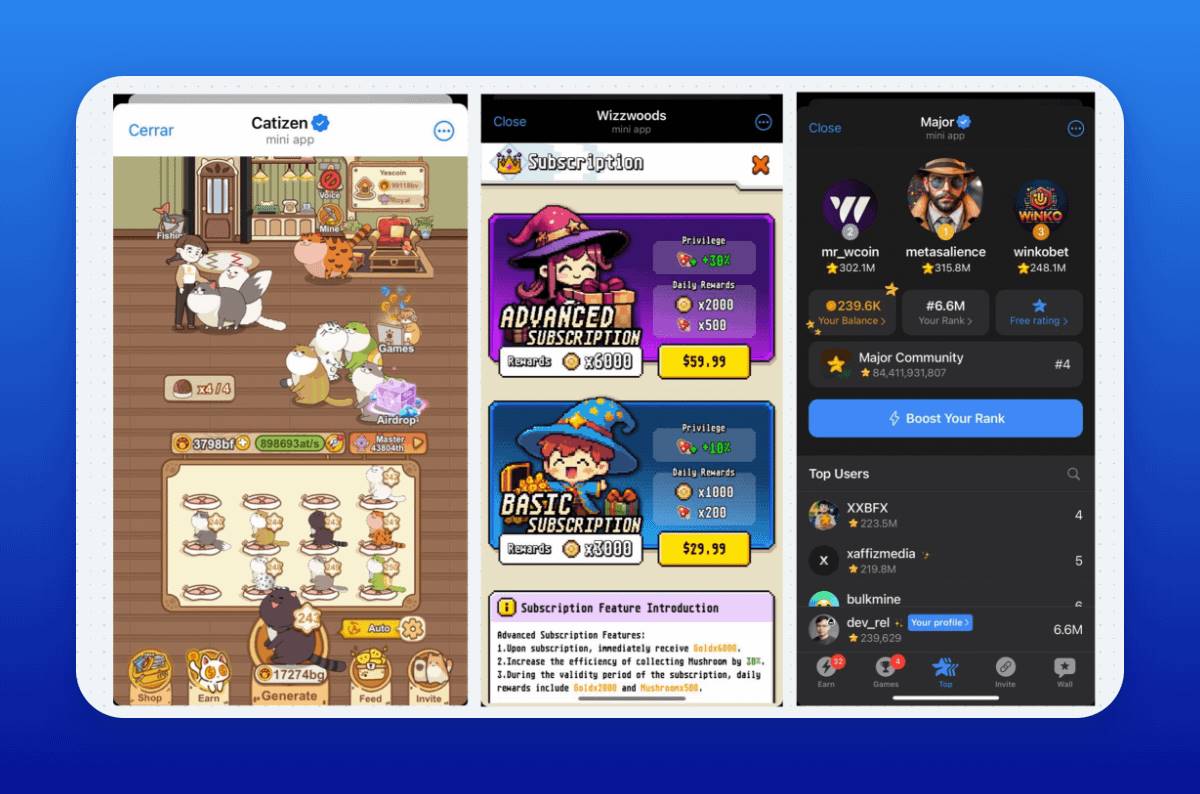

@CatizenAI / @Wizzwoods_game / @majoroftelegram

There is a huge opportunity in online shopping. Helping merchants switch to Tapps is a game-changer, especially in the gaming and content space. Here are some success stories:

-

Catizen ( @CatizenAI )

-

Major ( @majoroftelegram )

-

Wizzwoods ( @Wizzwoods_game )

Gaming platforms like Catizen have thrived with easy payment systems that generate revenue quickly — something that early Web2 games were unable to do.

finance

When we talk about finance here, we mean financial management and the “on-chain” aspects, such as bringing more assets on-chain and increasing TVL (Total Value Locked).

The need to promote decentralized finance (DeFi) in the short, medium, and long term is very strong. The reason is simple: we need to acknowledge that the TON ecosystem currently lacks diverse DeFi products – such as yield, profit opportunities, and other financial management projects.

You can certainly instinctively move in this direction, but you must also consider the challenges of developing smart contracts on the TON blockchain. This constitutes part of the investment risk.

However, there are also high-return opportunities through “trading derivatives”. For example, the LP (liquidity provider) returns of derivatives platforms like StormTrade and Tradoor are promising. These are opportunities worth exploring in depth.

-

StormTrade( @storm_trade_ton / https://storm.tg )

-

Tradoor ( @tradoor_io / https://tradoor.io )

2. Methodology

Our goal is to better categorize and discuss projects by elaborating on these three dimensions.

Currently, the financial sector faces a significant gap. TON lacks DeFi projects and needs more powerful modules to drive on-chain revenue and incentivize assets to stay on the chain. Putting more assets on the chain, or on-chaining, and increasing the total locked value (TVL) is the most direct solution.

But is following Ethereum’s path the best strategy? Would focusing solely on DeFi allow TON to quickly enter the market? After observing the market over the past few months, I’m skeptical about the effectiveness of this approach.

Telegrams strong user base suggests that we should shift our focus to finance to create more on-chain opportunities. I look forward to seeing more asset tokenization in the future. In addition, I advocate for more multi-dimensional or bilingual concepts that combine social and finance to redefine the traditional product ecosystem.

For example, decentralized exchanges (DEXs) are the foundation of DeFi and are often referred to as the “LEGOs” of the ecosystem. Let’s explore this independently.

Trading/Decentralized Exchange (DEX)

If we talk about DEXs alone, they belong to the financial field but lack a significant social element!

The problem facing DEXs today is mainly market penetration. Uniswap has evolved from v2 to v3 and is focusing on v4, but most of these updates are just some mathematical tweaks. What’s the real problem? They’re simply not attractive.

Can we view our friends portfolios? No.

Can we easily compare our profit and loss (PNL) with others? Yes, but only on niche platforms like DeBank or Zapper.

Can we send notifications to other traders on Uniswap? No such opportunity.

Trading should be fun and interactive. Imagine a platform that allows you to dive deep into trading and enjoy every moment. Get inspired by PumpFun, a product in our category .

Trading/Prediction Chợ

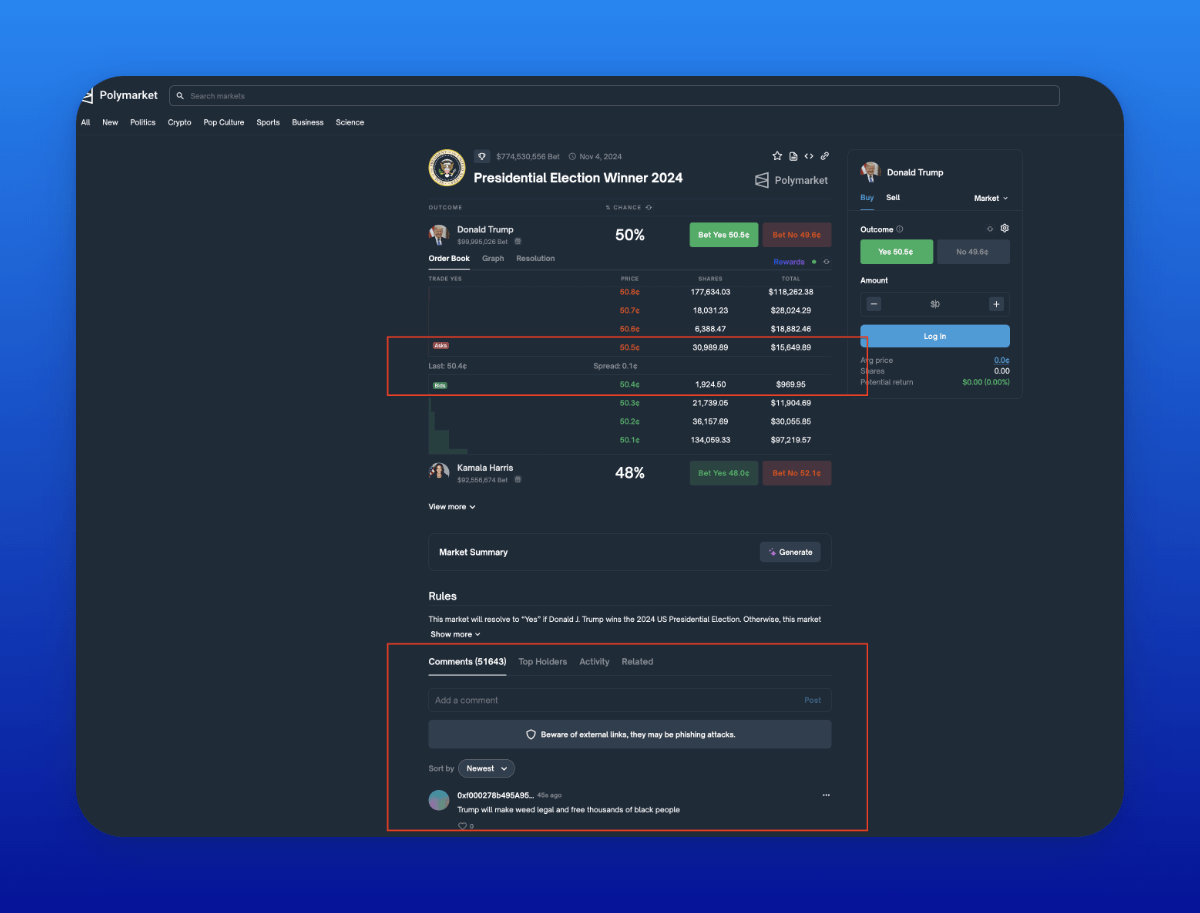

Even in an area as simple as prediction markets, problems abound. It’s tied to social dynamics but fails to engage users in a meaningful way. Interactions are fragmented, lacking integration with popular platforms like Telegram group chats. Users connected through blockchain finance need more personal channels for communication.

Polymarket also faces regulatory hurdles, which have stalled features like mobile apps. Poor user experience and missed convenience. Suppressed growth potential — who’s still using the web in 2024? Mobile is the future, and its dominance is only going to grow.

*Polymarket’s community participation is limited to commenting on topics or markets, and fails to form an active discussion.

*Financially, the platform is not attractive; AMMs (automated market makers) are neither fair nor attractive when considering temporary losses, gains, and capital exposure.

This is why I emphasize the close connection between prediction market and social, although I am cautious about its financial angle. We all look forward to the breakthrough functions of on-chain decentralized finance (DeFi) for prediction markets. Look at how Blur.io has reshaped the NFT market, and other innovative DeFi strategies.

Areas of concern/further exploration

We focus on the social, payment, and financial sectors within the TON ecosystem and identify early opportunities suitable for exploration.

Are you curious why I categorize Proof of Work (PoW) as a payment? Bitcoin revolutionized energy efficiency, lowered electricity costs, and drove advances in electricity technology. This is the best example of payment-driven innovation.

There is still a lot to cover: DNS domain names, MEME culture, credit cards, cross-chain bridges, etc.

3. Discussion on vertical expansion

Each category opens up an area ripe for exploration. Wondering how to spark creativity beyond this list? Of course, there is a way.

User (B2C)

Think in terms of verticals to grow your business. The social and payments sectors overlap because both rely on a large user base. Companies like Amazon, which sell directly to shoppers, embody B2C transactions. Apps that facilitate social connections or sell digital goods also fall into this category, leveraging user engagement to achieve expansion.

-

Here, projects bridging the social and payment sectors stand out.

-

The gaming industry is particularly prominent, combining social interaction with payment needs, driving growth in both ecosystems. Take the Catizen ( @Catizen ) mini app as an example: it has earned more than $6 million through @Telegram Stars.

-

In my opinion, the advertising business also falls into this category.

Developer (B2D)

In the payments and finance space, innovative developers are driving growth and breakthrough business models. Think of blockchain payment APIs or developer-specific decentralized finance (DeFi) protocols — they transform ordinary revenue-generating services into profit-generating engines.

-

Imagine combining “existing payment channels” with on-chain transactions. This is the next big leap, and tokenizing Telegram Stars could be a complete game changer.

-

Many projects will struggle when dealing with the complexity of Telegram Stars, struggling to deal with its strengths and limitations. While we cant go into detail here, its a gold mine waiting to be tapped. Explore deeper to unlock new potential.

-

What’s really bright? There’s a huge opportunity for developers to solve these challenges, sparking a wave of new projects. This is a major pain point that’s waiting for an innovative solution.

Liquidity (B2B)

Improve liquidity and drive growth through strategic B2B alliances. Collaborate with other businesses to form a strong network to enhance liquidity and drive collective success. This strategy creates a strong ecosystem, which is critical for decentralized finance (DeFi) and social platforms like Telegram. In simple terms, it is about turning traffic into profits.

-

The potential here is unquestionable; the synergies of Launchpool, decentralized exchanges (DEX), and social features are particularly exciting.

-

Emerging “yield” products, combining financial instruments with social features, are poised to revolutionize the market. Alipay’s innovative products demonstrate the power of this combination, especially in China.

4. Final Thoughts

Despite our deep dive into various categories, there are still some areas that require more attention, revealing lucrative opportunities for innovation teams. Mini-app games have dominated recently, which may be due to fatigue caused by click-to-earn or invite-to-earn models, as well as a highly competitive market environment.

However, it’s exciting to think about all the hot topics that are still untapped that have the potential to turn into billion-dollar businesses on Telegram mini-apps and the TON blockchain.

Promising areas include credit card (cashback) and gift card businesses, real world assets (RWAs), earning products, Launchpool type initiatives, or companies focusing on offline QR code payment solutions. These directions are full of potential and worth exploring in depth.

5. Postscript

Layer 1 blockchain can be likened to a country. Although TON may not be perfect, it is full of potential and hope – just like the American dream. In the 1980s, a new wave of immigrants came to the United States and bravely pursued their dreams.

Today, consensus in the EVM ecosystem is breaking down. We see Solana pushing the boundaries of a single chain, and Bitcoin’s Layer 2 is gaining traction.

As someone who experienced the DeFi summer wave, my choice is very clear – I see hope here.

-

Would I tell a young graduate to develop on Ethereum? No.

-

Without millions of dollars, the chances of success are slim.

-

Would I recommend a Web2 game studio to choose the EVM blockchain? No.

They lack users. Look at Black Myth: Wukong – would it have been a hit without Steam ( @Steam )? Unlikely. Platforms matter.

Our ecosystem is full of real growth potential. No matter what project you’re working on, you still have the opportunity to succeed. This place is like the American Midwest in the 1980s or Dubai today—you can be whatever you want to be.

With its huge user base, seamless cross-platform functionality, and powerful value transfer capabilities, TON/Telegram is the rocket that will propel your career forward.

This article is sourced from the internet: The TON ecosystem is becoming more and more popular. Which application directions have greater potential?

Related: Frontier Lab Crypto Market Weekly Report|W37

Tổng quan về BTC và ETH tuần này Hiệu suất thị trường Thị trường tiền điện tử nói chung đã phục hồi trong tuần này: Bitcoin: Tuần này, Bitcoin cho thấy xu hướng phục hồi chung. Tâm lý của các nhà giao dịch thị trường đối với giao dịch suy thoái kinh tế đã dịu đi và người ta thường tin rằng khả năng suy thoái của nền kinh tế Hoa Kỳ trong tương lai là tương đối thấp. Sau khi công bố dữ liệu CPI tháng 8 của Hoa Kỳ trong tuần này, có thể thấy rằng CPI đã được giảm bớt rất nhiều và đã tiến thêm một bước nữa tới mức 2% mà Cục Dự trữ Liên bang đang lo ngại. Do đó, hầu hết các nhà giao dịch thị trường đều đặt cược rằng Cục Dự trữ Liên bang sẽ cắt giảm lãi suất 25 BP vào tuần tới, điều đó có nghĩa là đây chỉ là đợt cắt giảm lãi suất phòng thủ và nền kinh tế Hoa Kỳ chưa bước vào suy thoái.…