Bài viết gốc của: Marco Manoppo

Bản dịch gốc: TechFlow

Hello everyone,

It’s been a while since I shared this with you all. Lately, I’ve been thinking a lot about the future of restaking, as this has been a major topic dominating the market over the past 18 months.

To simplify the discussion, I may refer to EigenLayer or AVS in this article to describe the broad concept of re-staking, but I use the term broadly to cover all re-staking protocols and the services built on top of them, not just EigenLayer.

The concept of EigenLayer and re-staking has opened Pandoras box.

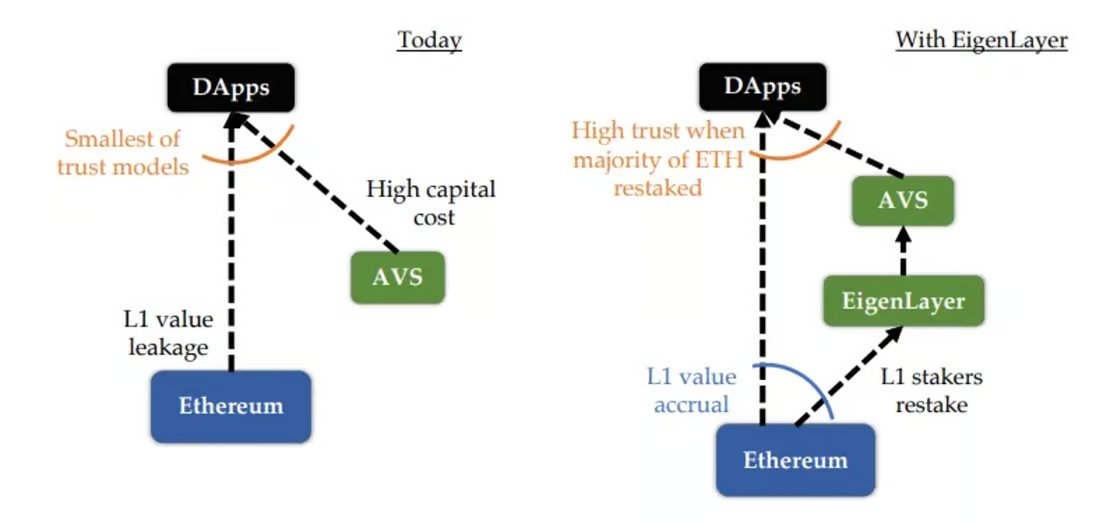

Conceptually, it makes a lot of sense to scale the economic security of a highly liquid and globally accessible asset that allows developers to create applications on-chain without having to build an entirely new ecosystem for their project-specific tokens.

Source: EigenLayer White Paper

Ethereum (ETH) is considered a high-quality asset based on the following premises:

1. It makes sense for developers to build products using its economic security , as this not only enhances security and reduces costs, but also enables products to focus on core functionality.

2. Provides a better product experience for end users. However, after 18 months of development, the re-staking landscape has changed since the release of the EigenLayer white paper.

We now have Bitcoin re-staking projects like Babylon, Solana re-staking projects like Solayer, and multi-asset re-staking projects like Karak and Symbiotic. Even EigenLayer has started to support permissionless tokens, allowing any ERC-20 token to become a re-staking asset without permission.

Source: EigenLayer Blog

The market has shown that every token will be re-staked.

The core of re-staking is no longer just about expanding the economic security of ETH, but about issuing a new on-chain derivative – the re-staking token (and the resulting liquidity re-staking token).

In addition, with the rise of liquidity staking solutions such as Tally Protocol , it is foreseeable that the future of re-staking will cover all crypto tokens, not just L1 assets. We will see stARB being re-staking as rstARB and then further wrapped as wrstARB.

So, what does this mean for the future of cryptocurrency? And what happens when economic security can be extended from any token?

Supply and demand dynamics of re-staking

These are two key factors that will determine the future of re-staking.

You could write a long post and go into the intricacies of subjective tokens and human coordination, but that’s a bit beyond my scope. If a restaking project was willing to give me some advisory tokens, I’d consider writing about it, but I’m getting off topic.

In the crypto space, there are two constants:

-

People always seek higher returns

-

Developers always want to create more tokens

People seek higher returns

The re-staking protocol has the best product-market fit (PMF) on the supply side.

From our predecessors on Wall Street, we see that the cryptocurrency market is rapidly evolving into a market that is constantly seeking higher risks. An example? Polymarket already has a derivatives market specifically for event news . We are all going to extremes.

Re-stakeholders earn more through AVS (a service built on the re-staking protocol). Ideally, developers will choose to build projects on the re-staking protocol and use incentives to attract re-stakeholders to invest their assets in these projects. To do this, developers may share part of the revenue or give it to re-stakers as a reward in their native tokens.

Lets do a simple calculation:

As of September 7, 2024,

-

There is currently $10.5 billion worth of ETH being re-staked on EigenLayer.

-

Assuming that most of this re-staked ETH is Liquid Staked Mã thông báos (LSTs), they are already generating a 4% annual yield (APY) and hope to gain more returns through re-stacking.

-

To earn an additional 1% APY per year, EigenLayer and its AVS would need to create $105 million in value. This does not take into account slashing and smart contract risks.

It’s obvious that if restaking only brings an additional 1% APY, the risk-reward (r/r) is not worth it. I would venture to say that it needs to be at least 8% or higher for capital allocators to consider the risk worthwhile. This means that the restaking ecosystem needs to create at least $420 million in value per year.

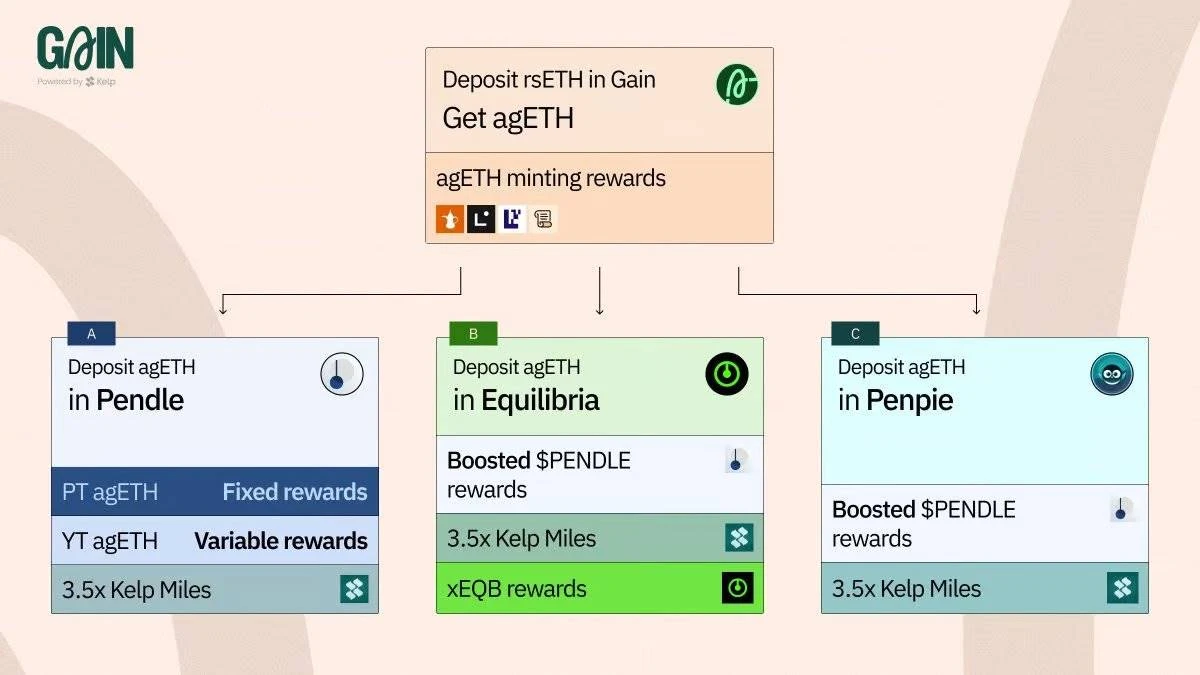

Source: KelpDAO

Currently, the high returns we see from re-staking are mainly driven by the upcoming EIGEN Token and the points program of the liquidity re-staking protocol – these returns are insignificant compared to actual or expected income.

Imagine a scenario where there are 3 re-staking protocols, 10 liquidity re-staking protocols, and over 50 AVS. Liquidity will be fragmented, and developers (here, consumers) will be confused by too many choices instead of having confidence in the existing options. Which re-staking protocol should I choose? What assets should I choose to enhance the economic security of my project? And so on.

Therefore, we either need to significantly increase the amount of ETH to be re-staked, or we need to speed up the issuance of native tokens.

In short, the re-staking protocol and its AVS need to keep the supply side active by issuing a large number of its tokens.

Developers want to create tokens

On the demand side, the re-pledge protocol believes that it is more economical and secure for developers to use re-pledge assets to drive their applications than to use their own dedicated tokens.

While this may be true for some applications that require extremely high trust and security (such as bridging), in reality, issuing your own token and using it as an incentive mechanism is key to the success of any crypto project, whether it is a chain or an application.

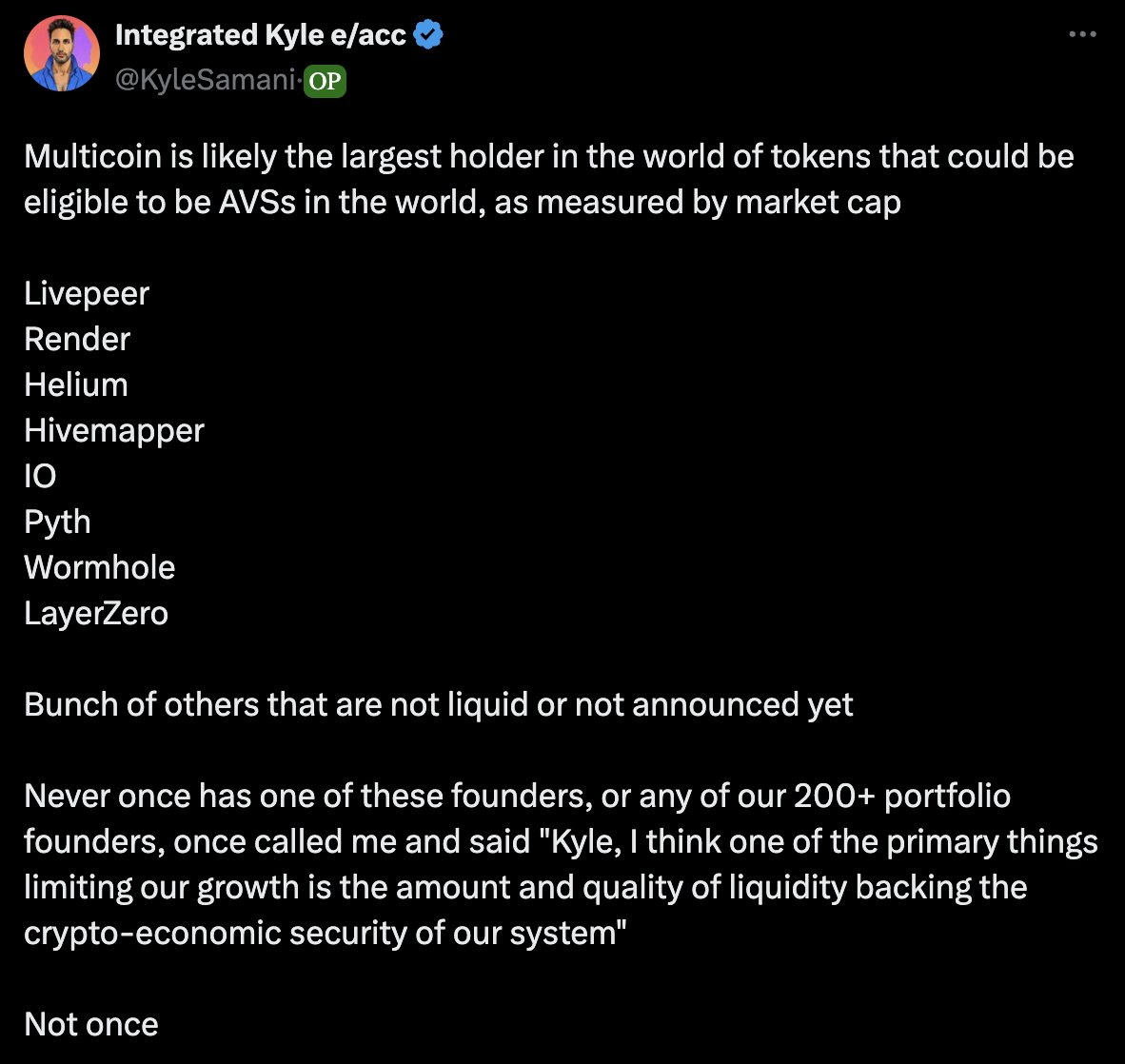

Adding re-hypothecated assets as an additional feature of the product can bring additional benefits, but it should not affect the core value proposition of the product, nor should it be designed to weaken the value of its own token. Some people, such as Kyle of Multicoin, even hold a tougher position, arguing that economic security is not a key factor in driving product growth at all.

Integrated Kyle e/acc: “Multicoin is probably the world’s largest holder and its token by market capitalization may qualify as AVS.

Including Livepeer, Render, Helium, Hivemapper, Pyth, Wormhole, LayerZero.

There are other tokens that are not yet in circulation or have not yet been announced.

Never have any of these founders, or any of our 200+ portfolio founders, called me and said, “Kyle, I think one of the major factors limiting our growth is the amount and quality of liquidity backing the cryptoeconomic security of our system.

Not once.”

Frankly, its hard to argue with his point.

I’ve been in crypto for 7 years and have never heard other heavy crypto users or industry friends — those who store the majority of their net worth on-chain — tell me that they chose one product over another because of its economic security.

From an economic perspective, Luca from M^0 wrote an excellent article explaining how it may be cheaper for projects to use their native tokens than to use ETH due to market inefficiencies.

When are tokens issued? Truthfully, project-specific tokens with some sort of governance function, utility, economics, or scarcity claim have long been viewed by investors as a symbol of project success or visibility, regardless of whether those tokens actually count as securities. This market sentiment persists even without any remaining financial or control claims. In a niche industry like crypto, tokens are often more tied to narratives or expected liquidity changes than to cash flows. No matter how we look at it, it is clear and well documented that in crypto, equity proxy markets are far from efficient, and higher-than-rational token prices translate into lower-than-rational-expected capital costs for projects. Lower capital costs are often manifested as lower dilution in venture rounds, or higher valuations relative to other industries. Arguably, native tokens actually offer developers a lower cost of capital than $ETH due to market inefficiencies at the capital markets level.

Nguồn: Dirt Roads

To be fair, EigenLayer seems to have anticipated this situation and designed a dual-staking system, and now its competitors are even using support for multi-asset re-staking as a marketing differentiation selling point.

If all tokens will be re-staked in the future, what is the real value of the re-stacking protocol to developers?

I think the answer lies in insurance and enhancement.

The future of multi-asset re-pledge will bring diversified choices

If projects want to improve their products and differentiate themselves, restaking will be a complementary feature that can be integrated.

-

Insurance: It provides an extra layer of assurance that the product being offered will work as advertised because there is more capital backing it.

-

Enhancement: The best strategy for re-staking protocols is to reshape the entire narrative and convince developers to include elements of re-staking technology by default in any product because it makes everything better. Oh, you are an oracle vulnerable to price manipulation attacks? What if we are AVS too?

Whether end users care about this issue remains to be seen.

All tokens will compete to become the preferred re-pledge asset because it gives them perceived value and reduces selling pressure. AVS can choose multiple types of re-pledge assets based on its risk appetite, incentive mechanisms, specific functions, and the ecosystem it wants to align with. Its no longer just about core economic security, its about insurance, re-pledge, and politics. As each token is re-pledged, AVS will have many options.

-

Which assets should I choose to ensure economic security, what political alignment do I want, and which ecosystem is best for my product?

Ultimately, the decision comes down to what provides the best functionality for my product. Just as applications are deployed on multiple chains and eventually become Lisks, AVS will ultimately leverage the economic security of the assets and ecosystems that provide the greatest benefit, sometimes even multiple at the same time.

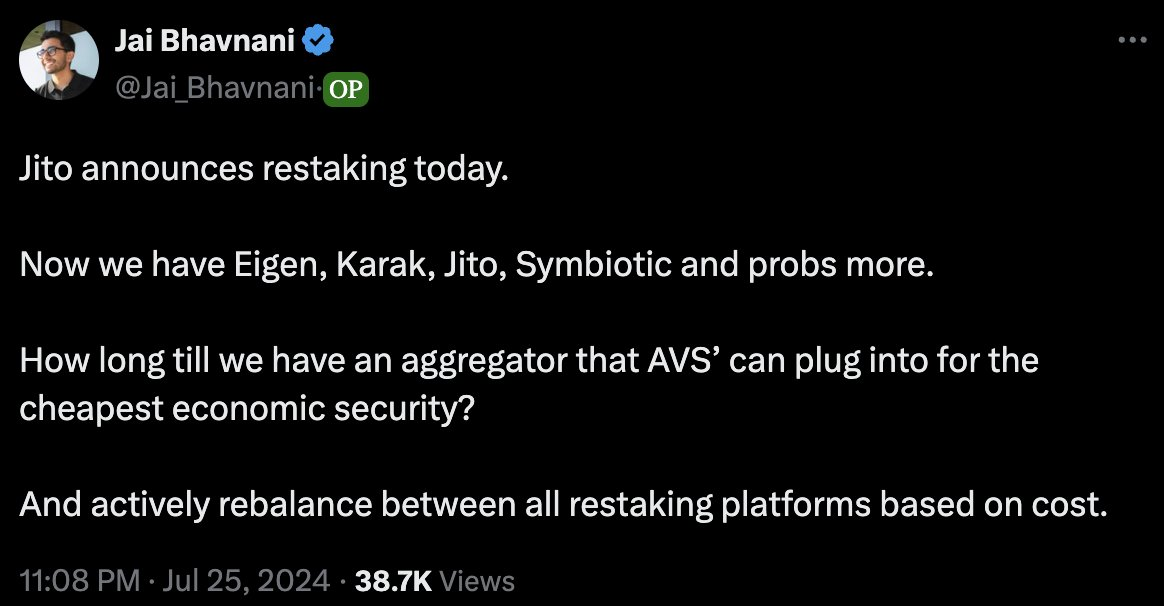

This tweet from Jai pretty well summarizes how most developers feel about the benefits of restaking.

It’s important to mention that we’ve seen some projects, like Nuffle , working to address this situation.

Jai Bhavnani: “Jito announced support for re-staking today. Now we have Eigen, Karak, Jito, Symbiotic, and probably more. How long will it take for us to have an aggregator that AVS can plug into to get the most economical security? And actively rebalance across all the re-staking platforms based on cost.”

Tóm lại là

Crypto Twitter tends to think in absolutes. In reality, restaking is an interesting infrastructure tool that expands developer options and impacts on-chain markets by issuing a new type of derivative, but it is not revolutionary.

At the very least, it allows crypto asset holders with higher risk appetite to earn additional returns while expanding technology options and reducing the engineering burden on developers. It provides a complementary function for developers and creates a new derivatives market for on-chain asset holders.

Many assets will be re-collateralized, which provides developers with multiple options when integrating re-collateralized assets. Ultimately, developers will choose a re-collateralized asset ecosystem just as they would when choosing a new chain to deploy, choosing the one that will provide the most benefit to their product, and sometimes even multiple ecosystems.

Tokens will compete to become re-hypothecated assets because the new derivatives markets created by re-hypothecated assets will benefit these tokens, increasing their widespread use and perceived value.

This was never about economics, security, but about insurance, re-hypothecation and politics.

This article is sourced from the internet: What happens when all tokens are re-staked?