Tài sản Taproot: Ưu điểm của Stablecoin trên Lightning Network

On July 23, 2024, Lightning Labs released the first mainnet version of the multi-asset Lightning Network, officially introducing Taproot Assets to the Lightning Network. This milestone marks the official support of stablecoins on the Lightning Network!

So, how are stablecoins on the Lightning Network different from stablecoins on other blockchains? For stablecoins running on blockchains such as Ethereum and Solana (such as USDT and USDC), we usually see them mainly used as a medium of exchange and unit of account for valuing other digital assets, but with limited use cases in the real world, and the Lightning Network fills this gap. With its settlement speed of up to 1 million transactions per second (1M TPS), ultra-low fees, and high security, stablecoins on the Lightning Network will stand out.

Here are three use cases that showcase the unique advantages of stablecoins on the Lightning Network:

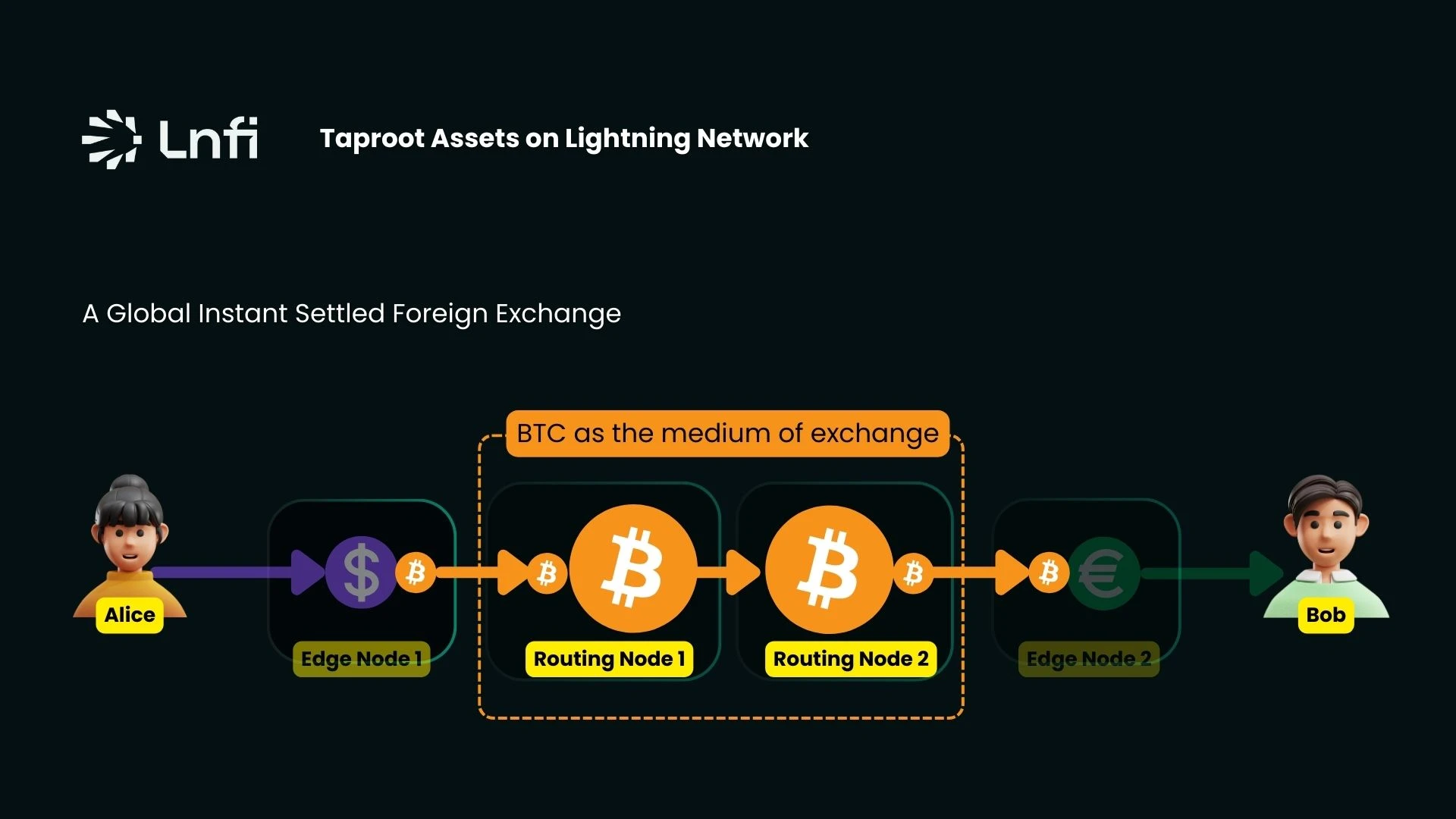

1. Global instant settlement of foreign exchange transactions: Alice sends USD stablecoins, Bob receives EUR stablecoins

Through the Lightning Network, Alice and Bob can exchange dollars and euros locally, in an atomic, decentralized, secure and instant process. In contrast, the traditional financial system charges high fees of 2-5% and takes several days to settle similar transactions. The openness of the Lightning Network allows anyone to become an edge node or routing node, thereby lowering spreads and fees and providing users with the most competitive exchange rates.

2. Use Lightning Invoice to directly pay for goods with stablecoins

Let鈥檚 look at another scenario that combines stablecoins with real-world payments.

Currently, merchants and platforms like Nubank, Shopify, PickNPay, NCR, Blackhawk, Clove, and Bitrefill already support Lightning Network payments. Even interesting small businesses like Pubkey@NYC and JooBar@SG have joined the ranks of Lightning payments. With the existing Lightning Network, stablecoins can be easily used in these payment scenarios without any upgrades to the existing infrastructure. For example, in the scenario where Alice buys coffee, the cafe receives Bitcoin.

We can see that using stablecoins like USDT and USDC for real-world payments is still challenging on other blockchains, but this is where stablecoins on the Lightning Network naturally have an advantage.

3. Stablecoins will benefit Bitcoin

The stablecoins in Taproot Assets will align the interests of Bitcoin miners and Lightning Network users in several key ways:

Bitcoin as a medium of exchange for routing nodes: The stablecoins in Taproot Assets allow Bitcoin to be used as a medium of exchange in the Lightning Network, as shown in the figure above. This creates utility value for Bitcoin.

Liquidity provision: Users can safely earn yield by participating in the Lightning Network鈥檚 liquidity provision. This yield is generated through RFQ spreads and routing fees, making the financial value of Bitcoin come from cash flow multiples.

Increased network activity : Stablecoins in Taproot Assets will drive more channel openings and closings, as well as loop-in and loop-out operations. Increased network effects on the Lightning Network are expected to drive more Bitcoin transactions on the mainnet, rather than just pure Lightning transactions.

These in turn could increase demand for Bitcoin to be transacted on the Lightning Network.

However, for widespread adoption of stablecoins on the Lightning Network, both internal and external challenges need to be addressed.

External challenge: connecting the Lightning Network with traditional finance.

In order to connect with traditional finance, it is critical to address concerns related to regulation and compliance. LightSpark has developed UMA to support comprehensive compliance messaging, including anti-money laundering, sanctions review, and travel rule requirements. LightSpark has successfully integrated the Lightning Network with multiple centralized institutions, including Bitso, Bitnob, Coins.ph, Foxbit, Ripio, Xapo Bank, etc.

On the other hand, the Amboss team has developed Reflex, a payment operations platform that provides proactive risk management for Lightning Network compliance policies. The platform enables entities to effectively implement their compliance policies and ensure they meet regulatory requirements.

In the near future, hundreds of millions of users will be able to quickly access the Lightning Network.

Internal Challenge: Deep Liquidity for Stablecoins on the Lightning Network.

To trigger a positive flywheel effect, deep liquidity for stablecoins on the Lightning Network is critical in three areas:

Demand liquidity: from a critical mass of end users.

Supply liquidity: from RFQs provided by edge node operators and transactions of all sizes facilitated by routing node operators. Sufficient channel liquidity is critical as the network grows from micro-transactions to larger-scale transactions.

Hedging and Rebalancing Liquidity: Edge node operators have access to deep liquidity sources, critical for hedging positions and rebalancing inventory on the Lightning Network.

Stablecoins on the Lightning Network are expected to become the key last mile solution for global adoption. With unparalleled transaction speeds, low fees, and high security, they provide unique solutions that are difficult to achieve with traditional blockchains. By bridging the gap between digital assets and real-world application cases, stablecoins on the Lightning Network will empower users, merchants, and financial institutions around the world, driving a new era of financial inclusion and making global payments faster, cheaper, and safer.

This article is sourced from the internet: Taproot Assets: Stablecoin Advantages on the Lightning Network

Related: Supporting Telegrams founder, Musks long-term and short-term concerns

Original author: Arain , ChainCatcher Original translation: Marco, ChainCatcher The arrest of Telegram founder Pavel Duro in Paris on the evening of August 24 (local time in France) has attracted widespread attention from the market in recent days, triggering discussions among many well-known figures from the investment, business and political circles, including Tesla founder Elon Musk, Sequoia Capital partner Shaun Maguire, Ethereum founder Vitalik Buterin and other celebrities who have expressed their support. The keywords of the support are mostly focused on EU and freedom of speech. Elon Musk has made several statements on X regarding the arrest of Pavel Durov. Nigel Farage, leader of the British Reform Party and MP for Clacton, commented on X: The arrest of Pavel Durov is worrying. Telegram is a safe application for free…