Tài khoản kinh tế mở rộng Ethereum: Có đáng để dành phần lớn doanh thu phân loại cho L2 không?

Tác giả gốc: Doug Colkitt

Bản dịch gốc: TechFlow

Đây là a good analysis of Data Availability (DA), and the most reasonable bullish speculation for DA. However, I think it is impossible for DA to get close to 50% of L2 fees. Because from an economic structure point of view, the value accumulation of sorting always far exceeds DA.

Hoạt động kinh doanh cốt lõi của blockchain là bán không gian khối. Vì không gian khối khó có thể trao đổi giữa các chuỗi khác nhau nên chúng gần như tạo thành độc quyền.

However, not all monopolies can obtain excess profits. The key lies in whether prices can be differentiated for consumers.

Without price differentiation, monopoly profits are little different from commodity goods. Think of how airlines differentiate between price-conscious business travelers and budget-conscious consumers, or how the same SUV is sold at very different prices under the Volkswagen, Audi, and Lamborghini brands.

Priority fees are an extremely effective price differentiation mechanism in blockchains. The highest priority transactions pay fees far exceeding the median.

L2 and Solana achieve high throughput and high revenue by leveraging sorter priorities for price differentiation. Marginal transactions pay very low fees, supporting high TPS, while price-insensitive transactions pay the majority of network revenue.

Below is the transaction distribution of 5 randomly selected blocks from Base L2. This shows a clear Pareto distribution, making price differentiation extremely effective. The top 10% of transactions pay 30% of the revenue, while the bottom 10% of transactions pay less than 1%.

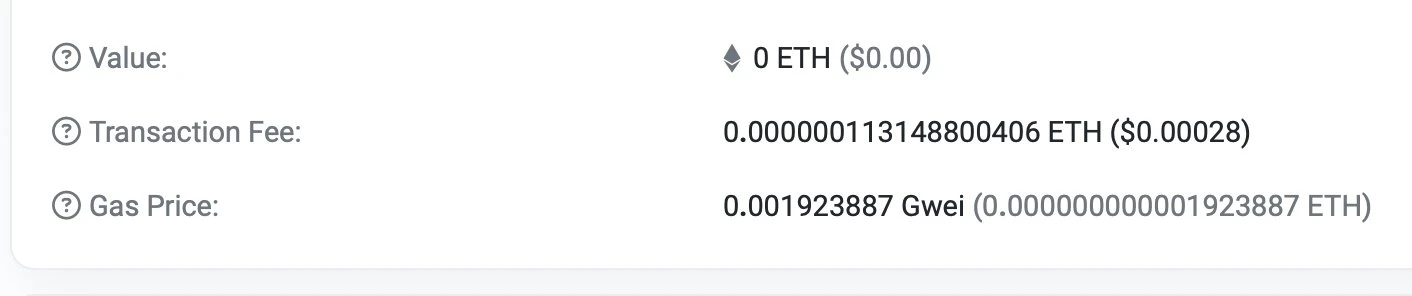

The problem is that while the sorter can profit from this, the DA layer cannot participate because it has no price differentiation capability. Whether it is a high-value arbitrage transaction or a 1 wei junk transaction, the fee paid on Ethereum DA is the same because they are settled in the same batch.

Since the value of marginal transactions is very low, high TPS can only be achieved when the median transaction can be on-chain at close to zero cost. But on the DA layer, basically every transaction pays the same fee. The DA layer can either have high throughput or high revenue, but not both.

This makes it nearly impossible for rollups to scale without impacting Ethereum network revenue. The rollup-centric roadmap is inherently flawed because it gives up the valuable part of the network (ordering) in the mistaken belief that it can be made up with the worthless part (DA).

I was initially optimistic about the rollup-centric roadmap because I thought reasonable people would recognize the economics of price differentiation and that it could develop in parallel with L1 expansion.

High-value, price-insensitive users will choose L1 for its durability, security, and finality, while L2 focuses on marginal low-price users who are excluded by L1鈥檚 high fees. As a result, Ethereum still earns significant sorter rent.

However, Ethereum鈥檚 leadership has repeatedly stressed that L1 as an application layer is no longer actually important and will not scale. As a result, users and developers have reacted rationally, resulting in the current gradual decline of the L1 application ecosystem and the decline of Ethereum鈥檚 network revenue.

Nếu bạn tin rằng giá trị lâu dài của ETH nằm ở việc trở thành một tài sản tiền tệ, thì điều này vẫn có thể khả thi. Bằng cách khiến nhiều người nắm giữ ETH hơn, nó sẽ trở thành một hình thức tiền tệ bền vững. Và việc trợ cấp L2 mà không tích lũy giá trị cho lớp cơ sở có thể thúc đẩy điều này.

Nhưng nếu bạn tin rằng giá trị lâu dài của ETH nằm ở việc trở thành một cổ phần mạng lưới trong một giao thức được sử dụng rộng rãi (mà tôi nghĩ là có khả năng xảy ra hơn ETH như một loại tiền), thì việc tích lũy giá trị cần phải xảy ra. Rõ ràng là chúng ta đang bỏ lỡ mục tiêu ở đây do những giả định kinh tế sai lầm.

This article is sourced from the internet: Ethereum expansion economic account: Is it worth giving the bulk of sorting revenue to L2?

Related: Exploring the economics of points: How to design an effective points program?

Original author: kenton.eth Original translation: Ismay, BlockBeats Editors note: Points programs have become an important tool for projects to gain user loyalty and promote product growth. The author of this article, Kenton, founder of Sense Finance and former MakerDAO integration engineer, discusses in detail the design and implementation of points programs and their advantages and disadvantages in practical applications. From the successful experience of projects such as Ethena, Napier and Blur, we can see that a reasonable points strategy can not only effectively improve the projects KPI, but also gain an advantage in market competition. However, points programs also face problems such as lack of transparency and user fatigue, and are in urgent need of further innovation and optimization. A new era of digital loyalty is dawning on Web3, driven…