Dữ liệu thực tế của pump.fun: Tỷ lệ tốt nghiệp 1,4%, chỉ có 3% người dùng kiếm được hơn $1.000

Tác giả gốc: Karen, Foresight News

What are the real data on the pump.fun platform? What is the graduation rate of tokens? How many tokens can reach a market value of millions or tens of millions of dollars? What is the real profit situation of users? This article will reveal them one by one.

About the pump.fun platform, in short, Meme tokens can be launched fairly on pump.fun, with no pre-sale and no team allocation. During the initial launch of the tokens, these tokens are traded along the joint curve within the platform. Once the token exceeds the key threshold of $69,000 market value, $12,000 of liquidity will be deposited into Raydium and destroyed.

As for the fees, the pump.fun platform will charge a 1% exchange fee to trading users during the issuance of Meme tokens, and this fee will continue until the token market value reaches the threshold of $69,000. For the creators of the tokens, before the platform policy adjustment (that is, before early August), they need to pay a creation fee of about 0.02 SOL, and after meeting the market value of $69,000, they need to pay a migration fee of 2 SOL.

It is worth noting that since early August, pump.fun has introduced new rules, launched a free token creation function, and provided economic incentives for token creators who successfully completed the joint curve. Under the new rules, the cost of creating a token shifts from the creator to the first buyer of the token, and the creator who successfully completes the joint curve will receive a reward of 0.5 SOL (approximately $80), that is, the migration fee is adjusted to 1.5 SOL.

1.8 million tokens have been deployed through pump.fun, but the graduation rate is only 1.4%

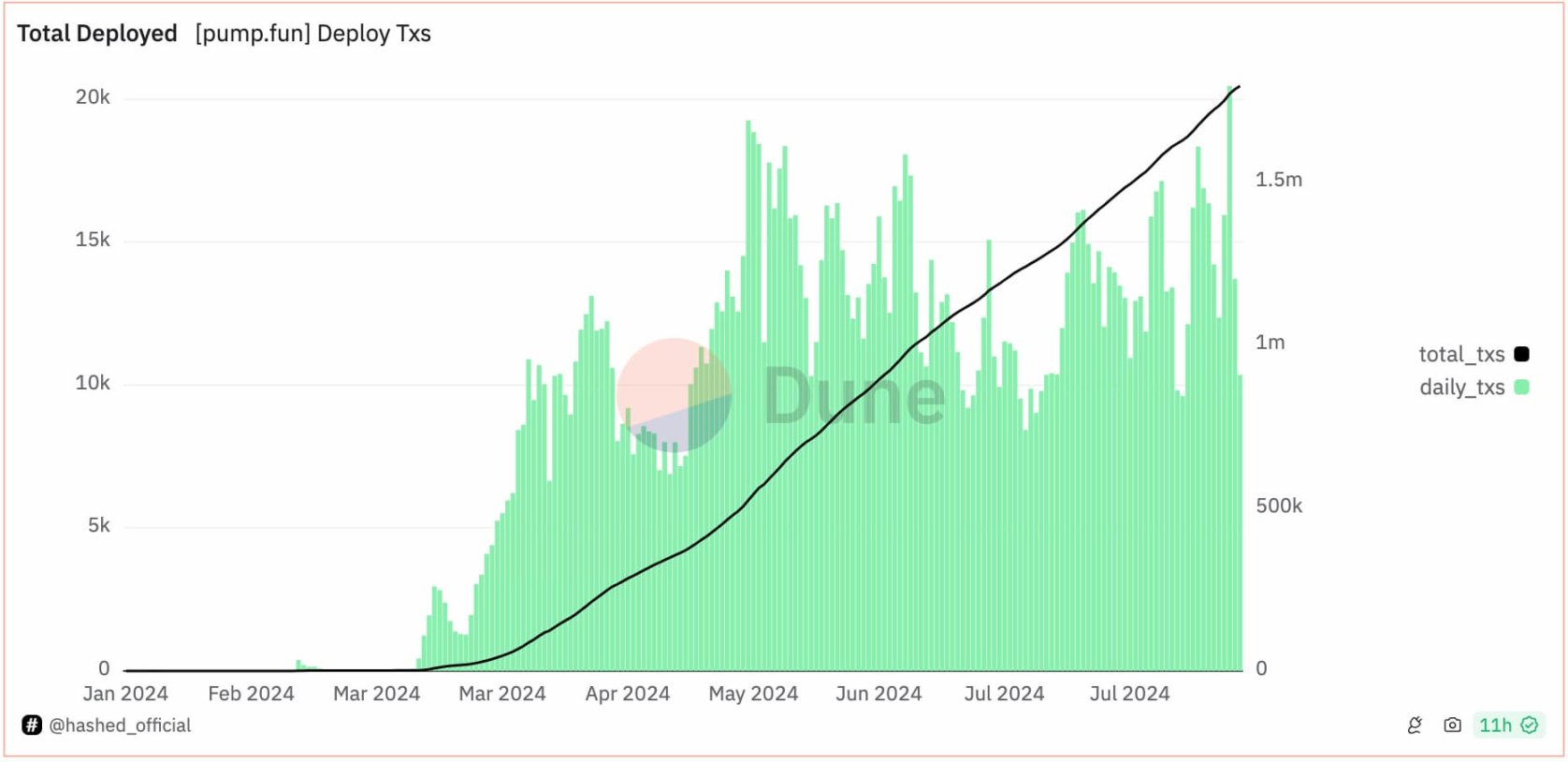

According to the Dune dashboard data provided by Hashed, the number of tokens deployed on the pump.fun platform is close to 1.8 million. Despite the current market volatility and the significant decline in the popularity of Meme tokens, the token deployment activities on the pump.fun platform have not decreased, but have continued.

Looking further, the Dune dashboard created by @evelyn 233 shows that in the past month, an average of more than 20,000 tokens have been deployed on pump.fun every day. However, among this huge number, only a very small number of tokens can be successfully launched on Raydium (that is, the market value exceeds 69,000 US dollars and meets the graduation standard), about 100 to 200. This means that the recent token graduation rate of pump.fun is at a low level of 1% to 2%, and the proportion of tokens that have successfully graduated on the entire platform so far is as low as 1.4%. In addition, many tokens that have successfully graduated have not performed well in the subsequent market performance, and their market value is close to zero.

What does a 1.4% graduation rate mean? By analogy with the 985 college entrance examination rate, the 985 college entrance examination rates in Shanxi, Hebei, Hunan, Guangdong and other places are all around 2% in 2023. It can be seen that it is very difficult for the tokens on the pump.fun platform to successfully graduate.

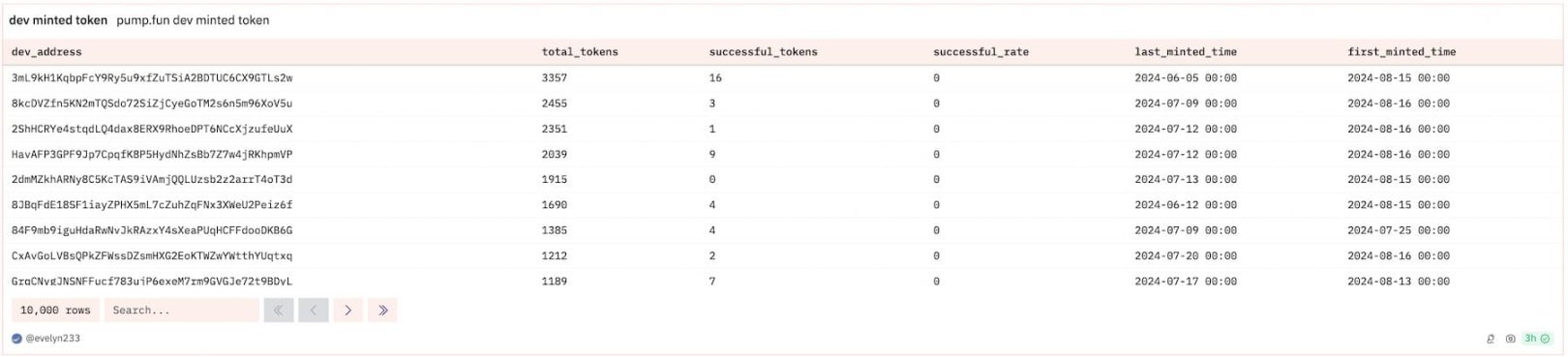

In addition, the developer who deployed the most tokens on pump.fun created up to 3,357 tokens, but only 16 tokens successfully graduated. A total of 10 developer addresses created more than 1,000 tokens, among which the address ranked fifth in the total number of tokens created created a total of 1,915 tokens, but none of them graduated.

The probability of a market value of tens of millions of dollars is only one in a hundred thousand

Successfully launching on Raydium does not mean that the market value performance of the token will be smooth sailing. Further observing the market performance of the token after migrating from pump.fun to Raydium, we can find that although some tokens have successfully launched transactions on Raydium, it is extremely rare for tokens to cross the threshold of tens of millions or millions of dollars in market value.

As of the time of writing, of the nearly 1.8 million tokens deployed on the pump.fun platform, only 18 tokens, including michi, DADDY, BILLY, MOTHER, SCF (Smoking Chicken Fish), TrumpAvega, aura, and SC (Shark Cat), have successfully exceeded the $10 million mark in market value, while the number of tokens with a market value of more than $1 million is currently only 96.

These data show that the probability of a token created on pump.fun having a market value of more than $10 million is about one in 100,000, and the probability of a token having a market value of more than $1 million is only about five in 100,000. These data reveal the characteristics of fierce competition and low success probability that are prevalent in the token market.

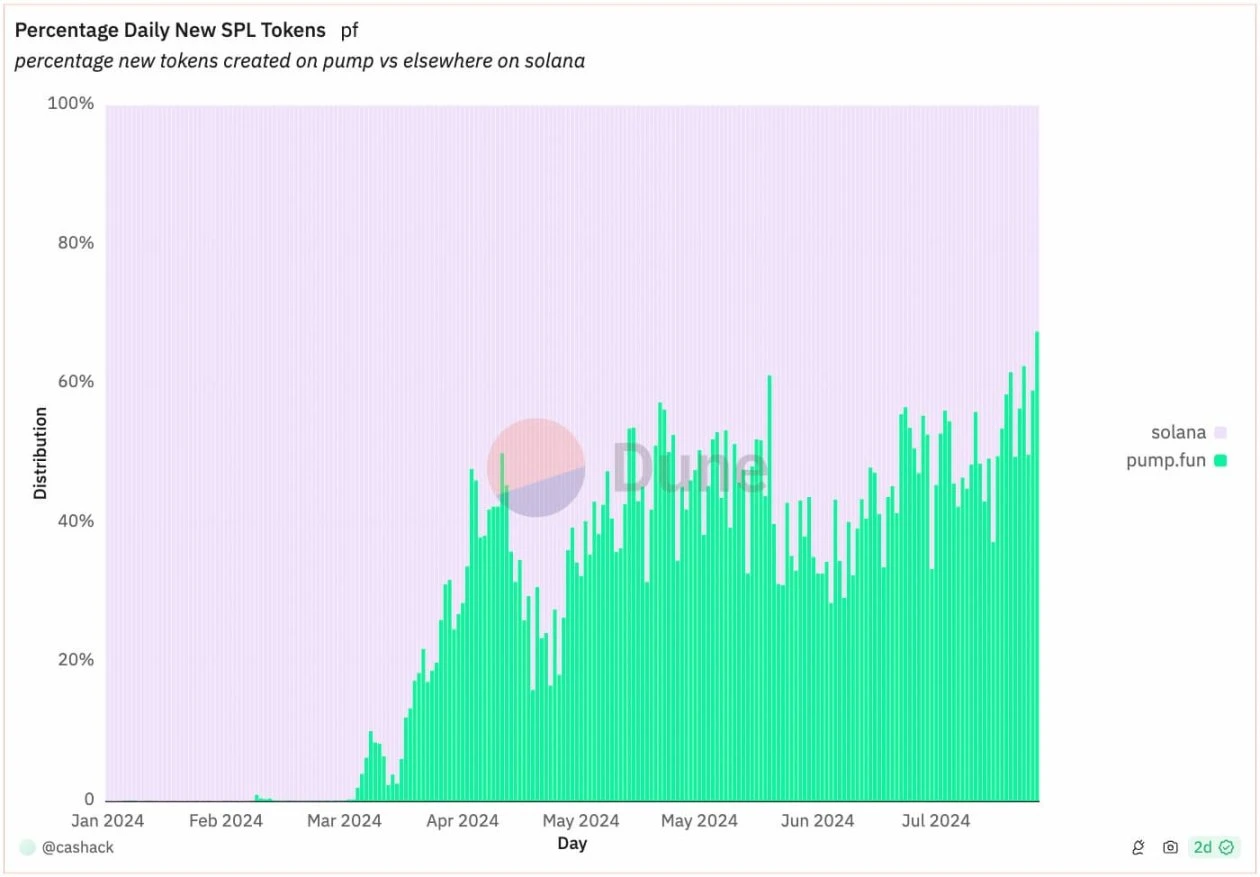

The percentage of new tokens created through pump.fun is steadily increasing

The following figure shows the ratio of new tokens created through the pump.fun platform to other newly created tokens on the Solana network. It can be observed that the proportion of new tokens deployed by pump.fun has shown a steady upward trend, reaching a ratio of 6:4 in recent days.

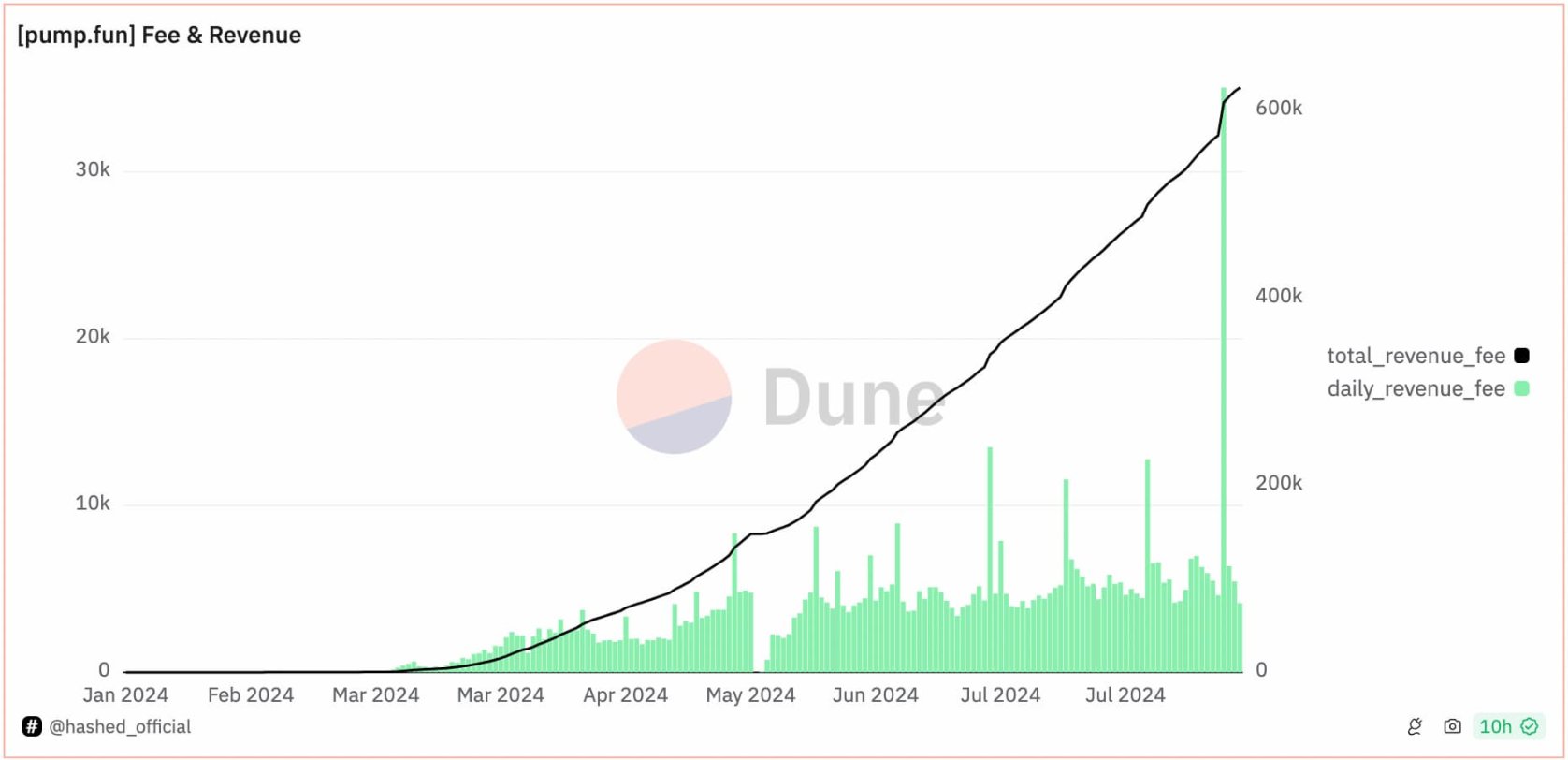

Total fees on pump.fun have reached more than 0.1% of the total supply of SOL

The total fees on pump.fun reached 624,640 SOL, which currently accounts for more than 0.1% of Solanas total supply, equivalent to about $90 million at current market prices. It should be noted that pump.fun has only been launched for 7 months.

In addition, according to Lookonchain, the pump.fun fee account sold 222,073 SOL at an average price of US$160 in the past three months, converted into 35.54 million USDC.

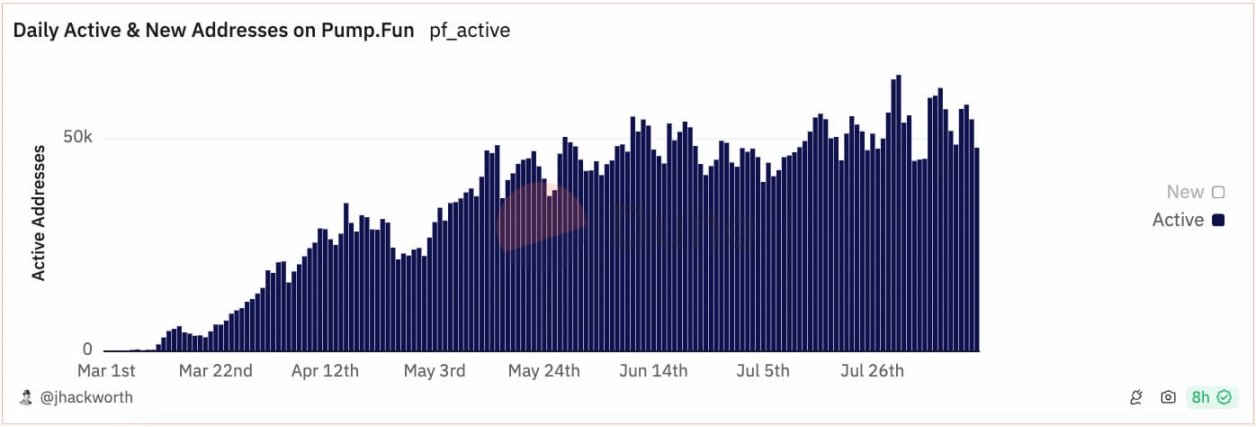

2.43 million users, with daily active users ranging from 50,000 to 70,000

@jhackworth s Dune dashboard data shows that as of the latest statistics, the pump.fun platform has more than 2.43 million users. In the past three months, the platform has maintained a high daily active user number of 50,000 to 70,000 on most days.

Only 3% of users on pump.fun make more than $1,000

Dựa theo @adam_tehc , if you make more than $1,000 in profit, youll be in the top 3% of profit rankings.

If you make over $10 million in profit on pump.fun, you are ranked in the top 6 in terms of profitability;

If you make over $1 million in profit on pump.fun, you are ranked in the top 70 in terms of profit (0.0028% of all wallets);

If you make more than $100,000 in profit on pump.fun, you are ranked in the top 924 in terms of profit (0.037% of all wallets);

If you make more than $10,000 in profit on pump.fun, you are ranked in the top 11,936 in terms of profit (0.477% of all wallets);

If you make over $1,000 in profit on pump.fun, you are ranked in the top 76,587 in terms of profitability (3.061% of all wallets).

Update: According to Lookonchain, the post about 0.477% of wallets earning more than $10,000 in transactions on pump.fun is inaccurate, and the address ranked first on the list only traded a Meme token called HP and earned only 4 SOL.

In summary, even though the overall cryptocurrency market is relatively sluggish and Solanas popularity has slightly declined, pump.funs user base and activity remain robust. Based on existing data, if pump.fun can continue to maintain user activity, pump.fun is expected to continue to receive stable fee income.

However, we must also be aware that there are a series of unfavorable factors that cannot be ignored. In particular, the extremely low graduation rate of tokens and the lack of market value growth in the later period, coupled with the unsatisfactory user profitability, have had a significant impact on user confidence. In the short to medium term, this wavering of confidence will directly affect the platforms user retention rate and the attractiveness of new users in the short to medium term.

This article is sourced from the internet: The real data of pump.fun: 1.4% graduation rate, only 3% of users earn more than $1,000

Original source: Glassnode Original translation: Lila, BlockBeats Summary Despite Bitcoin prices moving sideways or falling, a large portion of the market remains in profit, while short-term holders bear the majority of losses. By combining on-chain pricing models and technical indicators, we explore the future development of the market. Volatility continues to compress historically, which indicates investor apathy but also suggests that greater volatility may be ahead. Market profitability remains strong When Bitcoin price dropped to the $60,000 range, a certain level of fear and bearishness set in among many digital asset investors. It is not uncommon for apathy to creep in when market volatility stagnates and goes dormant. Still, overall investor profitability remains very strong from a MVRV ratio perspective, with the average coin still making 2x profit. This is…