MicroStrategy’s fourth anniversary of Bitcoin: A review of its acquisition strategy and market influence

Original title: MicroStrategys Bitcoin Anniversary: A Look Back at Its Acquisitions and Market Influence

Original author: Valdrin Tahiri, CCN

Original translation: Fairy, ChainCatcher

Tóm tắt các điểm chính

-

MicroStrategy (MSTR) started buying Bitcoin in August 2020.

-

The company purchased more than 15, 000 Bitcoins five times.

-

Is there a correlation between these purchases and MSTRs stock price?

On August 11, 2020, MicroStrategy made its first bold foray into Bitcoin (BTC), making headlines and ushering in a new era for the entire industry.

Led by Michael Saylor, MicroStrategy has rapidly risen to become one of the world’s largest public Bitcoin holders, revolutionizing the way businesses think about financial management and transforming the industry’s understanding of digital assets. attitude.

As we approach the fourth anniversary of this decision, let’s take a deeper look at some of MicroStrategy’s major Bitcoin purchases and see how these strategic moves affected the market.

Start purchasing

MicroStrategy’s most iconic purchase occurred on August 11, 2020.

At the time, the companys chairman, Michael Saylor, announced that the Nasdaq-listed company had purchased 21,454 bitcoins for $250 million. The investment marks a major shift in MicroStrategys strategy, Bitcoin is incorporated into the company’s financial strategy.

Saylor calls Bitcoin a reliable store of value and sees it as a hedge against inflation.

His vision was clear: to set a new standard for corporate financial management and demonstrate the company’s confidence in the future of Bitcoin. And it turns out he has indeed set a new standard—MicroStrategy has become one of the best-performing technology companies in the world.

Following the announcement, the price of Bitcoin surged, reflecting the markets growing confidence in its legitimacy as an asset. MicroStrategys stock also rose as investors appreciated the bold move. An initial purchase paved the way for MicroStrategy to become the leading company to publicly hold Bitcoin, reshaping industry norms.

Top 5 Bitcoin purchases

Bitcoin purchases have been a big part of MicroStrategys stock price performance.

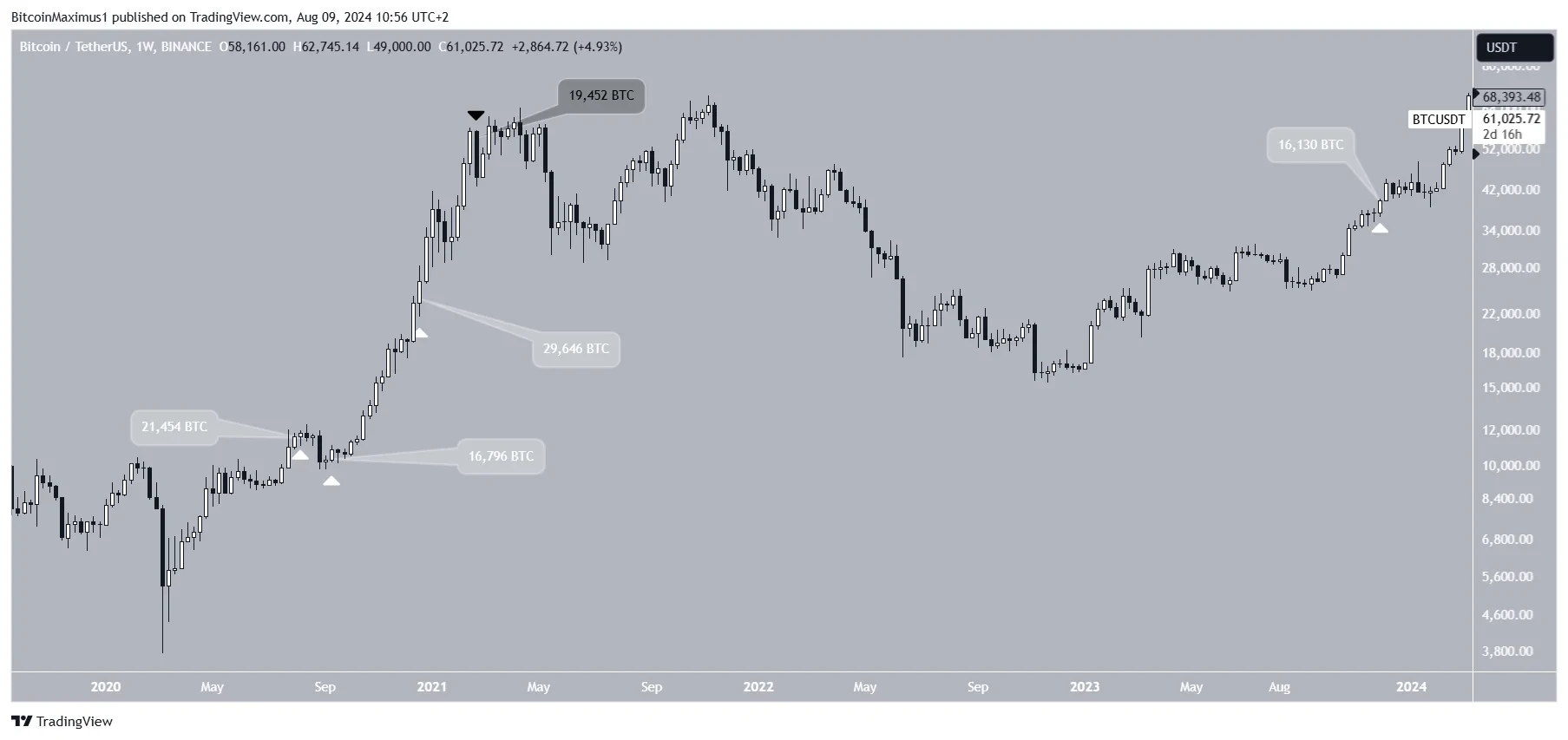

Here are the five largest Bitcoin purchases made by MicroStrategy, sorted by the number of Bitcoins purchased rather than the total price at which they were purchased:

-

December 21, 2020 – 29,646 BTC

-

August 11, 2020 – 21,454 BTC

-

February 24, 2021 – 19,452 BTC

-

September 14, 2020 – 16,796 BTC

-

November 30, 2023 – 16,130 BTC

Looking at share price performance, MicroStrategy (MSTR) stock rose in four of the five weeks (indicated by the white icons) when the company made its largest Bitcoin purchase. The only exception was in the week when the third largest purchase was made. That week (indicated by the black icon), MSTR stock fell more than 13%.

While MSTR’s stock price has risen 80% of the time following a large Bitcoin purchase, the relationship is not as simple as it seems. Stock price increases do not always line up perfectly with the size of the purchase.

MSTRs stock price has fluctuated between 5% and 21%. In fact, the most impressive gain came in August 2020, when the stock surged 21%. This was followed by another 12% gain in September 2020. .

While MicroStrategy stock has performed well most of the time, how has Bitcoin performed?

Impact on Bitcoin Price

Bitcoin’s price performance is similar to MicroStrategy’s. BTC prices rose in four of the five major Bitcoin purchases made by the company. The only exception was during the third major purchase in February 2021, when Bitcoin Prices have fallen.

But it is worth noting that Bitcoins biggest increase occurred during the largest purchase in December 2020, when the price rose 12%. This is in contrast to MicroStrategys stock performance, where the largest increase in MSTRs stock price is not necessarily associated with the largest associated with the purchase volume.

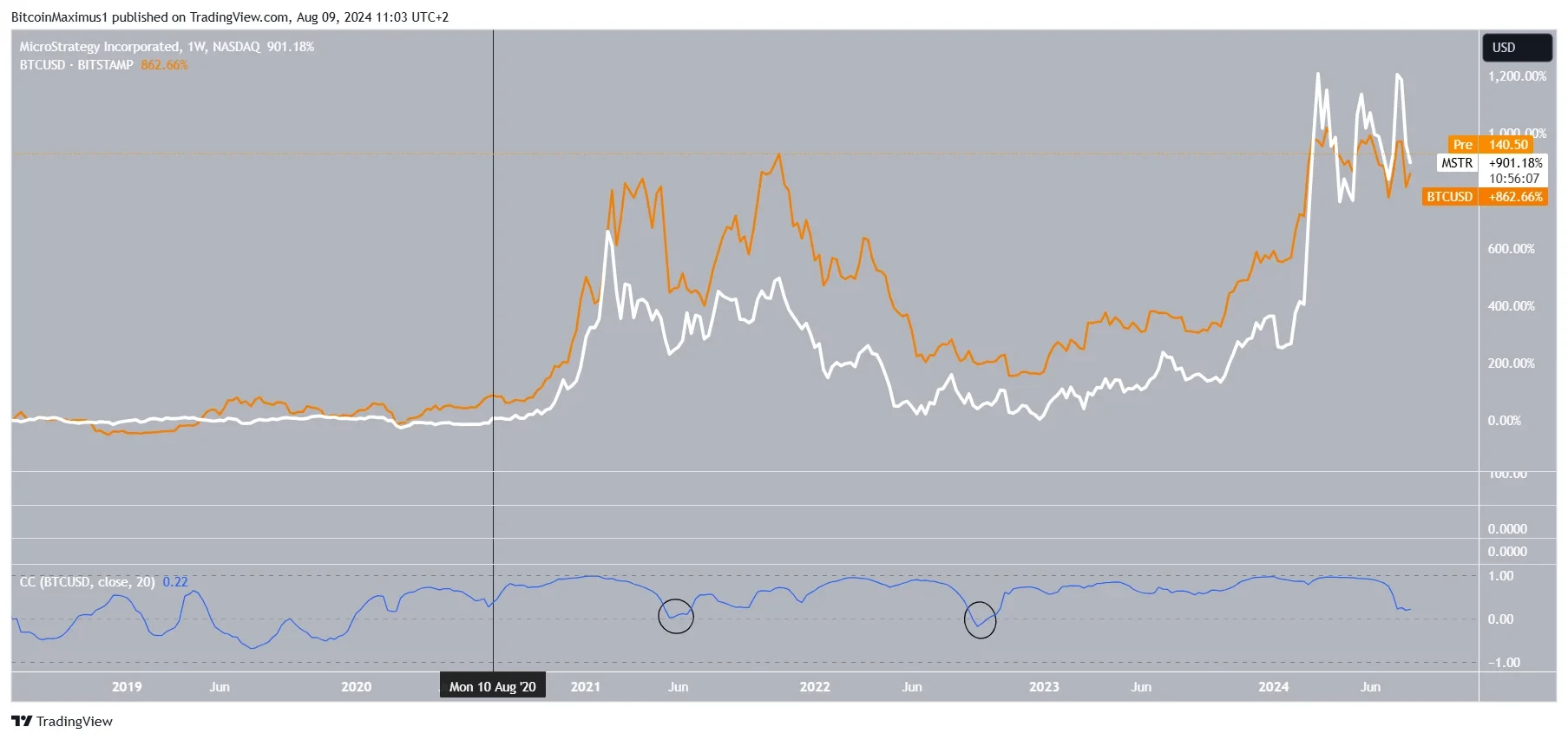

With this in mind, it is interesting to compare whether there is an increasing correlation between MicroStrategy’s stock price and the value of Bitcoin. As MicroStrategy’s Bitcoin holdings increase, one could expect the price movements of the two to become more closely tied together.

This may be the case. Before MicroStrategy first purchased Bitcoin in August 2020 (black mark), there was almost no correlation between MSTR and Bitcoin prices. The correlation coefficient (blue mark) fluctuates around zero, indicating that the two There is no actual relationship between the assets.

But since August 2020, the situation has changed significantly. The correlation has turned positive, sometimes even reaching a perfect positive correlation score. This shows that the price changes of the two now closely reflect each others movements.

This pattern is very clear when comparing price charts: MSTR (white) and Bitcoin (orange) have moved in close sync, especially during the current bull run. The sync phenomenon shows that as MicroStrategy’s Bitcoin holdings increase, its stock price increases. Increasingly mirroring the performance of Bitcoin, showing a growing correlation between the two.

The correlation occasionally drops to 0 or negative values (black circles). Interestingly, all of these instances marked local or absolute bottoms for Bitcoin. This bodes well for future Bitcoin and MSTR prices, as The current correlation is 0.20.

Therefore, there is a positive correlation between large purchases of MicroStrategy, the price of Bitcoin, and the price of MSTR. The correlation between MSTR and Bitcoin is also positive and strengthens with each purchase.

This article is sourced from the internet: MicroStrategy’s fourth anniversary of Bitcoin: A review of its acquisition strategy and market influence

Original | Odaily Planet Daily ( @OdailyChina ) Author|Nan Zhi ( @Assassin_Malvo ) This afternoon, Nansen founder Alex Svanevik published a post on the X platform with the content $IQ @makenowmeme. MakeNow.Meme mentioned in the post is a token launch platform similar to Pump.fun. Its biggest highlight is that it can issue tokens directly through posting on the X platform. Alex’s move is to release a “test” token through the platform function. Odaily will interpret the platform’s functions and potential directions in this article. Protocol Features According to the official definition, MakeNow.Meme is a platform that allows anyone to launch Meme tokens directly through tweets on X. In fact, the platform was launched on July 10, but it did not appear in the public eye until Alex tweeted. The application…