Original author: @0x Breadguy

Original translation: Peisen, BlockBeats

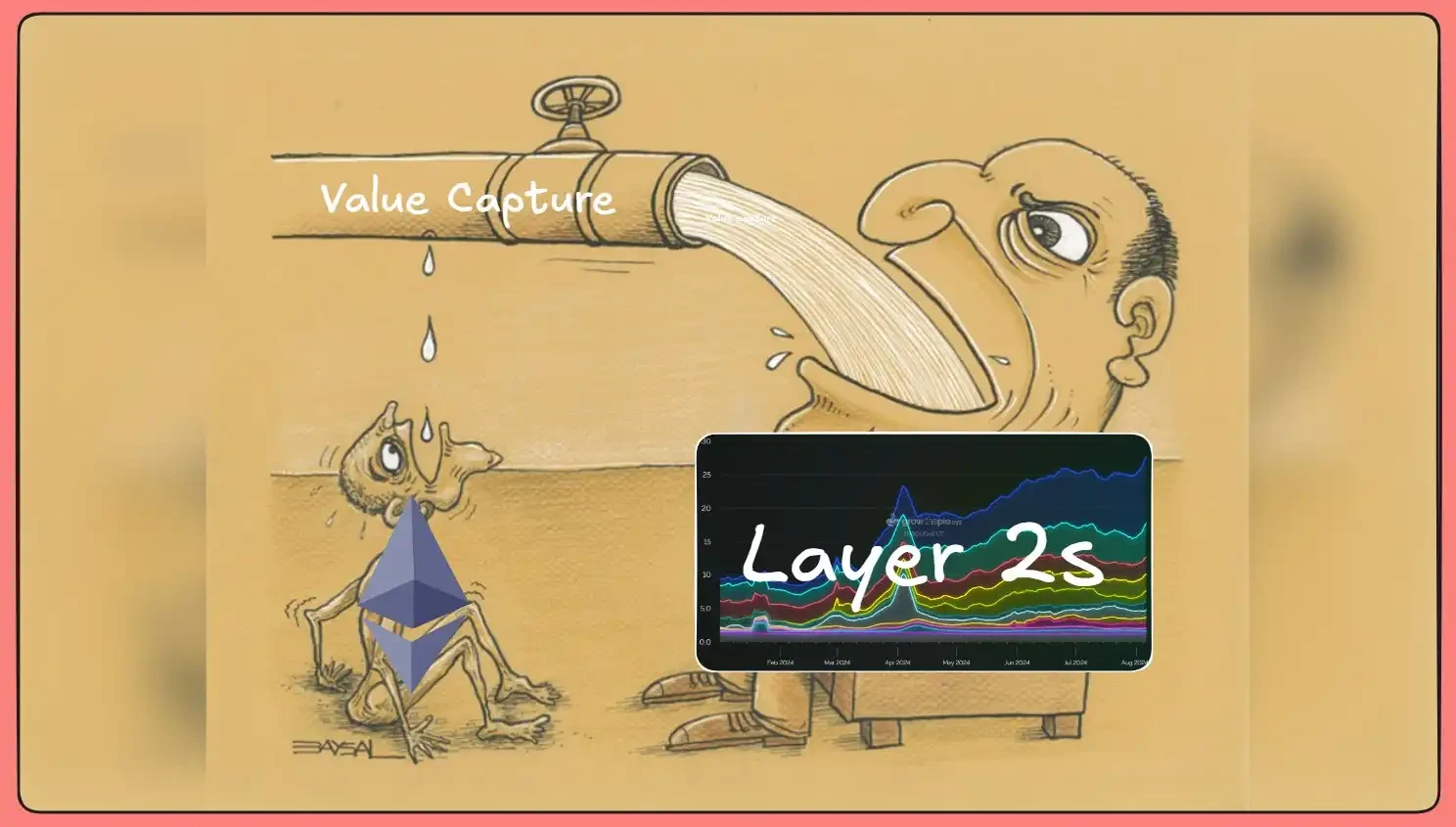

Editors note: Due to the reduction in transaction fees on the Ethereum network caused by the Dencun upgrade, the amount of Ethereum destroyed has dropped to one of the lowest levels since the Merge. CryptoQuant analysts said that the Dencun upgrade has made Ethereum inflationary again, which may undermine its characteristics as an ultra-sound currency. @0x Breadguy discussed on social media whether the concept of ultrasonic currency should be abandoned.

It’s crucial that Ethereum stops promoting the concept of “ultrasonic money” — but I’m not sure if that’s a good thing or a bad thing.

Why do I say this? Because now that users have been asked to migrate off the mainnet, it is unlikely that we will see L2 return to the level of sustained ETH destruction before Dencun (March 2024).

The current situation of L2 is:

-

Receive execution rewards

-

Own user relationship

-

Scaling throughput while keeping costs relatively constant on Ethereum (even better with Alt-DA)

Nguồn hình ảnh: @growthepie_eth

The Future We Envision

There has always been a user migration gap in the modularization roadmap, whereby mainnet activity will foreseeably decline as on-chain participants move to their favorite L2 solution or solutions.

The overall flow trend of users is as follows:

Nguồn hình ảnh: @growthepie_eth

Activity will decline as a small fraction of users spread across several early L2 solutions, mainnets, and alternative L1s.

These users will then be replaced by a swarm of new L2 networks coming online that will compete for the same block space we once used to mint Monkey Warrants.

ETH blockspace demand (driven by less cost-sensitive users (L2)), burn mechanisms are back on the table, and the ecosystem is both ultrasonic (ETH is gradually becoming inflation-free) and appealing to the masses via scalable L2. Very good.

However, after Dencun, things were a little different.

What we see

Now that blobspaces have been introduced, L2 can handle most transactions at a 10x discount, and we see another trend emerge:

A single L2 is handling an increasing number of transactions and throughput while keeping costs to Ethereum relatively stable.

Here are Bases metrics for the past 90 days:

-

Trading volume increased by approximately 75%

-

Throughput increased by approximately 100%

-

Payments to Ethereum remain unchanged

Nguồn hình ảnh: @growthepie_eth

What happens when a single L2 ecosystem grows indefinitely without incurring additional ETH costs? These L2 ecosystems will devour other L2 users without increasing the amount of ETH burned.

They act like a black hole, sucking users out of the Ethereum ecosystem. This means you’ll (most likely) end up with a situation like this:

Nguồn hình ảnh: @growthepie_eth

A power law effect is starting to emerge, with dominant L2 solutions attracting a disproportionate number of users, while Ethereum remains underutilized because the cost of posting data to Ethereum remains relatively constant despite growth.

This is why I think it’s time to abandon the concept of “ultrasonic money”: because it probably won’t be a significant factor for a long time (especially on crypto timescales).

Im not sure if its a bad thing. If you want ETH to be the chain for settlement and security now, rather than the user chain, inflation is not necessarily a bad thing, it helps improve liquidity and propagation in all these ecosystems.

Making ETH (artificially) scarce would hinder these properties (see: Bitcoin). Still, the concept is interesting, and that’s important.

Additional Thoughts

-

It should be noted that these are comments on the concept of ultrasonic currency rather than an outlook on the asset itself, and I remain optimistic about it.

-

I think the core developers would be better off continuing to push the modularity roadmap rather than fully pivoting to extending L1. They should try extending L1 earlier and longer before giving in to L2, but at a time when user education and further benefits to L2 economics would bring more benefits.

-

Make some optimizations (block times) to reduce unnecessary complexity like pre-confirmations, but keep the direction the same.

-

The importance of ETFs for ETH cannot be overstated. They are structural game changers, and all of these conversations will be irrelevant to them over the next few years.

-

Ironically, L2 abusing ETH in this way is bullish? If I were a corporate entity looking to monetize my user base, Coinbase has laid out the perfect blueprint for me. Therefore, I will still stay in the Ethereum ecosystem, continuing the concept, but in an extractive position. Not sure which side of this pendulum is more important.

This article is sourced from the internet: Should Ethereum abandon the concept of ultrasonic currency?

Original author | Arthur Hayes Compiled by Nan Zhi ( @Assassin_Malvo ) Some people would say: “The crypto bull run is over.” “I need to issue my token now because we are in the downside of the bull run.” “Why hasn’t Bitcoin risen like the big US tech companies in the Nasdaq 100?” This chart of the Nasdaq 100 (white) versus Bitcoin (gold) shows that the two assets have moved in tandem, but Bitcoin’s gains have stalled since hitting an all-time high earlier this year. However, the same people make the following point: “The world is shifting from a unipolar world order dominated by the United States to a multipolar world order that includes leaders such as China, Brazil, and Russia.” “To finance government deficits, savers must be financially repressed…