Báo cáo hàng tuần về thị trường tiền điện tử của Frontier Lab|W32

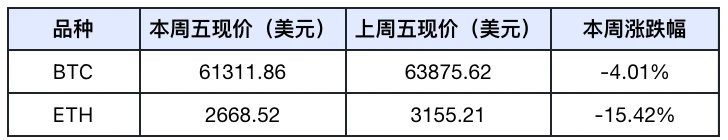

BTC and ETH this week overview

Market performance

The cryptocurrency market as a whole has been “violently volatile” this week:

-

Bitcoin: Bitcoin fell sharply on Monday as global markets fell, but as macro data was released on Tuesday, market sentiment improved and Bitcoin prices rebounded.

-

Ethereum: It also fell rapidly on Monday due to the market crash. The serial liquidations further exacerbated the decline. Although it rebounded afterwards, the rebound was small.

Key Events

US recession triggers global market plunge

-

On Monday, the Japanese stock market plummeted and triggered the circuit breaker mechanism. Subsequently, the three major U.S. stock indices fell across the board. The SP 500 index hit a low of 5,119 points, the Dow Jones Industrial Average fell to 38,499 points, and the Nasdaq index fell to 15,708 points.

-

The market reacted strongly to the lower-than-expected US employment data, which triggered recession concerns and led to risk aversion and panic selling. However, with the release of other macro data in the middle of the week, the market gradually recovered and began to rebound.

US Macro Data

-

The U.S. ISM non-manufacturing PMI reached 51.4 in July, exceeding expectations. The number of people applying for unemployment benefits fell to 233,000 in early August. These data eased market concerns about economic recession and prompted the market to gradually recover.

-

Geopolitical war uncertainty increases

-

After the top leader of Hamas was attacked in Iran last week, Iran threatened to retaliate against Israel. Although the action has not yet been implemented, the uncertainty of the situation in the Middle East has increased market concerns and put pressure on global markets.

US Democratic Party confirms candidate

-

After Biden announced that he would not run for election, the Democratic Party nominated the current Vice President Harris as the presidential candidate. Harris had initial contact with cryptocurrency industry executives. Although he did not make a clear statement, the market has new expectations for the Democratic Partys future cryptocurrency policy.

Altcoin Overview of the Week

Overall performance

Market sentiment rebounded to 9.2% this week, but it is still in the extreme fear zone, which is significantly lower than last weeks 12%. This change in sentiment is mainly due to the fact that the US employment data last Friday was far below expectations, which triggered market concerns about a future economic recession, leading to risk aversion and panic selling on Monday this week. Global markets fell sharply, and Altcoins generally fell by more than 20%. With the release of other macro data, recession concerns have eased and the market has begun to rebound. However, the rebound of most tokens is not as large as the market, reflecting that investors are still cautious and take a wait-and-see attitude towards Altcoins.

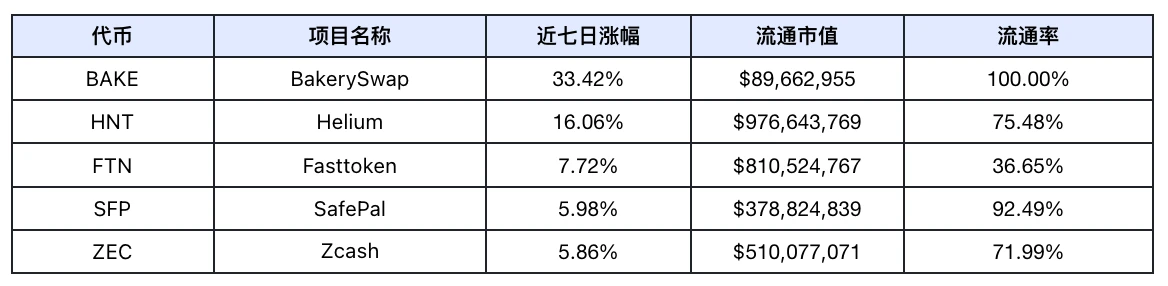

Overview of the Rising Stars

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: Coinmarketcap

The list of rising tokens did not show the characteristics of sector concentration. The rising tokens were scattered in various sectors, belonging to DEX, Depin, L1s, wallets and privacy tracks respectively. The market is still in a rebound.

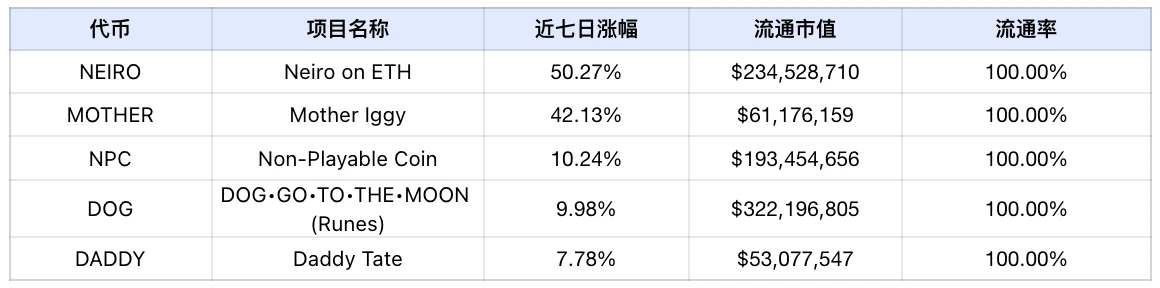

Meme Token Gainer List

Data source: coinmarketcap.com

After the market crash on Monday, the Meme track suffered a particularly severe decline, with all projects falling by more than 30%. Although it rebounded with the market after Tuesday and was stronger than other tracks, the increase in Meme tokens was not significantly outstanding.

It is worth noting that the speed of Meme themes’ replacement has accelerated. Although this appears to demonstrate its vitality and potential, it also exposes its instability and hidden concerns about its high replacement rate, which may lead to a lack of confidence among long-term investors, thus posing a challenge to the continued growth of the track.

Social Media Hotspots

Based on the top five daily growth in LunarCrush and the top five AI scores in Scopechat, the statistics for this week (8.3-8.9) are as follows:

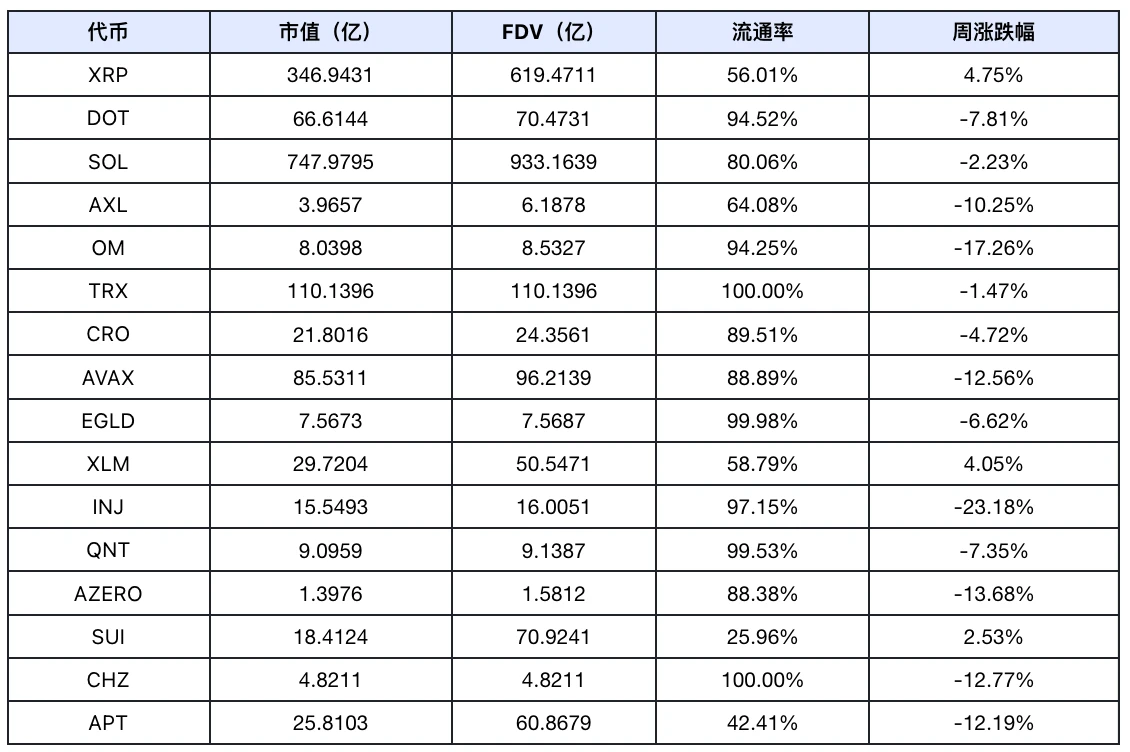

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: lunarcrush and Scopechat

As can be seen from the table above, the L1s track projects that have attracted attention on social media this week have seen mixed rises and falls. Although some tokens have rebounded after a sharp drop, if the rebound is weaker than the overall market and there is no impact from special events, this may reflect the weak power of the funds behind them.

Subject tracking

Data source: SoSo Value

-

In terms of weekly returns, the Payment track performed the best, while the RWA track performed the worst.

-

Payment track: XRP is the main force in this track, accounting for 68.01% of the market value. This week, Ripple won the lawsuit against the SEC. The court ruled that the sale of XRP did not violate federal securities laws, and the amount of the fine was also lower than expected. This positive news promoted XRPs strong rebound, driving the entire Payment track to perform well this week.

-

RWA track: Affected by expectations of a US economic recession, the stock market and bond yields fell this week, resulting in the RWA track, which is mainly connected to real assets, to have the smallest rebound and relatively poor performance.

Crypto Events Next Week

-

Tuesday (August 13) FireNow: Asian Web 3.0 Institutional Summit

-

Wednesday (August 14) US July-end seasonally adjusted CPI annual rate; Istanbul Blockchain Week 2024

-

Thursday (August 15) U.S. July retail sales monthly rate

-

Friday (August 16) OnChain Summit; ETHShenzhen 2024 Summit and Hackathon

Outlook for next week

-

Bitcoin: Although the recent U.S. economic recession expectations have eased, macroeconomic and geopolitical risks remain. Bitcoin is expected to continue to fluctuate widely before the Fed cuts interest rates. Investors should remain cautious, but can keep an eye out for rebound opportunities.

-

Ethereum: Ethereum spot ETF funds continue to flow in. Although there are bargain hunting opportunities in the short term, long-term risks remain. Ethereum is expected to fluctuate in sync with Bitcoin, and investors should be cautious about being bullish.

-

Altcoin: After the sharp drop this week, Altcoin is expected to rebound, but the increase may be limited. Investors should remain cautious and pay attention to market changes.

This article is sourced from the internet: Frontier Lab Crypto Market Weekly Report|W32

Related: What do we talk about when we talk about economic models?

Let鈥檚 start with the Bitcoin shutdown price Recently, as Mt. Gox began to pay out Bitcoin and the German government frequently sold Bitcoin, the price of Bitcoin once fell below $54,000 (it has now risen back above $60,000), reaching the shutdown price of some Bitcoin mining machines. According to a survey, if Bitcoin reaches 54,000, only ASIC mining machines with an efficiency of more than 23 W/T can make a profit, and only 5 models of mining machines can barely support it. This means that if the price of Bitcoin falls below the shutdown price, some miners with smaller risk resistance will seek to exit and stop losses. When these miners exit, they often sell Bitcoin for cash and sell mining machines at a lower price, causing the price of…