Tại sao Cosmos chưa bao giờ nhận được nhiều sự chú ý như Solana?

Original author: Cryptocito, Stakecito co-founder

Original translation: Aelx Liu, Foresight News

I saw a tweet from Rooter, co-founder of Solend and Suilend, asking: “Why has Cosmos never received as much attention as Solana?” Here are my thoughts:

1. Cosmos is not the same as Cosmos Hub

Cosmos is often misunderstood as just the Cosmos Hub, which means that as long as the price of ATOM does not perform well, Cosmos has failed.

In fact, the Cosmos ecosystem is very diverse and dominates entire vertical industries, or at least has strong competitors in various fields.

Fetch, Cronos, Injective, dYdX, Thorchain, MANTRA, Akash Network, Celestia, Saga, Dymension, Sei, etc. have all received great attention in their respective areas of expertise.

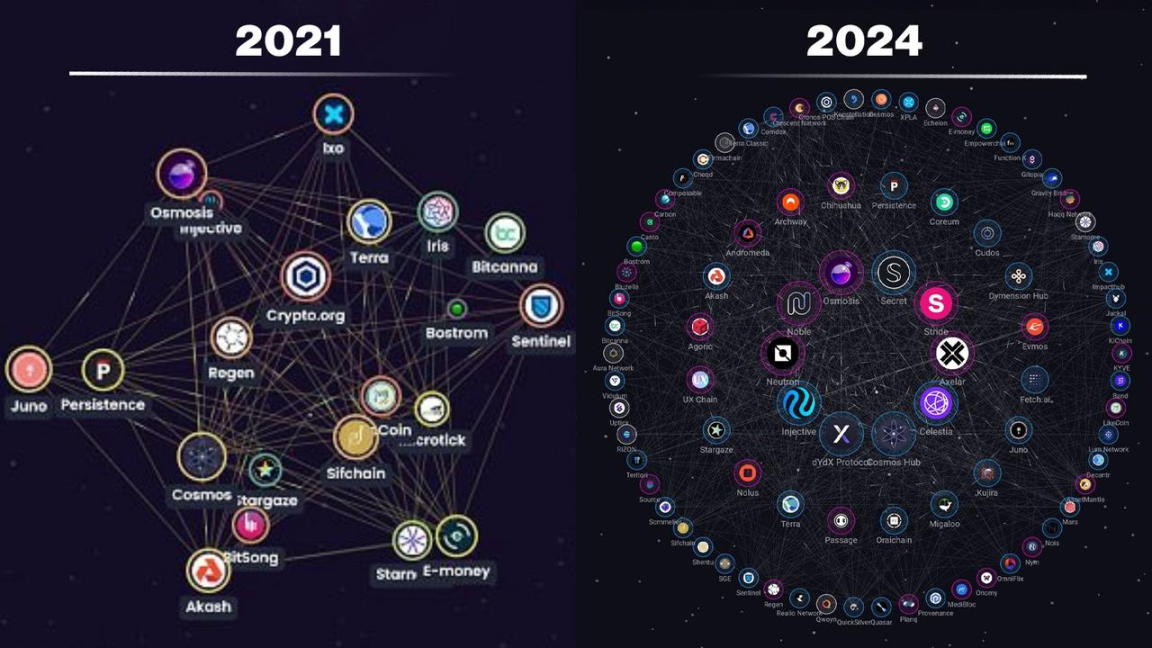

Cosmos Ecosystem Project Evolution

All of the above are Cosmos chains. The difference is that they are sovereign chains that can be autonomous, with their own ecosystems, foundations, marketing strategies, brands, etc.

Even larger chains like Polygon or BNB Chain partially adopt Cosmos’ technology. (Translator’s note: Polygon PoS uses Tendermint consensus, and BSC uses Cosmos SDK.)

There are also some big upcoming projects like Babylon, Berachain or Nillion that also use Cosmos technology. Some of these projects are more publicly identified as Cosmos projects and others are not, but thats okay. (Translators note: Although Berachain is built using the Cosmos SDK, it has always objected to being called a Cosmos project)

So the first point as to why Cosmos is considered unattractive is that it is still often considered synonymous with the Cosmos Hub and ATOM.

2. Interchain Foundation inaction

Second, unlike organizations like the Solana Foundation or the Ethereum Foundation, the Interchain Foundation does not play a central role in coordinating marketing, developer onboarding, community initiatives, and development — at least not yet.

The advantage of this is extremely low dependence on a single organization, but the disadvantages are lack of consistency, difficulty in coordination, fragmented vision and difficulty in dividing responsibilities.

Solana is moving very fast thanks to the Solana Foundation, which has taken a very proactive approach, hosting large conferences like Breakpoint, funding Superteams around the world, and strategically incentivizing all market participants to join and get educated about Solana.

This is so great, in fact, that we are working to replicate this model for the Cosmos ecosystem. Without funding, this is very challenging.

3. The ecosystem does not have a unified currency

Third, it is worth noting that the core of Cosmos is that chains are interoperable while ensuring sovereignty, which means that there is no unified currency that can rule all these chains.

The entire ecosystem is not supported by a single base chain or token, and this is not because they forgot it, but because this is the nature of Cosmos.

I wasn’t present when ATOM launched in 2019, but I’m told that this was a conscious design decision — not to directly tie IBC adoption to the value of ATOM, but to let the market decide.

Cosmos’ principles make it highly adaptable, which is great for long-term sustainability but less so for short-term hype.

Terra has proven the Appchain theory in extreme cases. Tendermint, now Comet BFT, has been around for a long time and is widely adopted. IBC has proven to be resilient, has never been hacked, and is integrated by many projects.

That being said, I still expect ATOM to do well and hold its ground, as it helped get this $30 billion ecosystem off the ground and proved its technology, while still remaining in the top 40 market cap 5 years into the coin’s existence.

What I think needs improvement is:

-

Rebranding Cosmos to “Interchain”

-

Improve the developer onbording process;

-

Copy the Solana Superteam model

-

The Interchain Foundation should play a more proactive role

The Interchain Foundation is currently going through some structural changes and more steps are likely to be taken from now on.

There is still a lot to consider and a lot to figure out, but this is my general opinion.

This article is sourced from the internet: Why has Cosmos never received as much attention as Solana?

Related: SignalPlus Volatility Column (20240717): IV goes higher and flat

Over the past day, the price of BTC has been rising steadily, breaking through $66,000 at one point, and the daily inflow of spot ETFs reached $422 million, the highest record since June, with a cumulative inflow of more than $1 billion in three days, indicating the increase in investor confidence and institutional investment interest. On the other hand, Kraken began to distribute a total of $3.1 billion in cryptocurrency (BTC/BCH) compensation to Mt Gox creditors, which is expected to be carried out gradually in the next 7 to 14 days. Despite this, we have seen that the selling sentiment caused by potential selling pressure has been offset by the support of institutional investors, and the price of BTC remains strong. At the same time, some people pointed out that…