Khối lượng giao dịch của 6 ETF tài sản kỹ thuật số tại Hồng Kông đã vượt quá HK$240 triệu vào ngày hôm qua, lập kỷ lục mới

On August 5, 2024, the total trading volume of six Hong Kong digital asset spot ETFs under China Asset Management, Harvest Global and other issuers exceeded HK$240 million, setting a new single-day trading volume record since their listing on April 30.

In the context of the July U.S. non-farm data falling far short of expectations and the unexpected surge in unemployment, the risk of geopolitical war in the Middle East has also risen sharply. This series of factors has led to a Black Monday in the global financial market, with Japanese and Korean stock markets triggering circuit breakers one after another, and the digital asset market also experiencing a flash crash. At the same time, the trading volume of Hong Kongs digital asset ETFs has increased dramatically, with the daily trading volume of Bitcoin and Ethereum ETFs both surging several times compared to the past, setting a record high.

*Data as of August 5, 2024, Hong Kong time (Source: Hong Kong Exchanges and Clearing Limited)

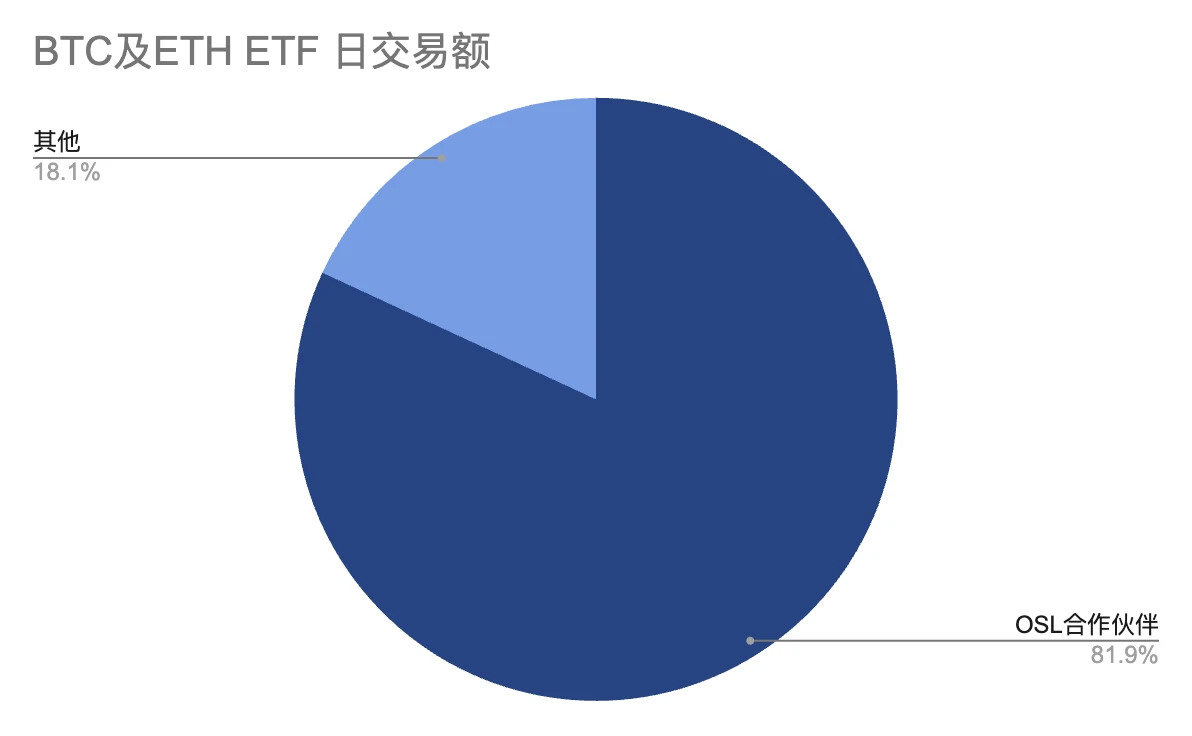

Among them, China Asset Management, for which OSL Digital Securities Co., Ltd. serves as the virtual asset custodian and trading partner, and four spot Bitcoin and Ethereum ETFs under Harvest Global ETFs have a total daily trading volume of approximately HK$196.5 million, accounting for a total of nearly 82% , ranking in an absolute leading position; the other two spot Bitcoin and Ethereum ETFs have a total daily trading volume of approximately HK$43.45 million, accounting for approximately 18%.

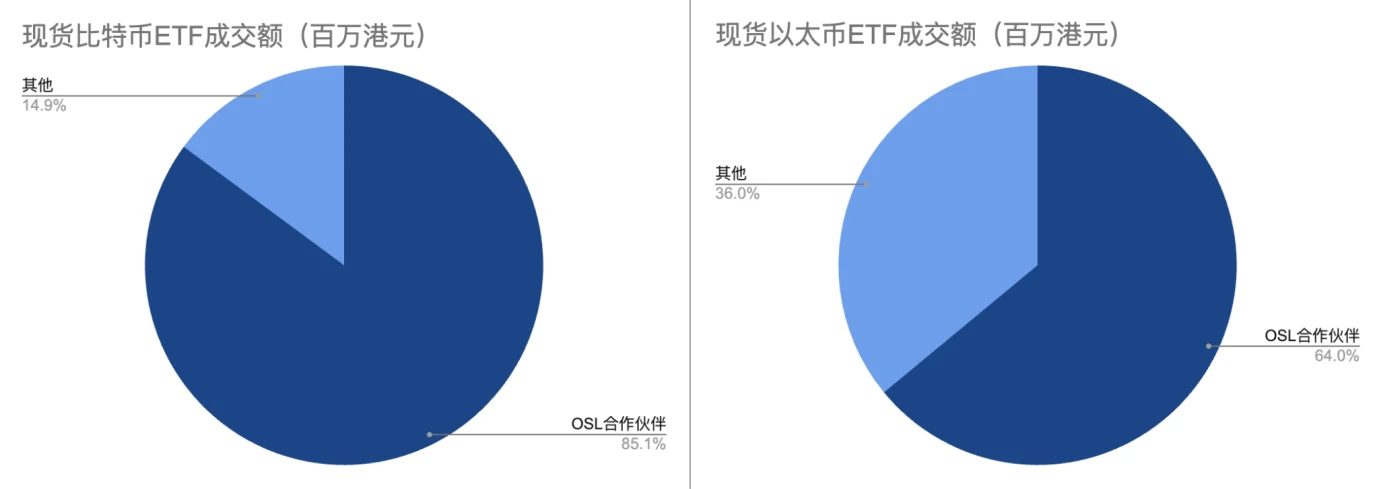

From the perspective of the Bitcoin and Ethereum ETF segments, OSL is also in a clear leading position in the trading volume of the relevant ETFs as a custody partner:

● The total trading volume of these three Hong Kong Bitcoin ETFs exceeded HK$203 million, of which the OSL-custodial ETFs – China Asset Management Bitcoin ETF (3042.HK) and Harvest Bitcoin Spot ETF (3439.HK) had a trading volume of over HK$173 million, accounting for more than 85%;

● The total trading volume of these three Hong Kong Ethereum ETFs exceeded HK$36.46 million, of which the OSL-custodial ETFs – China Asset Management Ethereum ETF (3046.HK) and Harvest Ethereum Spot ETF (3179.HK) had a trading volume of over HK$23.34 million, accounting for more than 64%;

In addition, from the perspective of asset management scale, the total asset management scale of the six Hong Kong digital asset spot ETFs has exceeded HK$2.157 billion, of which OSL has custody of HK$1.313 billion, accounting for more than 60%.

This article is sourced from the internet: The trading volume of 6 digital asset ETFs in Hong Kong exceeded HK$240 million yesterday, setting a new record high

Related: Prospects for Solana ETF approval: efficient and low-cost blockchain investment?

Hash ( SHA1 ) of this article: 4a79c3c2fa5456d2d335b08cb26d1bd519063b11 No.: Lianyuan Security Knowledge No.017 This year, the approval and trading of spot exchange-traded funds (ETFs) in the United States has become a major topic of discussion in the cryptocurrency space. The success of the Bitcoin ETF has been particularly remarkable, attracting $16 billion in inflows in just six months after its launch, driving the price of Bitcoin up 46%. As the ETF market has grown rapidly, in addition to major cryptocurrencies such as Bitcoin and Ethereum, more crypto assets such as Solana have gradually entered the market. The Solana blockchain is favored for its high throughput and low transaction costs, capable of processing thousands of transactions per second, and transaction fees are generally less than a few cents. These features make…