Báo cáo hàng tuần về thị trường tiền điện tử của Frontier Lab 锝淲31

BTC and ETH this week overview

Market performance

-

Crypto markets are back on a downtrend this week;

-

Bitcoin fell sharply this week, mainly affected by the Mtgox compensation distribution incident;

-

The actual volatility of Ethereum is weakening, which means that the negative impact of the spot ETF Sell News is rapidly decreasing, which is beneficial to forward prices!

Key Events

Mtgox compensation incident

-

Overview: Mtgox bankruptcy compensation work continues. This week, BTC is still being transferred from the address to the exchange for compensation. There are still 32,899 BTC left on the address.

-

Analysis: Although the BTC price did not fluctuate significantly when the compensation plan began, other uncertainties emerged in the market this week. As these factors increased, market purchasing power declined, and the Mtgox compensation incident began to affect market prices.

Federal Reserve interest rate meeting

-

Overview: On Thursday, the Federal Reserve announced that the interest rate remained at 5.25%, and then Powell hinted that the Federal Reserve may cut interest rates in September.

-

Analysis: This week, the Federal Reserve announced that it would keep interest rates unchanged in July, which was in line with market expectations. Powells subsequent speech hinted that interest rates would be cut in September, which was also in line with market expectations. Therefore, after the interest rate meeting, market traders have fully priced in a rate cut in September, and the expected rate cut has been changed from 25 basis points to 50 basis points, so the US stock market began to rise and the yield of the US bond market fell across the board. However, the liquidity in the market, which was not abundant to begin with, began to shift to the bond market and the stock market, so the liquidity of the Crypto market began to be drawn to other markets, resulting in insufficient liquidity in the Crypto market, a decline in purchasing power, and the phenomenon of rising US stocks and falling cryptocurrency markets.

Geopolitical war escalates

-

Overview: On July 31, Hamas Supreme Leader Haniyeh was killed in an airstrike in Tehran, Iran.

-

Analysis: This sudden situation may further escalate the conflict in the already turbulent Middle East. It is generally believed that if Iran intervenes, the United States will be dragged into the war. As a result, the U.S. stock market fell to varying degrees after opening that day. At the same time, it also caused a short-term rise in crude oil and gold prices.

Altcoin Overview of the Week

Overall performance

Market sentiment fell to 12% this week, and is in an extremely fearful stage. Compared with 42% last week, there is a significant retracement, mainly due to the uncertainty of various macro and policy factors, the escalation of geopolitical wars, and the continuation of the Mtgox compensation incident. In particular, after the Federal Reserve hinted at a rate cut in September, market liquidity began to flow to US bonds and stocks, which led to the withdrawal of the already scarce market liquidity, thereby reducing the purchasing power of the market. These factors have had a great impact on Altcoins, and investors have begun to avoid risks and wait and see.

Overview of the Rising Stars

Top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins)

Data source: coinmarketcap

The gain list did not show the characteristics of sector concentration. The rising tokens were scattered in various sectors, and the gains were lower than last week. This shows that Altcoins have experienced a sharp correction this week.

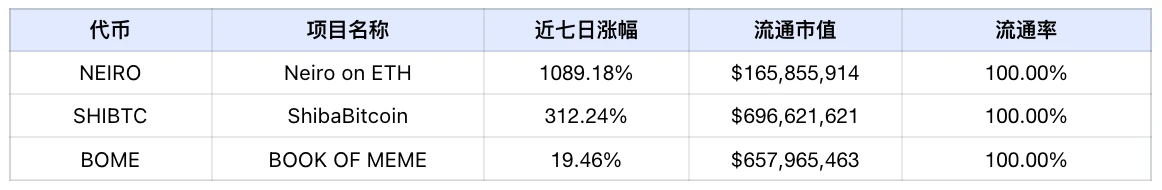

Meme Token Gainer List

Data source: coinmarketcap.com

The overall market showed a downward trend this week. The Meme track performed poorly this week. Basically, it was in a downward state as a whole. Only three tokens showed an upward trend this week.

Social Media Hotspots

Based on the top five daily growth in LunarCrush and the top five AI scores in Scopechat, the statistics for this week (7.27-8.2) are as follows:

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: lunarcrush and Scopechat

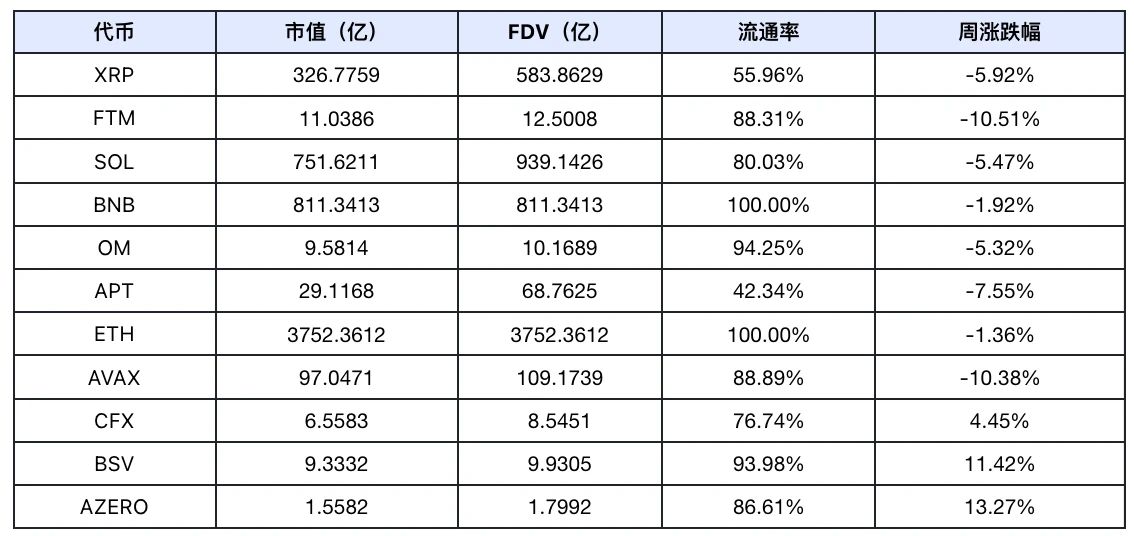

Subject tracking

Data source: SoSo Value

As can be seen from the above table, based on weekly returns, the best performing track is SocialFi and the worst performing is Meme.

The reason why the SocialFi track performs well is that there are fewer projects issuing coins in the SocialFi track, among which TON accounts for the largest proportion, accounting for 93.62% of the entire track in terms of market value. This week, TON did not follow the decline of the market and was in a relatively strong form, rising 2.41% this week. This week, the money-making effect of Crypto is very poor, and users prefer to pay attention to some small projects on SocialFi to achieve the goal of making a small profit with a big investment. In terms of annual return rate, TON is as high as 458.84%, which is the absolute leader in the SocialFi track. However, the rest of the SocialFi projects are on a downward trend.

The overall performance of the Meme track was poor in this weeks market. Among the top 500 Meme projects by market value, only three projects were rising, and all other projects were falling. This was mainly because the market has been on a downward trend this week, and users in the market were in a risk-averse state, trying to reduce their investment in the market and wait and see, resulting in poor liquidity in the market. In addition, every time the market was in a clear downward trend, the Meme track always fell more than other tracks.

Crypto Events Next Week

-

Tuesday (August 6) Asia Blockchain Summit; FTX and the U.S. Commodity Futures Trading Commission (CFTC) settlement hearing; Asia Blockchain Summit

-

Wednesday (August 7) The Democratic Party will determine its presidential candidate by August 7

-

Saturday (August 10) VeeCon 2024

-

Sunday (August 11) FORESIGHT 2024 Hong Kong Summit

Outlook for next week

-

Bitcoin: Mtgox continues to pay out, and there are currently 32,899 coins left on the address. Due to the increased uncertainty of recent macro events and the full pricing of the Feds interest rate cut in September, the already scarce liquidity in the market has begun to flow back from Crypto to US stocks and US bonds, resulting in even less purchasing power in the market. Therefore, BTC is likely to continue to maintain a wide range of fluctuations next week.

-

Ethereum: Ethereums spot ETF has been approved. Market investors continue to sell the news, and Grayscale Funds ETHE continues to sell a large amount. Although the sales volume has decreased compared to the beginning, there are still more than 40,000 sales every day, which makes Ethereum bear a large selling pressure in the short term. In addition, due to the poor market liquidity in the near future, the purchasing power of ETH is not high, and the overall market sentiment is not high, so there has been a large correction.

-

Altcoin: Due to the increasing uncertainty of many events in the market, the price of Ethereum has been greatly affected. In addition, the overall market has performed poorly, and investor sentiment has fallen sharply, making investment in various tokens more cautious. At the same time, there are no new hot tracks or events in the market, so Altcoin may still rely on the overall market trend next week and will not have an independent market trend.

This article is sourced from the internet: Frontier Lab Crypto Market Weekly Report锝淲31

Related: SignalPlus Macro Analysis Special Edition: Round 2

“Quadruple Witching Day” concluded successfully last Friday, with the SPX remaining near all-time highs and Nvidia taking a breather after becoming the world’s most valuable company. As midsummer approaches, the stock market continues to climb the wall of worry, and the markets attention will gradually turn to politics. Thursdays US presidential debate took place early, and after the court ruling, the market odds have been heavily tilted towards former President Trump, but both candidates are likely to continue the unsustainable US fiscal expansion policy. The US Congressional Budget Office (CBO) raised the deficit to more than 7% of GDP in 2024 and expected it to remain above this level for the foreseeable future. The French election will begin on June 29/30, with the second round to be held on July…