Viện nghiên cứu XT: Với lịch sử tương tự, liệu SOL có đang ở thời điểm đột phá quan trọng nữa không?

【Disclaimer】This article is for reference only and does not constitute any investment advice. Investment involves risks, please operate with caution. Readers should independently evaluate the content of this article based on their own circumstances and bear the risks and consequences of investment decisions.

This week, Bitcoin once again hit $70,000. The crypto market is generally recovering, driven by BTC. In this turmoil, Solana is the only one that stands out. This month, Solana and its ecosystem have performed exceptionally strongly, rising from $121 at the beginning of the month to $193, a price increase of nearly 60%. The entire ecosystem TVL is also far ahead of other public chains, and the performance is remarkable… Especially after the huge decline in the past two years, the rise of SOL now makes many people slap their thighs. Who will remember that for more than half a year last year, SOL was struggling at more than $20?

Breakthrough – Solanas Rise to Become a New Crypto Market Leader

Everyone was surprised that Solana could rebound so quickly. Starting this week, BTC rebounded above $70,000 and then pulled back again, ushering in a new round of volatility. SOL and its ecosystem have performed very steadily, rising 30% in the past two weeks. The entire ecosystem remains strong among all public chains, and the activity of the ecosystem has surpassed Ethereum several times. Can we predict that SOL will break through the previous high of $249 in the near future?

Looking back at Solanas rise last year, it rose from $30 to $60 and $120, and then to $200 this year, almost breaking through the previous high. Even when the entire market fell sharply, Solana firmly held the support level of $140. And with Bitcoins latest rebound, Solana took off again, directly breaking through $190 and rushing towards the $200 mark. Ecosystems are flourishing, and various MEME magic disks are emerging… This time, Solana may really flip Ethereum in an all-round way.

We can see that SOL hit an all-time high of $259 in November 2021, which reflected the markets great expectations for its high-performance public chain and Defi applications at the time. As the overall crypto market entered a bear market, Solana also fell sharply. Then in November 2022, the FTX bankruptcy incident broke out, and it fell to a low of $8 that no one dared to copy, which dealt a heavy blow to Solana and its ecosystem.

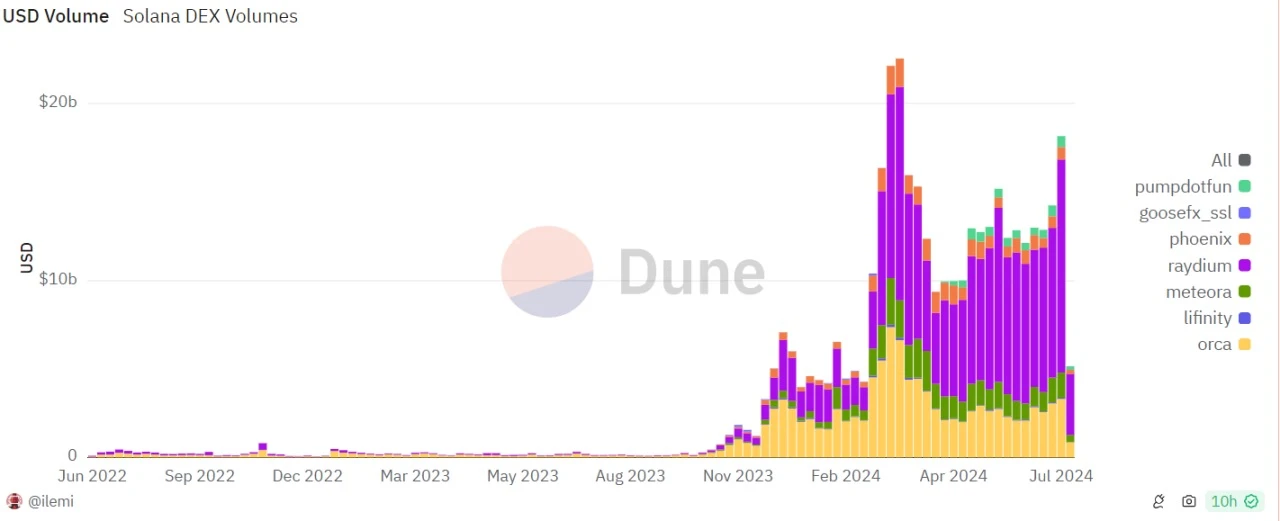

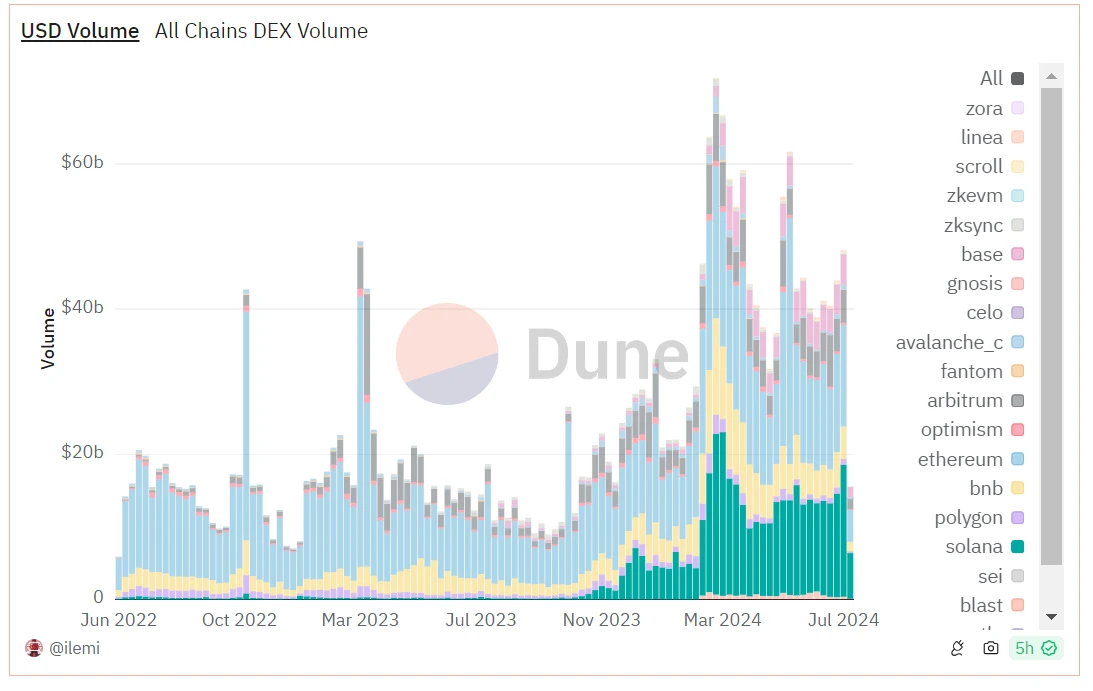

In fact, the high-performance public chain built by Solana during the bull market in 2021 was not ideal in terms of actual adoption. At that time, most of the popular hype projects such as Meme coins were concentrated on Ethereum and BNB chains. In this round, from the initial emergence of Meme in October 2023 to the outbreak of Tugou Shanzhai Meme in March 2024, Solanas high-speed public chain advantage was finally fully utilized. The team shifted the focus of ecological construction to the Meme project. The right time, right place and right people made Solanas crazy Meme season a success, injecting new vitality and growth momentum into Solana. The on-chain DEX activity once again reached a peak on the 19th of this month, with a staggering daily trading volume of 2.5 billion US dollars.

From silence to rise – leading the new trend of encryption with ecological explosion

In the past two years, Solana has experienced ups and downs. From the high-flying progress in 2021 to the tragic decline in 2022, Solana was once in a downturn. But starting in the third quarter of 2023, the Solana ecosystem ushered in its own summer carnival. In just two years, Solanas DeFi infrastructure has become more complete. Combined with the huge surge in HNT, HONEY, and MOBILE, the market has attracted widespread attention and enthusiasm for the Depin track. Immediately afterwards, the Solana ecosystem intensively launched a series of high-profile new projects, such as PYTH, JTO, JUP, etc., and cooperated with the generous national airdrop plan, which enriched the prosperity of the Solana ecosystem one after another. RNDR was also renamed RENDER and moved to the Solana ecosystem. It can be said that Solana has shifted from the initial pursuit of the number of projects to a greater focus on the transaction volume and popularity of the ecosystem. This shift in strategic focus has enabled Solana to stand out in the fierce competition among public chains and reshape its influence.

Recently, the transaction volume of Solana on-chain DEX has surpassed Ethereum again in the past 30 days. The users enthusiasm for trading Meme remains high. The current daily transaction volume of the leading Meme exceeds 50 million US dollars. Starting with BONK and WIF, Solana has set off a Meme craze. In December 2023, Bonk on Solana started a crazy rise, driving the Meme outbreak of the entire Sol ecosystem; in February 2024, Hat Dog also set off a wave of enthusiasm on Sol; in March, BOME started a new round of money concept Meme; and later, Pump.fun platforms silky one-click coin issuance, Golden Dog appeared frequently.

These skyrocketing Meme tokens not only brought a rich wealth effect, but also completely ignited the Solana Meme ecosystem. This is also due to the perfect Meme issuance and trading system that has been formed within the Solana ecosystem. From liquidity sharing platforms Orca and Jupiter to DEX trading platforms Raydium and Metaora, and to fully automatic trading bots, Solana has emerged with a variety of infrastructures dedicated to Meme projects.

More importantly, the founding team has also publicly expressed support for certain Meme projects and is constantly innovating and improving the trading experience. For example, Blinks and Actions, which were newly released this year, have been highly discussed, but they were not released in the midst of a correction cycle in the crypto market. The related concept hotspot Meme STARCAT (after the release of Blinks, Meteora launched the first MEME with a rebate model with a referral link, where the referrer would receive a transaction rebate) was short-lived and did not produce the Meme masterpiece that everyone expected, and ultimately did not drive the expected large-scale application… But it can be said that the innovative spirit of the ecosystem has been practiced in this Meme craze, creating a hotbed for the future Meme legend.

Solana Data

-

Market value changes: The overall market cooled down in the second quarter, and SOL experienced dramatic price fluctuations. In early April, the market value once surged to $90.2 billion, setting a record high. In May, it fell back 37% to $56.7 billion, and then stabilized around $60 billion. Last week, it rebounded to above $85 billion, showing strong recovery ability and being relatively resistant to declines among public chains.

-

TVL: Deflama data shows that Solanas TVL is US$5.4 billion, second only to Ethereum and Tron. Compared with the peak of US$10 billion in November 21, there is still nearly double the room for growth. However, it can be seen that TVL has been rising steadily this year, and there is a promising future.

-

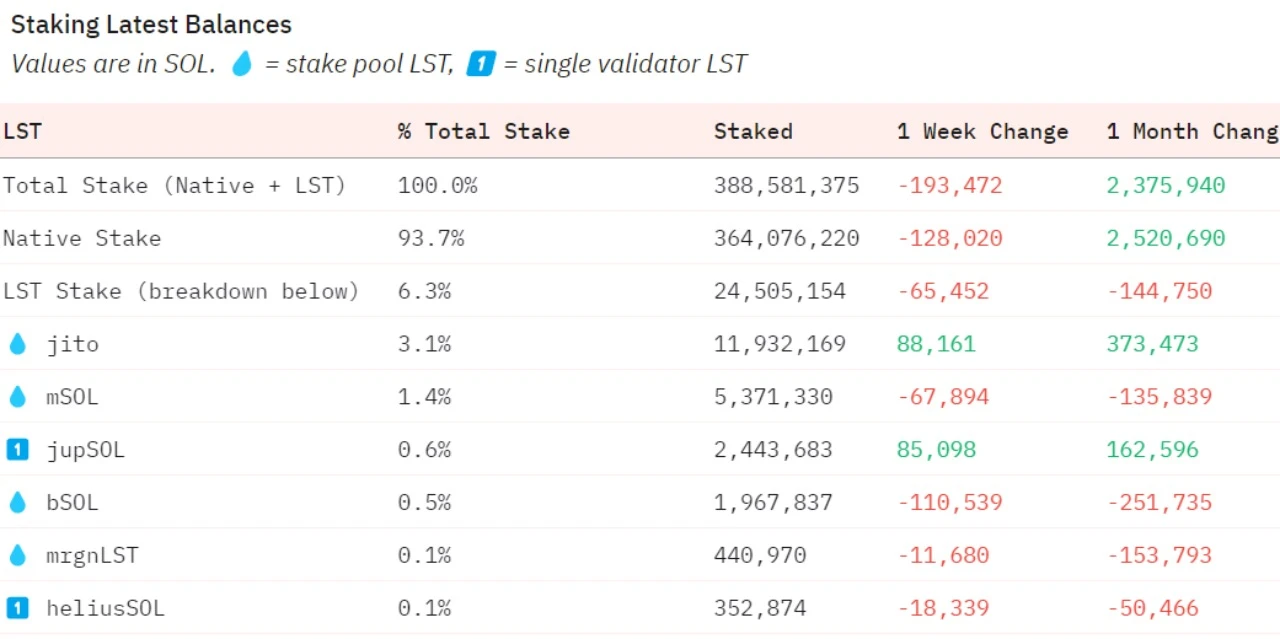

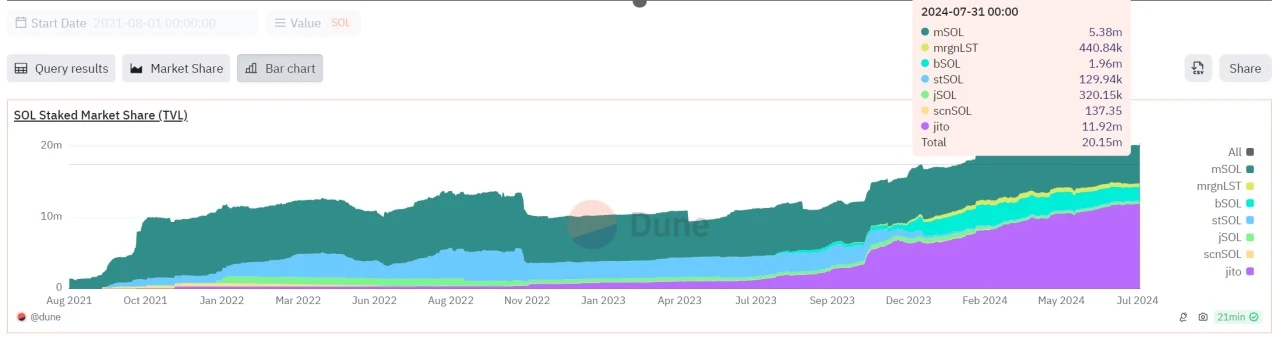

SOL staking amount: As of July 30, the total staking amount is 388 million SOL, a monthly increase of 0.6%, of which the amount locked by the LST protocol accounts for only 6.3%, or about 20 million.

SOL staked in liquidity protocols has been rising steadily since October last year, indicating that investors are optimistic about the value of SOL in the long term, with 59% locked in the Jito protocol.

-

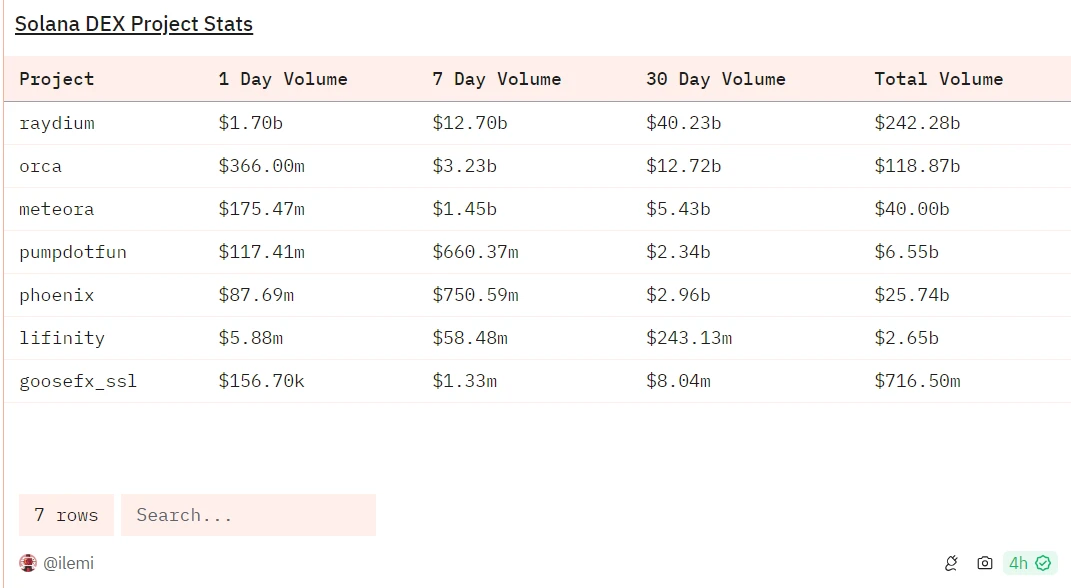

DEX transaction volume : Sol ecosystem’s DEX transaction volume has surpassed Ethereum several times, with a total transaction volume of 426.8 billion. In July, the recent 24-hour transaction volume and 7-day transaction volume were comparable to Ethereum. Among them, transactions in Raydium were the most active, with a market share of more than 60%.

-

Network activity also remained at a high level . The number of weekly DEX traders exceeded 3 million in July, far ahead of other public chains.

-

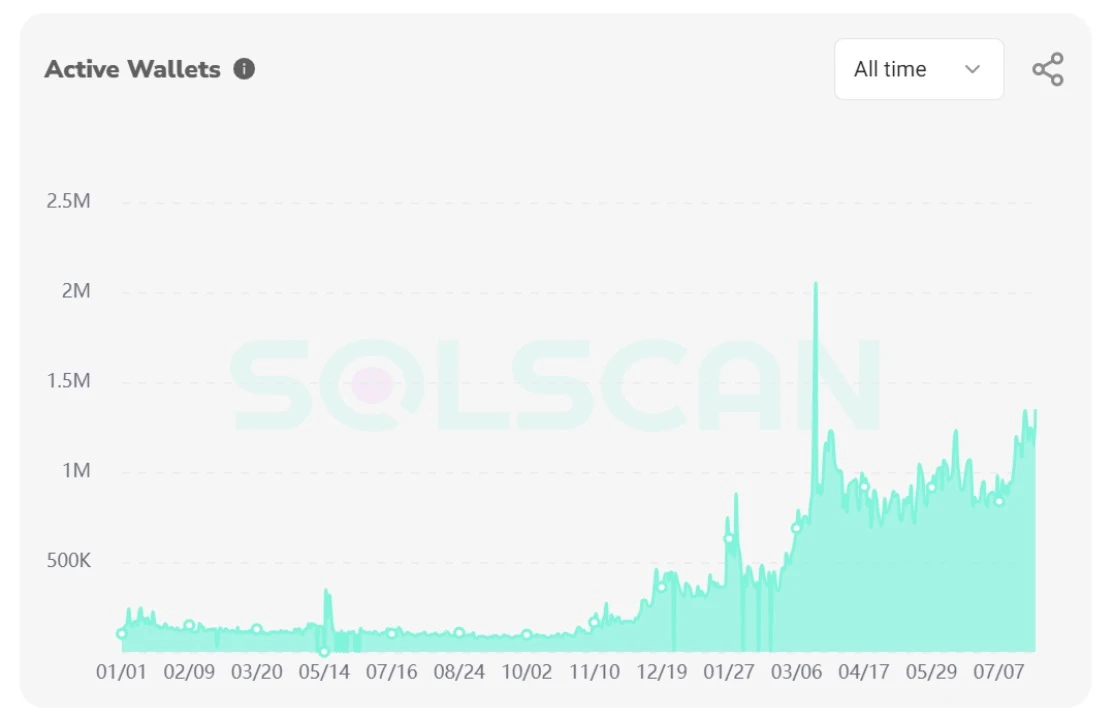

Active wallets : Since March this year, the number of active wallets on the Sol network has remained at a high level and has not been affected by the market correction in the previous two months. The number of daily active wallets in late July was over 1 million.

-

NFT : NFT transactions have been significantly more active on the Sol chain this year.

The SOL team has also been making many attempts to promote ecological prosperity:

In early July, SEND directly posted on X to showcase 100+ use cases of Blinks, which was officially supported by the founder of SOL. Then, 100,000 Send It series NFTs were launched, and combined with the function of Blinks, the Collect button can be directly clicked on the X page to mint, and SENDs 100,000 NFTs were sold out.

In addition, the ecological leader NFT Mad Lads’ floor price has recently rebounded to 60 sol. The increase in its own value and the support of many airdrops make it worthy of long-term investment.

Golden Dog MEME of the Month

XT Exchange focuses on discovering the first-level golden dogs on the chain. Driven by research, it screens out the risks of on-chain contracts for users and launches the latest hot Meme coins at the first-hand speed. Buy value coins – go to XT.com.

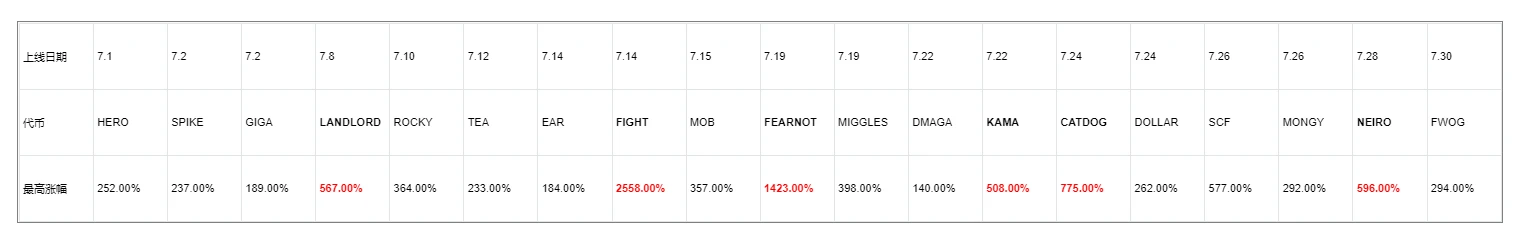

The following is the increase in the price of Memecoin after XT was listed on Sol in July :

Many of them have increased 5 times after going online, such as LANDLORD and KAMA. CATDOG has been rising steadily since its launch on July 24, with the highest increase reaching 7.75 times. The most outstanding performance is FIGHT, which has increased nearly 26 times; and FEARNOT, which has increased up to 14 times. The investment research team discovered and launched tokens such as NEIRO and FWOG at the first time.

To master Alpha, you can use these tools

Earlier this month, Sol Chains BONK led to a surge in Dogecoin-themed Meme tokens. Similarly, the market value of BILLY, a dog-themed token, has reached $100 million. Animal-themed Memes are always the winners among the on-chain Memes, and many old projects are showing signs of recovery. Currently, the trading volume of these Meme tokens has fallen back to the level at the end of last year, but the trading volume of DEX remains high, indicating that the main trading opportunities are still in the primary market on the chain.

There is an obvious hype problem with Meme tokens, which is the time difference between the issuance of the same-name tokens on the Solana chain and the Ethereum chain. The low threshold for issuing tokens on the Sol chain gives it a first-mover advantage. Usually, Meme tokens with the same hot IP will appear on the Sol chain first, and then funds will slowly buy the same-name tokens on Ethereum. Of course, the situation may be the opposite, such as PEW. In general, for buyers, the earlier they enter the market, the easier it is to make a profit. Compared with the Solana chain, where funds enter and exit quickly, the Meme tokens on Ethereum perform more steadily.

Practical suggestions: these 7 steps should help you avoid some scythes:

-

Seize some real-time opportunities. There will definitely be a golden dog with the same name in hot news. The time may be short, but you can make money if you seize the time difference. For example, when Trump wanted to pardon Assange, many related concept memes such as FREE came out; the meme with the same name on the day when Kabosu, the prototype of Doge, died brought wealth opportunities; and NEIRO at the end of July, which is the cute Shiba Inu newly raised by Kabosus owner, caused an explosive trading heat at the end of July, and the total 24-hour trading volume on the two chains exceeded 550 million US dollars. We need to observe the leading tokens running on the Sol chain, and then rush in when the market value on the Ethereum chain is very small. Dont forget to do a good job of risk management and carefully identify other risks.

-

Pay attention to the new plates that are about to be filled on pump.fun , and look at its three-piece set (official website/Twitter/social media): if the official website is well-made, you can keep a close eye on it; you can also observe whether Dev has launched other plates, whether he has a history of running away; whether Twitter has a blue/gold label; whether there are any famous kols shouting orders, etc.

-

Telegram robots can monitor some information, such as new market full-time reminders, celebrity Kol attention, on-chain smart wallet monitoring, etc.

-

Check whether Dev has shipped, chip distribution, smart wallets, insider trading information, etc. on GMGN.AI.

-

Sử dụng Rugcheck to check contract risks and pool lock status. After entering the contract address, check whether the pool is locked or burned, and whether the administrators rights are abandoned. Security checks always come first.

-

Check the hot list on Dexscreener/Dextool/Ave.ai to observe the changes in token prices, overall market value, pools, and number of holders.

-

Surf Twitter intensively, follow the active Tugou community information , and follow influential KOLs to see what they are shouting. But be aware that when a large area is shouted, it is likely that the dealer is selling. Listen to all directions, collect comprehensive information, and pay attention to the cold-opened golden dogs of some powerful projects. Partners who are interested in Memecoin are also welcome to join our Tugou special community to find the golden dogs on the chain as soon as possible: https://t.me/memetothemars

Triển vọng tương lai

The news that the SEC will no longer pursue the definition of SOL as a security has increased our expectations for the smooth listing of the Solana ETF, and also made us more optimistic about Solanas long-term growth potential in the future. At present, the market value of SOL is now about 85 billion US dollars, accounting for 3.52% of the entire crypto market. Assuming that SOL continues to build and its market value reaches half of Ethereums current 16.6% market share, the price of SOL can double. Of course, this is a rather outrageous algorithm. Optimistically, assuming that the price of BTC can double to $150,000 in this bull market, Solana, as the top five public chains in terms of market value, is also very worthy of optimism. We all know that Defi is not the main theme of this bull market, but it is still crucial to the ecological prosperity and infrastructure construction of all public chains. Perhaps in addition to price increases, we can also look forward to Solanas new technological breakthroughs in the future.

This article is sourced from the internet: XT Research Institute: With similar history, is SOL at the critical point of breakthrough again?

Related: Market liquidity is still dry, when will the upward tide come?

Original post by @DistilledCrypto Original translation: Tech Flow When will liquidity flow into the market? More money coming in generally means higher cryptocurrency prices thanks to liquidity. However, the current market remains dry, with no sign of the 2021 “uptick”. I consulted the insights of macro expert CG ( @pakpakchicken ) for some clues. Affected by policies @pakpakchicken spends hours every day tracking policy changes, Policies drive liquidity, liquidity drives assets, assets drive GDP… etc. His conclusion : The biggest risk is on the upside. @CryptoHayes and @RaoulGM agree. An overlooked insight @pakpakchicken points out that there is little discussion about the prospect of a weaker USD. He predicted a coordinated move to devalue the dollar in the future, a move that could increase liquidity. As background for the story,…