Bắt đầu mua lại cổ tức và nâng cấp các mô-đun bảo mật: Giải thích sâu sắc về mô hình kinh tế mới của Aaves

Original article by Alex Xu, Research Partner at Mint Ventures

Aave is one of the projects that I have been following for a long time. Yesterday, its governance team ACI released a draft of Aaves new economic model in the community forum, announcing expected upgrades in many aspects such as the value capture of Aave tokens and the security model of the protocol.

Regarding Aave, the author has a relatively complete analysis of its current situation, competitiveness and valuation in a recent article: Altcoins keep falling, its time to pay attention to Defi again

This article focuses on this latest proposal with great influence and mainly answers the following four questions:

1. What are the main contents of the proposal?

2. Potential impact of each major content

3. Timetable and triggering conditions for the implementation of the proposal

4. How this proposal might affect the price of Aave tokens in the medium to long term

Original proposal: https://governance.aave.com/t/temp-check-aavenomics-update/18379

1. The core content of the AAVEnomics proposal

The full name of this proposal is [TEMP CHECK] AAVEnomics update. It is in the early stage of community proposals, namely the temperature check stage. It was released 15 hours ago. The initiator of the proposal is ACI. ACI can be understood as the governance representative of the Aave official team. ACI is also the mastermind and main coordinator of community governance. Its important proposals are generally communicated with other governance representatives and professional service providers before release, so the probability of passing is very high.

[TEMP CHECK] The main contents of the AAVEnomics update are as follows:

1. Introduced Aave鈥檚 current good operating status and abundant financial reserves

The project continues to be a leader in the lending sector, with revenue levels far exceeding project expenses, and reserve funds mostly in ETH and stablecoins, so there is an opportunity to update the economic model and start protocol income distribution.

2. Update of bad debt handling mechanism: the original security module gradually exits the stage, and the new security system Umbrella is launched

-

Aave currently provides a reserve for possible protocol bad debts. This mechanism is called a safety module. This reserve currently consists of three parts:

-

Staked Aave, now worth $275 million

-

The staked Aave native stablecoin GHO is now worth $60 million

-

The staked Aave-ETH LP is also one of the main sources of liquidity on the Aave chain, currently worth $124 million

-

The newly launched Umbrella safety system will replace the original safety module. Specifically:

-

The bad debt reserve of the system will be managed by the new aToken module. The funds of this module come from users who voluntarily deposit money. After depositing money, users will not only receive the original deposit interest income, but also receive additional security subsidies, which come from Aaves protocol income.

3. Aave token鈥檚 new role and the start of protocol profit distribution

-

The Aave staking module still exists, but the staked Aave no longer serves as a risk reserve, but has two functions:

-

You can obtain the profit surplus distribution of the protocol in addition to the funds required for operation. The way is that Aaves financial team will regularly repurchase Aave in the secondary market through community governance proposals and distribute it to pledgers

-

Staking Aave can get Anti-GHO, which can be used to offset your GHO stablecoin debt, or directly deposited into the GHO staking module, so Aave can also obtain the profits generated by GHO

4. Changes to the GHO staking module

The original GHO pledge module needs to guarantee the bad debts of the entire Aave protocol system, but after the change, it only guarantees the bad debts of the GHO part.

5. Others

-

The liquidity of Aave tokens no longer relies on the Aave-ETH incentive in the staking module, but is handed over to the ALC (Aave Liquidity Committee)

-

The exchange of the protocols first-generation token Lend to Aave will be terminated, and the tokens not exchanged on time will be transferred to the treasury

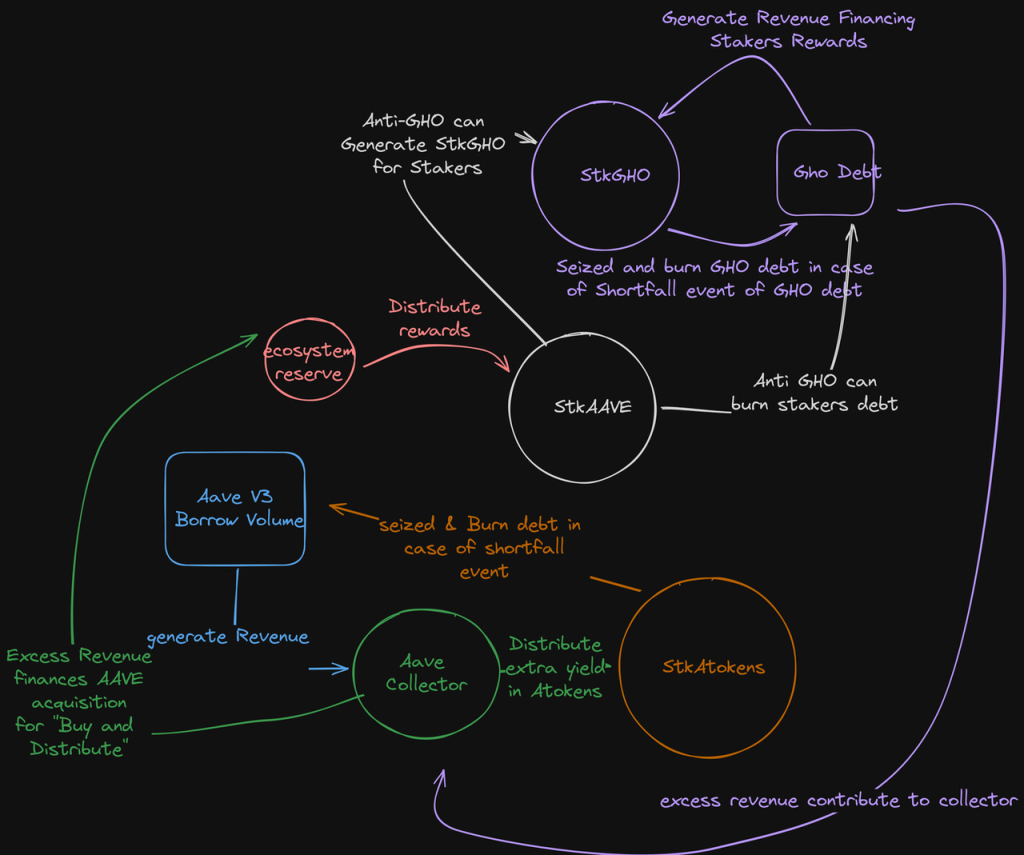

Aave鈥檚 new economic model relationship diagram can be seen:

II. Impact of the proposal

There are two main impacts:

-

Aave tokens have a relatively clear value capture, and the selling pressure is further reduced, which is further linked to the good development of the protocol

-

Value capture comes from: Repurchase of the interest rate spread of the agreement + GHO interest income feedback

-

The reduction in selling pressure comes from: the deactivation of the staking module also means that Aave will use the stablecoins and ETH from the protocol income as expenditure tokens to replace the output of Aave tokens, which will directly reduce the selling pressure of Aave and make Aave more scarce

-

The introduction of the Umbrella Security Module makes the structure of the protocol more flexible, further optimizes the protocol incentives, further increases the upper limit of the protocols security governance, and also puts forward higher governance requirements.

-

The original Aave security module is entirely motivated by Aave emissions and has little flexibility. The Umbrella Security Module is similar to Eigenlayers AVS model. It is a modular module that can be customized by asset class, time, and capacity.

-

This also means that in addition to risk indicators such as asset size, interest rate curve, and LTV, Aave鈥檚 risk team has one more indicator that needs to be evaluated and formulated:

III. Timetable and prerequisites for implementation of the plan

ACI stated that the implementation of the plan will be carried out in a step-by-step manner, divided into three stages (three governance proposals) based on different prerequisites to implement the above content.

Phase 1: Staking mechanism and GHO mechanism changes

-

GHO pledge is only responsible for the bad debt guarantee of GHO debt

-

Aave and Aave-ETH staking modules have been changed to legacy security modules and will continue to function as collateral until they are replaced. The cooldown period for Aave staking has been set to 0.

Prerequisites: Already met

Implementation time: After this proposal has received sufficient community input and Aave鈥檚 main community developer BGD Labs has approved the Umbrella upgrade

Phase 2: Aave token function update, new economic model gradually launched

-

End the function of staking Aave to get GHO interest discount

-

Anti-GHO function is launched, staking Aave can get Anti-GHO

-

Close Lend to Aave

Prerequisites:

-

GHO scale reaches 175 million (currently around 100 million)

-

The secondary liquidity of GHO can reach a transaction size of 10 million has an impact on the price of less than 1%. Currently, the transaction size that affects the price of GHO by 1% is about 2.1 million.

Phase 3: Aave fee switch activated, buyback enabled

-

Disable the traditional security module

-

Activate the aToken model of the Umbrella Security Module, where users can provide collateral for the system with their own deposits and receive additional rewards

-

Aave Financial Services Provider starts Aave repurchase through governance and distributes it to Aave stakers, and gradually achieves automation

Prerequisites:

-

The average NAV of the Aave income pool over the past 30 days is enough to cover the expenses of existing service providers for 2 years

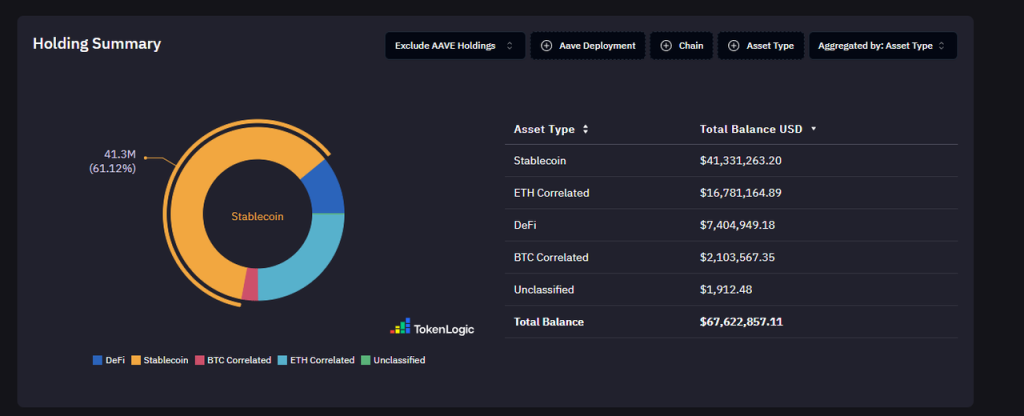

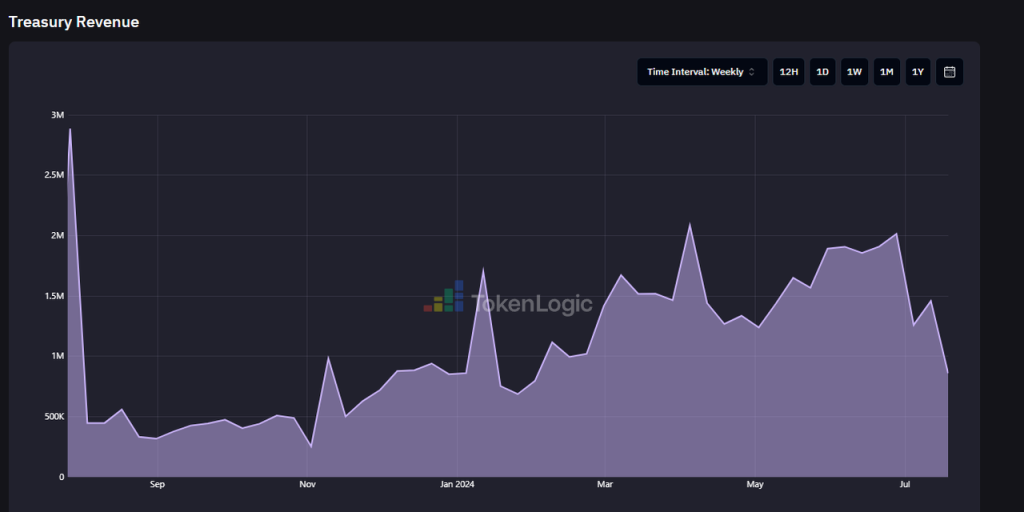

*Currently, the total assets in Aaves treasury excluding Aave tokens are approximately US$67 million (61% stablecoins, 25% Ethereum, and 3% BTC), and Aaves annual expenditure in 24 years is approximately US$35 million (data given by the head of ACI). If the expenditure level in 25 years is similar, the expenditure for two years will be US$70 million. Considering that Aaves weekly revenue has been basically US$1-2 million since the beginning of this year, the two are already quite close, and this level can be reached in about a month.

Aave鈥檚 treasury composition, source: https://aave.tokenlogic.xyz/treasury

Aave鈥檚 protocol revenue, source: https://aave.tokenlogic.xyz/revenue

-

Aave Protocol鈥檚 annualized revenue over the past 90 days is 150% of all protocol spending YTD (sic), including AAVE鈥檚 buyback budget and spending on the Umbrella Security Module

*Budgets are defined, allocated, and adjusted quarterly by Aave Finance service providers.

In general, Phase 1 has met the launch conditions, Phase 2 is expected to take several months (depending on the liquidity budget and investment of the liquidity committee for GHO), and the launch time of Phase 3 is less predictable, affected by factors such as specific budget plans, market environment and revenue. However, considering Aaves current strong revenue level, it is not difficult to meet the standards.

IV. How will this proposal affect the price of Aave tokens in the medium and long term?

In the long run, this proposal clearly links the development of the Aave protocol with the Aave token for the first time. The lower limit of the Aave token has a buyback backstop, and holders have cash flow income, which is beneficial to the price of Aave.

However, considering that the implementation of this proposal will take time and will be carried out in batches, and that the proposal was just published less than a day ago and the specific terms still need to be discussed and revised, the value capture of Aave tokens is a gradual and long-term process.

However, if the proposal is successfully implemented, Aave, as one of the largest Defi projects at present, may further gain the favor of investors with a preference for value investing due to its standardized and transparent governance and rewards for token supporters. These investors may not only come from the cryptocurrency circle, but also include Web3 newcomers from the traditional financial field.

This article is sourced from the internet: Start repurchase dividends and upgrade security modules: In-depth interpretation of Aaves new economic model

In the cryptocurrency market, data has always been an important tool for people to make trading decisions. How can we clear the fog of data and discover effective data to optimize trading decisions? This is a topic that the market continues to pay attention to. This time, OKX specially planned the Insight Data column, and jointly with Coingecko, CoinGlass, AICoin and other mainstream data platforms, starting from common user needs, hoping to dig out a more systematic data methodology for market reference and learning. The following is the fourth issue, jointly presented by the OKX Web3 team and the Coingecko team on the theme of Quickly Getting Started with the On-Chain World. It covers the basics of getting started, filtering out noise, screening for high-quality opportunities, etc. We hope it…