Khám phá thêm các mã tài sản trong thị trường dự đoán từ Polymarket ngoài vòng tròn

The popularity of the prediction market reflects, to a certain extent, the truest emotions of traders and the possibility of converting expected events into trading behaviors.

Vitalik Buterin has long been optimistic about the potential of prediction markets in expanding the daily application of cryptocurrencies, and has mentioned it publicly many times. Polymarket, which he invested in, has also become popular this year because of the topic of elections. Election betting can be said to have a long history. As early as the Middle Ages, people began to bet on the election of the Pope. To this day, the battle between Trump and the Democratic candidates has also attracted a lot of public attention. However, since the United States has expressly banned betting on political events, such activities have focused on crypto markets like Polymarket. Its real-time results reflect the real thoughts of users, and public sentiment is often used as an important factor in our trading reference. The prediction track is entering the public eye in a unique way.

What is a prediction market?

Take Polymarket as an example. This platform is essentially a binary options market. Traders can choose yes or no on a certain topic and invest the corresponding amount. If the prediction is correct, they can get a fixed income; if the prediction is wrong, they will lose the investment. Currently, Polymarket has completed three rounds of financing totaling US$74 million from individuals and institutions such as Vitalik, Polychain, and Dragonfly.

It is also a platform for traders to bet against each other. If someone makes a profit, it must be at the expense of other traders. The platform itself makes a profit by charging handling fees.

Predicting market status

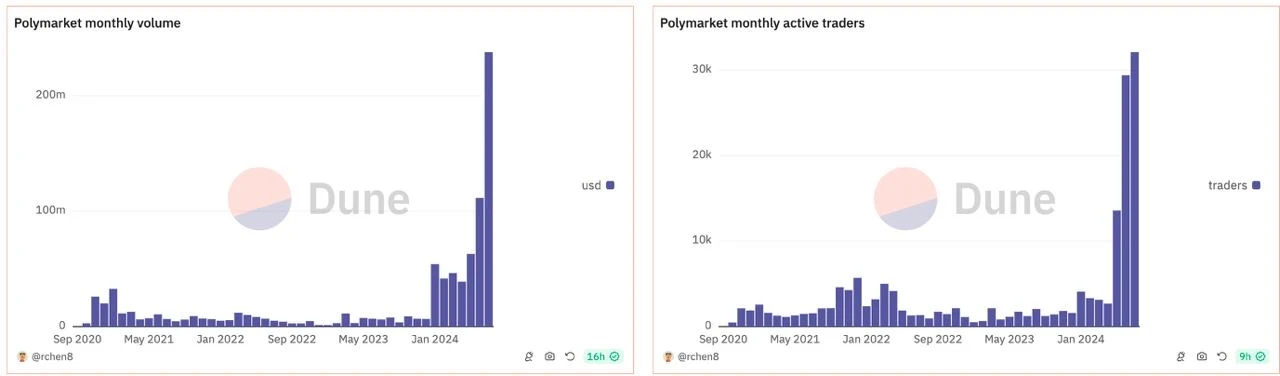

As can be seen from the chart, the number of visits and unique visitors to the Polymarket website has undergone significant changes in the past year. In particular, after completing a new round of US$35 million in financing in May this year, monthly active users, trading volume, and open interest have all hit record highs. In May and June, both the number of visits and the number of unique visitors increased significantly, reaching 733,689 and 220,956 respectively. This growth trend coincides with the approaching US election, indicating a surge in user interest in the political prediction market.

Data source: SimilarWeb

Since 2024, Polymarkets TVL has also risen rapidly, from about $10 million at the beginning of the year to the current $67 million, an increase of +570%. At the same time, the daily trading volume exceeded $27 million on July 1, and the number of daily trading users reached nearly 7,000… These rapidly rising data show that the prediction market platform is releasing a strong attraction to the entire crypto market.

Nguồn: DefiLlama

Nguồn: Dune

How to participate in Polymarket?

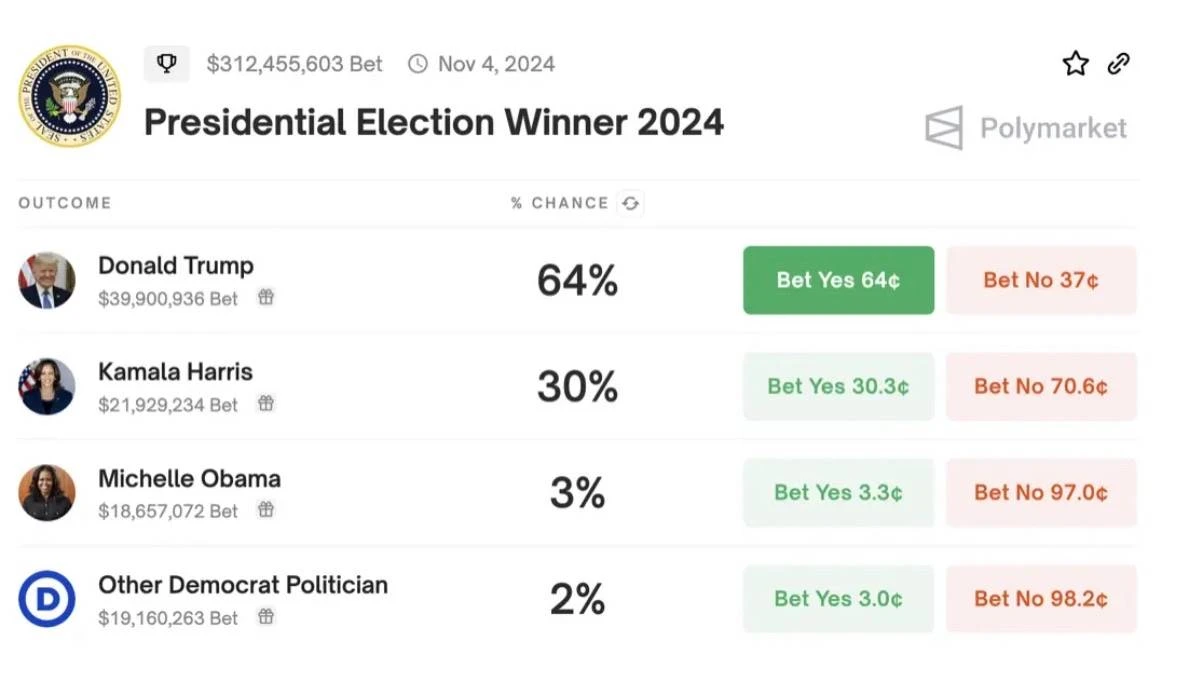

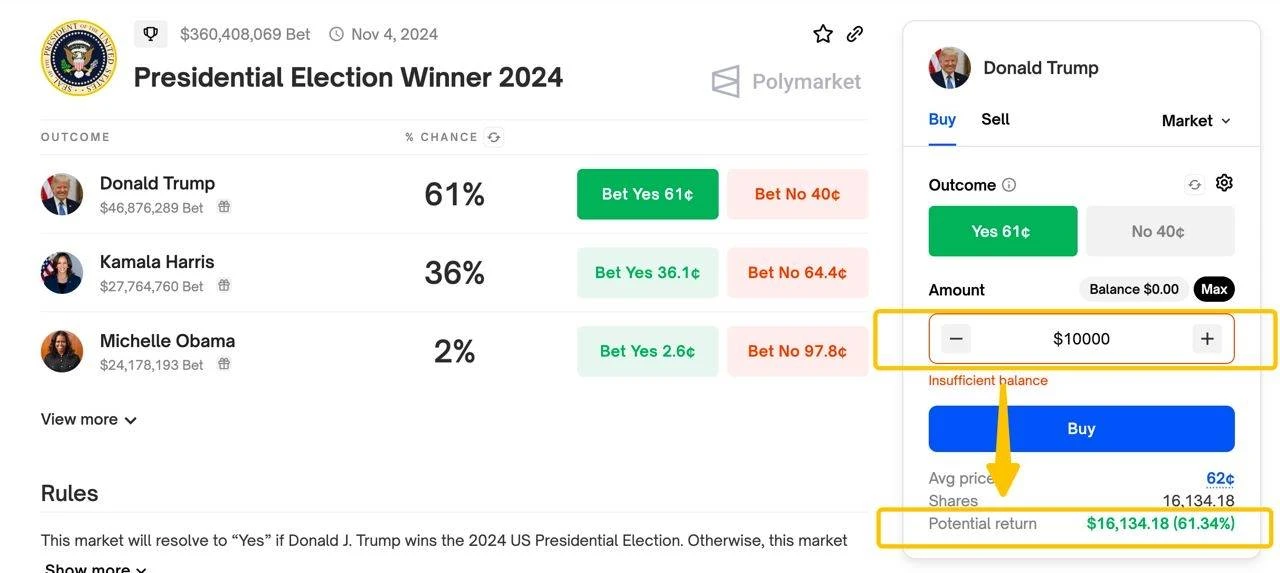

Entering the official website polymarket.com, users can choose to trade and provide liquidity. The most popular prediction topic on the homepage is Winner of the 2024 Presidential Election. The starting transaction price for each result is $0.5, and the price will change according to the amount of money users bet on the winning and losing sides, representing the probability of the current event. $0.5 means that Trump has a 50% chance of being elected president, and this predicted probability has now risen to 61%. At the same time, the total investment in this topic has exceeded $350 million.

As shown in the figure, users only need to enter their investment amount to know how much money they can win if they guess correctly, without having to understand the complex logic behind the product. The front-end design is simple and easy to use, very user-friendly. At the same time, due to the depth of topic funds, when the investment amount is too large, the rate of return that can be won will change significantly, for example:

1. If you bet $1,000 on Trump to win, you will get $1,615 (+61.51%) if he wins.

2. If you bet $10,000 on Trump to win, you will get back $16,131 (+61.34%) if he wins, which is not much change;

3. When you put $1,000,000 on Trump to win, you would only get back $1,369,041 (+36.90%) if he is elected, which drops your rate of return from 61% to about 37%.

Although the prediction market seems interesting and can bring considerable returns, due to various reasons, such as failed bets, high friction costs, low liquidity, etc., traders will lose money in the long run on this platform because their average return is negative. Even if individual traders can make considerable profits in the short term, it is still unknown whether they can continue to make correct predictions and achieve profits. After all, no one can be 100% sure that every bet they make is correct. Investors still face higher risks in such markets and need to be cautious.

In addition, Polymarke also has a liquidity reward program. By placing limit orders to provide market liquidity, the closer the order price is to the average market price, the more you earn. The reward amount also depends on the order amount. The larger the order amount, the more rewards you get.

Other prediction market projects

Polymarket is not the first prediction market project. As early as 2015, Augur was established and completed a $5.3 million financing. It is an open global prediction market protocol that allows anyone to create a market for anything. Gnosiss earlier 1.0 version also started as a prediction market. It has now become a dapp incubator and has its own series of infrastructure covering wallets and mainnet.

Source: CoinGecko

In general, the prediction market is still in its early stages, with relatively few projects and a total market value of around $700 million. According to the CoinGecko prediction market category, only Augur (REP), finance.vote (FVT), Prosper (PROS), Handy (HANDY), Polkamarkets (POLK), and Zeitgeist (ZTG) and Hilo (HILO) that have not yet been launched on CEX have released their own tokens. Their market value rankings on CoinGecko are all outside the top 1,000.

List of ecological projects

1. Polygon Ecosystem

• Polymarket: The ace prediction market, which will be launched on the mainnet in 2020. Users can trade on some political and real-time controversial topics, and they can get rewards if they bet correctly.

• Augur: A long-established prediction market that can also be traded on the Eth chain

• UBet: mainly used for sports prediction

• YOLOrekt: Predicting cryptocurrency prices

• Guesslot

• Reality Cards: A prediction platform in the form of NFT

2. BNB Ecosystem

• Prosper: Cross-chain prediction market and hedging platform

• finance.vote: Cryptocurrency price prediction platform, Eth chain can also be traded

• AlphaOrBeta: Web3 prediction and polling network, where users predict through voting, winners win ETH rewards, and losers get native tokens. Developed by OpinionLabs, it quickly accumulated 100,000 users within 2 months of its launch on the BNB ecosystem, and once became the most popular social project in the Mantle ecosystem, and Arbs ranked fourth, and was selected as the most valuable builder of Binance Labs.

3. Polkadot Ecosystem

• Zeitgeist: An active prediction market on Polkadot, which completed a $1.5 million seed round and $14 million in financing at the end of 22.

4. Solana Ecosystem

• Hedgehog: An old prediction market, but there has been no activity for a long time after the financing was completed in 21 years.

• JogoJogo: A 24-year new project, Solana’s AI-native prediction market where everyone can bet any amount on any topic and get rewards.

• mash.trade: A new project in 2014, with optional leverage trading, few followers, and the product is not yet perfect.

5. Sei Ecosystem

• PredX

• Kargo

6. Ton Ecosystem

• Wagmi 11: Mainly used for sports predictions

7. Other L2

• BetBase: Predictions and betting platform on Base

• Expectium: Information prediction market on Starknet

CEX’s attempt at prediction market

Many centralized exchanges have also launched similar prediction activities:

• Binance launched Binance Futures NEXT: Each person can invest up to 100 USDT to vote, and get 120 U for the correct choice, and a full refund for the wrong choice. This gameplay is equivalent to the exchange allowing users to participate in activities to get benefits, and there will be no loss.

• LBank launched a SBF pardon-related contract activity in November 2023, which can be opened with 10x leverage. If SBF is successfully pardoned, those who buy and open longs will make a profit, otherwise they will lose money. This activity has caused a lot of controversy.

• XT Exchange launched the “European Cup Championship· Battle for the Top of XT” at the start of this year’s European Cup, predicting the champions to share a huge prize. This event attracted the attention of more than 5 million users worldwide.

Future development expectations

From the data, the number of active users and newly registered users of Polymarket are growing rapidly. In the more than 20 days from July to now, the number of monthly active trading users of Polymarket has exceeded 32,000, and the number of newly registered users has exceeded 42,000. There are still many newly registered users waiting and watching, and they may become active users of the platform at any time. The explosion of the prediction market reflects the truest emotions of traders and the possibility of converting expected events into trading behaviors to a certain extent. This real-time reflection of public emotions provides us with a valuable source of data for analyzing and grasping market trends.

In the United States, such prediction-based trading platforms are subject to strict regulation. According to a 2012 ruling, regulated markets are not allowed to offer political event contracts. This leaves a huge market gap and development opportunities for emerging non-regulatory prediction markets, such as crypto platforms like Polymarket. It can be said that although the strict regulatory environment has caused some legal risks in this field, it is precisely because of this regulatory loophole that it provides innovative companies with the possibility of entry and expansion. For traders, this is both an opportunity and a danger.

【Disclaimer】This article is for reference only and does not constitute any investment advice. Investment involves risks, please operate with caution. Readers should independently evaluate the content of this article based on their own circumstances and bear the risks and consequences of investment decisions.

This article is sourced from the internet: Discover more wealth codes in the prediction market from Polymarket’s out-of-circle