Báo cáo hàng tuần về thị trường tiền điện tử của Frontier Lab|W29

BTC and ETH this week overview

Market performance

The Crypto market is in a rebound trend this week, with an obvious sector rotation effect.

Key Events

Mtgox compensation incident

-

Overview: Mtgox bankruptcy compensation has begun, and more than 50,000 BTC have been paid out so far, with 90,344 BTC remaining on its address.

-

Analysis: With the start of the compensation plan, the BTC price has not fluctuated significantly and has continued to rise over the past week, so investors’ negative expectations for Mtgox have been “priced in” and the impact of the Mtgox compensation incident on the market is gradually decreasing.

Trump assassination

-

Overview: On July 14, 2024, Trump was attacked by a gunman while giving a speech.

-

Analysis: Trump has a friendly attitude towards the cryptocurrency industry, and the monetary policy section of his campaign manifesto clearly states that he wants to lower the US dollar exchange rate, promote the depreciation of the US dollar, and thus promote exports. Therefore, the market believes that after he takes office, the Federal Reserve will start flooding the market with money, increasing market liquidity, and industry investors are very supportive of his campaign success. After the assassination, the probability of his campaign success has greatly increased, which has led to a rise in the market.

ETH spot ETF approval is expected to be approved next week

-

Overview: The market has adjusted the expected approval date for the ETH spot ETF to July 23.

-

Analysis: The ETH/BTC exchange rate has risen this week, and investors in the market are betting that the ETH spot ETF will be approved next week. After it is approved, it is very likely that Grayscale will continue to stage the phenomenon of continuous outflow after the approval of the BTC spot ETF, which will have an impact on the ETH price. This is also the focus of attention next week.

Fed expected to cut rates in September

-

Overview: The market has fully priced in the first rate cut from the Federal Reserve in September.

-

Analysis: This week, Federal Reserve Chairman Powell, Board member Waller, voting members Williams and Goolsbee have successively made remarks suggesting that the Fed is about to cut interest rates. As a result, market traders have raised the probability of the Fed cutting interest rates in September to 100%, and predict that the Fed will cut interest rates at least twice this year, boosting risk assets.

US stocks start rotation

-

Overview: The seven major technology stocks have experienced different degrees of correction, but the three major indexes have risen overall, and small-cap stocks have begun to take over the baton of market growth.

-

Analysis: The rise of US stocks has seen sector rotation, and the market is no longer dominated by high-tech blue-chip stocks, so the current bull market of US stocks is likely to have entered the second half.

Altcoin Overview of the Week

Overall performance

Market sentiment continued to be optimistic this week, with a significant increase compared to last weeks 20%. Negative factors gradually disappeared, and with the Federal Reserves upcoming interest rate cut and various factors related to the US election, investors gradually regained their confidence in the market.

Although the Altcoin Sentiment Index has rebounded significantly, the Altcoin price is still some distance away from the level before the German governments sell-off. When the Altcoin sentiment reaches 90%, it is easy to trigger a price correction, so we should remain cautious in the next few weeks and not blindly chase high prices.

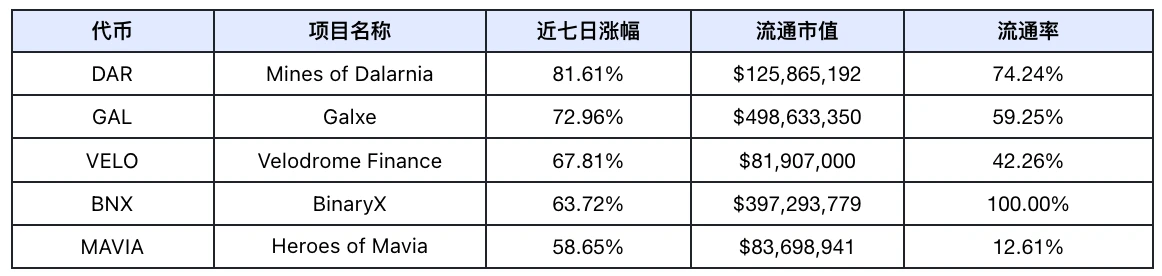

Overview of the Rising Stars

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: coinmarketcap

The list of rising tokens does not show the characteristics of sector concentration. The rising tokens are scattered across various sectors, and the increases are all higher than last week. It can be seen that Altcoin has a high bullish sentiment this week.

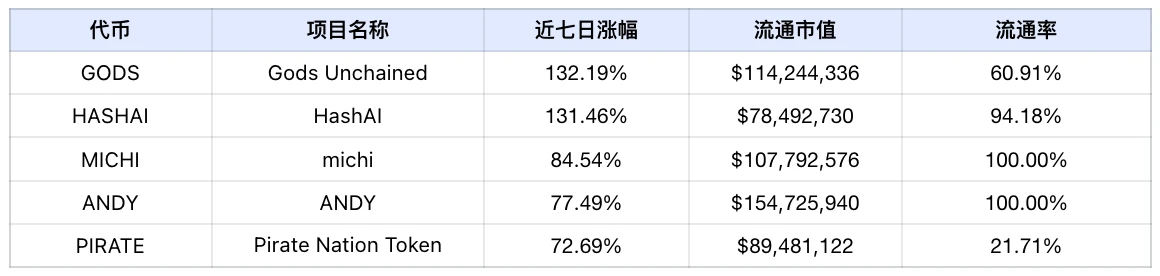

Meme Token Gainer List

Data source: coinmarketcap.com

The overall market showed an upward trend this week, and the Meme track has regained the markets attention and performed outstandingly. This weeks increase showed a significant increase compared to last week.

Social Media Hotspots

Based on the top five daily growth in LunarCrush and the top five AI scores in Scopechat, the statistics for this week (7.13-7.19) are as follows:

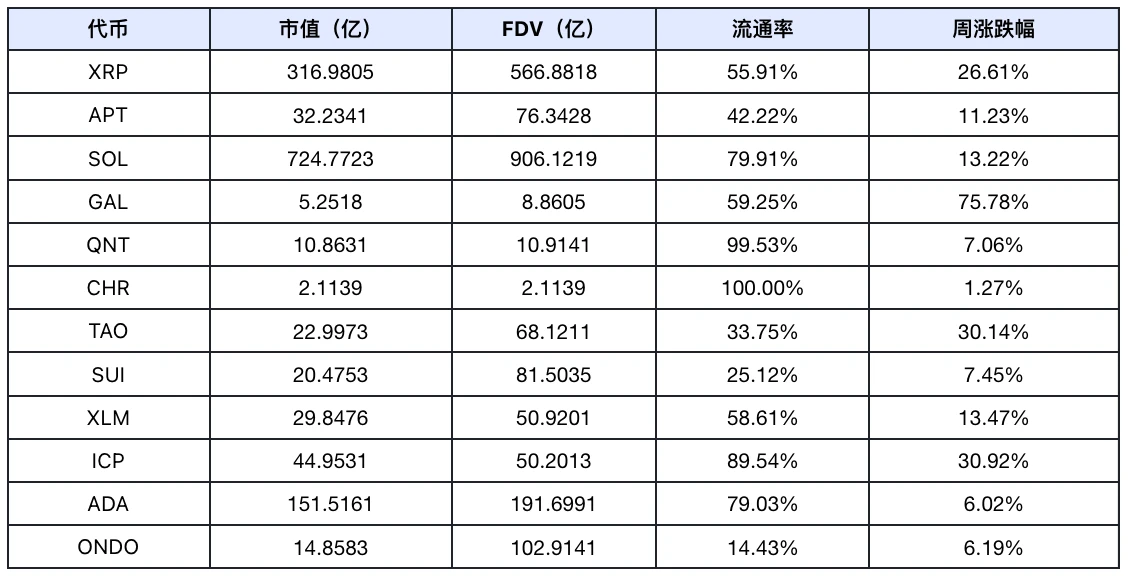

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: lunarcrush and Scopechat

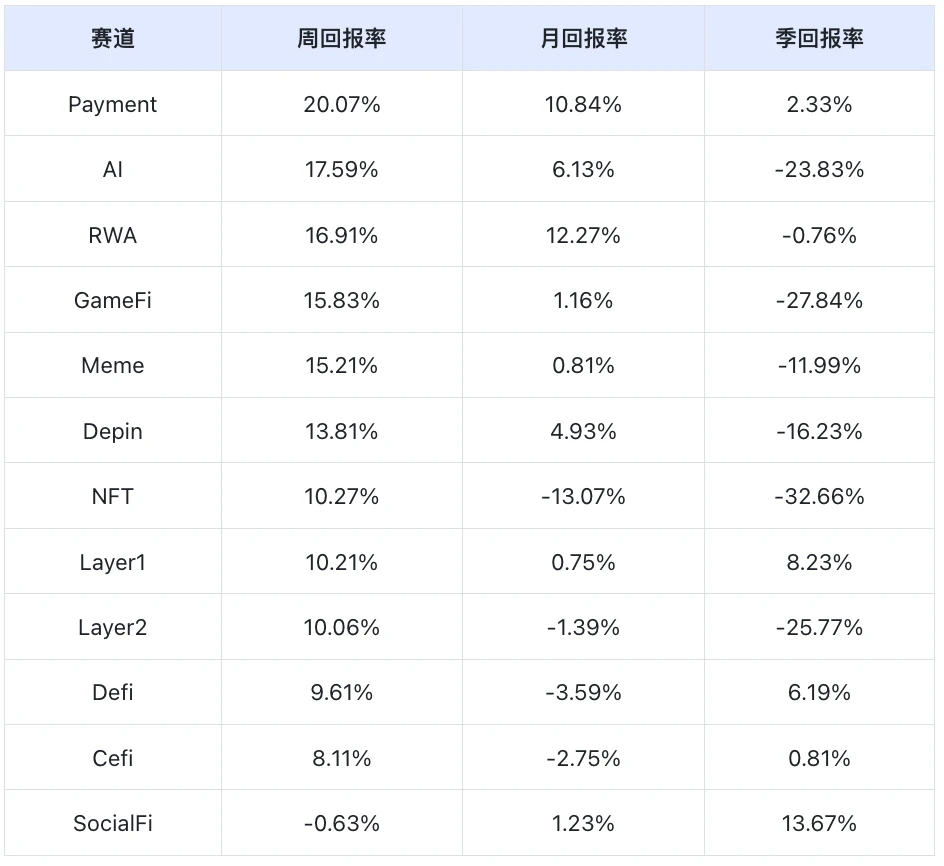

Subject tracking

Data source: SoSo Value

As can be seen from the above table, based on weekly returns, the best performing track is Payment and the worst performing is SocialFi.

XRP has the largest share in the Payment track, reaching 63.53%. This week, due to the closed-door meeting with the SEC, the market speculated that XRP might reach a settlement with the SEC, which led to a 26.61% increase in XRP, thus driving the entire Payment track up. BCH, LTC and XLM, which have a relatively large share in the track, have shown a good upward trend this week due to the recovery of the market, making the entire Payment track the most outstanding among all tracks.

TON accounts for 93.41% of the SocialFi track, but TON fell 2.01% this week, making the SocialFi track the only one in decline among all tracks.

Crypto Events Next Week

-

Bank of Canada interest rate decision on Wednesday (July 24)

-

Bitcoin 2024 will be held in Nashville, USA on Thursday (July 25), during which Trump, Robert Kennedy Jr., Michael Saylor, and Snowden will be invited to participate

-

Friday (July 26): US June Core PCE Price Index; US July University of Michigan Consumer Confidence Index Final Value; EDCON 2024; Solana Hacker House in Bangalore

Outlook for next week

-

Bitcoin: The Mtgox incident has started to pay compensation. There are currently 90,344 coins left on the address, more than 50,000 of which have been transferred out, and the German governments selling has been completed. What remains to be seen is whether there will be a market crash after the Mtgox compensation, as well as the trend of the U.S. stock market. Next week, BTC is likely to maintain a volatile trend.

-

Ethereum: Ethereums spot ETF has been delayed again to July 23, but it will most likely be passed on July 23. The main focus will be on whether Grayscales ETH will be sold in large quantities after it is passed next week, just like the BTC spot ETF was passed.

-

Altcoin: As the major negative factors in the market are constantly decreasing, investors are about to enter the greed level. Although Altcoin has rebounded significantly this week, there is still a certain gap from the price before the decline. Wide-range shock rebound is still the main theme of the market.

This article is sourced from the internet: Frontier Lab Crypto Market Weekly Report|W29

In late June, Chongqing Business Media Group Co., Ltd. officially released an apology statement to TRON founder Justin Sun on the Peoples Court Announcement Network. This also means that the two-year-long case of Justin Sun suing the media for defamation finally ended with the plaintiff Justin Sun winning the case and the defendant apologizing. 聽 Although justice came a little late, and the reputational damage suffered by the plaintiff in the past two years is difficult to quantify and recover, this result will still have a certain deterrent and warning effect on the spread of subsequent related rumors. For the Web3 industry, which has long been criticized, this judgment once again proves that Web3 is not a lawless place, which helps to urge information service practitioners to speak with evidence…