Báo cáo thị trường thứ cấp tháng 6: Dấu hiệu của thị trường người mua là rõ ràng, nhu cầu mua tài sản vượt quá giá chào bán là 75%

Tác giả gốc: SecondLane

Bản dịch gốc: TechFlow

-

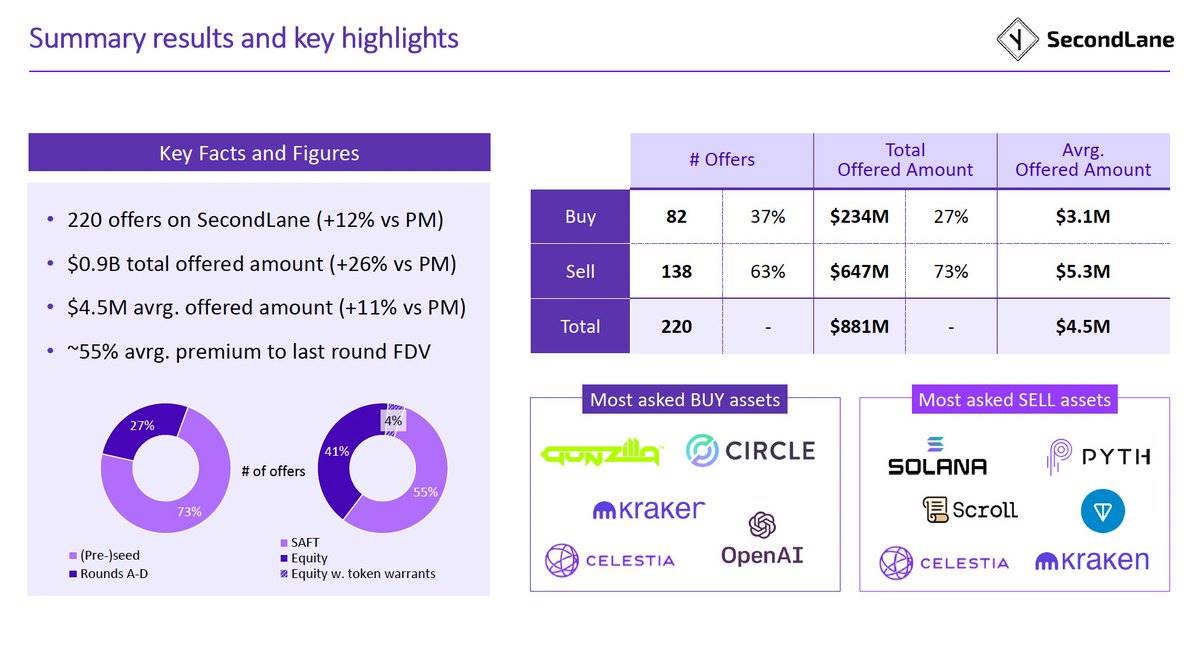

June was the first month this year that clearly showed a buyer’s market, with buy requests outnumbering sell offers by 75%!

-

The valuation gap between bid and ask prices for the same asset fell to 36% from 88% last month

-

The total order book value for June 2024 is $883 million

-

The average asking price was $4.5 million, up sharply from $3.9 million last month.

-

The average premium was 55% of the last fully diluted valuation

-

Major projects: Circle, Solana, Scroll, Kraken, Celestia, TON, Pyth, Gunzilla, OpenAI

-

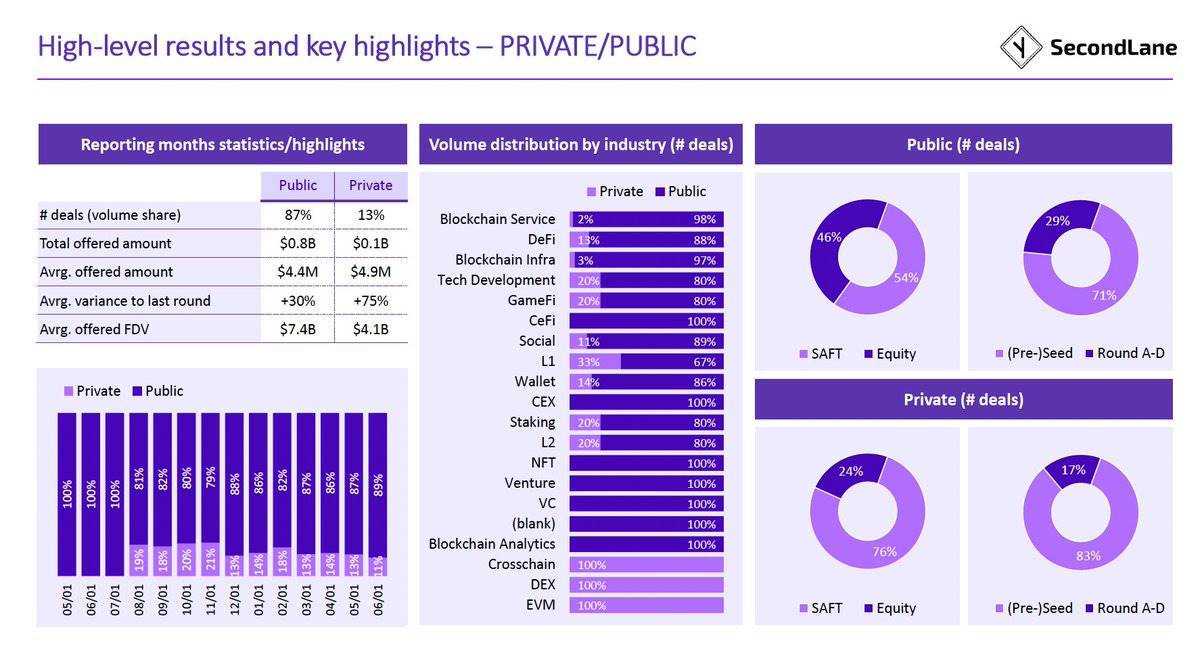

57% of transactions were SAFTs and 44% were equity transactions

-

73% of deals were (early) seed rounds, and 27% were Series A to D rounds

-

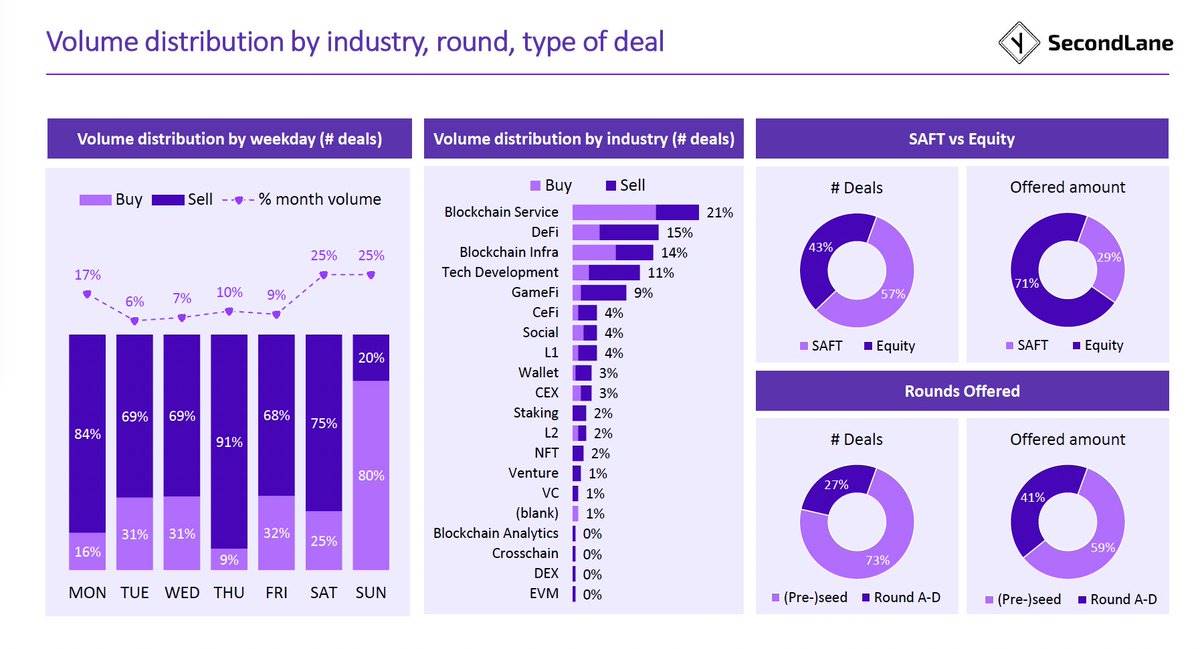

70% of transactions are concentrated in five areas: blockchain services, DeFi, infrastructure, technology development, and GameFi

-

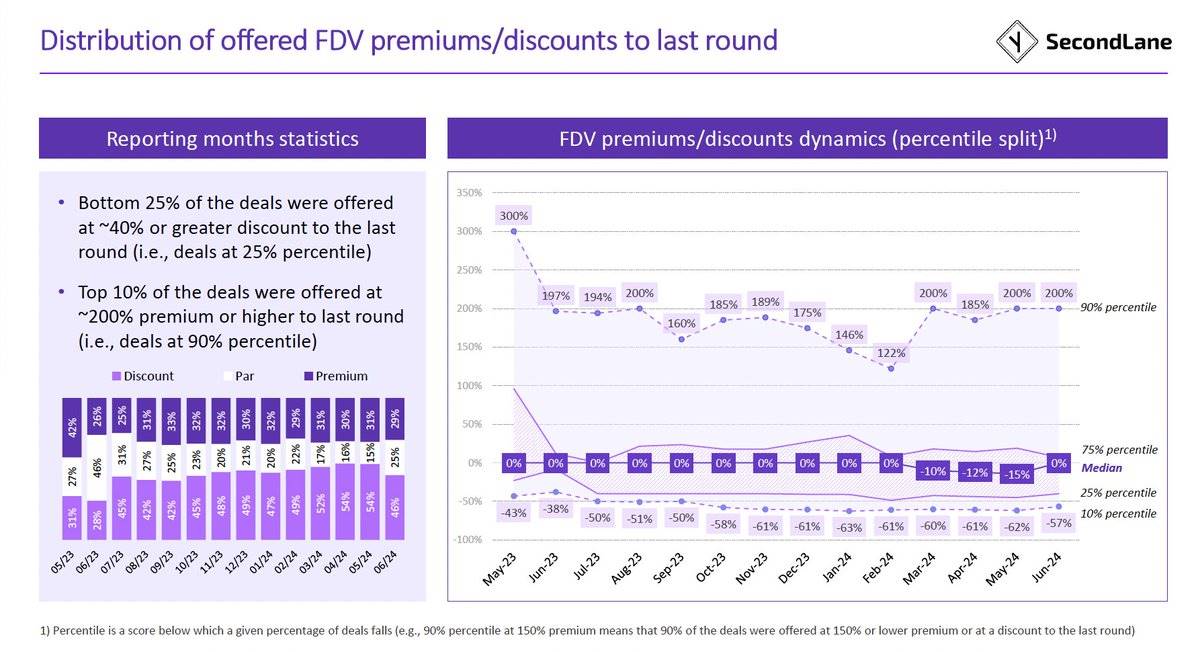

Deals with a previous round premium decreased by 2%

-

The number of transactions was the same as the previous round, an increase of 10%

-

46% of deals in June were at a discount, 25% were flat, and 29% were at a premium to the previous round

-

The median discount across all deals in June was 15% of the previous round

-

The top 10% of deals offer a 200% or higher premium over the previous round

-

The bottom 25% of deals offer discounts of 40% or more from the previous round

-

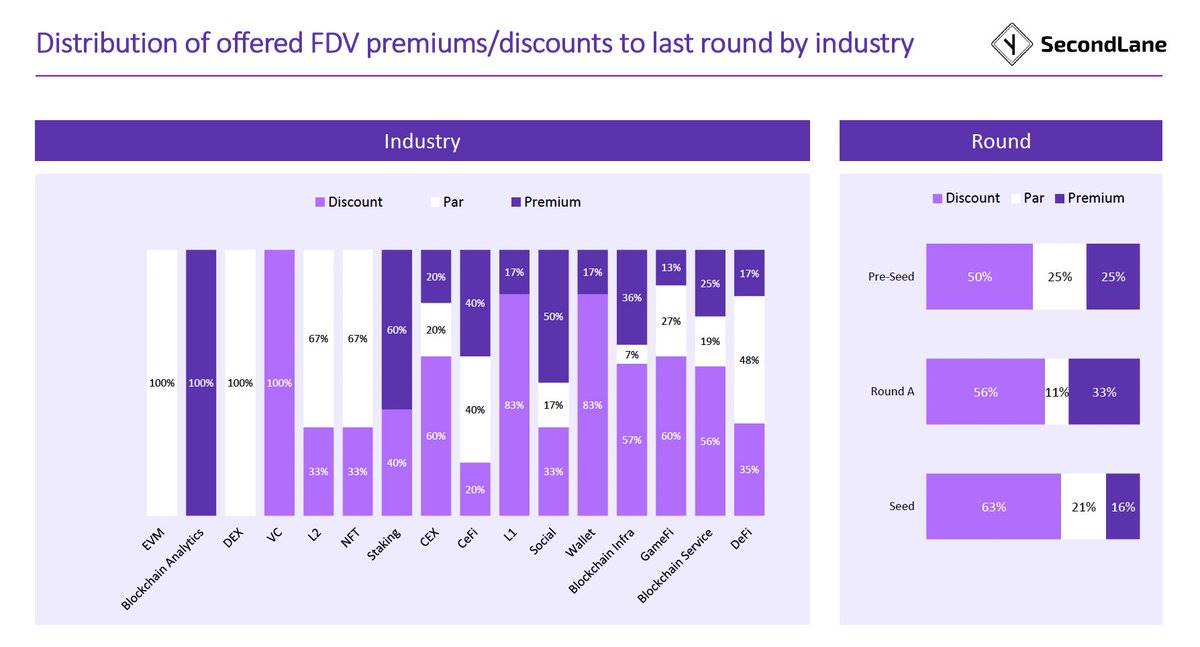

Enjoy the biggest discounts on LP positions in VC funds, CEXs, L1s, wallets, GameFi, blockchain infrastructure and services

(Note from Shenchao: The term “discount” in this article refers to a discount in a transaction, which means that the transaction price of some assets is lower than its previous round of financing or market price. For example, some transactions are conducted at a price lower than the previous round of financing, which is called a “discount”)

-

Blockchain analysis and staking projects enjoy the highest premium

-

Series A projects enjoy the highest premium, and seed round projects enjoy the biggest discount

-

13% of deals floated without public exposure and at lower valuations ($4.1 billion fully diluted valuation for private offers vs. $7.4 billion for public offers)

-

Most private placements were SAFTs (76%), at (early) seed stage (83%), targeting DEXes, EVM, and cross-chain solutions

-

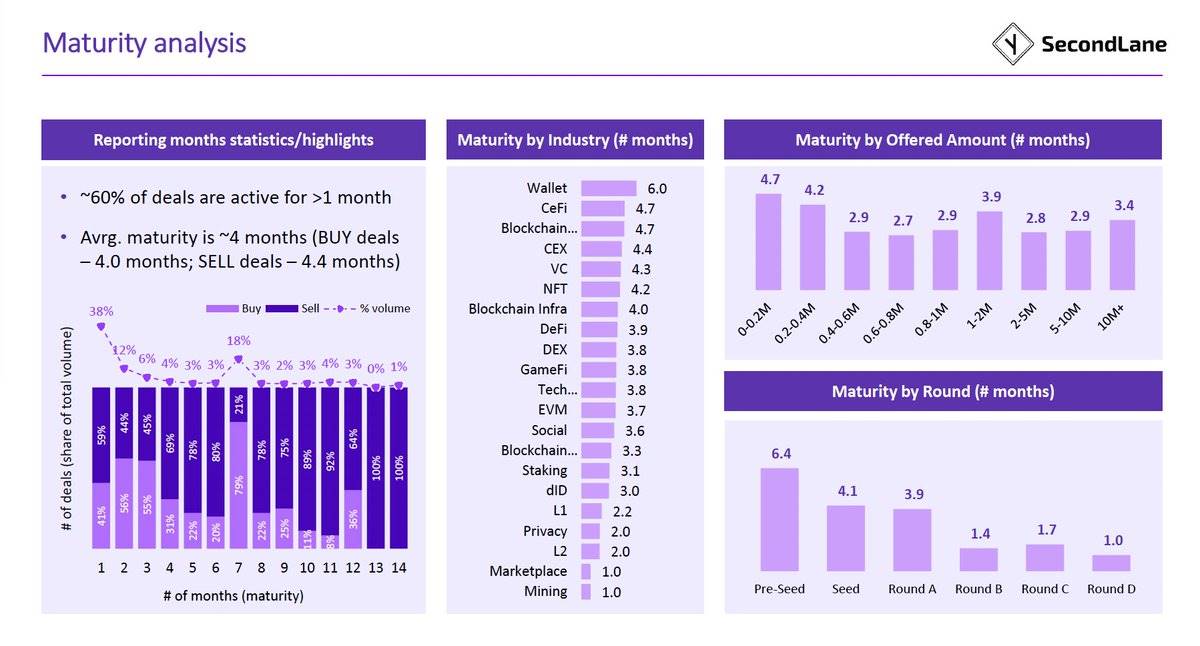

The average time to expiration of trades increased to 4 months for buy requests and 4.4 months for sell offers until expiration or trade completion.

-

60% of transactions are active for more than 1 month

-

The maximum expiration time is:

-

Early vs. late rounds: 6.4 months for early seed rounds; about 4 months for seed and A rounds, and more than 1 month for B, C, and D rounds

-

CeFi, wallets, CEX projects, VC, NFT, blockchain infrastructure

-

The median buy request was $200,000 and the average valuation was $9 billion

-

2/3 of buy requests were made at a discount (average discount was 40% of the previous round or spot price); 6% were flat; 25% required an average premium of more than 80%

-

The median asking price was $2 million, with an average valuation of $6.5 billion

-

40% of deals were done at a discount (average discount was 45%); 32% were flat; 29% required a premium (average was over 270%)

This article is sourced from the internet: June secondary market report: Buyers market signs are obvious, asset purchase demand exceeds offer price by 75%

Có liên quan: SharkTeam: Phân tích cuộc tấn công UwU Lend

Vào ngày 10 tháng 6 năm 2024, UwU Lend đã bị tấn công và dự án đã mất khoảng $19,3 triệu đô la Mỹ. SharkTeam đã tiến hành phân tích kỹ thuật về sự cố và tóm tắt các biện pháp phòng ngừa bảo mật ngay khi có thể. Chúng tôi hy vọng rằng các dự án tiếp theo có thể học hỏi từ sự cố này và cùng nhau xây dựng một tuyến phòng thủ bảo mật cho ngành công nghiệp blockchain. 1. Phân tích các giao dịch tấn công Kẻ tấn công: 0x841dDf093f5188989fA1524e7B893de64B421f47 Kẻ tấn công đã khởi tạo tổng cộng 3 giao dịch tấn công: Giao dịch tấn công 1: 0x242a0fb4fde9de0dc2fd42e8db743cbc197ffa2bf6a036ba0bba303df296408b Giao dịch tấn công 2: 0xb3f067618ce54bc26a960b660cfc28f9ea0315e2e9a1a855ede1508eb4017376 Giao dịch tấn công 3: 0xca1bbf3b320662c89232006f1ec6624b56242850f07e0f1dadbe4f69ba0d6ac3 Lấy giao dịch tấn công 1 làm ví dụ để phân tích: Hợp đồng tấn công: 0x21c58d8f816578b1193aef4683e8c64405a4312e Hợp đồng mục tiêu: Hợp đồng kho bạc cho vay UwU, bao gồm: uSUSDE: 0xf1293141fc6ab23b2a0143acc196e3429e0b67a6 uDAI: 0xb95bd0793bcc5524af358ffaae3e38c3903c7626 uUSDT: 0x24959f75d7bda1884f1ec9861f644821ce233c7d Quy trình tấn công như sau: 1. Cho vay nhanh nhiều mã thông báo từ các nền tảng khác nhau, bao gồm WETH, WBTC, sUSDe, USDe, DAI, FRAX, USDC, GHO…