Bản ghi đầy đủ về hoạt động đầu tư của ban biên tập Odaily (ngày 17 tháng 7)

Chuyên mục mới này là chia sẻ những kinh nghiệm đầu tư thực tế của các thành viên trong ban biên tập Odaily. Chuyên mục này không chấp nhận bất kỳ quảng cáo thương mại nào và không cấu thành lời khuyên đầu tư (vì đồng nghiệp của chúng tôi rất giỏi mất tiền) . Mục đích là mở rộng quan điểm của người đọc và làm phong phú thêm nguồn thông tin của họ. Bạn được chào đón tham gia cộng đồng Odaily (WeChat @Odaily 2018, Nhóm trao đổi Telegram , Tài khoản chính thức X ) để giao tiếp và khiếu nại.

Người giới thiệu: Nan Zhi (X: @Sát thủ_Malvo )

Giới thiệu : Người chơi trên chuỗi, nhà phân tích dữ liệu, chơi mọi thứ trừ NFT

chia sẻ :

-

Continue to hold FIGHT and buy FEARNOT when the time is right. Recently, the main network Trump Family Bucket is the main focus, and various slogans and core concepts are spreading.

-

SOL has not produced another phenomenal meme, and is clearly at a disadvantage in the battle for the FIGHT leader, so we no longer plan to increase our holdings.

Được đề xuất bởi: Asher (X: @Asher_ 0210 )

Giới thiệu : Hợp đồng ngắn hạn, phục kích dài hạn các ngôi nhà giá trị thị trường thấp, khai thác vàng trong trò chơi blockchain và các bữa tiệc kiếm tiền

chia sẻ :

-

BTC market: continue to be bullish, short-term peak has not yet been reached, it is expected to reach 67000-68000, there will be a correction, we will see then. In short, the market has reversed and is not a rebound, and the correction is an opportunity to buy the bottom of the altcoin.

A brief discussion on the selling pressure from Mentougou: I personally think that the selling pressure from Mentougou is not that big. Unlike the German government, which sold hundreds or thousands of coins at a time, the BTC in Mentougou was given to creditors to deal with on their own. So even if many people want to sell, they won’t do it at the same time. Therefore, judging from the rapid rise in BTC after the German government sold it, a slow sell-off may not have such a big impact on the market. (Don’t argue with me by opening a short-term BTC that is 100 times more)

-

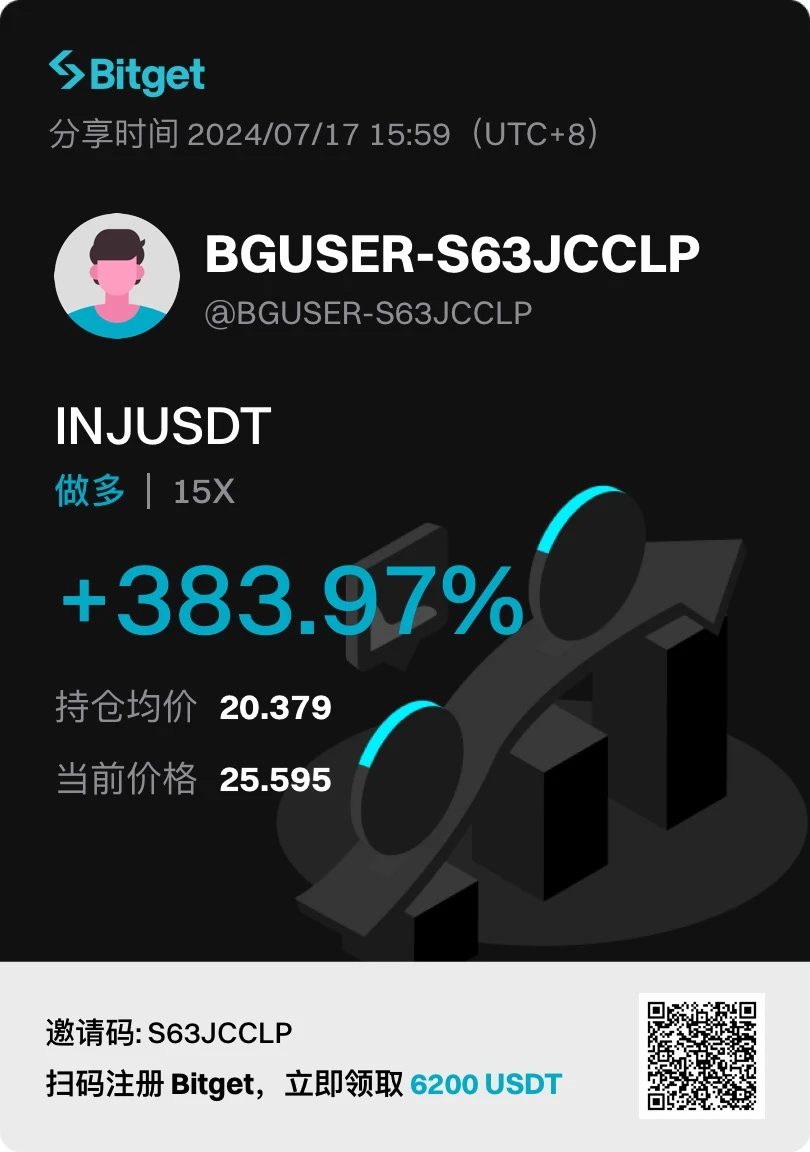

Review of copycat recommendations: FLOKI, which was recommended on Monday, ranked second in terms of growth among the top 100 currencies by market capitalization yesterday; INJ, which was recommended, rose by more than 10 points today.

-

This times recommendation for altcoins: I have been buying altcoins with good popularity and good K-line when BTC has a small correction in the past two days. I have bought TAO, JASMY, TURBO, and LISTA (this one is really weak. I cant trust Binance if it doesnt rise again…); there are two coins that I havent found a suitable opportunity to buy, but I am ready to buy: XLM and ONDO. Finally, I bought FIGHT on the SOL chain yesterday, waiting for a miracle that surpasses FIGHT on the ETH chain.

Recommended by: Cooper (X: @Marlborodingyi )

Giới thiệu : Roller coaster passenger, fake diamond hand

chia sẻ :

-

Continuing the previous idea: buy small-cap altcoins. Of course, it is best to buy Ethereum-based ones. I personally bought Renzo, a small-cap Ethereum-based new coin with a small circulation market value of 80 million. I think it still has a certain chance relatively speaking, and I set a low stop loss before spot trading.

-

I don’t have wisdom, but I will follow: I bought FIGHT on the SOL chain, mainly because I missed FIGHT and MAGA, it was a bit of Fomo, my predecessor also bought it, it didn’t rise much compared to the ETH chain’s FIGHT of the same name, it should be okay, Aisin, etc.

-

In addition, don’t listen to some KOLs and short WLD and other coins. It is easy to have a dead cat bounce. Today, I made $200 by shorting. It was like picking up coins in front of the railroad tracks. But I will never dare to do it again.

Được đề xuất bởi: Wenser (X: @wenser 2010 )

Giới thiệu : Buy whatever you want and you’ll take off

chia sẻ :

-

AI took off strongly with the rebound of the market, and suggested taking profits in batches;

-

On Monday, I mentioned the logic of the formers constant strength. The rebound of the Forbes top 10 cryptocurrencies in the first half of the year was also very good. You can wait and see. It will be time to sell them after the downward trend of the market is obvious.

-

On Monday, I wrote A Review of the Top 10 Trump Concept Coins . Ethereums FIGHT has increased eightfold, and other coins with over 5 million have also increased to varying degrees. Congratulations to those who read the article and bought in.

-

If the recent Mt. Gox crash can be well digested, and the expectation of FTX compensation can be transformed into “imaginary buying” during the voting phase, the next wave of speculation is expected to be in the Ethereum and Solana ecosystems.

-

Sanctum is too lame, not even worthy of being called a pig’s trotter. I will try not to participate in any staking protocols in the future (although Solayer is still around);

-

The Olympics are about to begin, but sports-related coins have already fallen badly. If there is no improvement on the 26th, it will be time to sell them.

Được đề xuất bởi: golem (X: @web3_golem )

Giới thiệu : Người bắt hệ sinh thái Bitcoin, thực tập sinh giật tóc, người chơi không bao giờ có được một bữa ăn nóng

chia sẻ :

-

Rune No. 2 DECENTRALIZED plans to release a new Ordinals NFT on July 18, and this time it supports the use of runes for minting. The minting price is about 100 u, and the total number is 222. The minting threshold is to hold 1 million No. 2 runes and a Promethean NFT (the threshold value is about 1300 u). The snapshot time is 21 oclock tonight. I plan to participate and see if I can grab it. This project originally has the background of Ethereum NFT. There are many big players and few paper hands. Now the total amount of NFTs to be issued is small, and it is a new way of playing. Using runes to mint, plus their teams operational capabilities, the odds are quite high. If it doesnt take off, it will be a low point to buy NFTs and runes. The risk is that the overall market of Bitcoin NFT is not good, and the small number of NFTs makes players appear more passive.

-

Continue to hold SOL. This time I was lucky enough to buy the bottom of SOL at around 135. The reason was that I wanted to save some money to invest in the Blink ecosystem, but the spot price went up before I made any move. ETH is not far from recovering my investment. I believed in the good news of Ethereum spot ETF and bought it at around 3550 in June. The spot price pretended to be dead for a month, and I finally dared to open the exchange.

Người giới thiệu: Vincent (X: @vincent 31515173 )

Giới thiệu : Mua và bán dựa trên cảm xúc của bạn và dừng lại khi bạn đang có lợi thế

chia sẻ :

-

ONDO, which was sold previously, was bought back on July 6 when the market fell. The cost price was 0.87, and the current price is 1.12, achieving a profit of nearly 40%, and it is expected to close the position at around 1.3. The reason for buying ONDO is that as a leading project in the RWA sector, such as the US dollar and US bonds, the narrative space brought by Ondo itself is sexy enough. The price is lower than 0.9, and you can buy it without thinking according to the market situation. As long as the overall market does not go bearish, Ondo can bring relatively stable returns. It is not recommended to enter the market at present. Although there is news of cooperation with RWA leaders recently, the upside is limited and the possibility of losses is relatively high.

-

Let me talk about my recent experience. I am not good at chasing trends and I am timid. My personal investment preference is to hold on to a sector or project that I understand and keep looking for opportunities in it. Getting rich overnight only exists for a few people. Instead of trying to get rich overnight, it is better to grow a little bit each time.

Hồ sơ trước đó

Đọc sách được đề xuất

Trump was assassinated, BTC strongly returned to $62,000, has the market bottomed out?

This article is sourced from the internet: Full record of Odaily editorial department investment operations (July 17)

Có liên quan: SharkTeam: Phân tích cuộc tấn công UwU Lend

Vào ngày 10 tháng 6 năm 2024, UwU Lend đã bị tấn công và dự án đã mất khoảng $19,3 triệu đô la Mỹ. SharkTeam đã tiến hành phân tích kỹ thuật về sự cố và tóm tắt các biện pháp phòng ngừa bảo mật ngay khi có thể. Chúng tôi hy vọng rằng các dự án tiếp theo có thể học hỏi từ sự cố này và cùng nhau xây dựng một tuyến phòng thủ bảo mật cho ngành công nghiệp blockchain. 1. Phân tích các giao dịch tấn công Kẻ tấn công: 0x841dDf093f5188989fA1524e7B893de64B421f47 Kẻ tấn công đã khởi tạo tổng cộng 3 giao dịch tấn công: Giao dịch tấn công 1: 0x242a0fb4fde9de0dc2fd42e8db743cbc197ffa2bf6a036ba0bba303df296408b Giao dịch tấn công 2: 0xb3f067618ce54bc26a960b660cfc28f9ea0315e2e9a1a855ede1508eb4017376 Giao dịch tấn công 3: 0xca1bbf3b320662c89232006f1ec6624b56242850f07e0f1dadbe4f69ba0d6ac3 Lấy giao dịch tấn công 1 làm ví dụ để phân tích: Hợp đồng tấn công: 0x21c58d8f816578b1193aef4683e8c64405a4312e Hợp đồng mục tiêu: Hợp đồng kho bạc cho vay UwU, bao gồm: uSUSDE: 0xf1293141fc6ab23b2a0143acc196e3429e0b67a6 uDAI: 0xb95bd0793bcc5524af358ffaae3e38c3903c7626 uUSDT: 0x24959f75d7bda1884f1ec9861f644821ce233c7d Quy trình tấn công như sau: 1. Cho vay nhanh nhiều mã thông báo từ các nền tảng khác nhau, bao gồm WETH, WBTC, sUSDe, USDe, DAI, FRAX, USDC, GHO…