How did smart money reap 100-fold gains after the Trump shooting?

Original author: Lucy, Joyce

On July 14, Trump was shot in the ear while giving a speech at a campaign rally. He raised his right fist while being protected by security. After that, Trump meme concepts skyrocketed, with TRUMP soaring nearly 70% in 1 hour and MAGA soaring 33% in 1 hour. In addition, several related meme coins appeared on Solana, including FIGHT and EAR, which rose more than 100 times after going online.

Last night, Trump posted a new social email at 11:51 Beijing time, with the text Dont be afraid (FEAR NOT), I am Trump, I will make America great again!. After that, Solana appeared a meme token named FEAR NOT, which increased 33 times in two hours.

After an explosive news event, a series of related meme tokens and coins will always appear quickly, with several targets that have increased by more than 100 times and have huge profit margins. How are these golden dogs born? What are the characteristics of the smart money that gets high profits?

15 minutes after the news, old coins pull up and new coins enter the market

The earliest report about Trumps shooting was from a Bloomberg reporter. Walter announced that Trump was shot at 6:15 a.m. on the 14th. 15 minutes later, Trumps concept coin began to rise.

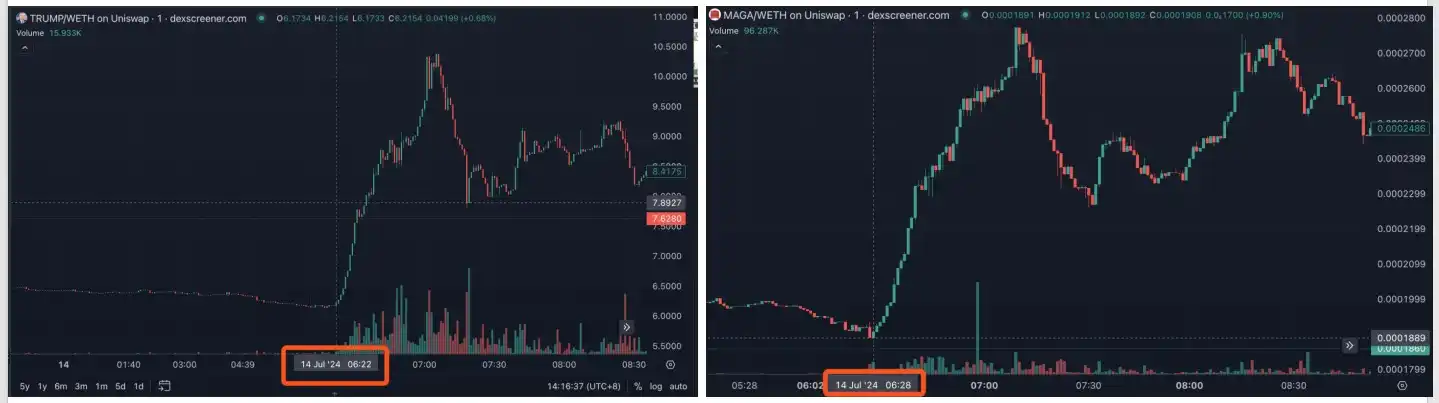

Previously, Trump concept leader TRUMP led the rise. At 6:22 am on the 14th, TRUMP took 40 minutes to rise by 70%, and began to fall around 7 am, with a trading volume of 6.01 million US dollars. Subsequently, MAGA also began to soar at 6:28, and the rise also lasted for 40 minutes. After the increase of 46%, it began to fall at 7:10, with a trading volume of 3.37 million US dollars.

But in addition to the old memes, many related concept coins have appeared in this emergency, such as EAR, Fight, SURVIVOR, FIST, MISSED and HERO, and the derivative words and phrases around these words also have corresponding memes, such as EAR IS FINE, EARWIF, etc.

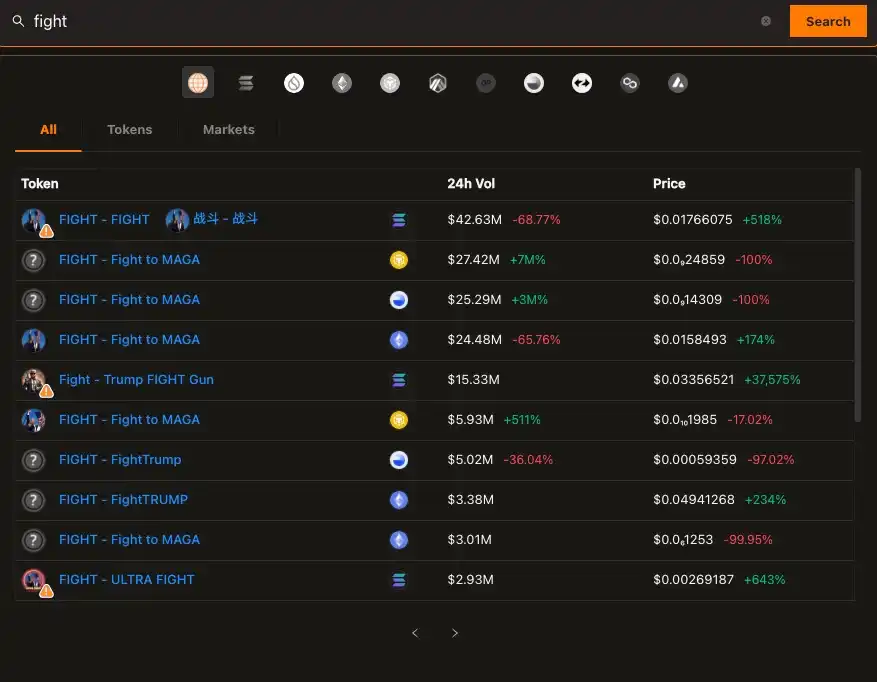

For meme hype, event fermentation, coin issuance, and market manipulation have become basic procedures. The above names represent more than one token. If you search for any of these words on any dex, you can find dozens of tokens with the same name. According to gmgn data, there are 24 tokens named Fight on Solana and 23 on Ethereum, while there are 11 EAR on Solana and 5 on Ethereum.

Since it is difficult to track the time when most memes were born, BlockBeats checked the birth time of several popular tokens, among which only FIGHT and EAR achieved a large increase, and their release time happened to be 15 minutes after the news was released.

According to dexscreener data, FIGHT, which has risen the most, was released at 6:50 am on the 14th and is still rising. Its trend has shown 3 rising highs. The first high point appeared at 11:45 am on the 14th. The price remained around $0.004 for nearly an hour before it began to fall. Six hours later, the price bottomed out at $0.002 and around 10:30 pm, FIGHT rose to a local high of $0.013. Subsequently, the number of sell orders increased, and FIGHT fell sharply again, and rebounded here early this morning.

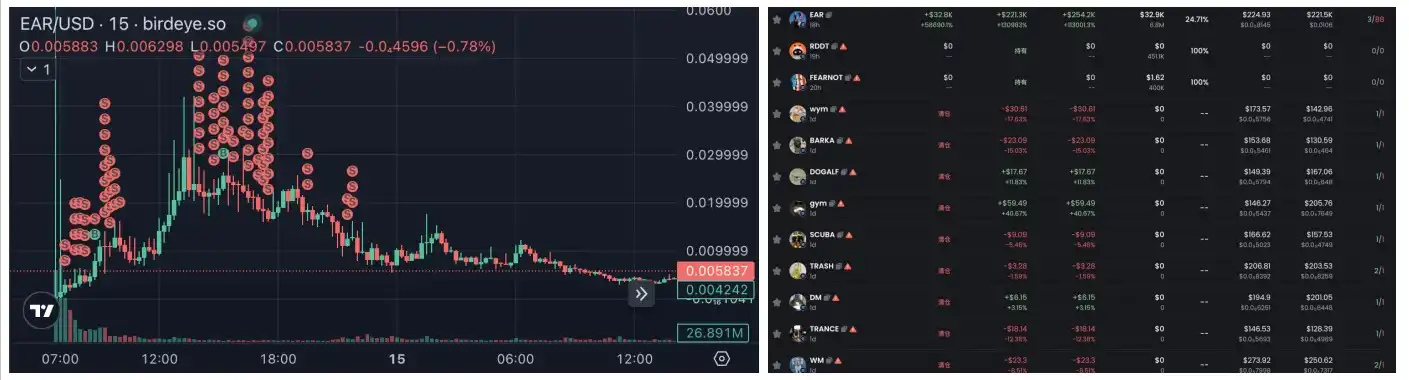

EAR is the meme that has survived longer after FIGHT. It was released at 6:37 am on the 14th and rose to a peak of $0.032 at 1:15 pm, an increase of more than 60 times in 7 hours. At 3:30 pm, the price of EAR began to decline at around $0.025. As of the time of writing, the price was $0.0035, with a market value of $3.7 million and a trading volume of $43.1 million.

The next most popular FIST and SURVIVOR were released later. FIST was released at 8:21 am on the 14th, and SURVIVOR was released at 1:05 am on the 15th. Both have now returned to zero.

How does smart money achieve the 100x meme?

According to gmgn.ai data, in addition to FIGHT and EAR, a large number of related memes were born around 6:30 in the morning, but perhaps due to the lack of orders, they did not attract much attention. Among these dozens or even hundreds of related memes, how did smart money accurately select the 100x meme? BlockBeats tracked the smart money addresses that bought the above two memes, EAR and FIGHT, in the early stage.

Luck plays a major role

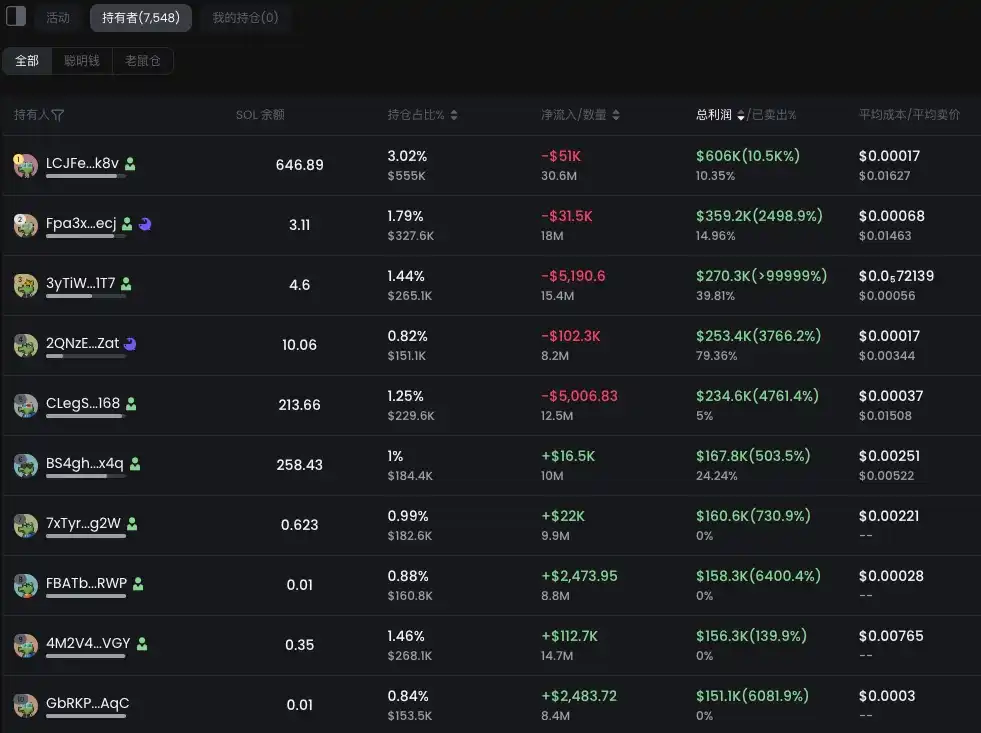

The lucky person who made the most profit on FIGHT is the address starting with LCJFe, who bought at an average cost of $0.00017 23 minutes after the opening and sold the principal after the price doubled. The current floating profit is $575,900, an increase of more than 100 times.

Another address starting with CLegS specializes in celebrity tokens. Among all the types of tokens it holds, celebrity tokens account for more than half of the total, but it was almost wiped out. From the overall performance, its total profit is still positive due to the rise of Trump concept coins.

In this Trump shooting case, he bought five related tokens: FIGHT, EAR, FIST, SURVIVOR and MAGA. Except for the loss of MAGA, the other four memes have brought him a total profit of more than 470,000 US dollars, and there is currently about 233,600 US dollars in unrealized profits.

The address starting with BS4gh is a hotspot player. In addition to FIGHT, the tokens it holds include BOME, WIF, and MOTHER. Although the latter three are all 100x coins that are hotly discussed in the meme circle, due to the late purchase timing, the current floating profit is only US$82.

Qwerty (address starting with 81RYq), who made the most profit on EAR, spent a total of $224 on the purchase and eventually made a profit of over $220,000, a return of 1,309 times. His strategy was to cast a wide net, buying 15 to 30 meme coins a day at a cost price of $100-300, and finally won the EAR lottery.

KOLs can make money, but they can’t sell on the top of the mountain

The KOL address movements and order calls have an important impact on the price trend of meme coins.

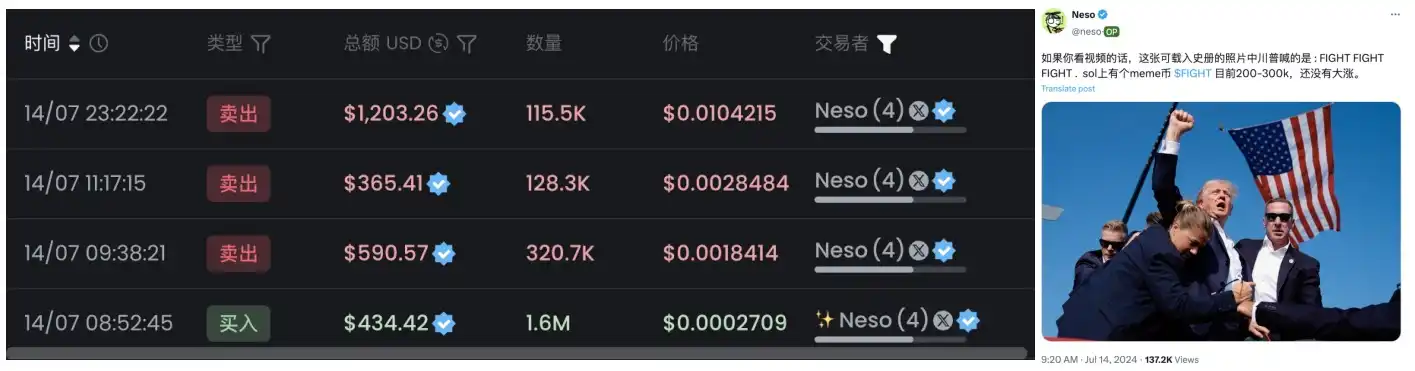

36 minutes after EAR appeared, the address of a KOL 0x Sun with more than 90K Twitter followers bought more than 2,700 US dollars of EAR in two transactions at 0.0015 and 0.0019 US dollars. At that time, the market value of EAR was less than 2 million US dollars. In the next 8 hours, EAR exceeded 32 million US dollars. But 0x Sun did not sell at the high point. If calculated at the high point, 0x Suns maximum profit could reach 16 times. But in this wave of market, 0x Suns actual rate of return was 1.36 times.

On FIGHT, Neso, who has over 30K followers, bought the token at a cost of $434 two hours after it went online, and posted a tweet about half an hour after the purchase. After that, FIGHT continued to rise, and after the profit reached 6 times, Neso sold the tokens one after another, and the last one was sold at the stage high point, leaving a surplus. As FIGHT broke through the historical high, Nesos unrealized profit on it reached $17,000.

An Incomplete Guide to “Knowing Coins with a Smart Eye”

After summarizing these lucky smart money, we will find that it is not only those who buy in within tens of minutes after the token is launched that can get high profits. These golden dogs were launched 20 minutes after the breaking news was reported. The production speed was extremely fast, but the process of upgrading to golden dogs took several hours. Even if you buy in 2 hours after the opening, there is still a profit space of 100 times.

BlockBeats has summarized some general tips for grabbing meme coins.

First of all, it is crucial to keep up with hot news and judge its potential impact. It is necessary to maintain a keen sense of meme coins for emergencies, timely screen out concept coins related to the events, and pay close attention to their trends.

In addition, paying attention to smart money and reputable KOL addresses is also an effective strategy. Smart money and KOLs often have richer market experience and a keener sense of the market. Following their movements can increase the probability of success. At the same time, diversification is also an important strategy to reduce risks. Just as some smart money has taken actions, casting a wide net and deploying in multiple locations, although not every investment can bring huge returns, there are always some that can stand out and achieve a hundred or even a thousand times the return.

Finally, timely withdrawal is also one of the key strategies. In the case of volatile market conditions, timely recovery of initial investment costs and ensuring that you will not lose money under any circumstances is an important means of protecting investment returns. Stay rational and calm, avoid blindly following the trend due to temporary fluctuations, and have your own judgment and strategy. In this way, even in a turbulent market, you can move forward steadily and seize the meme coin opportunities brought by the next emergency.

In short, seizing the meme coin of emergencies requires not only luck, but also keen market insight and scientific investment strategies. However, meme coins fluctuate violently, and BlockBeats reminds readers to be careful in identifying risks.

This article is sourced from the internet: How did smart money reap 100-fold gains after the Trump shooting?

Related: In-depth analysis: How big is the scale of MEV at L2?

Original author: sui 14 Original translation: Ladyfinger, BlockBeats Editors Note: This article deeply analyzes the impact of the Dencun upgrade on the Ethereum L2 network, reveals the positive results of the upgraded L2 network in reducing transaction costs, increasing user activity and asset inflows, and points out the negative effects such as network congestion and high rollback rate caused by MEV activities. The article calls on the community to pay attention and jointly develop MEV solutions that adapt to L2 characteristics to promote the healthy development of the Ethereum ecosystem. Introduction In this post, we aim to provide a data-driven overview of the current state of L2. We monitor the importance of the Dencun upgrade’s gas fee reduction for L2 in March, examine how activity on these networks has evolved,…