Sau đợt airdrop LayerZero và ZkSync: Đã đến lúc tạm dừng, xem xét và suy nghĩ lại về tương lai của airdrop

Tác giả gốc: Noah Ho , YuppieZombie , Lumos Ngok

giới thiệu

In recent days, the blockchain community has witnessed significant controversy surrounding the ZkSync and LayerZero airdrops. These events have sparked widespread discussion, prompting us to pause and reflect on the current and future state of airdrops in the crypto ecosystem. This article will discuss the historical evolution of airdrops, highlight several important projects that have shaped this space, and analyze the controversial airdrops of ZkSync and LayerZero in detail. Finally, we propose some key reflections and considerations for the future of airdrops.

Airdrop in blockchain

In the field of blockchain, airdrop refers to the act of sending free tokens or cryptocurrencies to a specific digital wallet address. In laymans terms, airdrop is the act of a project giving away crypto assets to users for free. The project is not interested in charity, but through airdrops:

-

Promotion: The project team hopes to make potential investors and users aware of the project through airdrop tokens, thereby achieving the purpose of promotion.

-

Give back to the community: Give back to community users, hoping that they will continue to support and promote the development of the project in the future.

-

Obtaining user volume data: In order to attract venture capital (VC), project owners need to show good user volume data. Therefore, sometimes they hint to users that they may receive airdrop rewards by using the product. This has become a consensus in the industry: early experience project products may receive airdrops.

When ordinary users get the airdrop tokens, they can:

-

Participate in governance: Participate in the governance of the project and vote for the future direction of the project.

-

Hold and wait for appreciation: The cost of the tokens airdropped in the early stage is very low, and high-quality projects are worth waiting for the price to rise.

-

Cash out: Sell directly on the exchange to accumulate your original capital.

The History of AirdropS

Origin of the Airdrop

2014: The first crypto airdrop was launched by a project called Auroracoin. It distributed free tokens to all citizens of Iceland to promote the adoption of a new crypto token. However, the project and the token ultimately failed. The airdrop at the time did not require any interaction or other requirements, as long as you confirmed that you were a member of the community.

Airdrop Development

In the early days of blockchain crowdfunding, Initial Coin Offering (ICO) took center stage. With the ICO boom, airdrops have become increasingly popular, and a large number of new web3 projects have begun using airdrops as a way to attract potential investors and users.

2017: Electroneum successfully used the airdrop strategy to airdrop more than 5,000 tokens to users for free. The campaign attracted more than 120,000 users to download the app and create accounts in the first two weeks. In this gold rush, a large number of startups emerged, the market was oversaturated, and investors were tired. In addition, in 2017, countries and regions such as Japan, the United States, Canada, and Hong Kong issued laws and regulations to regulate ICOs. In the same year, the Peoples Bank of China and seven other departments jointly announced that token issuance financing was suspected of being illegal and should be stopped immediately. The withdrawal of ICOs accelerated the development of airdrops.

2018: Ontology airdropped its native cryptocurrency ONT to NEO investors and 1,000 ONT to users who subscribed to its newsletter. In the same year, the Enumivo (ENU) project announced that it would imitate EOS and airdrop a large amount of ENU for free, further promoting airdrops as a means to increase the number and stickiness of community users.

Airdrops are booming

The rise of DeFi has brought about a new form of airdrop, in which web3 projects distribute tokens to liquidity providers or users participating in liquidity mining activities.

September 2020: Uniswap launched the UNI token and airdropped it. As long as users who had used Uniswap before September 1, 2020, whether they successfully exchanged or not, they could receive 400 UNI airdrops (about $1,400, calculated based on the closing price on the first day of listing). This airdrop completely ignited the entire DeFi airdrop and became the most influential event in the history of DeFi. Similarly, projects such as 1inch, DYDX, and Paraswap also airdropped between 2020 and 2021. In addition, projects in different tracks such as Gitcoin (funding platform), Immutable X (NFT layer 2), Ethereum Name Service (ENS) (domain name track), Terra Name Service (TNS) (domain name track), Dappradar (statistics website), etc. also airdropped during the same period, and the income of ordinary players ranged from a few hundred dollars to a few thousand dollars.

Today, airdrops have become an important part of the crypto market, and both projects and airdrops have experienced tremendous growth. For example, Arbitrums airdrop received more than 42 million ARBs in the first hour, becoming the most sensational airdrop in 2023. Although in the early days of airdrops, wool parties who used a large number of addresses to interact in batches were regarded as speculators, the short-term good user data is not good for serious project parties. At the same time, witches will cause token hoarding by brushing the volume, which will affect the fairness of project token distribution. However, the demise of ICOs and VCs monopoly on early project tokens seem to have given the wool party a sense of justice and correctness like Liangshan heroes. Airdrops to early users have become politically correct. Wool is essentially an investment in the original shares of blockchain star startups, and it is becoming a quasi-primary market investment. From an ecological perspective, wool party has become an important part of the development of the Web3 ecosystem. Novice users enter the Web3 field and obtain considerable benefits through airdrop expectations, and the project party achieves the purpose of educating users and project stress testing through the interactive tasks of the test network. In addition, the project party can ensure the decentralization of token distribution through airdrops, rather than highly concentrated in the team and VC. Todays money-making ecology has become a conspiracy between project parties, users and VC institutions. Each party takes what it needs and ultimately extracts profits from the secondary token market.

Evolution of airdrop rules

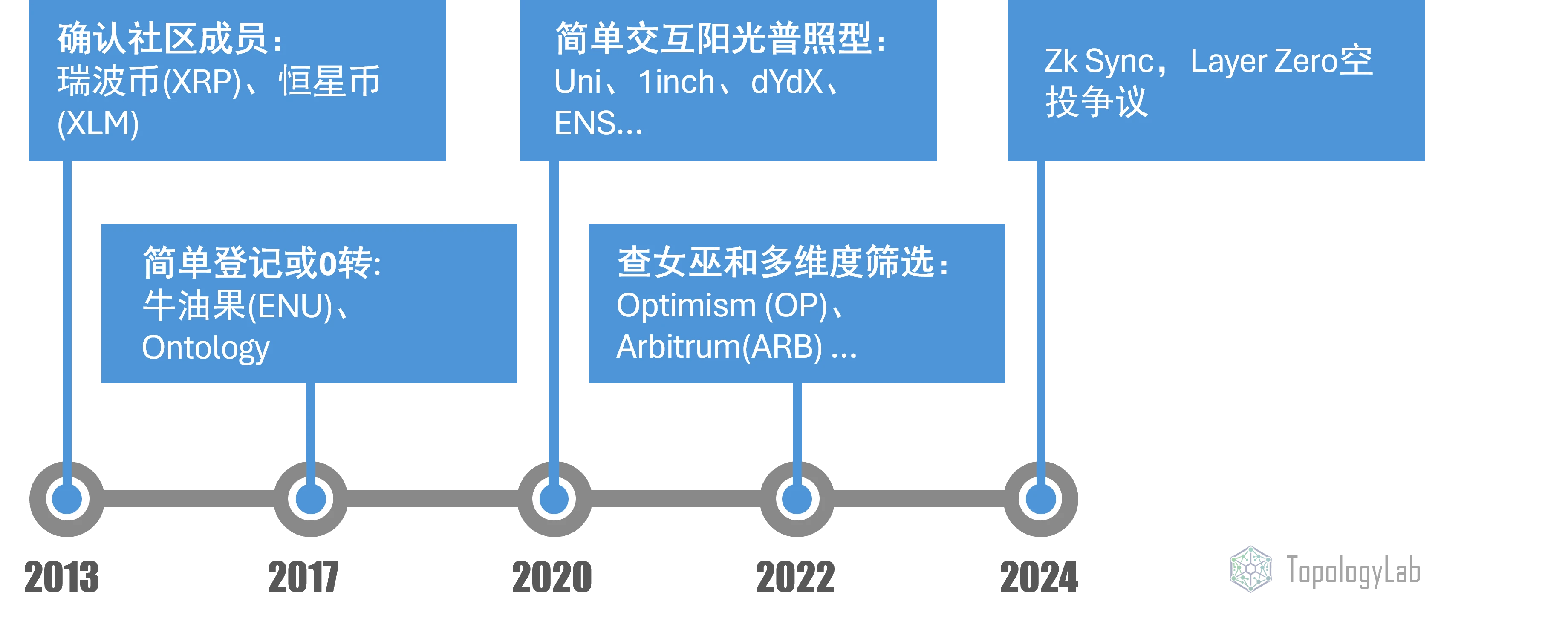

As crypto airdrops continue to evolve, the rules for airdrops have become increasingly complex. The development process is roughly as follows:

-

Confirming community members: For example, Ripple (XRP) in 2013 and Stellar (XLM) in 2014 used Facebook binding or mobile phone verification to confirm community members, which mobilized the stickiness of fans and attracted the attention of the public.

-

Simple registration or 0 transfer: For example, in 2017, just transfer 0 ETH to the contract address to get the airdrop. In the same year, Ontology airdropped 5:1 to NEO holders in their wallets.

-

Simple interactive sunshine type: such as projects such as Uni, 1inch, dYdX and ENS in 2020-2021. As long as you have used these platforms or held related tokens, you can get airdrops.

-

Checking Sybils and multi-dimensional screening: For example, Optimism (OP) in 2022 comprehensively evaluated the number of airdrops through multi-dimensional factors such as active users, DAO governance participation, multi-signature participation, Gitcoin donations, and cross-chain bridge users, and eliminated 17,000 Sybil addresses. Similarly, the rules of Arbitrum (ARB) in 2023 are also very complex, involving cross-chain bridges, transaction frequency and interaction, transaction value screening, and liquidity proof.

According to several historical stages and classic cases of airdrops, we can see that the wild growth period of airdrops has passed, and the existence of airdrop studios has limited the effectiveness of project parties in promoting projects through airdrops. From 2020 to 2021, the stories of getting rich quickly brought by airdrops attracted a large number of off-site personnel to experience new products, and also attracted many studios dedicated to airdrops. However, although these studios are heavy users in the circle, they have caused certain losses to the purpose of project parties to promote projects through airdrops. Therefore, the evolution of airdrops is almost equivalent to the history of anti-witch.

AirDrop Project Overview: A Milestone in Cryptocurrency

In this section, we will introduce some key strategies and innovative airdrops that are representative in the blockchain space. Uniswap set a precedent as the first airdrop project to shine a light on users, ensuring that all users receive tokens. ApeCoin customizes its distribution method based on NFT ownership. Arbitrum, ENS, and Blur use a tiered distribution based on loyalty and contribution. IO rewards users who provide hardware support for its platform, while Blast and Merlin distribute tokens through staking. These different approaches show the continuous evolution of airdrop mechanisms and considerations.

Uniswap: The pioneer of the DeFi revolution

Uniswap, as the cornerstone of decentralized finance (DeFi), has pioneered a trustless and permissionless cryptocurrency trading model with its automated market maker (AMM) model at its core. This innovation has greatly promoted the concept of financial liberalization and created an open trading environment for users.

On September 1, 2020, Uniswap showed the world how deeply it appreciates its early adopters through its airdrop event. This event was not only an important contribution to the DeFi airdrop culture, but also a recognition of the loyalty and contributions of the platforms early users. All users who interacted with the Uniswap DEX before that date, regardless of size, received an airdrop reward of at least 400 UNI tokens. For liquidity providers (LPs), their contributions were even more generously rewarded.

Uniswaps airdrop rules are highly praised by the community for their simplicity and fairness, reflecting the platforms respect and feedback to early participants, while setting an example for other projects in the DeFi field.

ApeCoin: The Heart of the BAYC Ecosystem

ApeCoin (APE), as the native token of the Bored Ape Yacht Club (BAYC) ecosystem, carries the heavy responsibility of governance and is the governance token of ApeCoin DAO. On March 17, 2022, ApeCoin held an airdrop event for holders of BAYC and Mutant Ape Yacht Club (MAYC) NFTs, which was an important feedback to community members and a key step in the development of the ApeCoin ecosystem.

The airdrop activity strictly follows the unique attributes of NFTs, and allocates a corresponding number of APE tokens for various NFTs and their combinations. For example, a single Bored Ape NFT holder will be awarded 10,094 tokens as a reward; if the NFT is combined with the Kennel Club NFT, the reward amount will be increased to 10,950 tokens. The formulation of this policy demonstrates the ApeCoin projects respect for the individual differences of community members and its recognition of their contributions to the ecosystem.

Arbitrum: A new chapter in Ethereum scaling

Arbitrum, as a pioneer in Ethereum Layer 2 solutions, uses its innovative Rollup technology to provide users with an efficient and low-cost transaction experience, significantly alleviating the congestion of the Ethereum network while ensuring the security and decentralized nature of transactions.

On March 16, 2023, Arbitrum launched its airdrop campaign with a carefully designed airdrop rule that rewards users who deeply participate in the Arbitrum ecosystem in detail:

-

Points System: Arbitrum has implemented a comprehensive points system to quantitatively distribute token rewards based on users’ activity on Arbitrum One and Arbitrum Nova, such as cross-chain transactions, transaction frequency, transaction amount, smart contract interaction, and liquidity provision.

-

Anti-Sybil Rules: To prevent Sybil attacks, the Arbitrum team has developed a series of quantitative rules to ensure that the recipients of airdrop rewards are real and eligible users. For example, for wallets that conduct all transactions in a very short period of time or have low balances and limited interactions, points will be reduced accordingly.

-

Data cleaning and cluster analysis: Arbitrum uses on-chain data to identify addresses controlled by the same user, and cleans data through partners such as Nansen, Hop, and OffChain Labs, using clustering techniques such as the Louvain community detection algorithm to accurately identify and exclude Sybil addresses.

The combined use of these mechanisms not only ensures the fairness and effectiveness of the airdrop, but also reflects Arbitrum’s deep commitment to community building and decentralized governance, setting a new benchmark for airdrop practices in the blockchain industry.

ENS: The innovator of Ethereum domain name service

Ethereum Name Service (ENS), as a key cornerstone of the Ethereum ecosystem, pioneered a human-readable domain name system in the decentralized network. ENS enables users to convert complex Ethereum addresses into concise and easy-to-remember domain names, greatly improving the user experience and increasing the popularity of blockchain technology.

ENS launched its highly anticipated airdrop event on November 9, 2021, which was cleverly designed to reflect the deep return to long-term supporters. The airdrop reward is proportional to the length of time the user holds the ENS domain name. This mechanism effectively increases the rewards for users who have grown with ENS for a long time, rather than simply based on the number of domain name registrations. In addition, for users who set up reverse resolution, that is, those loyal users who truly integrate ENS into daily blockchain operations, ENS provides double rewards, demonstrating the importance of actual use and rewards for deeply involved users.

Blur: A leader in professional NFT trading

Blur, a platform tailored for professional NFT traders, precisely meets the needs of professional traders with its Bloomberg-style professional interface. Blur has successfully attracted a large number of professional traders and flash traders in the NFT market by introducing advanced trading features such as call auctions and NFT protection mechanisms.

Blur’s first airdrop was held on February 15, 2023. Its airdrop mechanism is cleverly designed, showing a phased reward model and is carried out through a seasonal, continuous airdrop method. The main features include:

-

Phased incentive design: Blurs airdrop strategy adopts phased incentives, combined with a season system and continuous airdrops, to encourage users to continue to participate and be active at different stages.

-

Incremental incentive strategy: Blurs airdrop rewards increase in each round, bringing richer returns to users who join later.

-

Innovative Collection Bidding Feature: Blur’s exclusive “Collection Bidding” feature allows users to make a unified bid for the entire NFT series, effectively promoting the popularity of the new feature.

-

Liquidity incentives take precedence over trading volume: Blur’s token incentive mechanism focuses on incentivizing market liquidity and promoting the natural flow and completion of transactions.

Blurs airdrop mechanism is unique because it combines multi-dimensional strategies, not only in the distribution of tokens, but also in the detailed guidance and incentives for user behavior, as well as careful consideration of product features and market strategies.

IO: Pioneer in decentralized computing on the Solana blockchain

io.net, an innovative pioneer born from the Solana blockchain, is committed to unleashing the full potential of idle GPU resources and providing engineers and developers with the computing power they dream of. The projects grand blueprint is to build a decentralized physical infrastructure network (DePIN) as a solid foundation for technological innovation.

Starting from 19:00 on June 11, 2024, the IO project unveiled its highly anticipated airdrop ceremony. The highlights of its airdrop mechanism include:

-

Multi-dimensional scoring system: The IO project has adopted an innovative scoring mechanism that comprehensively considers key dimensions such as bandwidth, GPU model, and uptime to ensure the fairness and accuracy of reward distribution.

-

Destruction Deflation Mechanism: The project has implemented a destruction deflation strategy, using network revenue to repurchase and destroy $IO tokens, thereby increasing the scarcity and value of tokens.

-

Staking requirements: To ensure the robustness and security of the network, each node needs to stake a certain amount of IO tokens, which not only helps to lock the tokens in circulation, but also promotes the stability of the tokens and the long-term development of the network.

Although the IO projects airdrop strategy cleverly combines incentives and stability, aims to stimulate community vitality and maintain the value of tokens through deflation and staking mechanisms, its airdrop activities have also caused some controversy, mainly focusing on:

-

Airdrop points transparency: Some users have raised questions about the points statistics and distribution of the IO project airdrops, believing that there is a deviation between the earnings displayed by the platform and the actual situation, and called for improving the transparency of the points panel.

-

Technical issues and data accuracy: Community members have expressed concerns about the accuracy of the data displayed on the IO project frontend, with questions about average daily revenue, number of online clusters, and total computing time urgently needing answers.

-

Maintenance costs and anti-Syr measures: Users reported that the technical threshold and maintenance cost of participating in the IO project airdrop are high. The strict measures set by the project to screen Sybil accounts have increased the difficulty of operation and maintenance time for users.

-

Airdrop token allocation and management: Regarding the allocation and management of airdrop tokens, users expressed dissatisfaction with the ratio between the high expectations and actual returns of the invested capital costs, cloud service fees, and project tokens.

Blast: An innovative layer 2 solution on Ethereum

Blast, as a new layer 2 (L2) solution on Ethereum, focuses on opening up new value-added paths for users through its native revenue mechanism. The Blast airdrop event, which started in May 2024, marks that users can accumulate BLAST points through deposits and referral mechanisms, and then exchange them for BLAST tokens. The highlights of the Blast airdrop mechanism are:

-

Balanced token distribution: Blasts airdrop strategy will fairly distribute half of the total tokens to early adopters, and the other half to developers who contribute applications on the Blast platform, in order to encourage the prosperity and sustainable development of the ecosystem.

-

Dual incentive system: Blasts incentive mechanism fully covers those with sufficient funds and those who actively participate in the community, ensuring that each party can obtain corresponding Blast Points and Blast Gold rewards.

-

Automatic rebasing mechanism: Blast introduced an automatic rebasing function for ETH and its native stablecoin USDB, which enables users’ ETH balances to automatically map returns. This mechanism is unique among L2 solutions.

-

Full utilization of L1 staking income: Blast fully utilizes Ethereums L1 staking income through protocols such as Lido, automatically distributes it to users, and ensures the sustainability of income.

However, while the Blast airdrop activity has promoted the pace of innovation, it has also faced in-depth discussions and feedback from the community on its airdrop mechanism, mainly focusing on:

-

Complexity of the claiming process: Users need to watch a video and download a mobile app before claiming the airdrop, a process that some users consider cumbersome.

-

Disputes over share distribution: For users who pledge large amounts of tokens, the ratio of the airdrop value they receive to their investment has become the focus of community discussion.

-

Questions about fairness: Although Blast strives to balance the investment of funds and time through a points system, there are still concerns in the community about the fairness of airdrop valuation and distribution.

Merlin: A revolutionary innovation in Bitcoins second-layer network

Merlin Chain, as a revolutionary innovation of Bitcoins second-layer network, integrates key technical modules such as ZK-Rollup network, decentralized oracle network and fraud proof on Bitcoin chain. This not only greatly improves the performance and scalability of the Bitcoin network, but also injects new vitality into the native assets, protocols and application ecology on BTC Layer 1.

Merlin Chains airdrop event opens its doors to participants of the Merlins Seal event, with 20% of the tokens generously used for airdrops. The event mechanism is broken down into:

-

BTC native asset pledge: Users can pledge BTC, BRC-420 assets or BTC-20 assets to support the development of Merlin Chain and obtain M points.

-

EVM asset staking: Merlin Chain provides users who do not have BTC native assets with the opportunity to participate. Users can obtain native staking income by depositing assets on the Ethereum mainnet or Arbitrum.

-

Liquidity support: Users provide liquidity for Merlin Swap, which not only enriches the ecosystem of Merlin Chain, but also improves transaction efficiency by increasing the depth of trading pairs, while earning M points.

The Merlin Chain airdrop activity stands out for its unique attributes:

-

High airdrop ratio: 20% of the total tokens are used for airdrops, which is a particularly generous ratio for Layer 2 projects.

-

Combining staking with airdrops: By staking BTC native assets, EVM assets, or providing liquidity for Merlin Swap, users’ accumulated M points can be exchanged for MERL tokens.

-

M-Token Innovation: The pledged first-layer assets generate 1:1 mapped assets M-Token, which enhances the liquidity of assets and enables users to interact freely in the second-layer network.

-

Team profit improvement: The team mechanism allows users to increase profits through collective staking and maximize the points bonus.

-

Wide support for cross-chain assets: Merlin Chain supports cross-chain assets. Regardless of whether users hold BTC or EVM assets, they can participate in the airdrop activity.

Recent airdrop controversy

Recently, the highly-watched Zk Sync and Layer Zero projects have successively issued tokens, carried out airdrops, and listed on Binance. However, this has caused widespread controversy within the community. Users generally believe that in order to obtain these potential large airdrop rewards, they have invested a lot of time and energy, but many people have not received the due returns, and are not even eligible to participate in the airdrop.

Judging from the current situation, the long-term operation of these projects and the high expectations of users have led to the participation of a large number of users. The expansion of the user base means that if a sunshine airdrop is adopted, the amount allocated to each person will be very small, and may not even cover the users interaction cost. Therefore, users who aim to get airdrops have negative emotions about this situation.

The main complaints from users are that the airdrop rules are too strict, and many casual users are excluded. Some real users who have completed a lot of operations have only received a small amount of airdrop benefits. Next, we will review the entire process of these two airdrops and analyze the underlying reasons.

LayerZero Airdrop

As a highly anticipated full-chain interoperability protocol, LayerZero builds a bridge for information exchange between chains by transmitting arbitrary information between different chains, thus realizing the possibility of full-chain operation. Unlike cross-chain assets that only transfer tokens between different chains, LayerZero can directly initiate contract interactions deployed on chain B on chain A by deploying endpoint smart contracts on different chains to receive information, verify off-chain oracles, and transmit through relays. Since its establishment in 2021, LayerZero has been widely favored by capital and has received multiple rounds of investment of more than 200 million US dollars, including from multiple top institutions. However, LayerZero did not issue coins until June 2024, which attracted the attention of a large number of users who hoped to obtain token airdrops in the future through early interactions. As of the time of the coin issuance, LayerZero had more than 6 million users. Finally, after nearly three years of operation, LayerZero announced the issuance of platform tokens and airdrops in May 2024, and completed the airdrop snapshot. Although the airdrop expectations finally landed, it caused heated controversy.

The controversy mainly focuses on several aspects: the self-examination and reporting mechanism of witches, the opaque airdrop rules, and the official tough attitude of requiring mandatory donations to receive airdrops. We will sort out the entire airdrop process according to the timeline.

-

Anti-Witch Mechanism

After announcing the airdrop on May 2, LayerZero officially announced on May 3 that it would start a one-month witch review. In the current environment, due to the large number of gold-farming studios that specialize in making money, and many users interacting with multiple accounts in order to double the airdrop income, it is understandable that the project party conducts witch review and excludes the money-making party from the airdrop reward range. Although the studio has contributed a lot of interaction data and helped the development of the project to a certain extent, from the perspective of the long-term development of the project and the protection of loyal users, anti-witch is a move that has more benefits than disadvantages. The community does not oppose the witch review of the project party. In the past, there were also project parties that used clear rules to mark and reduce the airdrop amount of witch behavior or even exclude it. However, this time the community criticized the weirdness of the witch review system.

The witch review is divided into three stages: witch self-reporting, official review, and mutual reporting between users. In the first stage, users have 14 days to turn themselves in. If the user is not confident in their account and thinks that they may be marked as a witch, they can turn themselves in to the project party and retain 15% of the airdrop. However, if there is no self-reporting in this stage, and they are judged as witches by the project party in the next stage, they will lose all airdrops. At this time, users need to make a decision. If they think they are very likely to be witches, the best strategy is to self-report and take the bag. Because self-reporting only retains 15% of the benefits, from the expected value, as long as the user thinks that they have a probability of more than 15% that they will not be judged as a witch, it is worth a gamble to get a higher expected value. Therefore, when a user suspects that he is a witch, he is often indeed a witch. Although the official said that the witch self-reporting is aimed at the wool-pulling studio, not individual users, in our opinion, it is more like a target for wool-pulling users with multiple accounts. Because current projects will basically check for witches during airdrops, and large studios know this, they often have isolation strategies such as fingerprint browsers, independent wallets, and random transactions in different time periods. They are confident in their own strategies, so they are unlikely to expose themselves at this stage. During this stage, more than 338,000 addresses self-reported, and a total of more than 803,000 addresses were identified as witches, receiving 15% of the airdrops, and the remaining 85% will be distributed to other compliant users.

The second stage is the official review stage. In this stage, the official will conduct an internal review of common behaviors of Sybils based on specific rules. Users marked as Sybils in this stage will lose the right to receive airdrops.

The third stage is the most controversial, which is mutual reporting. In this stage, the authorities encourage community review and encourage users to report witch accounts. If the report is successful, the reporter can get 10% of the airdrop reward of the reported person, while the reported person will get nothing. Although the reporter clearly knows that this will harm the interests of the reported person, his behavior is profitable first, and secondly, anti-witch is a politically correct thing, which reduces the psychological pressure and moral condemnation of the reporter. For these reasons, the community actively reported in this stage, and a total of thousands of reports were submitted, involving a wide range of addresses, including the resigned LuMao studio employees reporting internal accounts, the addresses of the airdrop big holders of past projects being reported, and the users reports on LuMao big holders and KOLs. At this stage, most of the reports submitted by users were judged to be valid, so those who were reported paid money and interacted hard, but ultimately got nothing.

Finally, the month-long LayerZero witch hunt came to an end, and the results showed that among the 6 million LayerZero users, only about 600,000 met the final airdrop qualifications, and the rest of the addresses were excluded. This has greatly caught the witches among the users, screened the real users of the platform to a certain extent, and greatly reduced the scope of airdrops, so that more tokens can be airdropped to each user. However, one controversial point is that the project party blatantly took advantage of human nature and used each user as its own weapon, causing a war within the community.

-

Opaque airdrop rules

The one-month witch hunt before the airdrop sparked widespread discussion, and the second controversial point was its airdrop rules. After excluding witches, about 600,000 wallets were finally eligible for this airdrop. Of the airdrop tokens, 20.23 million were circulated on the first day, of which the official cross-chain bridge Stargate ecosystem users received a total of 10 million $ZRO, Pudgy Penguins and Kanpai Pandas NFT holders were each allocated 1 million airdrops, and the projects in the RFP each distributed the allocated tokens. According to the published airdrop results, tokens are mainly allocated based on the gradient of the number of interactions. More than half of the users will receive 50-100 tokens airdropped, while a small number of more than 100 users can receive up to 5,000 tokens airdropped.

The controversy mainly focused on the distribution of NFT holders, because Kanpai Pandas is not well-known in the community, and its holders can get this airdrop, which is questioned as a rat warehouse of the project party. However, it is worth noting that Kanpai Pandas has been operating, and the floor price is not low, and there has been no significant fluctuation before the airdrop. Whats more, the airdrop volume is not high relative to the total volume, and there is no sufficient basis to identify it as a rat warehouse. This may just be an outlet for the community to vent their dissatisfaction with the distribution results. In the final analysis, users are dissatisfied with the distribution results. From the results, the closing price of $ZRO on Binance on the first day was about US$3.4, and the total amount allocated for the entire airdrop was less than US$70 million, and more than half of the users only received less than US$340 in airdrops. Under the expectations of airdrops that were constantly created by the project party and VC in the early stage, user expectations were pulled very high, and a lot of energy and money were invested in this, but the expectations did not meet expectations after landing, resulting in a psychological gap. Ultimately, it is the long-term operation expectations of the project and the market value at the time of launch that cannot support this expectation bubble, leading to user dissatisfaction. This expectation is a good tool in project operation, which can use the air to make users work for free, but when it is ultimately not fulfilled, it will eventually cause the project to backfire.

-

Forced donations and a hardline approach

The final controversy came from the claiming stage. Before claiming the airdrop, eligible airdrop recipients must donate at least $0.1 multiplied by the number of tokens to Protocol Guild, the financing institution of Ethereum developers, in order to claim the airdrop. Although $0.1 is not much compared to the price of the ZRO token, the forced donation has caused strong dissatisfaction. In addition, users have to pay a considerable gas fee for this donation when interacting with the mainnet. Putting aside the opacity of donations, donations are spontaneous, and it is unpleasant to force donations in order to claim airdrops. After the community objected, LayerZero founder Bryan Pellegrino publicly responded that he had never forced anyone to donate, and if you dont want to donate, you dont have to claim the airdrop. However, this tough attitude is not accepted by the community, because users believe that the airdrop is what they deserve, not the charity of the project party, and they have contributed to the development of the project. Although Bryan Pellegrino later explained his views and vision on the project and airdrops, the community still did not buy it.

-

Our Review

Looking back at the entire LayerZero airdrop controversy, we believe that there are inevitable factors, but the projects strong attitude goes against the spirit of blockchain. The long-term expectation of project airdrops within the community has spawned the wool-pulling industry. From Uniswaps sunny airdrops to ENSs high rewards for loyal users, the community has reached a consensus that projects will send airdrops to early contributors. Star projects will inevitably attract studios and wool-pulling parties to participate. As a project party, in order to allow real users to get more tokens, anti-witch is an inevitable behavior. But the unsatisfactory point of the LayerZero project party this time is that it blatantly exploits human weaknesses. Although the effect is good, this unscrupulous means will make the community despise it. On the other hand, from the perspective of the project party, the airdrop expectation actually uses future potential incentives as a tool, which is an overdraft of the future. As a user, the decentralized spirit of Web3 means that users are not only users, but also early contributors to the project. It is the efforts of every user that drive the development of the project. As an early contributor, receiving airdrops is a reward and compensation for labor, not charity. The LayerZero projects tough attitude goes against the spirit of decentralization. It looks at users with a haughty attitude, believing that the development of the project is entirely the work of the project, not caring about the ideas and opinions of users, and even considering airdrops as charity. Even for Web2 projects, the project will listen to user opinions and give good explanations. However, as a Web3 project, LayerZero still has a strong desire for control, educates users, and regards airdrops as charity from the project to users.

ZkSync Airdrop

ZkSync is an Ethereum Layer 2 scaling solution that uses zero-knowledge proof technology to increase the number of executable transactions per second while maintaining the security of the Ethereum mainnet, thereby solving Ethereums congestion problem. Since its inception, ZkSyncs parent company has raised more than $250 million in total financing and is widely anticipated. ZkSync is known as the four kings of Layer 2 along with Optimism, Arbitrum, and StarkNet. Before June 2024, the other three projects had already issued tokens and the airdrops were relatively generous, so everyones attention was focused on this last king project. On June 11, 2024, ZkSync announced that it had completed the snapshot in March 2024 and would begin issuing token airdrops from mid-June, ending a four-year interactive run for users. However, the complexity and strictness of the airdrop rules caused widespread dissatisfaction within the community.

There are more than 6 million unique addresses on ZkSync. This airdrop will distribute all 3.675 billion tokens, of which 89% will be allocated to users and 11% to contributors. According to its rules, the final eligible addresses are about 695,000, accounting for about 10%. Compared with the airdrop rules of other Layer 2, ZkSyncs rules are more complicated and unconventional. This airdrop includes three aspects: eligibility multiplier, allocation multiplier and reward multiplier. At the same time, the minimum token requirements must be met and regular anti-sybil checks must be performed.

-

Eligibility

The first is the qualification multiplier. The official listed seven conditions. Each time a condition is met, one point can be obtained, which will be used as the first qualification multiplier. The second aspect is based on the average daily assets in the users wallet, which will give the second multiplier. It should be noted that if either the first point or the second point is 0, no airdrops can be obtained. The third is the reward multiplier. The official listed five conditions. If they are met, extra points can be obtained, but this multiplier will not be 0. The total amount of airdrops that users can get in the end is the multiplication of the three multipliers. At the same time, a minimum of 450 tokens must be met to obtain an airdrop, and the upper limit for a single account is 100,000 tokens, and the excess will be redistributed to the remaining users. Finally, the project party conducted a regular witch detection on eligible addresses. Mao Mao users often operate according to the rules of the past, but they failed in the face of this rule. The project party set a higher threshold to screen real users and reduce the ratio of Mao Mao Party to studio, resulting in many Mao Mao Party and shallow users being excluded, which caused conflicts.

Specifically, the seven conditions for the eligibility multiplier are:

-

Interact with ten smart contracts.

-

Add liquidity to DeFi and enable lending.

-

Use Paymaster to make five transfers.

-

Trade 10 ERC 20 tokens.

-

Hold the Genie Lamp NFT.

-

Before ERA went online, I was active on the Lite network for three months.

-

Donate to the Gitcoin project on the lite network.

Completing each condition can earn 1 point. These conditions are demanding and exclude most shallow users. For example, interacting with 10 smart contracts requires users to experience more than 10 DApps, increasing DeFi liquidity and lending tests users in-depth participation in the DeFi ecosystem, using Paymaster to make five transfers is relatively niche, and trading 10 ERC 20 tokens is difficult for ordinary users. Holding the magic lamp NFT and being active on the lite network for three months are rewards for loyal users. The seventh condition, donating to the Gitcoin project, is a test of users support for the ecosystem.

In contrast, the airdrop rules of Layer 2 projects such as Arbitrum more directly reflect the loyalty of users, such as cross-chain funds, transaction duration, number of transactions, transaction value, liquidity provided, etc. Although ZkSyncs conditions have screened out many freeloaders, they are too harsh and complicated, and may not be able to truly screen out real users. In addition, the official documents mention that even if you meet the above qualifications, you may not necessarily receive an airdrop, and the final decision-making power belongs to the official, which makes the rules more opaque and raises more questions.

-

Average daily balance (Allocation)

The second is the daily average balance multiplier. This multiplier is calculated by adding up the daily balance after the mainnet goes online, and then dividing it by the total number of days, that is, one year, to get the average daily balance. The rules state that the DeFi balance is doubled, which means that the amount of balance in the wallet and the holding time will greatly affect the total amount of the airdrop. A normal account balance will mostly exceed a few hundred dollars. If you start interacting from the launch of era, you can basically get a higher multiplier. The low-balance, multi-account hair-pulling party and the studio that transfers large amounts in and out are easily turned away. This rule is more reasonable. It not only screens out hair-pulling users and studios, but also incentivizes large accounts.

-

Reward Multipliers

The third is the reward multiplier, which has five conditions. Even if one condition is not met, it will not affect the total amount of airdrop. The conditions are:

-

Hold ZkSync native NFT.

-

Hold more than $50 USD of ZkSync native tokens.

-

Created abstract wallet.

-

Hold ARB/OP/ENS airdrops, where more than 50% of tokens have not been sold for more than 90 days.

-

Interacted with a smart contract with Gas Fee income of more than 100 ETH more than twice and was among the top 1000 interactors.

-

The first two items are understandable in supporting their own projects, and the third item is reasonable in promoting ZK-Rollup native function abstract wallet. The latter two rules are relatively demanding, but have little impact on the final airdrop. These conditions are acceptable as additional rewards for supporting the ZkSync ecosystem.

-

Our Review

In general, it is difficult to conduct airdrops with 6 million users. Users have a lot of loyal interactions based on the airdrop rules of other Layer 2 projects, making the screening more complicated and rigorous. Although the airdrop rules set a high threshold and screened out most users, it also caused dissatisfaction and doubts in the community. Dissatisfaction within the community may lead to an increase in distrust and doubts, which will have a negative impact on the long-term development of the project.

Where will airdrops go in the future?

After LayerZero and ZkSync released airdrops, in addition to criticism of these projects, there was also a voice within the community that airdrops are dead and ordinary people no longer have the opportunity to get rich through airdrops. In fact, with the development of blockchain technology and the market, it is inevitable that the early dividends of airdrops will gradually disappear. It will be increasingly difficult to see sunshine-like airdrops without witch censorship and thresholds like Uniswap in the future. Instead, witch checking has become a routine process for project parties, and even complex rules and DID verification will appear. This is because in the process of development, things often have loopholes, and when these loopholes are exploited by people with ulterior motives, things often cannot play their original role. Therefore, in order to prevent abuse, the rules will only continue to be improved and strict.

In this three-party game between VC, project owners and users, all parties are growing. The technology of LuMao Studio is becoming more and more mature, and LuMao members are constantly optimizing their boutique accounts, making the LuMao track more and more competitive. In order to make money, the cost of investment will only increase, while the expected returns will decrease. Large airdrops of early projects such as Uniswap will become increasingly rare, and the early dividends of this track are gradually disappearing. So, from the current perspective, how should we as users respond? We need to stand at a higher dimension to examine and analyze the current environment, and bring ourselves into the perspective of the project owners. If I were the project owner, in the current environment, how would I optimally allocate my airdrop tokens? In this way, we can better participate in the next project. At the same time, we must also adjust our mentality, accept the reality of missing out on early dividends, and stay calm when dealing with projects that have put in effort but have not achieved good results.

Looking back at the airdrops of these two major projects, the main contradiction at present lies in the imbalance between the communitys expectations for airdrops and the projects airdrop strategy. It has become a consensus within the community that each project will airdrop to participants or contributors. Users believe that the development of the project is inseparable from their participation, and airdrops are a reward for their hard work, rather than a reward from the project to early contributors. From the perspective of the project, airdrops are just a means. The project rewards early contributors through airdrops as a means of community building, project development and token dispersion. In the eyes of strong project parties, airdrops are a reward, not a reward for users. The project party needs to balance the price and market value of the token when it goes online, so as to balance the total token value that the airdroppers can get and the price and willingness of secondary market investors to buy tokens. Under the premise that the total value of the airdrop is fixed, the project party needs to think about how to reasonably distribute the token share of each participant. If the distribution group is too large, the total amount each user gets will be lower; if you want to ensure that users can get a satisfactory airdrop, you need to limit the number of eligible people. In addition, the project party also needs to consider how to reasonably distribute the proportion of participants with different contribution levels. The current mainstream practice is to first check the witches and exclude fake users who only want to get airdrops from the airdrop list, and then allocate different amounts of token airdrops through points based on the users contribution.

When the past methods are known to everyone and copied and become ineffective, we can no longer simply copy the rules of a project to a new project to obtain qualifications, but should jump out of the vision of the majority and predict the behavior of the majority and the possible rules of the project party in advance. Lets go back to the first principles and analyze what factors will affect the share of airdrops. The first must be the financing situation of the project. Although the community is currently resistant to VC projects and is more embracing of Meme projects, if we are starting for airdrops, a project with high financing has a better chance of developing to the coin issuance stage, and it is also more likely to have a higher market value when issuing coins. Without considering the project partys pattern and the airdrop allocation ratio, the overall airdrop amount will be higher. However, such projects are often accompanied by higher attention, which means that more competitors are trying to divide up this big cake, resulting in more involution as a whole.

Therefore, the best way is to ambush projects that have raised a lot of money but have not received much attention. In such projects, you can deploy multiple accounts to get low-level airdrops without witches. Such projects are often not so involuted, and the project owners do not need to screen out many users. They often give low-level accounts a constant minimum airdrop. For projects with huge financing amounts and explosive popularity, such as ZkSync and LayerZero, it is not completely impossible to participate, but it is necessary to control costs and expectations, and figure out the rules while doing a good job.

The control of expectations lies in no longer accepting PUA from the project party. For those project parties that have long overdrawn token airdrops to the present as a marketing tool, and whose various rules are ambiguous and have been delaying the announcement of details and the issuance of tokens, we should not expect them to have a big vision. How will such project parties treat community supporters when issuing tokens? It is extremely important to judge the behavior and motivation of the project party. Users are not fools, and every behavior and speech of the project party will be seen. Therefore, control expectations and costs, and give up when it is time to give up, or at most change a project. For suitable projects, if they are very competitive, you have to speculate on the intentions of the project party and even use on-chain data analysis. For projects with a large number of users, the distribution model often screens out most low-value users, and then distributes the remaining users, setting a minimum guarantee and an upper limit, which may be relatively linear in the middle. On the other hand, the project party will tend to support its direct income or liquidity, that is, to support the internal ecosystem. From these two perspectives, it is recommended that users treat such projects, consider a small number of boutique accounts based on the amount of funds, and truly support the corresponding calls of the project party to ensure that they can obtain airdrop quotas and not be wiped out. If you think the project party is constantly PUAing and the investment is not proportional to the expected output, you should boldly abandon the project.

This article is sourced from the internet: After the LayerZero and ZkSync airdrops: It’s time to pause, review, and rethink the future of airdrops

Tác giả gốc: Cobie Bản dịch gốc: TechFlow Bài đăng này sẽ thảo luận về chủ đề ra mắt token mới, tập trung vào các câu hỏi và hiểu lầm phổ biến về token mới trên thị trường, thường được gọi là lưu thông thấp, FDV cao. Trước khi bắt đầu – nếu bạn bối rối về những gì tôi nói trong bài đăng này, tôi đã viết một bài báo vào năm 2021 có tên là Market Cap and the Unlocked Myth có thể giúp bạn. Như mọi khi, hãy nhớ rằng: Tôi không phải là cố vấn tài chính, tôi là một con người thiên vị và có nhiều khuyết điểm, tôi đã bị tẩy não, tôi là một kẻ ngốc, tôi đã qua thời kỳ đỉnh cao về mặt tinh thần và bước vào những năm tháng hoàng hôn, và tôi loay hoay trên thế giới để cố gắng hiểu tất cả mọi thứ, nhưng không thành công. Trên thực tế, tôi là một người tham gia vào…