Báo cáo hàng tuần về thị trường tiền điện tử của Frontier Lab 锝淲28

BTC and ETH this week overview

Market performance

The Crypto market is in a volatile trend this week and still lacks a money-making effect. At the same time, the market lacks hot spots and the overall price performance is poor.

Key Events

Mtgox compensation incident

-

Overview: The Mtgox bankruptcy compensation plan has been announced, and it is planned to distribute BTC and BCH to victims within 3 months. Currently, there is no new change in the total number of BTC in the on-chain addresses.

-

Analysis: With the announcement of the compensation plan of Mtgox, the market has begun to digest the negative impact brought by Mtgox. Although the price of BTC is still below 600 million US dollars, it has begun to show signs of stabilization. It is expected that the impact will decrease with the passage of time.

German government sells off BTC

-

Overview: This week, the German government鈥檚 BTC sales have exceeded 65%, and the number of BTC held by the German government has dropped from 50,000 to 9,094.

-

Analysis: As the number of BTC held by the German government decreases, the market fear has eased. The impact of several thousand to ten thousand BTC transferred into the market every day has become smaller and smaller. In addition, the daily net inflow of US ETFs has remained above 4,000 this week. It can be seen that the current price of BTC is attractive to market investors. According to the selling speed, the selling will be completed around next week.

ETH spot ETF approval is expected to be approved next week

-

Overview: The market has adjusted the expected time for the approval of the ETH spot ETF to before July 15, but the markets hype about the ETH spot ETF has declined.

-

Analysis: The ETH/BTC exchange rate has risen this week, indicating that ETH is stronger than BTC this week. The main reason is that investors in the market are betting that the ETH spot ETF will be approved next week. However, after it is approved, it is very likely that Grayscale will continue to outflow after the BTC spot ETF is approved, which will have an impact on the ETH price.

US June CPI annual rate

-

Overview: The U.S. unemployment rate (annual rate) for June, released Thursday night, was 3.0%.

-

Analysis: The CPI data released this time is much lower than 3.4% in May, and even lower than the expected value of 3.1%, indicating that the US CPI is cooling down rapidly. In addition, Powell made it clear during his work report on Capitol Hill on Wednesday and Thursday that the Fed will not wait until the CPI drops to 2% before starting to cut interest rates. As a result, the market has now fully priced in 2024 interest rate cuts as 2 times, and some traders have even started betting on 3 times. Although there are positive data, market prices have not risen due to the positive data, and even US stocks have fallen.

Altcoin Weekly Overview

Overall performance

From the chart, we can see that although the market sentiment is still in a panic stage this week, it has rebounded compared to last week, mainly because the negative factors in the market have been gradually digested and the macroeconomic data has gradually improved, and investors confidence in the future has gradually recovered. However, it should be noted that the impact of Mtogx and the German government has not dissipated, and there will still be a certain panic in the market, so it is not appropriate to be too optimistic now, and we still need to pay attention to the trend of the Mtgox compensation incident.

Overview of the Rising Stars

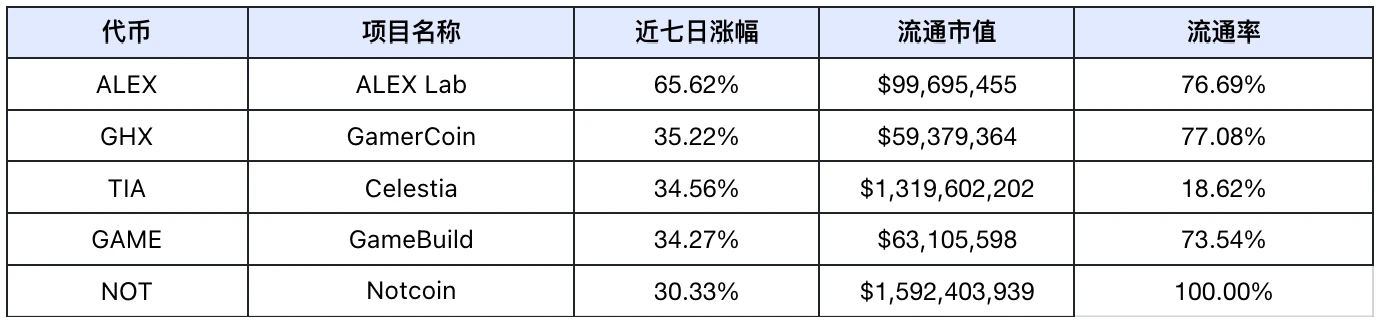

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: coinmarketcap

The list of rising tokens does not show the characteristics of sector concentration. The rising tokens are scattered across various sectors, and the increases are all higher than last week. It can be seen that Altcoin showed good signs of rebound this week.

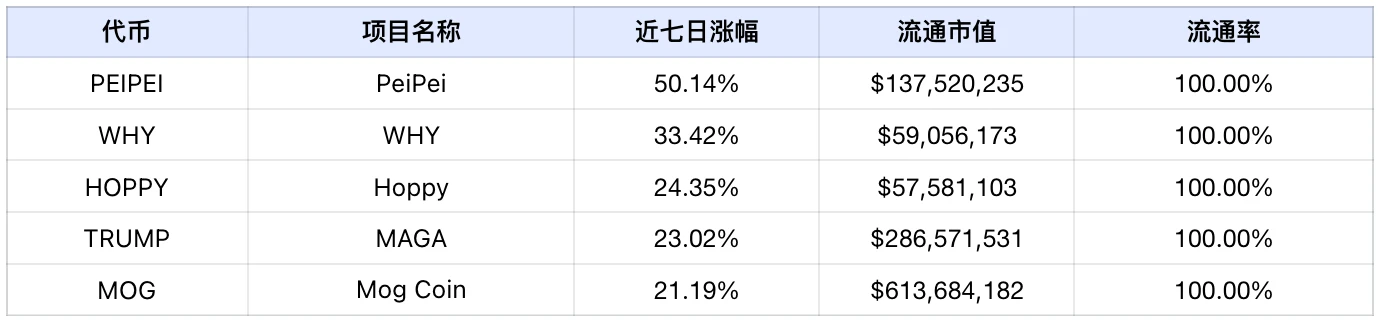

Meme Token Gainer List

Data source: coinmarketcap.com

The market showed a volatile trend this week, and the Meme track received less market attention. Compared with last week, this weeks increase continued to show a downward trend.

Xã hội Media Hotspots

Based on the top five daily growth in LunarCrush and the top five AI scores in Scopechat, the statistics for this week (7.6-7.12) are as follows:

The most frequently appearing theme is AI, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: lunarcrush and Scopechat

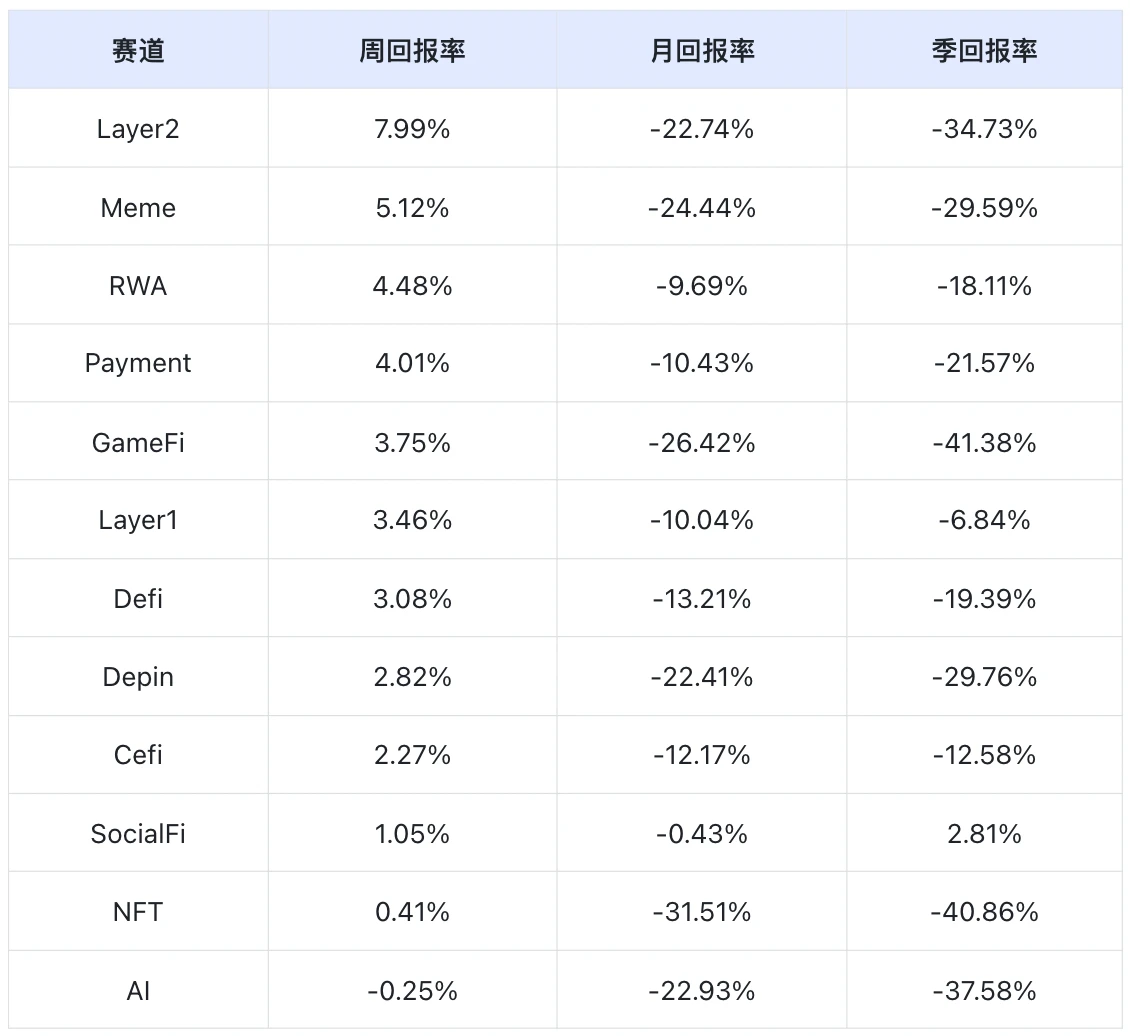

Subject tracking

Data source: SoSo Value

From the above table, we can see that according to the weekly return rate, the best performing track is the Layer 2 track, and the worst is the AI track.

The Layer 2 track includes BTC-L2 and ETH-L2. Because the return rate of BTC-L2 and ETH-L2 this year can reach more than 50%, the increase is relatively large compared with other tracks, so they have followed the market in a large correction in the past two weeks, and even most of the tokens have been cut in half. It is also because of the huge decline in the previous few weeks. After the market stabilized this week, the Altcoin sentiment quickly rebounded. Among them, the Layer 2 track was the first to rebound significantly, and almost all tokens showed positive growth this week. Therefore, the Layer 2 track performed best this week only because of its rebound after a large decline before, and it still needs to be observed in the future.

Except for the IQ token, the AI track is in a downward trend this week. This is mainly because most of the tokens in the AI track are VC tokens, and the unlocking event of WLD has caused market investors to express strong dissatisfaction with it.

Crypto News Next Week

-

Tuesday (July 16) U.S. June retail sales monthly rate; BEVM computing power RWA ecological brand conference

-

On Wednesday (July 17), Democratic U.S. Congressman Ro Khanna hosted a Bitcoin roundtable

-

The ECBs main refinancing rate rose on Thursday (July 18).

-

On Friday (July 19), the South Korean State Council passed the executive order of the Virtual Asset User Protection Act.

-

Sunday (July 21) ETH Global Paris

Outlook for next week

-

Bitcoin: The Mtgox incident has been determined to be compensated gradually within 3 months. The number of BTC held by the German government has been reduced to 9,094. The sell-off is expected to end next week. The negative factors in the market are gradually decreasing in the short term. What still needs to be continuously monitored is the compensation situation of Mtgox.

-

Ethereum: The market has adjusted the time for the ETH spot ETF to before July 15. At that time, we will pay attention to whether S 1 of the spot ETF will be passed.

-

Altcoin: As the main negative factors in the market have decreased and because Altcoin was previously in an oversold state, it is very likely to continue to rebound next week.

This article is sourced from the internet: Frontier Lab Crypto Market Weekly Report锝淲28

Related: Exploring re-staking: Overview of Symbiotic, Karak, and EigenLayer

Original author: @poopmandefi Original translation: Alex Liu, Foresight News If you are interested in Restaking or AVS (Active Verification Service), this article will briefly compare @người bản địa , @symbioticfi and @Karak_Network and introduce related concepts, which should be helpful to you. What is AVS and re-staking? AVS stands for Active Validation Service, a term that basically describes any network that requires its own validation system (e.g., oracles, DAs, cross-chain bridges, etc.). In this article, AVS can be understood as a project that uses the re-stake service. Conceptually, re-staking is a way to re-use already staked ETH for additional validation/services to earn more staking rewards without having to unstake it. Re-staking usually takes two forms: Native Re-staking LST / ERC 20 / LP re-staking By restaking, restakers and validators can secure thousands…