Nghiên cứu 10x lại chỉ ra con đường: Lần này chúng ta sẽ xem xét 60.000 trước, sau đó là 50.000

Original: 10x Research

Biên soạn bởi: Odaily Planet Daily ( @OdailyTrung Quốc )

Translator: Azuma ( @azuma.eth )

Six Ethereum spot ETF issuers have filed updated S-1 forms, meaning the U.S. Securities and Exchange Commission (SEC) could give final approval for Ethereum spot ETFs at any time. Meanwhile, cryptocurrencies appear to be on a rebound this week , a rebound we predicted in our report last weekend, driven by expectations of lower-than-expected U.S. CPI data on Thursday.

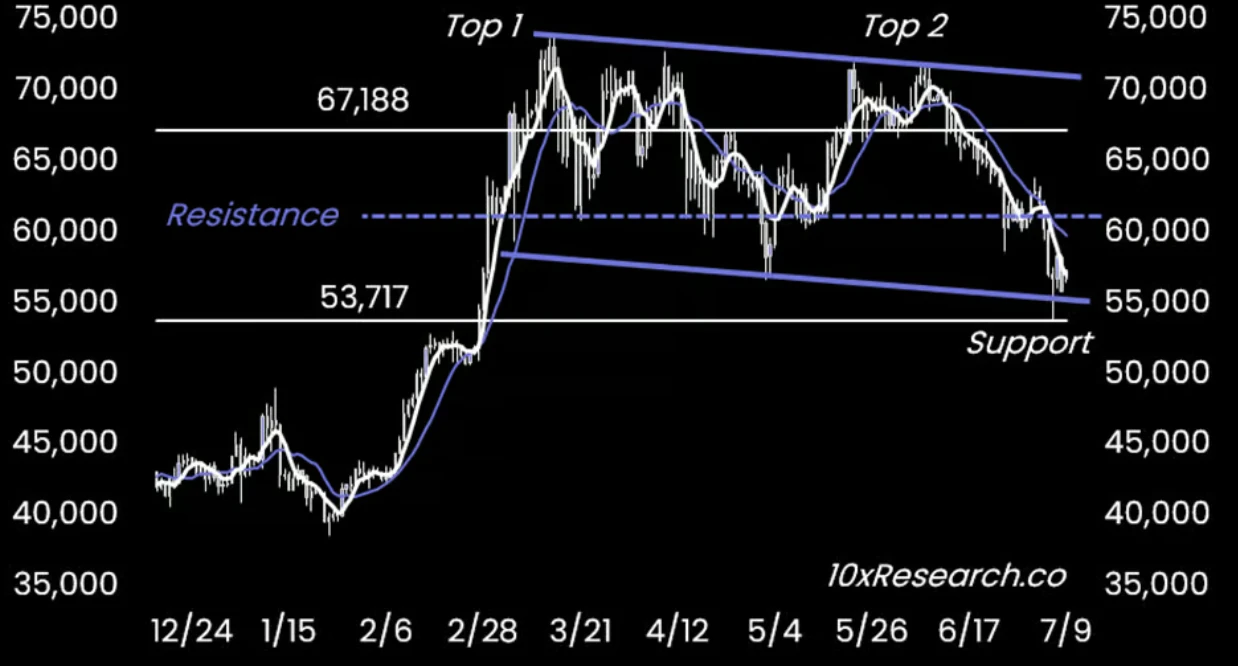

Oversold indicators show that the market is looking forward to a possible small-scale rebound, which means that the market trend will reverse in the short term. At present, two of the three reversal indicators have shown bullish signals, and the RSI (Relative Strength Index) is temporarily reported at 38%, which means that shorts may also need to wait and see until the price of Bitcoin encounters resistance in the price range of $60,000 to $62,000, which will lead to another downward trend.

From a technical analysis perspective, the price range of $55,000 to $56,000 is forming a support level. However, considering that the medium-term technical pattern has deteriorated, we predict that this will only be a short-term rebound and will not last long. It is particularly important to note that the recent trend of Bitcoin falling during Asian trading hours and performing relatively well during European and American trading hours continues.

Despite a 20% drop in the price of Bitcoin over the past 30 days, Bitcoin futures traders have remained relatively bullish since May 20, when expectations for the approval of an Ethereum spot ETF increased. Since then, Bitcoins open interest has grown from 260,000 BTC to 305,000 BTC, temporarily reported at 277,000 BTC, but Bitcoins price has fallen from $66,000 to $57,000 over the same period; Ethereum is in a similar situation, with open interest increasing from 2.6 million ETH to 3.1 million ETH, although the trading price has remained largely unchanged at around $3,068.

Since May 24, the negative premium of Grayscale Ethereum Trust鈥檚 net asset value (NAV) has shrunk significantly to only -1.5%, which has narrowed significantly from the peak (-60%) in December 2022, mainly due to the expectation that the Ethereum spot ETF will be approved soon. Grayscale Ethereum Trust has a total asset management value of approximately US$9 billion, and the transformation of this ETN to an ETF means that investors will be able to redeem their shares freely.

Once the Ethereum spot ETF begins trading, Grayscale redemptions could cause significant selling pressure, similar to what happened with the Grayscale Bitcoin Trust (GBTC) in January 2024. GBTCs assets under management have fallen by 47% since the Bitcoin spot ETF opened for trading. It is predicted that Grayscales outflows could offset the inflows of the other five ETF issuers.

Therefore, although the current price of ETH is still similar to when the SEC expressed its intention to approve it, there may still be a potential good news is out when the S-1 is approved. In the case of ETH, open interest in the futures market shows a strong bullish attitude towards ETH, and potential Grayscale outflows may affect market trends again.

A similar pattern exists for Bitcoin, where inflows into spot ETFs precede CPI data releases. Bitcoin ETFs saw net inflows of $295 million on Monday, following $143 million in net inflows last week. This corresponds to the 20 consecutive days of $4 billion in net inflows observed during the May and June CPI data releases, though it is important to note that after the June CPI data release, Bitcoin ETFs saw net outflows of $1.2 billion.

The market expects the CPI data to be released on July 11 to drop to 3.1%, which is in line with our conjecture and the markets rebound expectations. If the core CPI can drop by 0.2% month-on-month, it is expected to still affect the price trend of Bitcoin. However, potential selling pressure from the German government, Mt.Gox and the upcoming Bitgo cannot be ignored.

The news that FTX creditors may receive about $16 billion in compensation has attracted widespread attention in the market recently. However, many of FTXs claims have actually been acquired by professional bankruptcy claims agencies, which only focus on the recovery expectations and arbitrage space of the claims themselves, and are unlikely to reinvest the received US dollars in the cryptocurrency market . We estimate that the scale of funds flowing back into the market may be between $3.2 billion and $5 billion. In addition, when FTX was liquidated in November 2022, the price of Bitcoin was about $16,800, and now it is $57,000. The current pullback is not an attractive discount for FTXs creditors.

The deadline for FTX customers to vote on the bankruptcy liquidation plan is August 16, and the relevant hearing will be held on October 7, when Judge Dorsey will consider whether to approve the plan. It is worth mentioning that overseas creditors may face a tax withholding of up to 30% when they finally pay.

In summary , we expect that Bitcoin will likely rebound to around $60,000 first, and then fall to a low of around $50,000 again , after which the market will enter a relatively complex trading environment. By then, we expect the market to gradually digest the selling pressure from the German government and Mt.Gox from a psychological level, which will pave the way for some subsequent bullish events, such as the expected changes in FTX claims in mid-August, and the potential impact of the upcoming US election on Bitcoin.

This article is sourced from the internet: 10x Research points the way again: This time we鈥檒l look at 60,000 first, then 50,000

Related: Solana Funding Vortex: Why Rug Puller Is Losing Money?

Original author: CertiK On the evening of May 13, 2024, the CertiK team detected a suspicious address on the Solana chain: 9ZmcRsXnoqE47NfGxBrWKSXtpy8zzKR847BWz6EswEaU (hereinafter referred to as Xiaojiu) From May 12 to 13, Xiaojiu initiated about 64 rug pulls on the chain, one every few minutes. In less than 24 hours, Xiaojiu lost a total of 272 SOL, worth about $45,900. 01 High investment and low return: Uncovering Xiaojiu’s operating methods So how did Xiaojiu do it? Let’s take the last meme TWS deployed by Xiaojiu as an example. At 4:05 UTC on May 13, Xiaojiu minted 99,999,999 TWS. At 13:18, Xiaojiu deployed a TWS/SOL liquidity pool on Raydium, injecting 98,999,999.99 TWS and 1 SOL; then, he immediately used 4 SOLs to pull the market. At 13:22, 4 minutes later, Xiaojiu…