Original title: Our Thoughts on the ETH ETF

Original author: Kairos Research

Bản dịch gốc: Ladyfinger, BlockBeats

Ghi chú của biên tập viên:

This article deeply analyzes the potential market impact of the ETH ETF, exploring Grayscale’s concerns about premium burden, listing conditions that differ from BTC ETFs, US market demand proxies, and long-term impacts on the DeFi ecosystem, while emphasizing the interaction between price, usage, and narrative.

Giới thiệu

Regarding the expectations for ETH ETF, our views are briefly summarized as follows:

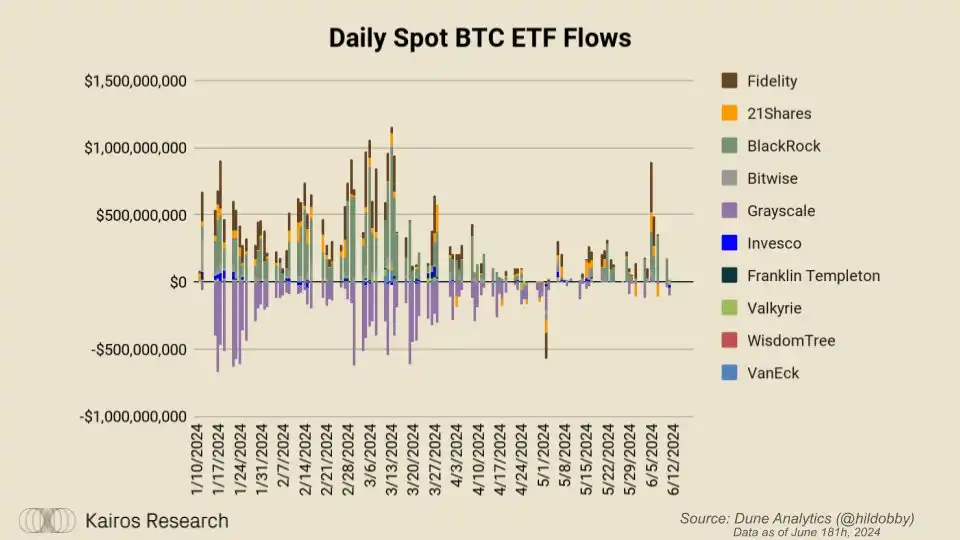

By most measurable data points, BTC ETFs have been a huge success. To date, we have seen approximately $15 billion in net inflows across approximately 260,000 BTC. The volume of these ETFs has also been phenomenal, with 11 ETF products doing cumulative volume of $300 billion since they began trading in early January. Now, the second-largest crypto asset is having its moment in the spotlight. We don’t predict flows, but here’s our take on how they will impact the ecosystem more broadly.

In this post, we’ll cover:

Grayscale’s concerns about premium burden

Different listing conditions than BTC

Demand Agent

Impact on DeFi

Grayscale’s concerns about premium burden

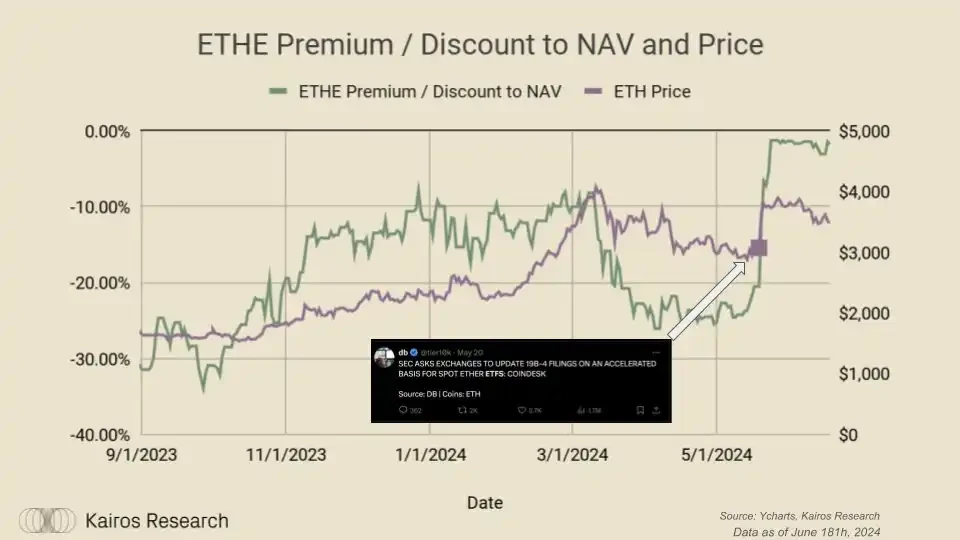

This has been noted by others before, and for good reason. We think there are several reasons that would cause someone to be a seller when an ETH ETF is launched. When looking at ETHE’s discount to net asset value (NAV) until its final approval and conversion, ETHE traded as low as -56%. Additionally, if a similar pattern continues with ETHE to GBTC, we will likely see management fees translate into higher expense ratios than the closest competitors. Currently, ETHE has a 2.5% management fee, while Van Eck and Franklin Templeton have fees around 20 basis points. We expect other issuers’ fees to be around these levels as well. If sellers are purely motivated by achieving lower management fees, then it will likely only be offset by net inflows into different products. In summary, the two main types of sellers we expect are:

Sell due to high fees relative to other issuers

Selling in order to realize a profit from purchasing a product at a discount

Despite the heavy selling from Grayscale, we are still seeing net inflows into the ETF overall, both in USD and BTC.

Different listing conditions from BTC

The Bitcoin ETF was probably the most anticipated ETF launch of all time, if not the most anticipated one. But despite the gossip and discussion from Bloomberg analysts, it all came down to Grayscale’s major SEC breakthrough, announced on August 29th, which was followed by a 30% rise in GBTC and a slow return to its true net asset value. Despite false news from Cointelegraph interns, the SEC’s Twitter account being hacked, etc., the ETF was eventually approved on January 10th. All of this means: all potential stakeholders had plenty of time to prepare for this event.

However, when we look at the preparations for the Ethereum ETF, we find that the situation is almost the exact opposite. There was almost no market discussion until March 20, and on that day, Bloomberg analysts raised their odds from 25% to 75%. On the same day, the news that the SEC required exchanges to prepare for spot Ethereum ETFs was confirmed. Subsequently, the ETHE price soared, and three days later, the listing was officially approved. Since then, ETHE has returned to a level close to its net asset value.

So, what’s the big deal here? Clearly, a lot of people were caught off guard by this. From the ETF issuer’s perspective, they didn’t have enough time to educate their clients about Bitcoin. However, this may vary from case to case, but it’s clear that the Bitcoin ETF has received a lot of media attention. Finally, for some capital allocators, launching such a high-profile product at the beginning of the year as a kickoff to their annual performance is obviously a smart strategy. This may mean that inflows are slower than Bitcoin because more education time is needed, or vice versa; people may rush in madly because of the huge success of the Bitcoin ETF. In either case, I think investors will find Ethereum to be a more attractive digital asset.

Demand Agent

There are some who claim that there is little to no interest in an ETH ETF. While there is little data to support this claim, there is a lot of data to suggest that the West, and specifically Americans, have shown a huge appetite for ETH to date. For example, while Binance is the largest centralized exchange by user base and trading volume, Coinbase owns more than 1.4 million ETH (over $4.75 billion). To further illustrate this point, Kraken, Robinhood, and Gemini (all US exchanges) own more ETH than OKX, UpBit, Bybit, BitThumb, and Crypto.com combined, with a surplus of 1.2 million ETH. According to ethernodes.org, 34% of Ethereum nodes are run in the United States. What we are really saying is that Americans love ETH, they have for some time, and we expect this trend to continue and strengthen with the launch of a spot ETH ETF.

Impact on DeFi

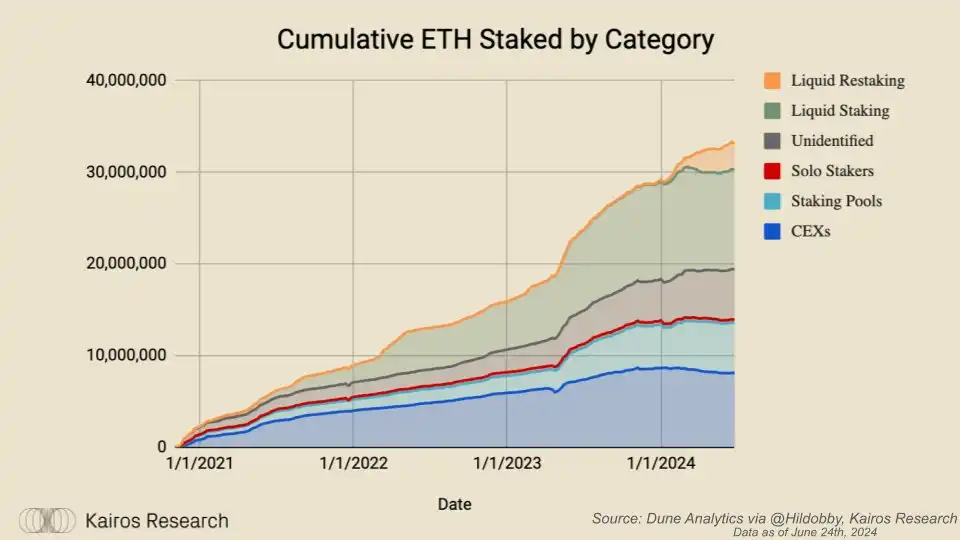

You can have your own opinion about what the flow of funds will look like in the short term, but in the medium to long term, we believe that the flow of funds will have a significant impact on the entire Ethereum supply. In @rewkang s article, he pointed out that Ethereum does not have structural buyers like Bitcoin (Saylor, Tether, whales), however, Ethereum does have important structural supply differences.

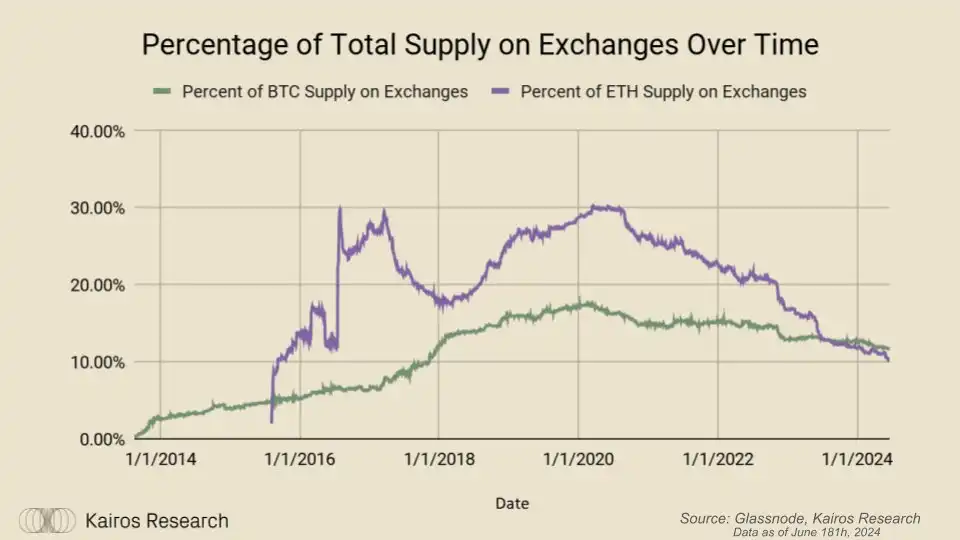

For example, when looking at ETH’s supply, it shows a consistent decline in the percentage of total supply held on exchanges, even below that of Bitcoin. Even more interestingly, the downward trend in supply on exchanges aligns almost perfectly with the launch of Uniswap v2 in May 2020.

Despite Ethereum’s wild price swings, this trend seems to be holding true

Furthermore, staking alone accounts for 27.57% of the entire ETH supply, which is more than any single entity in BTC in terms of percentage. Add in all the ETH locked in the canonical L2 bridge, and the ETH in the wrapped ETH contract, and you have over 32.33% of the entire ETH supply. This is all part of a larger trend.

DeFi has only been around for 5 years, and as liquid staked tokens and liquid re-staking tokens become the preferred tokens for DeFi users, this will take more ETH off exchanges and lock it in staking contracts, further decentralizing ETHs spot liquidity. Play for another ten or twenty years and ask yourself what will happen in the end. In addition, the more ETH is liquid staked or liquid re-staking, the more reflective the on-chain economy will be.

Overall, we don’t think we have an advantage in predicting the dollar amount of fund flows, but we think the reasons above give us a rough idea of the impact that an ETH spot ETF could have on the general supply pool of ETH as an asset, and on attracting more investor interest in tokens and on-chain economies. In the end, remember that price drives usage, usage drives narrative, and then narrative drives price. We continue to closely monitor the impact of these structured products on ETH broadly.

This article is sourced from the internet: How is the Ethereum ETF different from the Bitcoin ETF?

Next weeks highlights ZK Nation: ZK airdrop will be available on June 17th ; LayerZero will release an updated list of witches on Monday ; Nostra will conduct a TGE and airdrop on June 17 ; Renzo Co-founder: It is expected that users can request withdrawals on June 17/18 ; Lista DAO: TGE and airdrop will start on June 20 ; Starknet Foundation: The STRK airdrop claim window will close on June 20th . From June 17 to June 23, more noteworthy events in the industry are previewed below. June 17 Tether CEO: Plans to launch new types of digital asset products on June 17 Odaily Planet Daily News: Tether CEO Paolo Ardoino announced on the X platform that after a year of hard work, Tether will launch a new…