Tâm điểm thị trường chuyển sang dữ liệu PCE của Hoa Kỳ, BTC dao động ngang

Tác giả gốc: Mary Liu, BitpushNews

Crypto markets traded sideways on Thursday as investors await tomorrow’s report on personal consumption expenditures (PCE), the Federal Reserve’s preferred inflation measure.

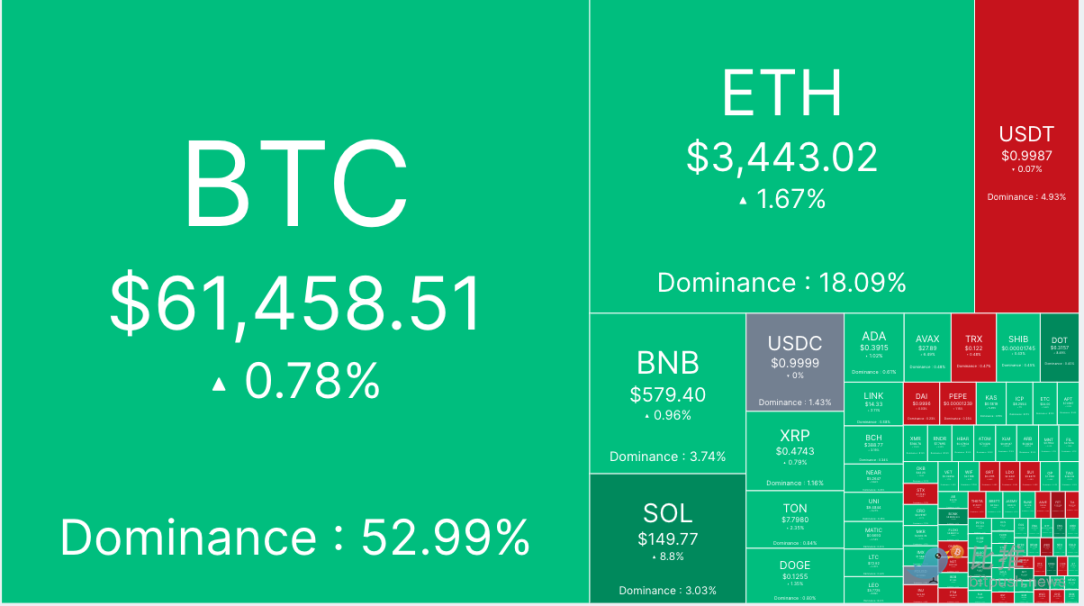

According to Bitpush data, the long and short positions of Bitcoin are evenly matched, with the trading price fluctuating between US$60,500 and US$62,500. As of press time, the transaction price was US$61,458, a 24-hour increase of 0.8%.

Altcoins rose, with most of the top 200 tokens by market cap seeing gains. Mog Coin (MOG) led the gains with a 31% gain, followed by SATS (1000 SATS) with a 16% gain, and Book of Meme (BOME) with a 15.6% gain. Three AI-related tokens led the declines, with Fetch.AI (FET) down 13.3%, Ocean Protocol (OCEAN) down 11.8%, and SingularityNET (AGIX) down 11.4%.

The current overall market value of cryptocurrencies is $2.29 trillion, and Bitcoin’s market share is approximately 53%.

As for U.S. stocks, as of the close of the day, the SP and Dow Jones indexes both rose 0.09%, and the Nasdaq index rose 0.30%.

In addition to macro data, crypto investors focus on Biden-Trump debate

The U.S. personal consumption expenditures price index for May is due on Friday, with investors hoping the report will show some easing in price pressures, providing evidence that the Federal Reserve could cut interest rates later this year.

Additionally, crypto traders are also closely watching the upcoming Biden-Trump presidential debate at 9 p.m. EST. It is unclear whether the two candidates will mention crypto during the debate, but the election results could have a significant impact on the cryptocurrency industry.

BitPush previously reported that Standard Chartered Bank predicted in a report that if Trump wins the election, Bitcoin will rise to a record high of $150,000.

Investors Return to Spot Bitcoin ETFs

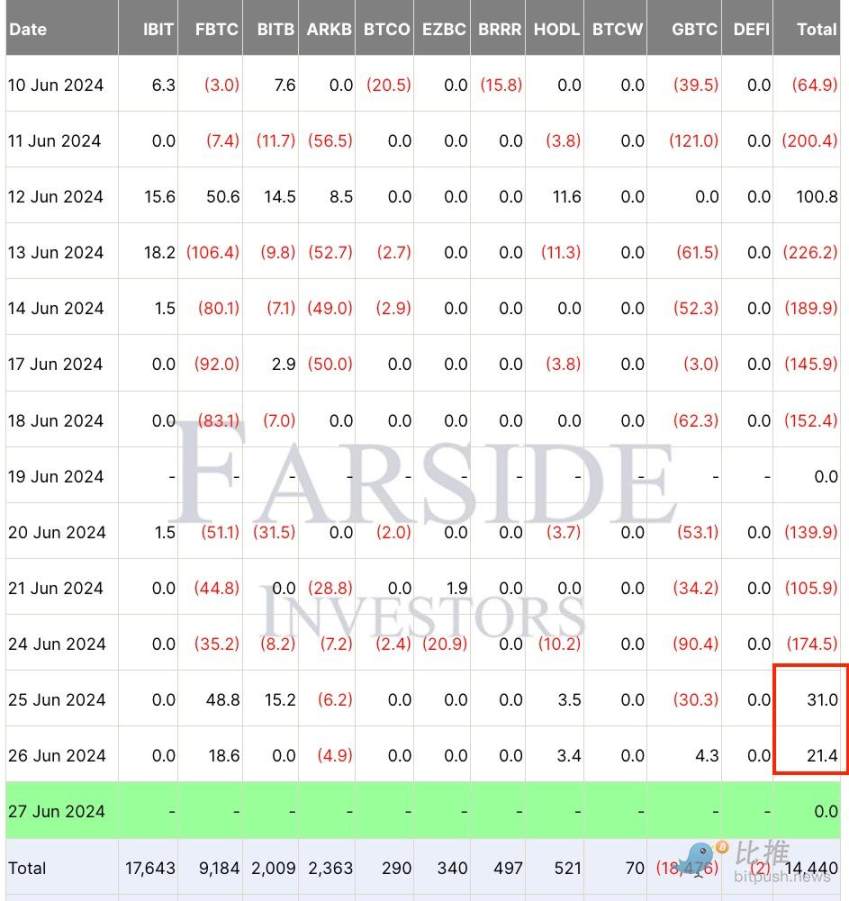

Data from Farside Investors shows that after seven consecutive days of outflows from U.S. spot Bitcoin ETF investment products, spot Bitcoin ETF fund flows turned positive in the past two days, recording net inflows of $31 million and $21.3 million on June 25 and June 26, respectively. As of June 26, the value of BTC managed by these funds was approximately $52.61 billion, up from $47 billion at the beginning of May.

At the same time, VanEck, one of the first spot Bitcoin ETF issuers in the United States, applied to issue a new Solana ETF. The company also submitted the first Ethereum ETF application in 2021.

Although industry insiders say the Solana ETF has little chance of being approved this year, the development highlights the growing acceptance and adoption of Bitcoin and other cryptocurrencies in the traditional financial sector, helping to drive up crypto market valuations.

Analyst: Bitcoin Could Return to $50,000

Crypto strategist Benjamin Cowen touched on the possibility of further lower prices, saying on his podcast that Bitcoin could return to the $50,000 range in a possible “summer slump.”

“It’s possible that we could have a much deeper correction, back to around $50,000,” Cowen said. “I do think that’s definitely a possibility. In the previous cycle, after we peaked in 2019, we ended up having a correction of about 50%. Even in 2016, there were some larger corrections, like 30% and 40%.”

However, Cowen acknowledged that volatility is expected to decrease as the asset class matures. “You may also see volatility decrease and the cycle continues because more and more money is needed to drive prices higher,” he said.

Analysts at Secure Digital Markets believe that BTC is currently testing Tuesday’s highs, with the next upside target being $65,000, with strong support at the $60,200 level.

“For altcoin traders, a close below $60,000 can only mean one thing: a painful summer ahead, otherwise, joyous times ahead,” analyst Bloodgood said on the X platform.

The adjustment may last five months.

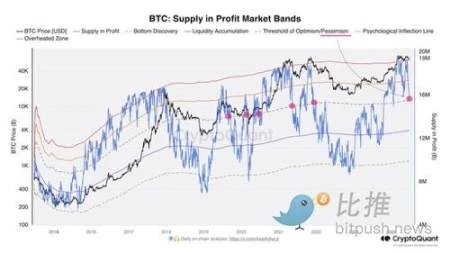

Axel Adler Jr., an analyst at on-chain analysis platform CryptoQuant, talked about how long it will take for BTC prices to adjust from its all-time highs in March. By comparing it with price movements in the past few years, he believes that Bitcoin is replicating the behavior that occurred at the end of 2019.

He wrote on Platform X. “The current market is very similar to the 2019-2020 correction, which is the most likely scenario for this correction, which lasted for 5 months and had a maximum drop of 46%.”

In another chart, the profit share of BTC in circulation fell by 18%, which Adler said corresponds to the overall pessimistic sentiment among coin holders.

Adler added that things could still change – it would take 500,000 BTC ($31 billion) of buying pressure to reverse the current situation.

Market analyst Sage Young is optimistic about the outlook for July, noting that history shows that a drop in Bitcoin prices in June means double-digit growth in July.

According to data from crypto derivatives statistics platform Coinglass, in addition to this year, BTC prices have performed poorly in June in five years: 2022, 2021, 2020, 2018, and 2013. After falling in June, BTC rose by more than 9.6% in the next month, sometimes as high as 24%.

Sage Young added: “Looking at the sample size, BTC’s median return in June was -0.49%, while BTC’s median return in July was 9.6%.”

This article is sourced from the internet: Market focus shifts to US PCE data, BTC fluctuates sideways

In the past 24 hours, many new hot currencies and topics have appeared in the market, and it is very likely that they will be the next opportunity to make money. The cryptocurrency market is still under pressure today, with SEC Chairman Gary Gensler testifying at a Senate hearing that he expects the spot Ethereum ETF to receive full approval from the agency by the end of the summer. Sectors with strong wealth-creating effects are: ETH ecological projects, TON ecological tokens; Hot searched tokens and topics by users are: Daddy, RWA Crypto; Potential airdrop opportunities include: Zircuit, MYX Finance; Data statistics time: June 14, 2024 4: 00 (UTC + 0) 1. Market environment Cryptocurrency markets remain under pressure today, extending a correction that began the day before after the Federal…