Phân tích dữ liệu: 9 biểu đồ phân tích sự phát triển của Blast

Tác giả gốc: 1912212.eth, Foresight News

Blast was late to the party. It was originally scheduled to release an airdrop at the end of May, but it was only recently that the governance token plan was officially announced. The total supply is 100 billion, of which 50% will be airdropped to the community, and the initial airdrop amount is 17 billion. In addition, 25.5% is allocated to core contributors, 16.5% to investors, and 8% to the Blast Foundation. As part of the transition to a decentralized governance structure, officials said that the governance of the project Twitter, website, and Blast protocol is shifting to foundation control.

OP and Arbitrum have attracted attention due to their airdrops, while ZKsync has become a negative example. Since Blast opened its airdrop application, the communitys reputation has also been unsatisfactory. According to Bitgets market data, BLAST is currently priced at $0.025.

From the beginning, Blast was highly anticipated, but now it is not popular. How has it developed along the way? 9 data charts will help you analyze it.

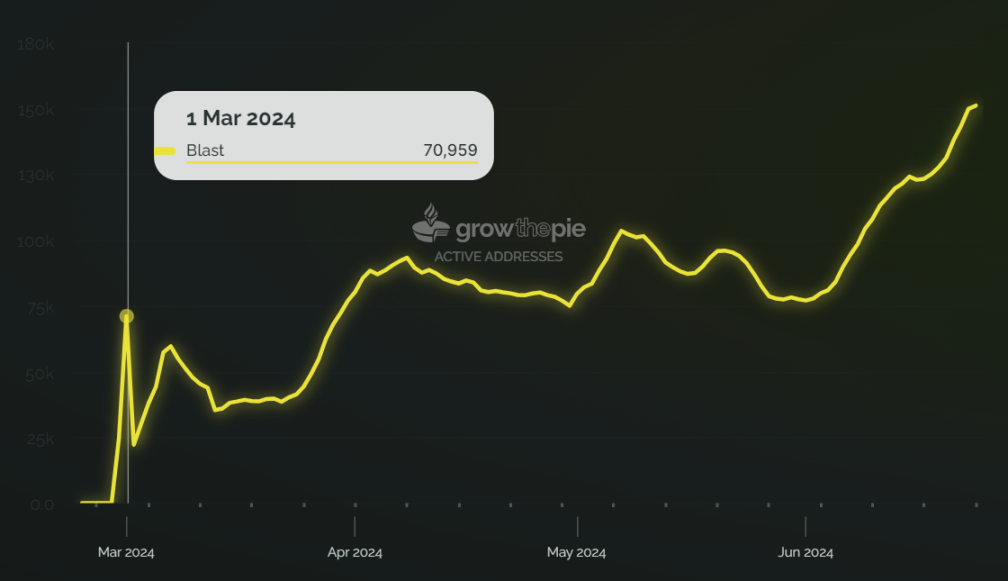

The total number of participating users exceeds 1.56 million, and the daily active users exceed 150,000

Blast launched its test network in mid-January this year and officially launched its main network on March 1. According to data from its official website, the total number of users has now reached 1.56 million.

On the day of its mainnet launch, the number of daily active users exceeded 70,000, and then quickly declined. However, it soon continued to rise under the incentives of various points activities. On June 24, its daily active users reached 150,000, which was twice the number of daily active users when the mainnet was launched.

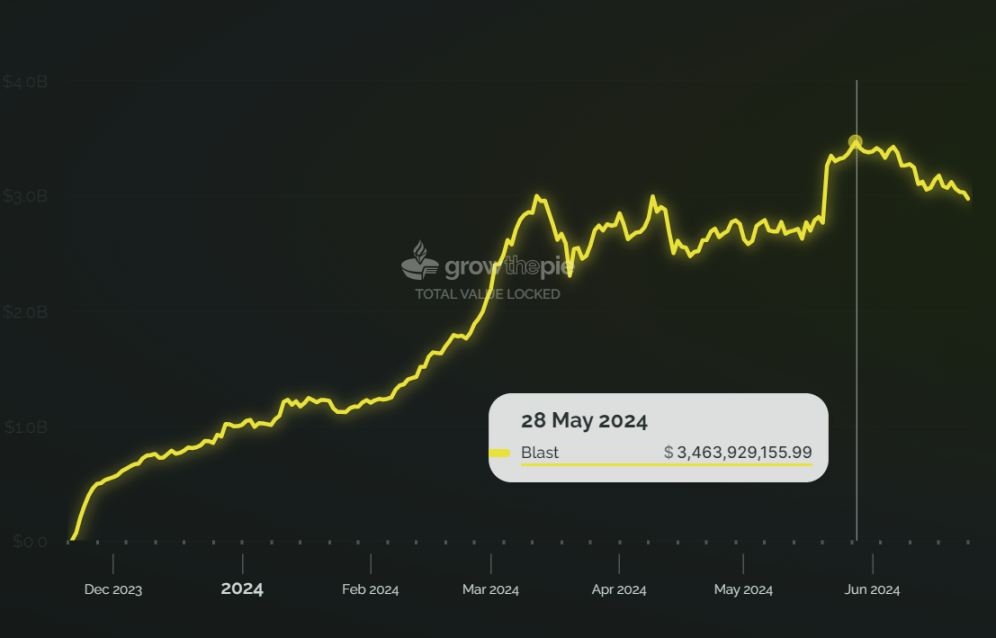

Total TVL hits an all-time high of $3.46 billion

Although the Blast testnet was launched in January this year, it was only open for staking on November 21 last year. The TVL exceeded $100 million the next day, and exceeded $400 million on November 24. On December 2, it became the third largest Ethereum L2 with over $667 million, second only to Arbitrum and OP. On December 26, its TVL exceeded $1 billion.

It is worth mentioning that on February 25 this year, TVL exceeded 2 billion, and Blast became the fastest chain to reach a TVL of 2 billion US dollars. In May, it reached a peak value of over 3.4 billion US dollars.

Cross-chain Ethereum exceeds 479,000

According to Dune data, after the launch of the independent network, the number of ETH passing through the cross-chain bridge reached 479,709, accounting for 62.25% of the total cross-chain amount, stETH accounted for 26.81%, and USDC, USDT and DAI accounted for a total of 10.94%.

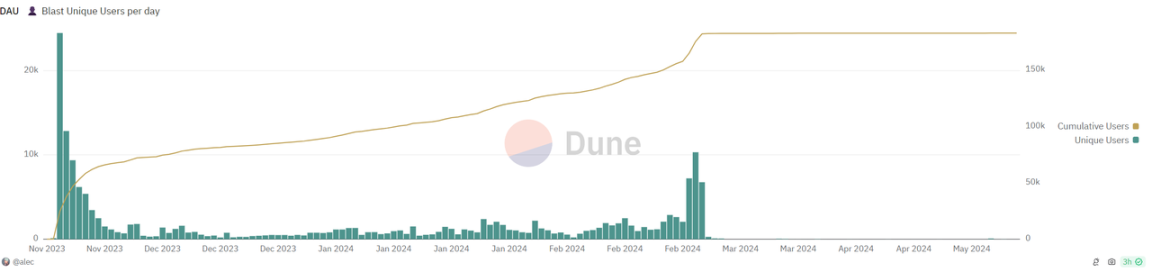

The number of active users is the highest when Ethereum staking is opened and the mainnet is launched

The number of independent users has been active and has increased significantly since the opening of Ethereum staking at the end of last year and the launch of the mainnet in February 2024.

The cumulative number of new users quickly reached its peak after the mainnet was launched.

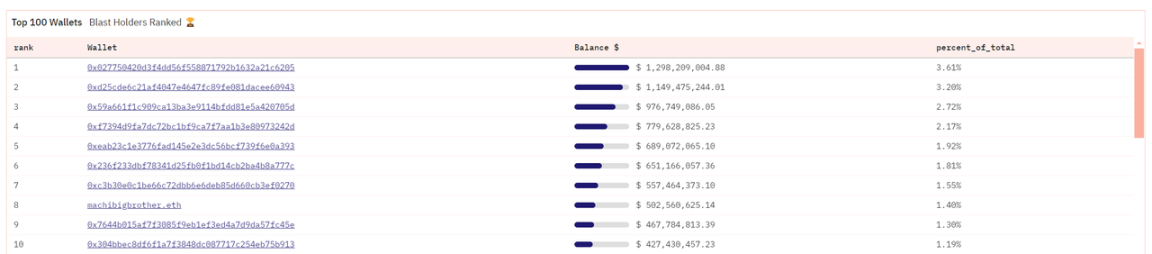

The top 10 wallet addresses account for 20.87% of the total funds

In the crypto world, open airdrops are always accompanied by big players. The top Blast big player has a single wallet address that accounts for 3.61% of the total Blast Holder funds. The top 10 Blast holders hold 20.87% of the total Blast holders.

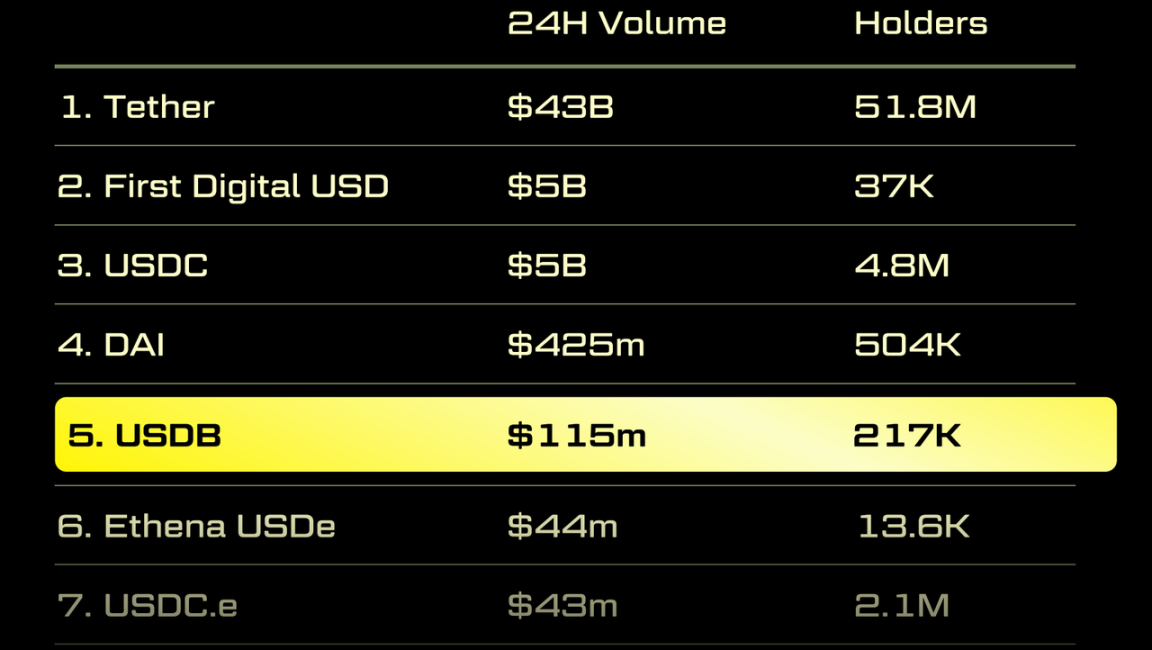

USDB has become the fifth most used and fourth most held stablecoin

Blast is a chain with a native stablecoin. According to data on June 21, USDBs 24-hour trading volume reached US$115 million, with 217,000 holders, ranking fifth in terms of activity, and its total market value has exceeded US$400 million.

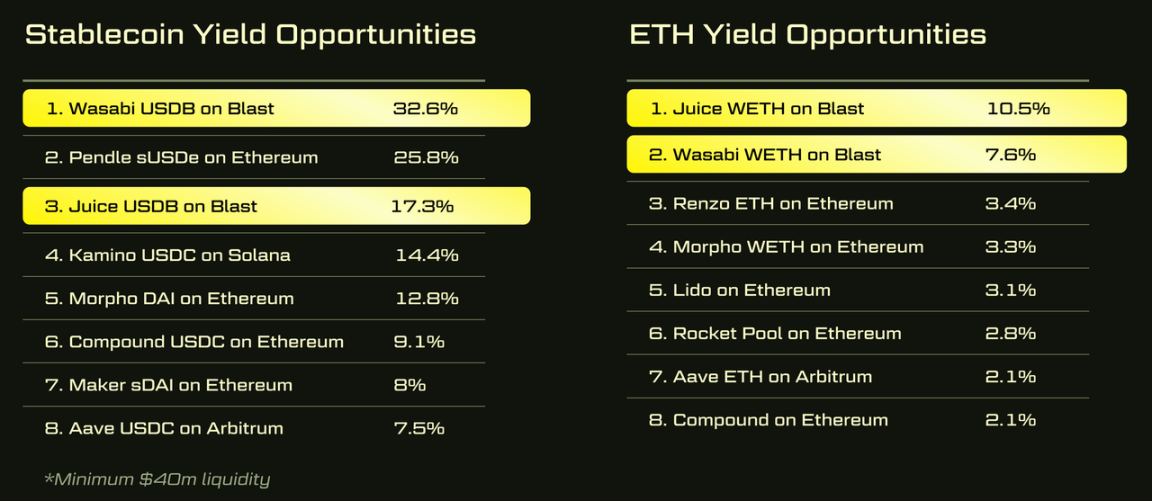

USDB and WETH rank top three in yield

In a liquidity pool with a balance of more than 40 million USD, USDB can achieve a yield of 17.3% to 32.6% on Blast, while WETH can achieve a yield of 7.6% to 10.5% on Blast.

The number of native DApps accounts for more than 75%

Most EVM chains are full of similar applications, but because Blast provides native yields and gas fee revenue sharing, the number of its native DApps accounts for over 75%, far exceeding the other three major L2s.

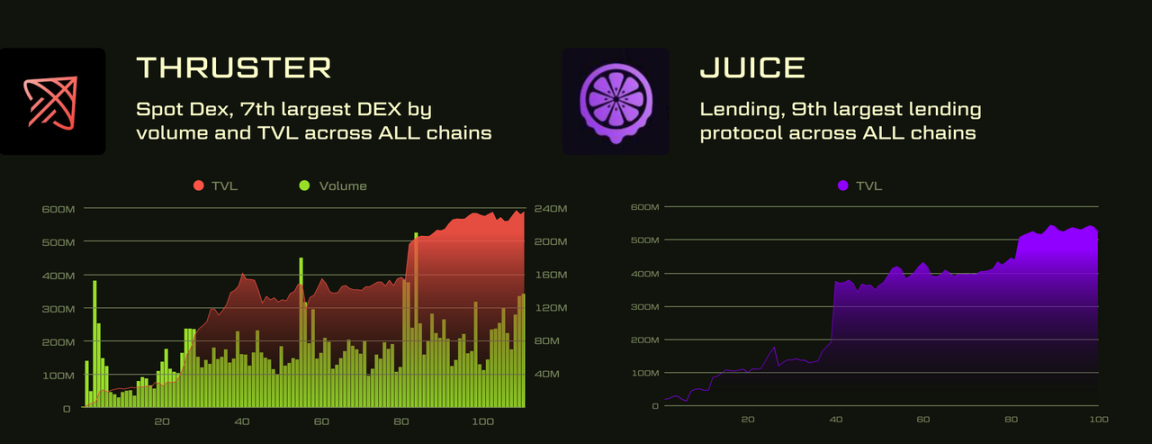

Lending and spot trading products reached $500 million TVL in 4 months

The spot trading protocol Thruster has become the 7th largest DEX protocol, with its TVL exceeding US$500 million about 80 days after the mainnet launch. Another lending product Juice also reached US$500 million in the same period of time and has now become the 9th largest lending protocol.

This article is sourced from the internet: Data analysis: 9 charts to analyze the development of Blast

Related: Senior Witchs Self-narration: How I Got 6.6 Million ZK Airdrop

Original|Odaily Planet Daily Author: Azuma It has been many days since ZKsync (ZK) launched its airdrop, but the aftermath of the incident is still ongoing. On the evening of June 22, Beijing time, user k1z4 , who was marked as the co-founder of Memeland (his identity has not been verified), posted a rather provocative message: Hey, ZKsync, I want to tell you that I finally completed the airdrop application and transfer of 350 wallets, and each wallet received an average of 18,871 ZK tokens . Unfortunately, I still don’t have enough money to buy a Lamborghini or a Beverly Hills villa… I was looking forward to getting more tokens, you disappoint me so much! According to the screenshot of holdings on the suspected Binance exchange released by k1z4 , the…