Cuộc điều tra của SEC về ETF 2.0 vừa kết thúc, nhưng các luật sư đang tranh luận

Bản gốc|Odaily Planet Daily

Tác giả: jk

On June 18, the U.S. Securities and Exchange Commission (SEC) announced the end of its investigation into Ethereum 2.0 and would not take enforcement action against Consensys. This is undoubtedly a milestone victory for Ethereum developers, technology providers, and the Ethereum ecosystem.

A week has passed since the discussion on this matter, and many people in the legal community have written detailed legal opinions on this matter. However, there are different opinions on the interpretation of this decision. Some lawyers believe that the end of this investigation means that all topics related to Ethereum as a security (except staking) will no longer be investigated in the future, while other lawyers believe that this is just a temporary truce against Consensys.

This article will summarize the reactions of all parties, especially the different views of the legal community on this incident.

Recap

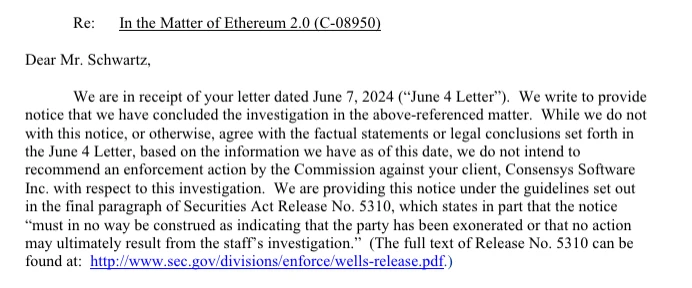

On June 18, the U.S. Securities and Exchange Commission (SEC) issued a notice of terminating its investigation into Consensys. The investigation stemmed from Consensyss previous lawsuit against the SEC (for more details, please refer to ConsenSys sues the SEC, which may affect the approval of the Ethereum ETF ). Although the wording of this notice was somewhat reluctant, it still expressed that it would end the investigation into Ethereum 2.0. Among them, the SEC itself used some ambiguous statements: Although we do not agree with the facts or legal conclusions stated in the June 4 letter in this notice or in any other case, based on the information we have so far, we do not intend to recommend to the Commission that you take enforcement measures against your client, Consensys Software Inc. However, this notice should not be regarded as an indication of the partys innocence or that no action will be taken as a result of the staffs (termination) investigation.

Original notice issued by the US SEC. Source: SEC

On the day of the incident, Consensys immediately issued a statement, labeling the incident as a major victory. The article mentioned, On June 7, we sent a letter to the SEC asking it to confirm that the Ethereum ETF approved in May (based on Ethereum being a commodity) means that the agency will end the Ethereum 2.0 investigation. Today, the SEC Enforcement Division notified us that they are ending their investigation into Ethereum 2.0 and will not take enforcement action against Consensys. Consensys also insisted that the SEC must abandon its unprincipled and opaque enforcement supervision and provide the industry with much-needed regulatory clarity.

What did the lawyer say?

Consensys lawyers are in line with the company. Laura Brookover, senior counsel and head of litigation and investigations at Consensys, expressed her views on the X platform. She posted that the entire investigation (not just Consensys) is closed. The letter states that no charges will be filed against Consensys, but the end of the investigation means that no charges will be filed against anyone. It covers the entire Ethereum, so anyone who contributed code or bought or sold ETH is covered by the investigation. Now, the entire investigation is closed, not just for Consensys, but for everyone.

She also cited the SECs enforcement manual, which states that an investigation that has resulted in enforcement actions may be closed only when all enforcement actions are completed. So, the closure of this investigation means that no enforcement actions were brought against anyone.

Secondly, a very important thing is that yesterday, Laura Brookover and Sam Enzer, a partner of Cahill Gordon Reindel, attended an interview with the podcast media Unchained, and the two shared a lot of content that was not mentioned on the X platform. They believe that this letter represents a disagreement within the SEC to some extent:

“It suggests that the enforcement staff had convinced Gensler that if they brought an enforcement action alleging that merged Ethereum (ETH) was offered or sold as a security, they would lose and be embarrassed. I think Gary Gensler believed in his heart that ETH was a security, or that ETH was offered and sold as a security because of the validation staking mechanism. He thought it was a security, right? Because people deposited something of value and got rewarded. In his mind, that made it a security, or he very much wanted to have the power to regulate it. But I think his staff told him we were going to lose the case.”

However, this statement has also attracted a lot of doubts, especially when the ETF is still not settled and other exchanges and crypto institutions are still involved in lawsuits because of Ethereum. Enumma founder David Barrera posted that there is no part of the SECs letter that the investigation is over. This decision only means that the SEC will not file a lawsuit against others who provide and sell Ethereum, but according to the SECs enforcement manual, the staffs conclusion of the investigation and decision not to file a lawsuit against one party does not mean that the investigation is over or that other parties will not be sued. In other words, Uniswap or other institutions may still be involved in legal cases because of Ethereum.

David went further to say that the phrase “We disagree with…your statements of fact and legal conclusions” is not a common or standard language in such letters indicating that an investigation will not proceed. In other words, the SEC only mentioned this sentence in the case against Consensys, which does not necessarily mean that it will completely abandon the lawsuit in the future.

Sam in the podcast also believes that

“The SEC has discretion in the letter closing an investigation, right? Criminal prosecutors have prosecutorial discretion, regulatory enforcement agencies have regulatory enforcement discretion. When they turn down a case, that doesn’t necessarily mean that the conduct was legal or in compliance with the law. It could be that the SEC doesn’t have the resources this year, or they have other things that are more important to deal with… But they are not constrained from going back. Unfortunately, the SEC changes its position quite often.”

At the same time, Laura made a point that the SEC’s end of the investigation has nothing to do with Liquid Staking and Restaking, which is another completely different matter:

“The SEC’s investigation into those activities is actually a separate investigation and is not part of the Ethereum 2.0 investigation. Therefore, the conclusion of the Ethereum 2.0 investigation does not actually say anything about the SEC’s views on liquid staking, re-staking services, and pooled staking.”

Will there be an impact on the final approval of the ETF and other litigation issues?

At present, it is unlikely that the approval of the ETF will be affected. Coindesk reported that SEC Chairman Gary Gensler told senators at a budget hearing on the 13th that the final approval of the Ethereum ETF will be completed this summer.

In a budget defense hearing before a subcommittee of the Senate Appropriations Committee, Gensler said the process was “working smoothly” following initial approvals for a group of ETFs. The agency had previously approved the initial applications, but he said the final registration requirements — the filing of the Form S-1 — were now being processed at the “staff level.”

As for other lawsuits, since most legal cases progress slowly, there are no updates yet. Odaily will continue to follow up and report.

This article is sourced from the internet: The SECs investigation into ETF 2.0 just ended, but lawyers are arguing