First Bitcoin theft: Crypto OG loses 25,000 Bitcoins due to key leak

Author: The Bitcoin Historian , KOL tiền điện tử

Biên soạn bởi: Felix, PANews

Allinvain mined Bitcoin when the price was less than $0.05 and owned 25,000 Bitcoins. This article takes you through the biggest robbery in the history of cryptocurrency: the tragic story of Allinvains $1.6 billion loss.

In 2010, Allinvain founded one of the first Bitcoin exchanges, Bitcoin Express. Bitcoin Express allowed users to buy BTC using PayPal. Allinvain sold 1,000 BTC for $5. That’s $0.005 per BTC.

But Allinvain is also a dedicated Bitcoin miner. He can mine 500 BTC per hour using only his laptop. That’s 1,200 Bitcoins per day.

Here’s what mining Bitcoin looks like when it’s worth $10, Allinvain still has access to his home computer. He presses a button and generates BTC.

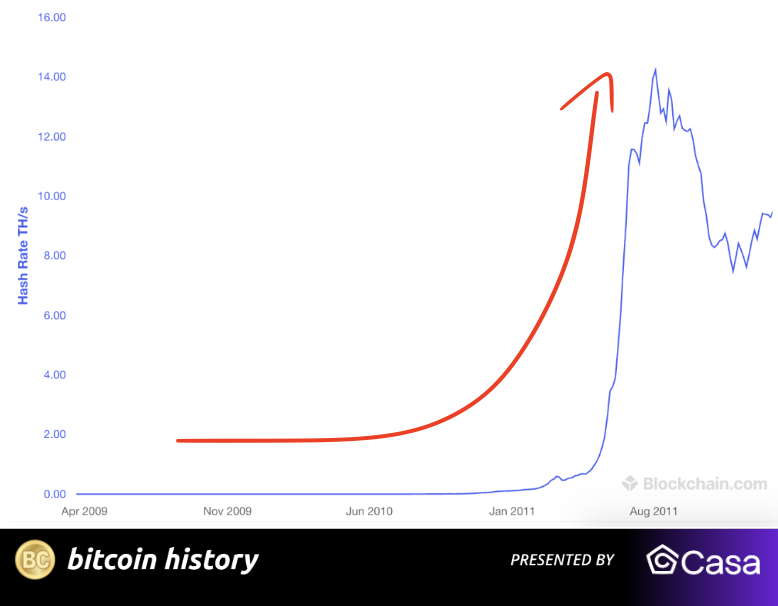

By 2011, mining difficulty had skyrocketed. The hash rate had soared to 4 TH/S. In 2010, the hash rate was just 0.001% of that — a 114,000% increase.

“It was like everybody, their mother, father, cousin, whatever, started mining,” Allinvain said.

But the more Allinvain researched, the more he was amazed. Allinvain wanted to help Bitcoin and began promoting the purchase and sale of real goods with Bitcoin (BTC).

Allinvain soon became a Bitcoin whale, owning more than 25,000 Bitcoins. In early 2011, Allinvain cheered on the rise in Bitcoin prices, which surged to as high as $30. This was the first Bitcoin bubble. Allinvain owned $500,000 worth of the “magic” currency at the time.

On June 13, 2011, disaster struck.

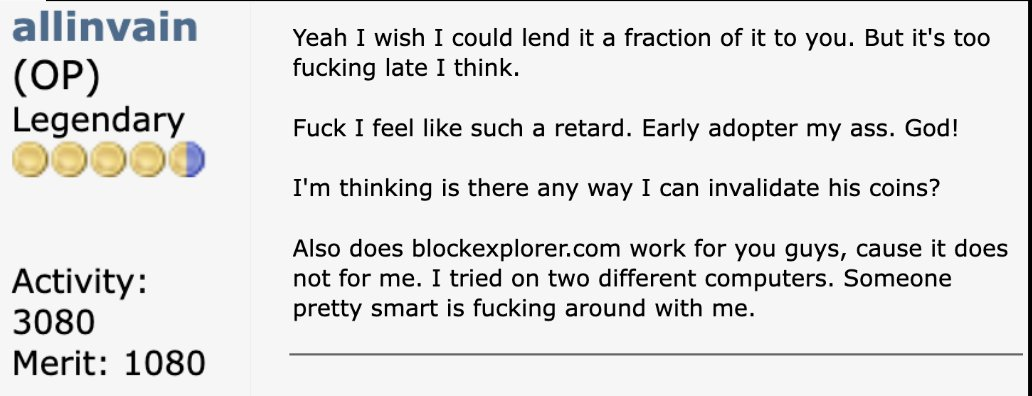

Allinvain saw a transaction for 25,000 BTC in his wallet. Just like that, all his BTC was stolen.

Allinvain was devastated and fell into depression. All the work he had done for Bitcoin was gone.

To make matters worse, the news spread all over the world.

Forbes, The Atlantic, and NPR all reported on it. They called it the first Bitcoin theft.

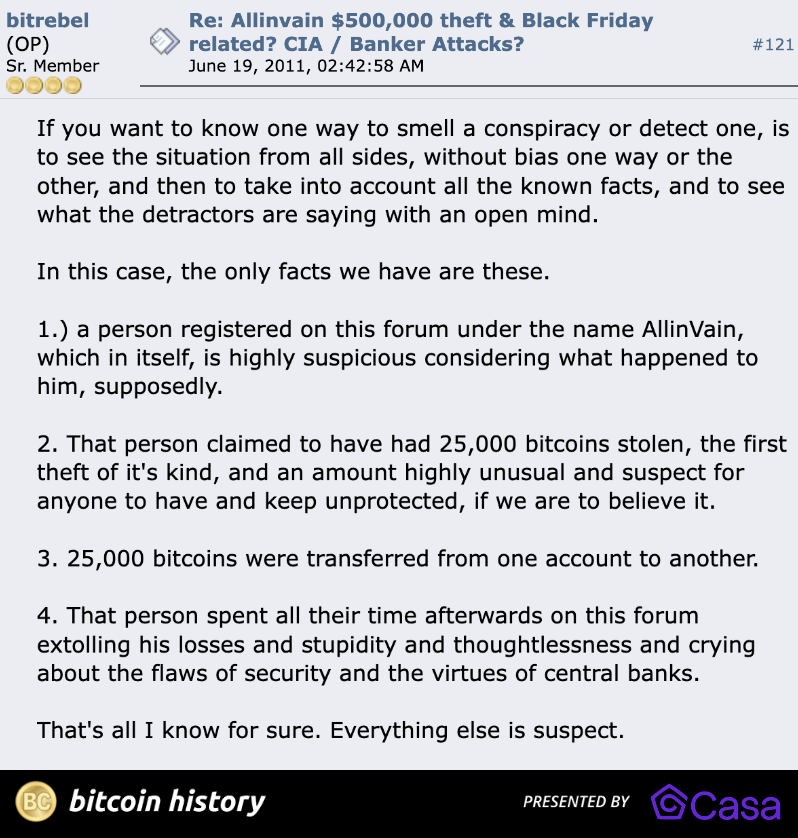

The huge amount of money involved in the theft has sparked conspiracy theories. Some say that the whole thing was planned by Allinvain. They accuse Allinvain of spreading FUD.

In the end what happened?

Allinvain said it was all his own fault. I trusted the safety measures too much. It was stupid of me.

Allinvain backed up his wallet to Dropbox, Wuala, and SpiderOak. When he discovered that Dropbox staff had remote access to the files, he deleted them. But the root of the problem was that someone had hacked into his computer and stolen the unencrypted wallet files.

Later, Allinvain discovered that this might be a Trojan virus disguised as Bitcoin mining software.

And once again, a reminder that personal security is important when you hold BTC.

But the hack didn’t stop Allinvain from moving forward. He remained active in the Bitcoin space and started his own managed mining business, doing everything he could to get his fortune back.

Allinvain’s biggest mistake was keeping his keys unencrypted on his computer. The hacker’s actions serve as a reminder to always keep your private keys in a secure offline location. Even some of the most well-known companies in the Bitcoin space have suffered similar attacks.

To this day, Allinvain’s story continues to remind people of the importance of Bitcoin security.

Bài đọc liên quan: The amount involved is about 300 million US dollars. From the recent huge cryptocurrency theft in Japan, we can see the latest fraud methods of hackers

This article is sourced from the internet: First Bitcoin theft: Crypto OG loses 25,000 Bitcoins due to key leak

According to incomplete statistics from Odaily Planet Daily, there were 29 blockchain financing events announced at home and abroad from May 20 to May 26, an increase from last weeks data (26). The total amount of financing disclosed was approximately US$338 million, a significant increase from last weeks data (US$151 million). Last week, the project that received the most investment was the decentralized social protocol Farcaster ($150 million); followed by Turkish fintech startup Colendi ($65 million). The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and MA events; 3. * indicates a traditional company whose business involves blockchain): Decentralized social protocol Farcaster completes $150 million financing, led by Paradigm On May 22, the decentralized social protocol Farcaster announced the completion…