Sự suy thoái mùa hè đã bắt đầu chưa? Các quỹ tiền điện tử đã chứng kiến dòng tiền chảy ra hàng tuần lớn nhất kể từ cuối tháng 3

Tác giả gốc: Mary Liu, BitpushNews

Thị trường tiền điện tử phải chịu áp lực giảm khi mở cửa phiên giao dịch ngày thứ Hai.

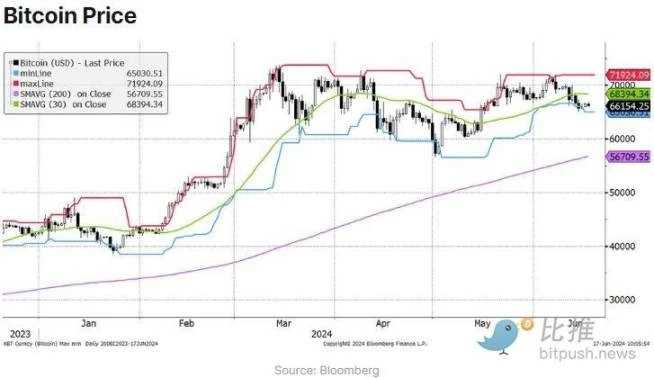

Theo dữ liệu của Bitpush, Bitcoin đã giảm xuống dưới mức hỗ trợ $66.000 trong giao dịch đầu ngày và chạm mức thấp $65.046 trong giao dịch giữa ngày. Một đợt mua vào sau đó đã đẩy giá trở lại mức $67.286. Tuy nhiên, đà tăng giá đã không tiếp tục. Tính đến thời điểm báo chí đưa tin, giá Bitcoin là $66.580,16, với biến động 24 giờ gần 0%.

Chỉ có năm trong số 200 token hàng đầu theo giá trị thị trường tăng hơn 1% vào thứ Hai, với Convex Finance (CVX) dẫn đầu với mức tăng 25,3%, tiếp theo là cat in a dogs world (MEW), tăng 19,7% và XRP, tăng 5,8%. zkSync (ZK) giảm nhiều nhất, giảm 24,3%, io.net (IO) giảm 22,1% và ConstitutionDAO (PEOPLE) giảm 18,7%.

Tổng giá trị thị trường hiện tại của tiền điện tử là $2,41 nghìn tỷ và thị phần của Bitcoin là 54,6%.

Trên thị trường truyền thống, các cổ phiếu liên quan đến AI vẫn được ưa chuộng, với SP 500 và Nasdaq 100 thiên về công nghệ tiếp tục tăng lên mức cao kỷ lục, lần lượt tăng 0,9% và 1,2%.

Một số nhà phân tích đã điều chỉnh giá trị mục tiêu của họ cho SP 500 trong năm nay, với Evercore ISI tăng giá mục tiêu cuối năm lên 6.000 và Goldman Sachs dự đoán chỉ số này sẽ đạt 5.600.

Lần cắt giảm lãi suất đầu tiên sẽ diễn ra vào tháng 9 hay cuối năm?

Theo công cụ FedWatch của CME Groups, hiện các nhà đầu tư đang kỳ vọng có 64% khả năng lãi suất sẽ được cắt giảm vào tháng 9.

Tuy nhiên, Chủ tịch Fed Minneapolis Neel Kashkari cho biết trong một cuộc phỏng vấn với CBS vào Chủ Nhật rằng có thể dự đoán hợp lý rằng ngân hàng trung ương có thể sẽ cắt giảm lãi suất một lần trong năm nay và đợi đến tháng 12.

BitPush trước đó đã đưa tin rằng Cục Dự trữ Liên bang đã giữ nguyên lãi suất chuẩn trong khoảng 5,25%-5,50% vào tuần trước, đánh dấu mức lãi suất này đã được duy trì trong gần một năm.

Sự thay đổi theo năm trong thước đo lạm phát ưa thích của Cục Dự trữ Liên bang, chỉ số giá chi tiêu tiêu dùng cá nhân, là 2,7% vào tháng 4, cao hơn nhiều so với mục tiêu 2% của Cục Dự trữ Liên bang.

“Chúng ta cần thấy thêm bằng chứng cho thấy lạm phát đang giảm xuống mức 2%,” Kashkari cho biết. “Hiện tại, chúng ta đang ở vị thế rất tốt để từ từ có thêm dữ liệu lạm phát, dữ liệu kinh tế, dữ liệu thị trường lao động trước khi đưa ra bất kỳ quyết định nào. Chúng ta đang ở vị thế tốt, nhưng nếu bạn chỉ nói rằng sẽ có một lần cắt giảm lãi suất, như mức trung bình cho thấy, thì có lẽ sẽ là trước khi kết thúc năm.”

Mùa hè suy thoái đã bắt đầu

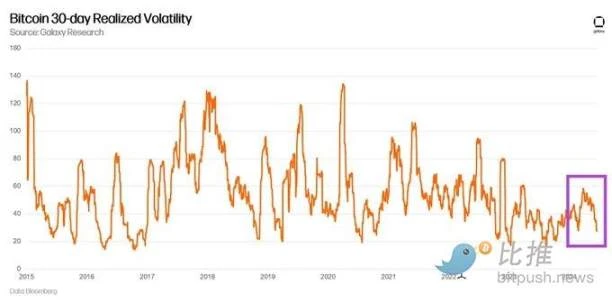

Bitcoin đã giao dịch đi ngang trong phạm vi hẹp kể từ tháng 3. Alex Thorn, người đứng đầu bộ phận nghiên cứu tại công ty đầu tư tài sản kỹ thuật số Galaxy, đã lưu ý trong bài đăng trên X rằng mức biến động thực tế trong 30 ngày của Bitcoin đã giảm xuống mức thấp nhất mọi thời đại, làm nổi bật diễn biến giá nhàm chán.

Ngoài ra, báo cáo ngày 17 tháng 6 của CoinShares cho thấy các sản phẩm và quỹ giao dịch tài sản kỹ thuật số đã chứng kiến dòng tiền chảy ra là $600 triệu vào tuần trước, mức chảy ra lớn nhất kể từ ngày 22 tháng 3 và tổng tài sản được quản lý của các quỹ tiền điện tử đã giảm từ $100 tỷ xuống còn $94 tỷ.

Dữ liệu từ CoinShares cho thấy khối lượng giao dịch sản phẩm đầu tư tài sản kỹ thuật số toàn cầu tuần trước cũng thấp hơn mức trung bình hàng tuần là $22 tỷ trong năm nay, ở mức $11 tỷ. Khối lượng giao dịch của ETF Bitcoin giao ngay của Hoa Kỳ là $8,73 tỷ, nhưng vẫn thấp hơn nhiều so với mức đỉnh $32,69 tỷ trong tuần từ ngày 4 đến ngày 8 tháng 3.

Mạng lưới giao dịch phái sinh Paradigm cho biết thị trường tiền điện tử đang "mất đà" do thiếu chất xúc tác để các nhà giao dịch hành động. "Bất chấp mọi dự đoán tích cực, các thị trường mới cần tin tức thực sự để thúc đẩy và duy trì lực kéo", công ty cho biết trong bản cập nhật Telegram vào đầu ngày hôm nay.

Các nhà phân tích tại Secure Digital Markets tin rằng "các nhà đầu tư đang 'chuyển sang chất lượng' sau lập trường cứng rắn của Fed. Trong giai đoạn thị trường bất ổn, các nhà đầu tư chuyển vốn từ các khoản đầu tư rủi ro hơn sang các tài sản an toàn hơn để giảm thiểu tổn thất và bảo toàn vốn".

Charlie Morris, nhà phân tích trưởng tại ByteTree, cho biết dữ liệu trên chuỗi cho thấy điểm yếu của Bitcoin sẽ tiếp tục trong ít nhất vài tháng nữa vì "giá trị giao dịch bằng USD đã giảm".

Morris đã viết: Tôi không biết điều này sẽ kéo dài bao lâu, nhưng có vẻ như đây là một sự thay đổi mang tính quyết định. Nó cho thấy chúng ta không nên ngạc nhiên khi đột phá theo hướng giảm. Những dự đoán rằng việc halving sẽ đưa Bitcoin lên mức cao mới đã bị phá vỡ. Mặc dù dòng tiền ETF đổ vào mạnh trong năm nay, giá đã nhiều lần chạm ngưỡng kháng cự trên $70.000. Hôm nay, giá đã giảm trở lại dưới đường trung bình động 30 ngày và xu hướng đã giảm 2/5. Tuy nhiên, nó vẫn trong xu hướng tăng dài hạn.

Morris cho biết: Luận điểm của tôi không thay đổi, đó là Bitcoin sẽ bùng nổ vào tháng 10 sau kỳ nghỉ hè. Điều này đã xảy ra vào năm 2016 và 2020. Sau khi halving, mạng lưới Bitcoin đã tạm dừng trong sáu tháng để ổn định sau cơn sốt trước halving.

Theo nhà phân tích thị trường TedTalksMacro, tuần này là tuần quan trọng đối với Bitcoin. Ông đã phân tích trên nền tảng X: Trong tuần tới, điều quan trọng đối với Bitcoin là duy trì mức hỗ trợ $66.000. Khi mức này giảm xuống dưới, người bán có thể thống trị thị trường và buộc những người mua phải thanh lý nhanh chóng.

Bài viết này có nguồn từ internet: Sự suy thoái mùa hè đã bắt đầu chưa? Các quỹ tiền điện tử đã chứng kiến dòng tiền chảy ra hàng tuần lớn nhất kể từ cuối tháng 3

Liên quan: Hiểu biết có hệ thống về EigenLayer: Các nguyên tắc của LST, LRT và Đặt lại là gì?

Giới thiệu: Đặt lại và Lớp 2 là những câu chuyện quan trọng của hệ sinh thái Ethereum trong chu kỳ này. Cả hai đều nhằm mục đích giải quyết các vấn đề hiện có của Ethereum, nhưng các con đường cụ thể là khác nhau. So với ZK, bằng chứng gian lận và các phương tiện kỹ thuật khác có chi tiết cơ bản cực kỳ phức tạp, Đặt lại thiên về việc trao quyền cho các dự án hạ nguồn về mặt an ninh kinh tế. Nó dường như chỉ yêu cầu mọi người cầm cố tài sản và nhận phần thưởng, nhưng nguyên tắc của nó không hề đơn giản như tưởng tượng. Có thể nói, Resting giống như con dao hai lưỡi. Trong khi trao quyền cho hệ sinh thái Ethereum, nó cũng mang đến những mối nguy hiểm tiềm ẩn rất lớn. Hiện nay mọi người có nhiều ý kiến khác nhau về việc Reset. Một số người nói rằng nó đã mang lại sự đổi mới và tính thanh khoản cho Ethereum, trong khi những người khác nói rằng nó quá tiện dụng và đang đẩy nhanh…