ETHFI: Sản phẩm Resting hàng đầu bị thị trường đánh giá thấp

giới thiệu

Ether.fi cam kết staking Ethereum và re-staking thanh khoản. Điểm khó khăn lớn nhất trong lĩnh vực staking và re-staking Ethereum hiện tại là người dùng mất quyền kiểm soát Ethereum sau khi staking. Do đó, Ether.fi hướng đến mục tiêu giúp người dùng tận hưởng lợi ích staking và re-staking trong khi vẫn duy trì quyền kiểm soát Ethereum bằng cách phát triển giải pháp staking phi lưu ký.

Sức mạnh của dự án

đội ngũ cốt lõi

Mike Silagadze: Nhà sáng lập kiêm Tổng giám đốc điều hành. Tốt nghiệp Đại học Waterloo, Mike Silagadze bắt đầu đầu tư vào ngành công nghiệp tiền điện tử vào năm 2010. Ông thành lập Gadze Finance và giữ chức Tổng giám đốc điều hành, đồng thời thành lập Top Hat.

Chuck Morris: Kỹ sư trưởng. Tốt nghiệp Đại học Chicago chuyên ngành khoa học máy tính. Có kinh nghiệm sâu rộng trong các nhóm kỹ sư phát triển tiền điện tử.

Cộng sự

Kiln: Cung cấp dịch vụ cơ sở hạ tầng cho Ethereum.

DSRV: Một công ty cung cấp hỗ trợ cơ sở hạ tầng blockchain, bao gồm các dịch vụ nút và hỗ trợ kỹ thuật khác.

Chainnodes: Nhà cung cấp dịch vụ blockchain tập trung vào hoạt động và quản lý node.

Obol: Một công ty tập trung vào các giao thức tin cậy phân tán hoặc các công nghệ phi tập trung liên quan đến blockchain.

Từ thông tin về nhóm và đối tác được ether.fi tiết lộ, có thể thấy rằng nhóm phát triển của họ có kinh nghiệm đầu tư và phát triển rất phong phú trong ngành tiền điện tử, đã thiết lập mối quan hệ hợp tác với nhiều công ty cơ sở hạ tầng tiền điện tử và nhận được sự hỗ trợ mạnh mẽ trong việc xây dựng cơ sở hạ tầng.

Sức mạnh tài chính

ether.fi đã huy động được khoảng $32,3 triệu đô la trong hai vòng gọi vốn.

-

Vòng hạt giống: Tháng 2 năm 2023, do Version One Ventures dẫn đầu, với sự tham gia của Purpose Investments, North Island Ventures, Node Capital, Maelstrom, Kommune.one, Chapter One Ventures và Arrington XRP Capital. Số tiền là $5,3 triệu.

-

Vòng A: Tháng 2 năm 2024, do Version One Ventures và OKX Ventures dẫn đầu, với sự tham gia của White Star Capital, White Loop Capital, Stani Kulechov, Selini Capital, Sandeep Nailwal, North Island Ventures, Node Capital và Matthew Howells-Barby. Số tiền là $27 triệu đô la Mỹ.

Version One Ventures và OKX Ventures là những tổ chức đầu tư hàng đầu trong ngành công nghiệp tiền điện tử. Nhà sáng lập AAVE Stani Kulechov, nhà sáng lập Polygon Sandeep Nailwal và nhà sáng lập Kraken Matthew Howells-Barby cũng tham gia vào hoạt động tài trợ ether.fis. Có thể thấy rằng những người đứng đầu trong ngành có mức độ công nhận rất cao đối với Eth.fi.

Chế độ hoạt động

Theo số lượng token ETH và LST mà người dùng gửi, có thể chia thành hai loại: 32 ETH và bội số của LST; các số lượng token ETH và LST khác.

-

Khi số lượng token ETH và LST được người dùng gửi là bội số nguyên của 32

Người vận hành nút gửi giá thầu để được chỉ định chạy một nút xác thực. Người vận hành nút đáng tin cậy có thể gửi giá thầu danh nghĩa để được đánh dấu là có sẵn. Người vận hành nút không đáng tin cậy tham gia vào cơ chế đấu giá và được chỉ định người xác thực dựa trên giá thầu của họ. Người gửi tiền gửi 32 ETH vào hợp đồng gửi tiền ether.fi. Điều này kích hoạt cơ chế đấu giá và chỉ định một người vận hành nút để chạy một người xác thực. Điều này cũng đúc một két rút tiền và hai NFT (T-NFT, B-NFT) cấp quyền sở hữu két rút tiền. T-NFT biểu thị 30 ETH, có thể chuyển nhượng bất kỳ lúc nào. B-NFT biểu thị 2 ETH và là bắt buộc. Cách duy nhất để rút 2 ETH là thoát khỏi trình xác thực hoặc thoát hoàn toàn. Trình xác thực mã hóa khóa xác thực bằng khóa công khai của người vận hành nút chiến thắng và gửi nó dưới dạng giao dịch trên chuỗi. Người vận hành nút khởi động trình xác thực bằng khóa xác thực đã giải mã. Người đăng ký (hoặc người vận hành nút) có thể gửi lệnh thoát để thoát khỏi trình xác thực và gửi ETH đã đăng ký vào két rút tiền. Sau đó, người đăng ký có thể đốt NFT và thu hồi ETH sau khi trừ phí giao dịch.

B-NFT được sử dụng để cung cấp khoản khấu trừ cho bảo hiểm giảm giá (trong trường hợp xảy ra sự kiện giảm giá) và thể hiện trách nhiệm giám sát hiệu suất của nút xác thực. Do rủi ro và trách nhiệm tăng lên, B-NFT có lợi nhuận cao hơn T-NFT.

-

Khi số lượng ETH và token LST được người dùng gửi là số tiền khác

Khi người dùng gửi ETH và số lượng token LST của họ là số lượng khác. Khi người dùng có ít hơn 32 Ethereum hoặc không muốn chịu trách nhiệm giám sát nút xác thực, họ có thể tham gia staking ether.fis bằng cách đúc eETH vào nhóm thanh khoản NFT. Hợp đồng nhóm thanh khoản chứa một tài sản hỗn hợp bao gồm ETH và T-NFT. Khi người dùng gửi ETH vào nhóm thanh khoản, nhóm thanh khoản sẽ đúc token eETH và chuyển chúng cho người dùng. Người đúc nắm giữ T-NFT có thể gửi T-NFT vào nhóm thanh khoản và đúc eETH bằng giá trị của T-NFT. Người tạo lập thị trường nắm giữ eETH có thể chuyển đổi nó thành ETH trong nhóm thanh khoản theo tỷ lệ 1: 1, với điều kiện là có đủ thanh khoản. Nếu không đủ thanh khoản, quá trình chuyển đổi sẽ kích hoạt thoát xác minh. Người dùng sử dụng B-NFT để staking sẽ gửi ETH của họ vào nhóm và vào hàng đợi để phân bổ B-NFT. Khi số lượng Ethereum trong nhóm thanh khoản vượt quá ngưỡng, người nắm giữ tiếp theo trong hàng đợi sẽ được phân bổ. Trong quá trình này, một khóa riêng được tạo ra và quá trình staking được kích hoạt. 32 ETH sẽ được staking vào nhóm và hai NFT sẽ được đúc cùng lúc: T-NFT sẽ được đưa vào nhóm và B-NFT sẽ được trao cho người nắm giữ trái phiếu. Khi số lượng ETH trong nhóm thanh khoản giảm xuống dưới ngưỡng, T-NFT có thời gian đúc sớm nhất sẽ kích hoạt yêu cầu thoát. Yêu cầu thoát sẽ ghi lại dấu thời gian và bắt đầu đếm. Nếu bộ đếm thời gian hết hạn và trình xác thực chưa thoát, giá trị của người nắm giữ B-NFT sẽ giảm dần. Người vận hành nút có thể nhận được phần thưởng khi họ thoát khỏi trình xác thực đã hết hạn. Khi trình xác thực thoát, T-NFT và B-NFT sẽ bị đốt cháy và ETH (trừ phí) sẽ được gửi vào nhóm thanh khoản.

Đồng thời, để tăng lợi nhuận cho người đặt cược, ether.fi đã thiết lập một thị trường dịch vụ nút ngoài việc cung cấp phần thưởng đặt cược trong thiết kế của dự án, cho phép người đặt cược và nhà điều hành nút đăng ký nút, cung cấp dịch vụ cơ sở hạ tầng và chia sẻ doanh thu dịch vụ. Khi người dùng gửi tiền vào ether.fi và nhận được phần thưởng đặt cược, ether.fi sẽ tự động đặt cược lại khoản tiền gửi của người dùng vào Eigenlayer để nhận được lợi nhuận. Eigenlayer sử dụng Ethereum đã đặt cược để hỗ trợ nhiều AVS khác nhau và tăng lợi nhuận cho người đặt cược bằng cách thiết lập một lớp bảo mật kinh tế. Tổng số tiền của tất cả các phần thưởng đặt cược sẽ được phân phối cho người đặt cược, nhà điều hành nút và giao thức, lần lượt chiếm 90%, 5% và 5%. Người dùng có thể nhận được phần thưởng đặt cược Ethereum, điểm trung thành ether.fi, phần thưởng đặt cược lại (bao gồm điểm EigenLayer) và phần thưởng cho việc cung cấp thanh khoản cho các giao thức Defi.

Công nghệ xác thực phi tập trung (DVT)

Trong sách trắng ether.fi, Công nghệ xác thực phân tán (DVT) được giới thiệu. Sự xuất hiện của DVT chủ yếu là để giải quyết vấn đề tập trung xác thực trong staking Ethereum. Trong staking Ethereum truyền thống, một trình xác thực thường được thiết kế để được quản lý bởi một nhà điều hành nút duy nhất. Trong mô hình này, có hai vấn đề rõ ràng:

-

Nếu nút này bị lỗi, nó sẽ ảnh hưởng đến tính bảo mật và lợi ích của ETH được đặt cược trong trình xác thực này;

-

Nếu nút này không đáng tin cậy hoặc bị tấn công, nó có thể ảnh hưởng đến hiệu suất và tính bảo mật của trình xác thực. Do đó, thiết kế của DVT phân tán rủi ro lỗi điểm đơn bằng cách cho phép nhiều thực thể độc lập cùng quản lý một trình xác thực duy nhất.

Việc triển khai công nghệ DVT chủ yếu thông qua việc nâng cấp và cải thiện hai phương diện:

-

Đầu tiên, trong DVT, khóa được chia nhỏ. Thay vì được kiểm soát bởi một khóa duy nhất, khóa của trình xác thực được chia thành nhiều phần. Mỗi thực thể tham gia quản lý trình xác thực chỉ có một phần khóa. Bất cứ khi nào một hoạt động được thực hiện, nó cần phải có được sự đồng thuận của phần lớn các thực thể. Điều này làm giảm hiệu quả rủi ro của một nút duy nhất kiểm soát khóa.

-

Thứ hai, phải có hợp đồng, thỏa thuận rõ ràng giữa các bên tham gia DVT để quy định trách nhiệm, quyền lợi của từng đơn vị tham gia và đảm bảo tính công bằng, minh bạch của toàn bộ hệ thống.

Tóm lại, ether.fi đã giảm đáng kể rủi ro tập trung của các nút ban đầu bằng cách giới thiệu công nghệ DVT và đảm bảo hơn nữa tính bảo mật và công bằng cho người đặt cược và người tham gia.

NFT hóa Quản lý trình xác thực

Trong thiết kế của ether.fi, hai NFT được tạo ra khi mỗi trình xác thực được tạo ra, cụ thể là T-NFT và B-NFT. T-NFT đại diện cho 30 ETH, có thể được chuyển bất kỳ lúc nào. B-NFT đại diện cho 2 ETH, là bắt buộc và chỉ có thể được trả lại khi bạn rút toàn bộ. NFT được đúc không chỉ đại diện cho quyền sở hữu các quỹ được đặt cược vào trình xác thực mà còn chứa tất cả các dữ liệu chính cần thiết để quản lý và chạy trình xác thực. NFT chứa: thông tin chi tiết về trình xác thực đã tạo, chẳng hạn như nút, vị trí vật lý, nhà điều hành nút và thông tin chi tiết về dịch vụ nút mà trình xác thực chạy trên đó; người nắm giữ NFT có quyền kiểm soát trình xác thực.

Thiết kế NFT của ether.fi là phiên bản nâng cấp của LST trong các dự án LSD trước đó. Nó cho phép những người stake quản lý trình xác thực của họ theo cách linh hoạt và phi tập trung hơn bằng cách nắm giữ NFT. Điều này cũng làm giảm các vấn đề về lòng tin mà những người stake trước đây phải đối mặt khi chuyển ETH của họ cho bên thứ ba.

Đổi mới so với các dự án tương tự

So sánh ether.fi với các dự án Resting khác.

-

Bảo vệ: Ưu điểm rõ ràng nhất của ether.fi so với các dự án staking truyền thống là tính bảo mật. Trong các dự án staking truyền thống, người dùng staking ETH của họ trực tiếp vào node thông qua dự án. Khi người dùng staking ETH vào node, họ cũng mất quyền kiểm soát khóa. Nếu node có ác ý hoặc bị tấn công, người staking sẽ phải chịu tổn thất tương ứng. Ether.fi hướng đến mục tiêu phát triển giải pháp staking phi lưu ký, thông qua việc tham chiếu công nghệ DVT và quản lý NFT của các trình xác thực, để người staking có thể kiểm soát khóa của họ và giữ quyền lưu ký ETH của họ trong khi giao phó staking cho nhà điều hành node và nhận ra nhiều thực thể độc lập để cùng quản lý một trình xác thực duy nhất, do đó phân tán rủi ro thất bại tại một điểm duy nhất. Ether.fi giảm thiểu rủi ro cho người dùng tham gia staking Ethereum.

-

Cơ chế thoát: Trong các dự án Resttaking khác, khi người dùng cần đổi ETH hoặc LST đã stake trong giao thức, họ cần phải đợi 7 ngày để đổi. Tuy nhiên, ether.fi cung cấp một cơ chế thoát độc đáo, đó là người dùng có thể unstake eETH trở lại ETH thông qua Unstake. Điều này có nghĩa là người dùng không chỉ có thể hoán đổi ETH trở lại thông qua DEX mà còn có thể chọn Unstake 1: 1 để đổi ETH, với thời gian chờ ngắn hơn. Và ether.fi là giao thức duy nhất hỗ trợ thoát trực tiếp LRT, trong khi các giao thức khác như Curve, Balancer, v.v. thoát thông qua trao đổi nhóm LP, nhưng thời gian rút tiền sẽ thay đổi theo tình hình dự trữ thanh khoản.

Trong ngành công nghiệp tiền điện tử, đặc biệt là đối với người dùng tích cực trên chuỗi, vấn đề quan trọng nhất là tính bảo mật của tài sản của họ, tiếp theo là tỷ lệ lợi nhuận. Ether.fi giảm thiểu tính bảo mật của tài sản của người dùng bằng cách sử dụng công nghệ DVT để tham chiếu và quản lý NFT. Đồng thời, nó có một cơ chế rất thân thiện với người dùng để thoát khỏi các cam kết, giúp giảm bớt rất nhiều mối lo ngại cho người dùng khi tham gia vào dự án.

Mô hình dự án

Mô hình kinh doanh

Mô hình kinh tế của ether.fi bao gồm ba vai trò: nhà điều hành nút, người dùng đặt cược và nhà cung cấp dịch vụ xác minh tích cực (AVS)

-

Toán tử nút: Các nhà điều hành nút ether.fis chủ yếu là các thực thể có thể sử dụng cơ sở hạ tầng ether.fis để cung cấp các dịch vụ chất lượng cao cho những người đặt cược và những người tham gia mạng khác. Các nhà điều hành nút đóng vai trò rất quan trọng trong mô hình kinh tế ether.fis. Đầu tiên, người dùng phải đặt cược ETH hoặc LST của họ thông qua các nhà điều hành nút, sau đó các nhà điều hành nút sẽ đúc NFT cho những người đặt cược. Ether.fi sẽ tính một khoản phí nhất định khi đúc hoặc hủy NFT, đây cũng là một trong những nguồn thu nhập của ether.fis. Sau đó, nhà điều hành nút sẽ đặt cược ETH đã đặt cược vào Eigenlayer để có thu nhập hoặc cung cấp dịch vụ cho AVS được kết nối với ether.fi để có thu nhập.

-

Người dùng Staking: Sau khi ether.fis staking, người dùng staking ETH của họ vào ether.fi, ngoài việc nhận được phần thưởng Ethereum cho các ưu đãi staking node, họ chủ yếu staking vào Eigenlayer để kiếm thu nhập và cũng có thể cung cấp dịch vụ cho AVS để kiếm thu nhập. Trong số thu nhập mà người dùng staking kiếm được, 5% sẽ được phân bổ cho node và 5% sẽ được phân bổ cho dự án ether.fi, đây cũng là một trong những nguồn thu nhập của ether.fis.

-

Nhà cung cấp dịch vụ xác minh chủ động (AVS): ether.fi là một dự án trong lộ trình Restalking, chắc chắn sẽ liên quan đến AVS. Mặc dù hầu hết các dự án trong lộ trình Resting hiện kết nối ETH đã staking của dự án với Eigenlayer, cho phép Eigenlayer hoàn tất quá trình neo AVS để nhận phần thưởng vượt mức, bước tiếp theo trong kế hoạch của ether.fis là thiết lập hệ sinh thái AVS của riêng mình. AVS là nguồn lợi nhuận vượt mức do dự án ether.fi cung cấp cho người dùng staking.

Từ phân tích trên, chúng ta có thể thấy doanh thu của ether.fis là:

-

Khi đúc hoặc hủy NFT, ether.fi sẽ tính một tỷ lệ phần trăm phí nhất định

-

Người dùng Staking nhận được 5% thu nhập

Mô hình mã thông báo

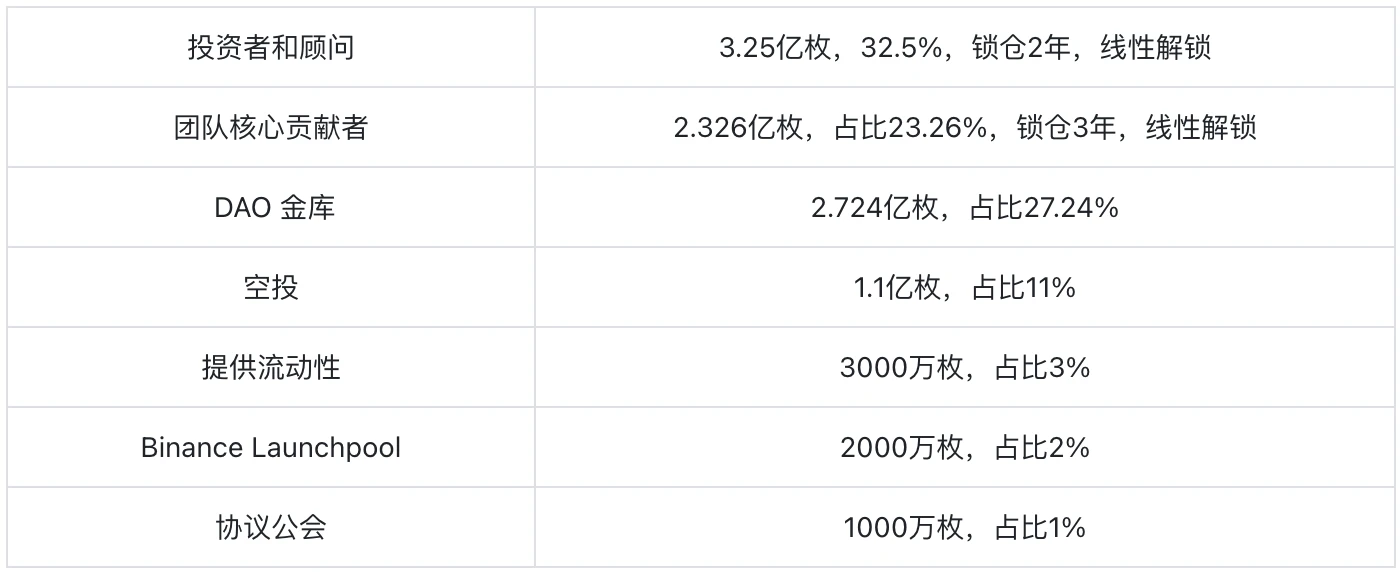

Theo sách trắng: tổng số lượng ETHFI là 1 tỷ, nguồn cung token ban đầu là 115,2 triệu và tỷ lệ lưu thông của các đồng tiền hiện đại là 11.52%.

Phân phối ETHFI như sau:

Trao quyền cho Token

Theo sách trắng, mục đích sử dụng ETHFI trong ether.fi như sau:

-

Thanh toán phí giao thức: Người dùng cần sử dụng ETHFI để thanh toán cho các hoạt động và giao dịch trong ether.fi.

-

Khuyến khích của dự án: Thưởng cho người dùng tham gia đặt cược và chạy nút.

-

Tham gia quản trị: Nắm giữ token ETHFI có thể tham gia quản trị dự án.

Đánh giá giá trị của ETHFI

Theo sách trắng, trong dự án ether.fi, không có kịch bản nào về việc phá hủy tập trung hoặc thường xuyên đối với ETHFI.

Việc trao quyền cho ETHFI ít hơn là một thiếu sót đáng kể của dự án ether.fi. Không có cơ chế staking trong thiết kế của nó, điều này làm giảm điểm chính là khóa token ETHFI để tăng giá trị của dự án. Tuy nhiên, theo phân bổ ETHFI trong sách trắng, hai bộ phận của token ảnh hưởng nhiều nhất đến thị trường là các nhà đầu tư và cố vấn, và những người đóng góp cốt lõi của nhóm. Các token được phân bổ cho hai bộ phận này chiếm 55.76% trong tổng số. Mặc dù tỷ lệ này tương đối cao, nhưng xét theo thời gian khóa, hầu hết các token sẽ không được phát hành cho đến sau tháng 3 năm 2026, vì vậy nó sẽ không ảnh hưởng đến tỷ lệ lưu thông của các token trong thời điểm hiện tại.

Xu hướng tương lai của ETHFI vẫn phụ thuộc nhiều hơn vào việc giá ETH có thể tiếp tục tăng sau khi vượt qua ETF giao ngay hay không và liệu ether.fi có thể kết nối với nhiều AVS hơn trong tương lai để mang lại thêm thu nhập từ việc đặt cược ETH cho những người thế chấp dự án ether.fi hay không.

TVL

https://defillama.com/protocol/ether.fi#information

https://defillama.com/protocol/ether.fi#information

https://dune.com/ether_fi/etherfi

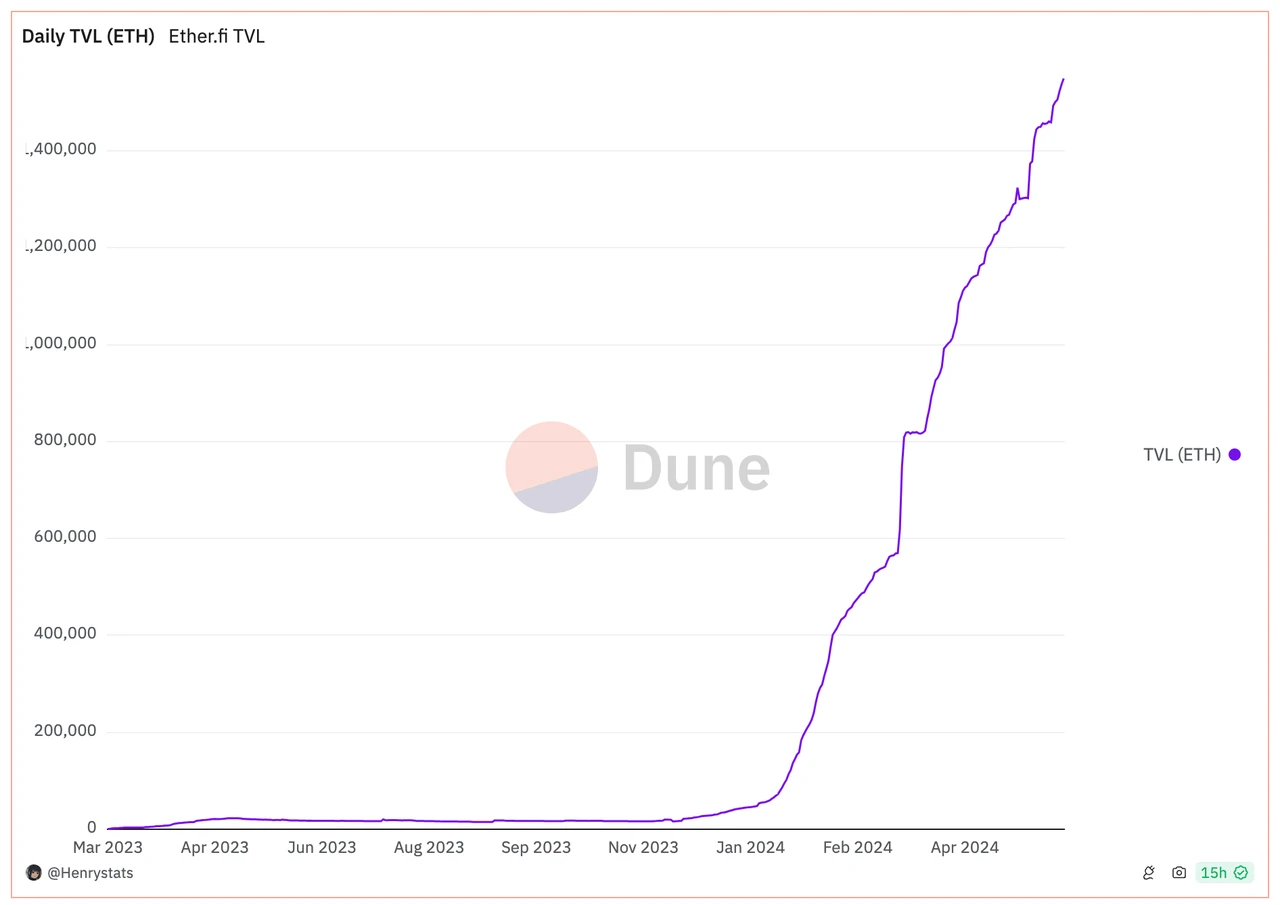

Như có thể thấy từ hình, TVL ether.fis đã đạt 5,88 tỷ đô la Mỹ và hiện TVL của nó đứng đầu trong đường đua Resttaking. Và có thể thấy rằng TVL ether.fis đã duy trì xu hướng tăng nhanh kể từ năm 2024.

APY

https://www.ether.fi/

Chúng ta có thể thấy từ trang web chính thức của ether.fi rằng APY của ether.fi đã đạt tới 14,4%, mức này rất hấp dẫn đối với người dùng staking.

Top 10 người nắm giữ

https://ethplorer.io/en/address/0xfe0c30065b384f05761f15d0cc899d4f9f9cc0eb#pageTab=holderstab=tab-holders

Mười địa chỉ nắm giữ tiền xu hàng đầu bao gồm kho bạc DAO của ether.fi, địa chỉ chính thức của Binance và OKEX. Số lượng tiền xu còn lại chiếm 7.07%. Số lượng ETHFI là 77,07 triệu và lưu thông hiện tại là 115,2 triệu, chiếm 66,91% lưu thông, cho thấy hầu hết các mã thông báo đều tập trung trong tay của cá voi.

Rủi ro dự án

-

Ngoài việc là token quản trị của ether.fi, chức năng chính của token ETHFI là trả phí khi người dùng sử dụng dự án và phân phối phần thưởng cho những người đặt cược và nhà điều hành nút. Mặc dù khối lượng mở khóa token ETHFI không cao ở giai đoạn này và thời gian khóa cho hai nhóm nhà đầu tư, cố vấn và những người đóng góp cốt lõi lớn nhất trong cơ chế phân phối ether.fis là hợp lý, sẽ không có nhiều đợt mở khóa trong đợt tăng giá này, nhưng ETHFI thiếu cơ chế mua lại và thế chấp, điều này đã dẫn đến việc lưu thông ETHFI liên tục tăng và không có cơ chế nào có thể đạt được hiệu ứng giảm phát, từ đó ảnh hưởng đến việc tăng giá của đồng tiền ở một mức độ nhất định.

-

Mặc dù ether.fi có lợi thế là giải quyết vấn đề người thế chấp luôn nắm giữ quyền sở hữu tài sản của họ và có thể giải phóng cổ phần kịp thời so với các dự án Resting khác, nhưng điều quan trọng nhất đối với một dự án Resting là tăng thêm thu nhập thực tế của người dùng thế chấp. Hiện tại, ether.fi, giống như các dự án Resting khác, dựa vào Eigenlayer để kết nối các token đã thế chấp với Eigenlayer để cung cấp dịch vụ xác minh chủ động AVS. Mặc dù dự án có kế hoạch ra mắt dịch vụ xác minh chủ động AVS của riêng mình trong năm nay, nhưng vẫn còn nhiều điều không chắc chắn về việc liệu các dự án khác có thể sử dụng ether.fi hay không. Nếu không thực hiện được, điều này sẽ ảnh hưởng lớn đến giá tiền tệ.

Tóm tắt

Hướng phát triển của ether.fi cam kết staking Ethereum và staking lại thanh khoản. Bằng cách trích dẫn công nghệ DVT và NFT hóa quản lý trình xác thực, nó giải quyết vấn đề phổ biến trong đường dẫn staking Ethereum và staking lại thanh khoản hiện tại là người dùng mất quyền kiểm soát Ethereum sau khi staking Ethereum. Nó cũng hiện thực hóa quyền kiểm soát khóa của người dùng staking và hiện thực hóa việc quản lý chung một trình xác thực duy nhất bởi nhiều thực thể độc lập, do đó rủi ro tập trung của người dùng staking trong nút được giải quyết tốt. Đồng thời, ether.fi cũng là giao thức duy nhất trong đường dẫn Resttaking cho phép người dùng thoát trực tiếp bằng LRT. Do đó, ether.fi có lợi thế rất lớn trong đường dẫn Resttaking và hiện TVL đứng đầu trong đường dẫn Resttaking.

Tuy nhiên, bản thân nền kinh tế token của ether.fi quá đơn giản, không có cơ chế staking và cơ chế hủy, dẫn đến việc lưu thông token liên tục tăng, gián tiếp tác động tiêu cực đến giá token tăng. Mặc dù ether.fi có kế hoạch ra mắt dịch vụ xác minh chủ động AVS của riêng mình, nhưng vẫn còn nhiều bất ổn về việc liệu các dự án khác có thể sử dụng dịch vụ này hay không. Nếu không thực hiện được, nó sẽ ảnh hưởng lớn đến giá của đồng tiền. Hiệu ứng cụ thể của nó vẫn chưa được biết.

Tóm lại, dự án ether.fi giải quyết vấn đề mất quyền kiểm soát Ethereum sau khi staking theo hình thức staking truyền thống thông qua công nghệ DVT độc đáo và cơ chế quản lý xác thực NFT. Đồng thời, cơ chế thoát LRT của dự án cũng rất hợp lý và đã được người dùng công nhận. Giải quyết được mối quan tâm của người dùng và các vấn đề chung trong ngành từ hai khía cạnh bảo mật mà người dùng on-chain quan tâm nhất. Ngoài ra, ETF giao ngay của Ethereum về cơ bản đã được chấp thuận. Nếu ETH có thể có mức tăng tốt trong thị trường tăng giá tiếp theo, thì ether.fi dựa trên Ethereum chắc chắn sẽ có hiệu suất rất ấn tượng.

Bài viết này có nguồn từ internet: ETHFI: Sản phẩm Resting hàng đầu bị thị trường đánh giá thấp

Bản gốc | Tác giả Odaily Planet Daily | Asher Sáng nay, Binance đã công bố rằng dự án khai thác tiền mới thứ 55 của mình là io.net (IO) và sẽ ra mắt thị trường giao dịch IO/BTC, IO/USDT, IO/BNB, IO/FDUSD và IO/TRY vào lúc 20:00 giờ Bắc Kinh ngày 11 tháng 6. Ngay khi tin tức này được đưa ra, các cộng đồng kiếm tiền lớn đã ngay lập tức trở nên tích cực. Tiếp theo, Odaily Planet Daily sẽ đưa bạn đến với việc tìm hiểu về dự án io.net, nền kinh tế mã thông báo IO và giao dịch OTC. Phân tích toàn diện về io.net Mô tả dự án Nguồn hình ảnh: Twitter chính thức io.net là một mạng lưới điện toán phi tập trung đã xây dựng một thị trường hai mặt xung quanh chip. Phía cung là sức mạnh tính toán của chip (chủ yếu là GPU, nhưng cũng có cả CPU và iGPU của Apple, v.v.) được phân phối trên toàn thế giới và phía cầu là các kỹ sư trí tuệ nhân tạo muốn hoàn thiện mô hình AI…