Ba trục kinh doanh của công ty tiền điện tử: stablecoin, DePIN và mã hóa tài sản, nhu cầu phi đầu cơ xuất hiện

Tác giả gốc: James Hồ , Co-founder of Modular Capital

Bản dịch gốc: TechFlow

Vincent and I founded @Modular_Capital 2 years ago with the belief that the use cases for cryptocurrencies will expand. The last cycle was focused on decentralized finance (defi) and non-fungible tokens (NFTs), which we believe are powerful primitive assets (both speculative and non-speculative), but we believe that the potential of cryptocurrencies goes far beyond that.

Here are some instances we’ve found in the B2B space where there is real use case for this that is not speculative, and these are just three examples that I can think of.

Stablecoin

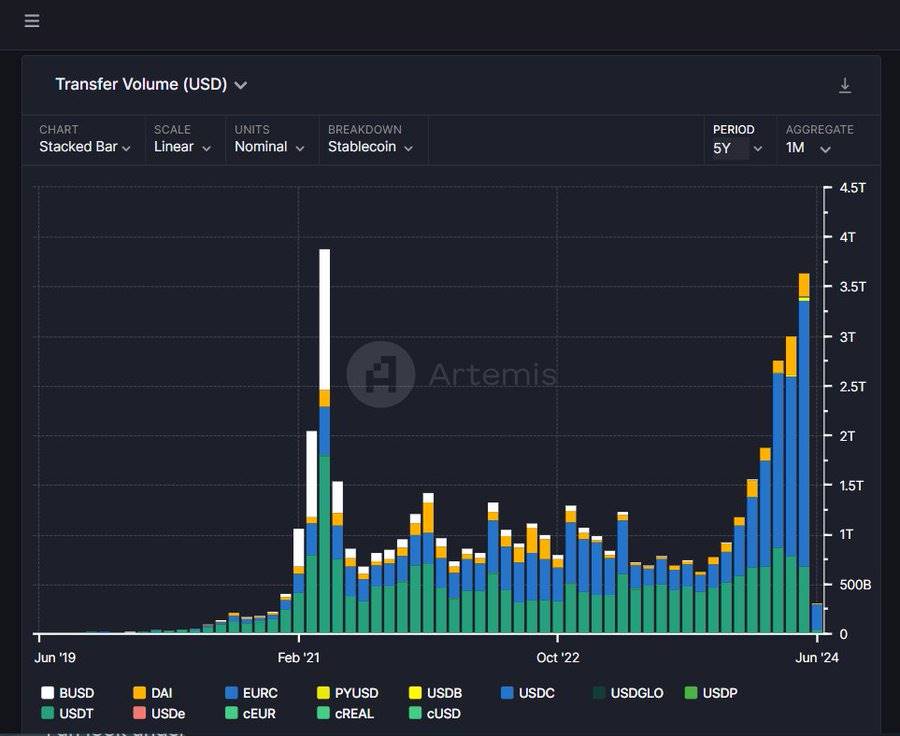

We have issued over $160 billion in stablecoins (90%+ of which are Tether and USDC) and are doing over $2-3 trillion in monthly trading volume. Instant, global, 24/7 real-time payments (rather than T+1 day, closed on weekends) is a huge innovation. Legacy infrastructure is difficult to modernize for coordination reasons.

Over the past two years, we’ve seen several primitive assets drive this adoption, including the issuance of native stablecoins on more chains, fast and cheap cross-chain bridges (like @AcrossProtocol , @circle ’s CCTP), low-fee chains that reduce transaction costs (Solana, Base both have transaction fees below 1 cent), and multi-currency stablecoins (EUR, GBP, JPY).

Being a stablecoin issuer is an extremely profitable business. Every consumer and business needs idle cash that is not earning interest for payments, working capital, etc. Most of the ~5% these issuers get keeps for themselves. Tether makes billions of dollars in profits every year, and Circle has already filed for an IPO in secret.

Nguồn: @artemis__xyz

DePin (Decentralized Physical Infrastructure Network)

In the last cycle, Helium sold over 2 million boxes for IoT coverage worldwide. While this did not generate much demand and was often mocked, the point is to democratize capital formation for physical networks through a global asset ledger and micropayments and achieve massive scale.

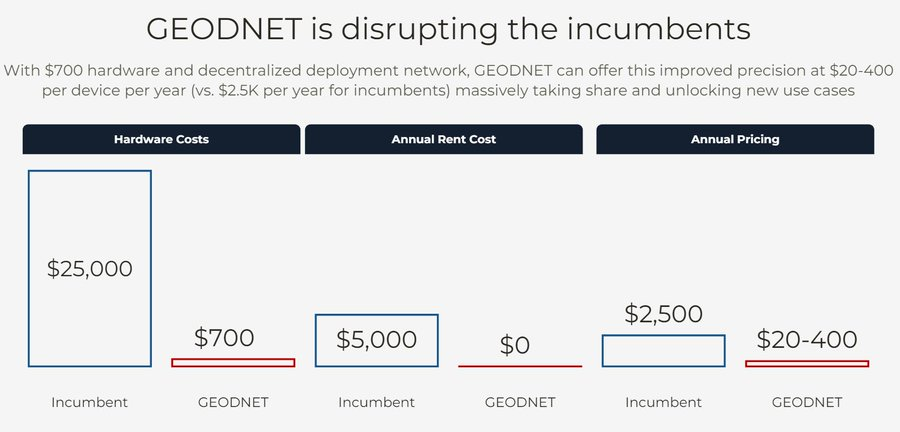

Since then, we’ve seen DePin success stories like @helium Mobile (100k+ telecom users), @Hivemapper (~150k contributors mapping ~13 million km of unique maps, almost half of Google Maps), @GEODNET_ (world’s largest RTK GPS data network with 6k+ miners), and more.

DePin can radically reduce the cost of setting up and operating these networks by more than 90%. Typically, installing a box requires paying for it with balance sheet capex, renting land or facilities, and sending technicians for ongoing maintenance. It turns out that there are many consumers around the world willing to do these things for a small amount of ownership (via tokens) in the network. This is something that blockchain uniquely enables, enabling programmatic, global micropayments.

Supply side is only half the battle for DePin networks. All of these networks need demand side. We are currently seeing this happening. Hivemapper and Geodnet are both close to $1M in annualized revenue (via on-chain native token buybacks in the last 2-3 months) . This wave of new DePin networks are finding product-market fit and paying customers.

Asset Tokenization

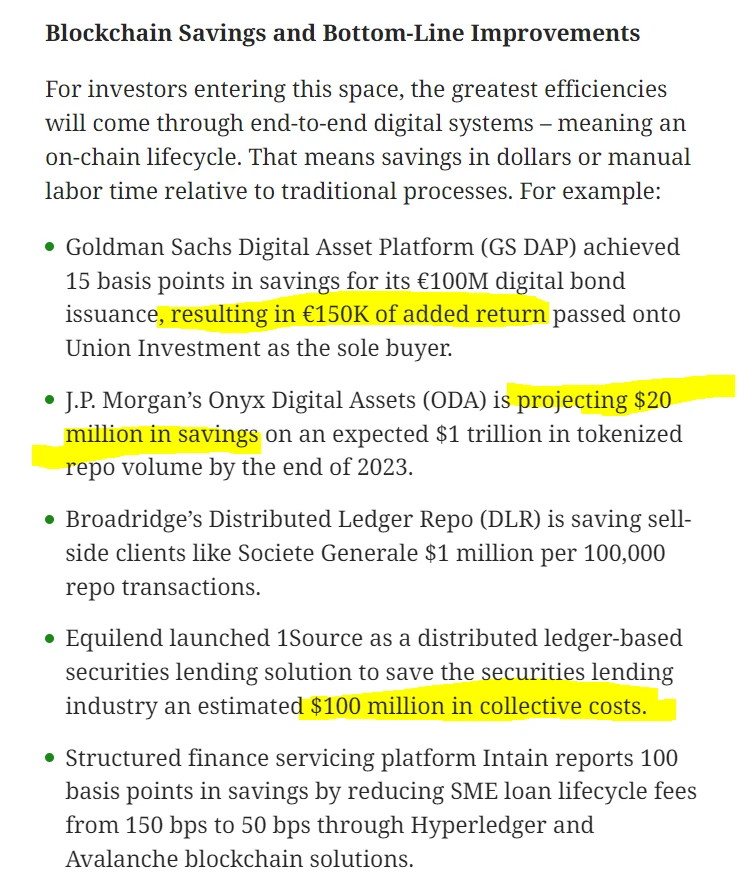

Asset tokenization has been talked about for a long time, but its on-chain adoption has been slow due to its regulated nature (even more so than stablecoins, which do not pay interest).

We see two approaches. Traditional issuers on-chain, notably Blackrock’s tokenized Treasury bond fund ( $BUIDL ), which has ~$500M issued on Ethereum so far. The other is crypto-native products launching new funds under existing regulatory frameworks: @OndoTài chính , @superstatefunds , @maplefinance , etc. are all examples. Both approaches are valid. Notably, this has not happened with stablecoins (all crypto-native companies like Tether, Circle), and now traditional financial institutions are finally realizing the importance of issuing on-chain.

Tokenized Treasuries approach $1.5 billion in issuance. Large issuers will come on board, existing products will scale, and new asset types will be tokenized on-chain.

Nguồn: @rwa_xyz

Tokenization unlocks some important features, including 24/7 transfer and settlement, composability, and also significantly upgrades the traditional infrastructure of most financial institutions, such as the middle and back offices, and reconciliation. JPMorgan Chase expects to save more than $20 million in its repurchase volume by tokenizing it. Blockchain has become the modern asset ledger of the 21st century.

Source: coindesk

Yesterday during the GameStop trading frenzy, the NYSE experienced a technical glitch that caused outages, trading halts, and the system showed Berkshire and gold prices falling 98-99%.

Yesterday on Ethereum and Solana, there were no volatility suspensions, trading failures, price errors, and other issues.

Ethereum launched in 2015 and Solana in 2020 — while both have had major outages, bugs, and downtime in the past, they have become time- and battle-tested systems.

The modern global asset ledger will become the preferred settlement layer for more assets.

Stablecoins, tokenized treasuries, ETFs, and more — these are just the beginning.

This article is sourced from the internet: Three axes of crypto corporate business: stablecoins, DePIN and asset tokenization, non-speculative demand emerges

Tóm tắt Giá của Toncoin đã không xác nhận được kênh giảm dần sau khi mất hỗ trợ cho $5.4. Việc ngăn chặn sự suy giảm xuống dưới $5 đã dẫn đến sự phục hồi nhanh chóng, điều này thể hiện rõ ở khả năng giao cắt tăng giá trên MACD. Các nhà đầu tư cũng có thể thúc đẩy sự phục hồi vì TON là lý tưởng để tích lũy ngay bây giờ. Giá Toncoin (TON) đang giảm từ nỗi sợ điều chỉnh và có khả năng sẽ sớm bắt đầu phục hồi. Điều này có thể xảy ra nếu những người nắm giữ TON tận dụng tối đa cơ hội này và cố gắng thêm TON vào ví của họ. Toncoin có thể chứng kiến sự phục hồi Giá của Toncoin được kỳ vọng sẽ ghi nhận một đợt tăng giá vào tuần trước, nhưng sau khi rơi khỏi kênh giảm dần, giá đã thay đổi. TON đã giảm nhưng vẫn giữ được đà tăng ở mức khoảng $5.2 và $5.4, đây là mức kháng cự.…