Làn sóng suy luận tường thuật tiếp theo trong lĩnh vực AI tiền điện tử: các yếu tố xúc tác, lộ trình phát triển và các mục tiêu liên quan

giới thiệu

Cho đến nay, chu kỳ thị trường tăng giá tiền điện tử này là chu kỳ nhàm chán nhất về mặt đổi mới kinh doanh. Nó thiếu các đường đua nóng phi thường như DeFi, NFT và Gamefi trong thị trường tăng giá trước đó, dẫn đến việc thiếu các điểm nóng trong ngành trên toàn thị trường và sự tăng trưởng của người dùng, đầu tư trong ngành và nhà phát triển tương đối yếu.

Điều này cũng được phản ánh trong giá tài sản hiện tại. Trong toàn bộ chu kỳ, tỷ giá hối đoái của hầu hết các đồng tiền Alt so với BTC tiếp tục mất tiền, bao gồm cả ETH. Xét cho cùng, định giá của các nền tảng hợp đồng thông minh được xác định bởi sự thịnh vượng của các ứng dụng. Khi sự phát triển và đổi mới của các ứng dụng không mấy khởi sắc, định giá của các chuỗi công khai cũng khó có thể tăng lên.

Là một loại hình kinh doanh tiền điện tử tương đối mới trong vòng này, AI đã được hưởng lợi từ tốc độ phát triển bùng nổ và các điểm nóng liên tục trong thế giới kinh doanh bên ngoài, và vẫn có khả năng mang lại sự gia tăng đáng kể về sự chú ý đến các dự án theo dõi AI trong thế giới tiền điện tử.

TRONG báo cáo IO.NET được tác giả công bố vào tháng 4, sự cần thiết của việc kết hợp AI và Crypto đã được giải quyết. Nghĩa là, lợi thế của các giải pháp kinh tế tiền điện tử về tính chắc chắn, huy động và phân bổ nguồn lực, và sự không tin cậy có thể là một trong những giải pháp cho ba thách thức về tính ngẫu nhiên của AI, cường độ nguồn lực và khó khăn trong việc phân biệt giữa con người và máy móc.

Trong phần AI của nền kinh tế tiền điện tử, tác giả cố gắng thảo luận và suy ra một số vấn đề quan trọng thông qua một bài viết khác, bao gồm:

-

Những câu chuyện nào khác đang nổi lên trong lĩnh vực AI tiền điện tử có thể bùng nổ trong tương lai?

-

Các con đường xúc tác và logic của những câu chuyện này

-

Mục tiêu của dự án liên quan đến tường thuật

-

Rủi ro và sự không chắc chắn trong suy luận tường thuật

Bài viết này là suy nghĩ tạm thời của tác giả cho đến thời điểm xuất bản. Nó có thể thay đổi trong tương lai và quan điểm mang tính chủ quan cao. Cũng có thể có lỗi về sự kiện, dữ liệu và logic lý luận. Vui lòng không sử dụng nó làm tài liệu tham khảo đầu tư. Sự chỉ trích và thảo luận từ các đồng nghiệp đều được hoan nghênh.

Sau đây là nội dung chính.

Làn sóng tường thuật tiếp theo trong lĩnh vực AI tiền điện tử

Trước khi chúng ta chính thức xem xét làn sóng tường thuật tiếp theo trong lĩnh vực AI tiền điện tử, trước tiên hãy xem xét các tường thuật chính của AI tiền điện tử hiện tại. Theo góc nhìn về vốn hóa thị trường, những công ty có vốn hóa thị trường hơn 1 tỷ đô la Mỹ là:

-

Sức mạnh tính toán: Render (RNDR, giá trị thị trường 3,85 tỷ), Akash (giá trị thị trường 1,2 tỷ), IO.NET (vòng định giá tài trợ sơ cấp mới nhất là 1 tỷ)

-

Mạng thuật toán: Bittensor (TAO, giá trị thị trường 2,97 tỷ)

-

Đại lý AI: Fetchai (FET, giá trị thị trường trước khi sáp nhập là 2,1 tỷ)

*Thời gian dữ liệu: 2024.5.24, đơn vị tiền tệ là đô la Mỹ.

Ngoài các lĩnh vực trên, lĩnh vực AI nào sẽ có giá trị thị trường dự án đơn lẻ tiếp theo vượt quá 1 tỷ đô la?

Tác giả tin rằng có thể suy đoán từ hai góc độ: góc nhìn từ phía cung của ngành và góc nhìn từ thời điểm GPT.

Góc nhìn đầu tiên về câu chuyện AI: xem xét các cơ hội theo dõi năng lượng và dữ liệu đằng sau AI từ phía cung ứng của ngành

Theo góc nhìn của ngành cung ứng, bốn động lực thúc đẩy sự phát triển của AI là:

-

Thuật toán: Thuật toán chất lượng cao có thể thực hiện các nhiệm vụ đào tạo và suy luận hiệu quả hơn

-

Sức mạnh tính toán: Cả đào tạo mô hình và lý luận mô hình đều yêu cầu phần cứng GPU cung cấp sức mạnh tính toán, đây cũng là nút thắt chính của ngành. Sự thiếu hụt chip trong ngành đã dẫn đến giá cao cho chip trung và cao cấp.

-

Năng lượng: Các trung tâm tính toán dữ liệu mà AI yêu cầu tiêu thụ rất nhiều năng lượng. Ngoài năng lượng mà GPU tự yêu cầu để thực hiện các tác vụ tính toán, cũng cần rất nhiều năng lượng để xử lý tản nhiệt của GPU. Hệ thống làm mát của một trung tâm dữ liệu lớn chiếm khoảng 40% tổng mức tiêu thụ năng lượng.

-

Dữ liệu: Việc cải thiện hiệu suất của các mô hình lớn đòi hỏi phải mở rộng các tham số đào tạo, nghĩa là cần có một lượng lớn dữ liệu chất lượng cao.

Về động lực thúc đẩy của bốn ngành công nghiệp trên, cả hai lĩnh vực thuật toán và sức mạnh tính toán đều có các dự án tiền điện tử có vốn hóa thị trường hơn 1 tỷ đô la Mỹ, trong khi lĩnh vực năng lượng và dữ liệu vẫn chưa có dự án nào có giá trị thị trường tương đương.

Trên thực tế, tình trạng thiếu hụt nguồn cung năng lượng và dữ liệu có thể sớm xảy ra, trở thành làn sóng điểm nóng mới của ngành, qua đó thúc đẩy sự bùng nổ của các dự án liên quan đến tiền điện tử.

Trước tiên chúng ta hãy nói về năng lượng.

Vào ngày 29 tháng 2 năm 2024, Musk đã phát biểu tại Hội nghị Bosch Connected World 2024: Tôi đã dự đoán tình trạng thiếu hụt chip từ hơn một năm trước. Tình trạng thiếu hụt tiếp theo sẽ là điện. Tôi nghĩ rằng sẽ không có đủ điện để chạy tất cả các chip vào năm tới.

Từ dữ liệu cụ thể, Viện Trí tuệ nhân tạo lấy con người làm trung tâm tại Đại học Stanford do Fei-Fei Li đứng đầu, hàng năm đều công bố Báo cáo chỉ số AI. Trong báo cáo về ngành công nghiệp AI năm 2021 do nhóm công bố năm 2022, nhóm nghiên cứu ước tính rằng quy mô tiêu thụ năng lượng AI trong năm đó chỉ chiếm 0,9% nhu cầu điện toàn cầu và áp lực lên năng lượng và môi trường là có hạn. Năm 2023, Cơ quan Năng lượng Quốc tế (IEA) đã tóm tắt năm 2022 như sau: các trung tâm dữ liệu toàn cầu tiêu thụ khoảng 460 terawatt giờ (TWh) điện, chiếm 2% nhu cầu điện toàn cầu và dự đoán rằng đến năm 2026, mức tiêu thụ năng lượng của trung tâm dữ liệu toàn cầu sẽ đạt ít nhất 620 TWh và nhiều nhất là 1.050 TWh.

Trên thực tế, ước tính của IEA vẫn còn thận trọng, vì đã có rất nhiều dự án liên quan đến AI sắp được triển khai và quy mô nhu cầu năng lượng tương ứng vượt xa trí tưởng tượng của họ cách đây 23 năm.

Ví dụ, Microsoft và OpenAI đang lên kế hoạch cho dự án Stargate. Dự án dự kiến sẽ bắt đầu vào năm 2028 và hoàn thành vào khoảng năm 2030. Dự án có kế hoạch xây dựng một siêu máy tính với hàng triệu chip AI chuyên dụng để cung cấp cho OpenAI sức mạnh tính toán chưa từng có để hỗ trợ nghiên cứu và phát triển trí tuệ nhân tạo, đặc biệt là các mô hình ngôn ngữ lớn. Dự án dự kiến sẽ tiêu tốn hơn $100 tỷ, cao gấp 100 lần so với chi phí trung tâm dữ liệu lớn hiện tại.

Chỉ riêng mức tiêu thụ năng lượng của dự án Stargate đã lên tới 50 terawatt giờ.

Đó là lý do tại sao Sam Altman, người sáng lập OpenAI, đã phát biểu tại Diễn đàn Davos vào tháng 1 năm nay: “Trí tuệ nhân tạo sẽ đòi hỏi những đột phá về năng lượng trong tương lai, vì lượng điện mà trí tuệ nhân tạo tiêu thụ sẽ vượt xa mong đợi của con người”.

Sau sức mạnh tính toán và năng lượng, lĩnh vực thiếu hụt tiếp theo trong ngành AI đang phát triển nhanh chóng có thể là dữ liệu.

Nói cách khác, tình trạng thiếu hụt dữ liệu chất lượng cao cần thiết cho AI đã trở thành hiện thực.

Hiện tại, con người về cơ bản đã tìm ra quy luật tăng trưởng của khả năng mô hình ngôn ngữ lớn từ quá trình tiến hóa của GPT – tức là, bằng cách mở rộng các tham số mô hình và dữ liệu đào tạo, khả năng của mô hình có thể được cải thiện theo cấp số nhân – và không có nút thắt kỹ thuật nào trong quá trình này trong ngắn hạn.

Nhưng vấn đề là dữ liệu công khai và chất lượng cao có thể ngày càng khan hiếm trong tương lai và các sản phẩm AI có thể phải đối mặt với mâu thuẫn cung cầu dữ liệu tương tự như chip và năng lượng.

Đầu tiên là sự gia tăng các tranh chấp về quyền sở hữu dữ liệu.

Vào ngày 27 tháng 12 năm 2023, The New York Times chính thức kiện OpenAI và Microsoft tại Tòa án Liên bang Hoa Kỳ, cáo buộc họ sử dụng hàng triệu bài viết của mình mà không được phép để đào tạo mô hình GPT và yêu cầu họ bồi thường hàng tỷ đô la tiền bồi thường theo luật định và thực tế vì sao chép và sử dụng bất hợp pháp các tác phẩm có giá trị độc đáo và phá hủy tất cả các mô hình và dữ liệu đào tạo có chứa tài liệu có bản quyền của The New York Times.

Vào cuối tháng 3, tờ New York Times đã công bố một tuyên bố mới, nhắm mục tiêu không chỉ vào OpenAI mà còn cả Google và Meta. Tờ New York Times cho biết trong tuyên bố rằng OpenAI đã phiên âm các phần lời nói của một số lượng lớn video YouTube thông qua một công cụ nhận dạng giọng nói có tên là Whisper, sau đó tạo văn bản dưới dạng văn bản để đào tạo GPT-4. Tờ New York Times cho biết hiện nay các công ty lớn thường sử dụng hành vi trộm cắp vặt khi đào tạo các mô hình AI và cho biết Google cũng đang làm như vậy. Họ cũng chuyển đổi nội dung video YouTube thành văn bản để đào tạo các mô hình lớn của riêng họ, về cơ bản là xâm phạm quyền của người sáng tạo nội dung video.

Tờ New York Times kiện OpenAI là vụ kiện bản quyền AI đầu tiên. Xem xét tính phức tạp của vụ kiện và tác động sâu rộng của nó đến tương lai của nội dung và ngành công nghiệp AI, có thể không thể sớm đưa ra kết luận. Một kết quả có thể xảy ra là hai bên giải quyết ngoài tòa án, với Microsoft và OpenAI, những bên có nhiều tiền, phải trả một khoản bồi thường lớn. Tuy nhiên, nhiều mâu thuẫn về bản quyền dữ liệu hơn trong tương lai chắc chắn sẽ làm tăng tổng chi phí của dữ liệu chất lượng cao.

Ngoài ra, với tư cách là công cụ tìm kiếm lớn nhất thế giới, Google cũng tiết lộ rằng họ đang cân nhắc tính phí cho chức năng tìm kiếm của riêng mình, nhưng đối tượng tính phí không phải là công chúng nói chung mà là các công ty AI.

Nguồn: Reuters

Máy chủ công cụ tìm kiếm của Google lưu trữ một lượng lớn nội dung và thậm chí có thể nói rằng Google lưu trữ tất cả nội dung đã xuất hiện trên các trang Internet kể từ thế kỷ 21. Hiện tại, các sản phẩm tìm kiếm do AI điều khiển, chẳng hạn như Perplexity ở nước ngoài và Kimi và Mita ở Trung Quốc, xử lý những dữ liệu được tìm kiếm này thông qua AI và sau đó xuất chúng cho người dùng. Các khoản phí cho AI của các công cụ tìm kiếm chắc chắn sẽ làm tăng chi phí thu thập dữ liệu.

Trên thực tế, ngoài dữ liệu công khai, các gã khổng lồ AI cũng đang để mắt tới dữ liệu nội bộ không công khai.

Photobucket là một trang web lưu trữ ảnh và video lâu đời có 70 triệu người dùng và chiếm gần một nửa thị phần ảnh trực tuyến của Hoa Kỳ vào đầu những năm 2000. Với sự phát triển của phương tiện truyền thông xã hội, số lượng người dùng Photobucket đã giảm đáng kể và chỉ còn lại 2 triệu người dùng hoạt động (họ phải trả mức phí cao là $399 mỗi năm). Theo thỏa thuận và chính sách bảo mật mà người dùng ký khi đăng ký, các tài khoản không được sử dụng trong hơn một năm sẽ được tái chế và Photobucket cũng hỗ trợ quyền sử dụng dữ liệu hình ảnh và video do người dùng tải lên. Giám đốc điều hành Photobucket Ted Leonard tiết lộ rằng 1,3 tỷ dữ liệu ảnh và video mà họ sở hữu cực kỳ có giá trị để đào tạo các mô hình AI tạo sinh. Ông đang đàm phán với một số công ty công nghệ để bán dữ liệu này, với mức giá dao động từ 5 xu đến $1 cho mỗi ảnh và hơn $1 cho mỗi video. Ông ước tính rằng dữ liệu mà Photobucket có thể cung cấp có giá trị hơn $1 tỷ.

EPOCH, một nhóm nghiên cứu tập trung vào xu hướng phát triển của trí tuệ nhân tạo, đã công bố một báo cáo về dữ liệu cần thiết cho máy học , Chúng ta sẽ hết dữ liệu chứ? Phân tích giới hạn của việc mở rộng tập dữ liệu trong Học máy , dựa trên việc sử dụng dữ liệu và tạo ra dữ liệu mới trong học máy vào năm 2022, có tính đến sự tăng trưởng của tài nguyên điện toán. Báo cáo kết luận rằng dữ liệu văn bản chất lượng cao sẽ cạn kiệt trong khoảng thời gian từ tháng 2 năm 2023 đến năm 2026 và dữ liệu hình ảnh sẽ cạn kiệt trong khoảng thời gian từ năm 2030 đến năm 2060. Nếu hiệu quả sử dụng dữ liệu không thể được cải thiện đáng kể hoặc các nguồn dữ liệu mới xuất hiện, xu hướng hiện tại của các mô hình học máy quy mô lớn dựa trên các tập dữ liệu khổng lồ có thể chậm lại.

Xét theo tình hình hiện tại khi các gã khổng lồ AI đang mua dữ liệu với giá cao, dữ liệu văn bản chất lượng cao miễn phí về cơ bản đã cạn kiệt. Dự đoán của EPOCH hai năm trước là tương đối chính xác.

Đồng thời, các giải pháp cho nhu cầu “thiếu hụt dữ liệu AI” cũng đang xuất hiện, cụ thể là: Dịch vụ cung cấp dữ liệu AI.

Defined.ai là công ty cung cấp dữ liệu tùy chỉnh, thực tế và chất lượng cao cho các công ty AI.

Ví dụ về các kiểu dữ liệu mà Defined.ai có thể cung cấp: https://www.defined.ai/datasets

Mô hình kinh doanh của công ty là: Các công ty AI cung cấp cho Defined.ai nhu cầu dữ liệu của riêng họ. Ví dụ, về mặt hình ảnh, chất lượng cần phải cao hơn một độ phân giải nhất định, tránh mờ, phơi sáng quá mức và nội dung cần phải chân thực. Về mặt nội dung, các công ty AI có thể tùy chỉnh các chủ đề cụ thể theo nhiệm vụ đào tạo của riêng họ, chẳng hạn như ảnh chụp ban đêm, nón, bãi đậu xe và biển báo vào ban đêm, để cải thiện tỷ lệ nhận dạng AI trong các cảnh đêm. Công chúng có thể thực hiện nhiệm vụ, tải lên sau khi chụp và sau đó công ty sẽ xem xét chúng. Sau đó, các phần đáp ứng yêu cầu sẽ được giải quyết theo số lượng ảnh. Giá khoảng 1-2 đô la Mỹ cho một bức ảnh chất lượng cao, 5-7 đô la Mỹ cho một bộ phim ngắn dài hơn 10 giây, 100-300 đô la Mỹ cho một bộ phim chất lượng cao dài hơn 10 phút và 1 đô la Mỹ cho một nghìn từ văn bản. Những người thực hiện nhiệm vụ thầu phụ có thể nhận được khoảng 20% phí. Cung cấp dữ liệu có thể trở thành một hoạt động kinh doanh crowdsourcing khác sau khi gắn nhãn dữ liệu.

Việc huy động nguồn lực cộng đồng trên toàn cầu để thực hiện các nhiệm vụ, các ưu đãi kinh tế, giá cả, lưu thông và bảo vệ quyền riêng tư của tài sản dữ liệu, cũng như sự tham gia của mọi người, có vẻ như là một hình thức kinh doanh phù hợp với mô hình Web3.

Mục tiêu tường thuật AI từ góc nhìn của phía cung ứng ngành công nghiệp

Mối lo ngại về tình trạng thiếu chip đã lan rộng đến ngành công nghiệp tiền điện tử, khiến sức mạnh tính toán phân tán trở thành hạng mục theo dõi AI nóng nhất và có giá trị nhất cho đến nay.

Vậy nếu mâu thuẫn cung cầu về năng lượng và dữ liệu trong ngành AI bùng nổ trong 1-2 năm tới, thì hiện tại có những dự án liên quan đến câu chuyện nào trong ngành tiền điện tử?

Trước tiên chúng ta hãy xem xét các mục tiêu liên quan đến năng lượng.

Có rất ít dự án năng lượng được niêm yết trên các CEX hàng đầu, ngoại trừ Power Ledger (mã thông báo Powr).

Power Ledger được thành lập vào năm 2017. Đây là một nền tảng năng lượng tích hợp dựa trên công nghệ blockchain. Nền tảng này hướng đến mục tiêu phi tập trung hóa các giao dịch năng lượng, thúc đẩy giao dịch điện trực tiếp giữa các cá nhân và cộng đồng, hỗ trợ ứng dụng rộng rãi năng lượng tái tạo và đảm bảo tính minh bạch và hiệu quả của các giao dịch thông qua hợp đồng thông minh. Ban đầu, Power Ledger hoạt động trên chuỗi liên kết dựa trên Ethereum. Vào nửa cuối năm 2023, Power Ledger đã cập nhật sách trắng và ra mắt chuỗi công khai tích hợp của riêng mình, được chuyển đổi từ khuôn khổ kỹ thuật của Solana để tạo điều kiện thuận lợi cho việc xử lý các giao dịch vi mô tần suất cao trên thị trường năng lượng phân tán. Hiện tại, các hoạt động kinh doanh chính của Power Ledger bao gồm:

-

Giao dịch năng lượng: Cho phép người dùng mua và bán điện trực tiếp trên cơ sở ngang hàng, đặc biệt là điện từ các nguồn tái tạo.

-

Giao dịch sản phẩm môi trường: chẳng hạn như giao dịch tín chỉ carbon và chứng chỉ năng lượng tái tạo, cũng như tài trợ dựa trên các sản phẩm môi trường.

-

Hoạt động chuỗi công khai: Thu hút các nhà phát triển ứng dụng xây dựng ứng dụng trên chuỗi khối Powerledger và phí giao dịch của chuỗi công khai được thanh toán bằng token Powr.

Giá trị thị trường lưu hành hiện tại của dự án Power Ledger là $170 triệu và tổng giá trị thị trường lưu hành là $320 triệu.

So với các mục tiêu được mã hóa liên quan đến năng lượng, số lượng mục tiêu được mã hóa trong đường dẫn dữ liệu phong phú hơn.

Tác giả chỉ liệt kê các dự án theo dõi dữ liệu mà ông hiện đang chú ý và đã được ra mắt trên ít nhất một trong các CEX, Binance, OKX và Coinbase, và sắp xếp chúng từ thấp đến cao theo FDV:

1. Streamr – DỮ LIỆU

Giá trị đề xuất của Streamrs là xây dựng một mạng dữ liệu thời gian thực phi tập trung cho phép người dùng tự do giao dịch và chia sẻ dữ liệu trong khi vẫn duy trì toàn quyền kiểm soát dữ liệu của riêng họ. Thông qua dữ liệu của nó thương trườngStreamr hy vọng có thể giúp các nhà sản xuất dữ liệu bán luồng dữ liệu trực tiếp cho người tiêu dùng quan tâm mà không cần thông qua trung gian, qua đó giảm chi phí và tăng hiệu quả.

Nguồn: https://streamr.network/hub/projects

Trong một trường hợp hợp tác thực tế, Streamr đã hợp tác với một dự án phần cứng trên xe Web3 khác là DIMO để thu thập nhiệt độ, áp suất không khí và các dữ liệu khác thông qua các cảm biến phần cứng DIMO được lắp trên xe, tạo thành một luồng dữ liệu thời tiết để truyền đến các cơ quan có nhu cầu.

So với các dự án dữ liệu khác, Streamr tập trung nhiều hơn vào dữ liệu của Internet vạn vật và cảm biến phần cứng. Ngoài dữ liệu xe DIMO được đề cập ở trên, các dự án khác bao gồm luồng dữ liệu giao thông thời gian thực ở Helsinki, v.v. Do đó, token dự án Streamrs DATA cũng đã tạo ra sự tăng gấp đôi giá trị của nó trong một ngày duy nhất vào tháng 12 năm ngoái khi khái niệm Depin là nóng nhất.

Giá trị thị trường lưu hành hiện tại của dự án Streamr là $44 triệu và tổng giá trị thị trường lưu hành là $58 triệu.

2. Cộng hóa trị – CQT

Không giống như các dự án dữ liệu khác, Covalent cung cấp dữ liệu blockchain. Mạng Covalent đọc dữ liệu từ các nút blockchain thông qua RPC, sau đó xử lý và sắp xếp dữ liệu để tạo cơ sở dữ liệu truy vấn hiệu quả. Theo cách này, người dùng Covalent có thể nhanh chóng truy xuất thông tin họ cần mà không cần phải thực hiện các truy vấn phức tạp trực tiếp từ các nút blockchain. Loại dịch vụ này cũng được gọi là lập chỉ mục dữ liệu blockchain.

Khách hàng của Covalents chủ yếu là B-side, bao gồm các dự án Dapp, chẳng hạn như nhiều Defi và nhiều công ty tiền điện tử tập trung, chẳng hạn như Consensys (công ty mẹ của Metamasks), CoinGecko (một trạm thị trường tài sản tiền điện tử nổi tiếng), Rotki (công cụ thuế), Rainbow (ví tiền điện tử), v.v. Ngoài ra, Fidelity, một gã khổng lồ trong ngành tài chính truyền thống và Ernst Young, một trong bốn công ty kế toán lớn, cũng là khách hàng của Covalents. Theo dữ liệu chính thức do Covalent tiết lộ, doanh thu của các dự án từ dịch vụ dữ liệu đã vượt qua The Graph, một dự án hàng đầu trong cùng lĩnh vực.

Do tính toàn vẹn, tính cởi mở, tính xác thực và bản chất thời gian thực của dữ liệu trên chuỗi, ngành công nghiệp Web3 được kỳ vọng sẽ trở thành nguồn dữ liệu chất lượng cao cho các kịch bản AI phân đoạn và các mô hình AI mini cụ thể. Là một nhà cung cấp dữ liệu, Covalent đã bắt đầu cung cấp dữ liệu cho nhiều kịch bản AI khác nhau và đã ra mắt dữ liệu có cấu trúc có thể xác minh dành riêng cho AI.

Nguồn: https://www.covalenthq.com/solutions/decentralized-ai/

Ví dụ, nó cung cấp dữ liệu cho nền tảng giao dịch thông minh trên chuỗi SmartWhales, sử dụng AI để xác định các mô hình giao dịch và địa chỉ có lợi nhuận; Entendre Finance sử dụng dữ liệu có cấu trúc Covalents và xử lý AI để có thông tin chi tiết theo thời gian thực, phát hiện bất thường và phân tích dự đoán.

Hiện tại, các kịch bản chính của dịch vụ dữ liệu trên chuỗi do Covalent cung cấp vẫn chủ yếu là tài chính, nhưng với việc khái quát hóa các sản phẩm và loại dữ liệu Web3, các kịch bản sử dụng dữ liệu trên chuỗi sẽ được mở rộng hơn nữa.

Hiện tại, dự án Covalent có giá trị thị trường lưu hành là $150 triệu và giá trị thị trường lưu hành đầy đủ là $235 triệu. So với The Graph, một dự án chỉ số dữ liệu blockchain trong cùng lĩnh vực, thì dự án này có lợi thế định giá tương đối rõ ràng.

3. Hivemapper – Mật ong

Trong số tất cả các tài liệu dữ liệu, giá đơn vị của dữ liệu video thường là cao nhất. Hivemapper có thể cung cấp dữ liệu bao gồm thông tin video và bản đồ cho các công ty AI. Bản thân Hivemapper là một dự án bản đồ toàn cầu phi tập trung nhằm mục đích tạo ra một hệ thống bản đồ chi tiết, năng động và dễ tiếp cận thông qua công nghệ blockchain và đóng góp của cộng đồng. Những người tham gia có thể thu thập dữ liệu bản đồ thông qua camera hành trình và thêm dữ liệu đó vào mạng dữ liệu Hivemapper nguồn mở và nhận phần thưởng dựa trên những đóng góp của họ trong mã thông báo dự án HONEY. Để cải thiện hiệu ứng mạng và giảm chi phí tương tác, Hivemapper được xây dựng trên Solana.

Hivemapper được thành lập lần đầu vào năm 2015 với mục đích ban đầu là sử dụng máy bay không người lái để tạo bản đồ, nhưng sau đó nhận thấy mô hình này khó có thể mở rộng quy mô nên đã chuyển sang sử dụng camera hành trình và điện thoại thông minh để thu thập dữ liệu địa lý, giúp giảm chi phí sản xuất bản đồ toàn cầu.

So với phần mềm bản đồ và chế độ xem phố như Google Map, Hivemapper có thể mở rộng phạm vi bản đồ hiệu quả hơn, duy trì độ mới của các cảnh thực trên bản đồ và cải thiện chất lượng video thông qua mạng lưới khuyến khích và mô hình huy động vốn từ cộng đồng.

Trước khi nhu cầu dữ liệu của AI bùng nổ, khách hàng chính của Hivemapper bao gồm ngành công nghiệp ô tô lái xe tự động, các công ty dịch vụ dẫn đường, chính phủ, công ty bảo hiểm và bất động sản, v.v. Ngày nay, Hivemapper có thể cung cấp dữ liệu đường bộ và môi trường rộng lớn cho AI và các mô hình lớn thông qua API. Với đầu vào là các luồng dữ liệu hình ảnh và đặc điểm đường bộ được cập nhật liên tục, các mô hình AI và ML sẽ có thể chuyển đổi dữ liệu tốt hơn thành các khả năng được cải thiện và thực hiện các nhiệm vụ liên quan đến vị trí địa lý và phán đoán trực quan.

Nguồn dữ liệu: https://hivemapper.com/blog/diversify-ai-computer-vision-models-with-global-road-imagery-map-data/

Hiện tại, giá trị thị trường lưu hành của dự án Hivemapper-Honey là $120 triệu và tổng giá trị thị trường lưu hành là $496 triệu.

Ngoài ba dự án trên, các dự án khác trong đường dẫn dữ liệu bao gồm The Graph – GRT (giá trị thị trường là $3,2 tỷ, FDV là $3,7 tỷ), có hoạt động kinh doanh tương tự như Covalent và cũng cung cấp dịch vụ lập chỉ mục dữ liệu blockchain; và Ocean Protocol – OCEAN (giá trị thị trường là $670 triệu, FDV là $1,45 tỷ, dự án này sắp sáp nhập với Fetch.ai và SingularityNET và mã thông báo sẽ được chuyển đổi thành ASI), một giao thức nguồn mở được thiết kế để tạo điều kiện thuận lợi cho việc trao đổi và kiếm tiền từ dữ liệu và các dịch vụ liên quan đến dữ liệu, kết nối người tiêu dùng dữ liệu với các nhà cung cấp dữ liệu, để chia sẻ dữ liệu trong khi đảm bảo sự tin cậy, minh bạch và khả năng truy xuất nguồn gốc.

Góc nhìn thứ hai về câu chuyện AI: Khoảnh khắc GPT tái xuất, trí tuệ nhân tạo chung xuất hiện

Theo tôi, năm đầu tiên của lộ trình AI trong ngành công nghiệp tiền điện tử là năm 2023 khi GPT gây chấn động thế giới. Sự gia tăng các dự án AI tiền điện tử là hậu quả của sự phát triển bùng nổ của ngành công nghiệp AI.

Mặc dù khả năng của GPT 4, turbo, v.v. đã liên tục được nâng cấp sau GPT 3.5 và Sora đã chứng minh khả năng tạo video đáng kinh ngạc và các mô hình ngôn ngữ lớn bên ngoài OpenAI cũng đã phát triển nhanh chóng, nhưng không thể phủ nhận rằng tác động nhận thức của tiến bộ công nghệ AI đối với công chúng đang suy yếu, mọi người đang dần bắt đầu sử dụng các công cụ AI và việc thay thế công việc trên quy mô lớn dường như vẫn chưa xảy ra.

Vậy, liệu có một khoảnh khắc GPT nào khác trong lĩnh vực AI trong tương lai, với bước tiến vượt bậc trong AI khiến công chúng phải kinh ngạc và khiến mọi người nhận ra rằng cuộc sống và công việc của họ sẽ thay đổi nhờ vào đó không?

Khoảnh khắc đó có thể là sự ra đời của trí thông minh nhân tạo tổng quát (AGI).

AGI đề cập đến những cỗ máy có khả năng nhận thức toàn diện tương tự như con người và có thể giải quyết nhiều vấn đề phức tạp, không chỉ những nhiệm vụ cụ thể. Hệ thống AGI có khả năng suy nghĩ theo cách trừu tượng cao, có kiến thức nền tảng sâu rộng, lý giải về lẽ thường trong mọi lĩnh vực, hiểu được mối quan hệ nhân quả và chuyển giao kiến thức giữa các ngành học. Hiệu suất của AGI không khác gì con người giỏi nhất trong từng lĩnh vực, và xét về khả năng toàn diện, nó hoàn toàn vượt trội hơn nhóm người giỏi nhất.

Trên thực tế, cho dù được trình bày trong tiểu thuyết khoa học viễn tưởng, trò chơi, phim ảnh và chương trình truyền hình, hay kỳ vọng của công chúng sau khi GPT nhanh chóng phổ biến, công chúng từ lâu đã mong đợi sự xuất hiện của AGI vượt quá mức độ nhận thức của con người. Nói cách khác, bản thân GPT là tiền thân của AGI và là phiên bản tiên tri của trí tuệ nhân tạo nói chung.

Lý do khiến GPT có tác động lớn về mặt công nghiệp và tâm lý là vì tốc độ triển khai và hiệu quả của nó vượt xa mong đợi của công chúng: mọi người không ngờ rằng một hệ thống trí tuệ nhân tạo có thể hoàn thành bài kiểm tra Turing thực sự sẽ xuất hiện và với tốc độ nhanh như vậy.

Trên thực tế, trí tuệ nhân tạo (AGI) có thể tái hiện lại khoảnh khắc đột ngột của GPT trong vòng 1-2 năm: con người vừa mới thích nghi với sự hỗ trợ của GPT, và họ thấy rằng AI không còn chỉ là một trợ lý nữa. Nó thậm chí có thể tự mình hoàn thành các nhiệm vụ cực kỳ sáng tạo và đầy thử thách, bao gồm cả những vấn đề khó khăn đã khiến các nhà khoa học hàng đầu của con người mắc kẹt trong nhiều thập kỷ.

Vào ngày 8 tháng 4 năm nay, Musk đã được Nicolai Tangen, giám đốc đầu tư của Quỹ đầu tư quốc gia Na Uy, phỏng vấn và nói về thời điểm AGI sẽ xuất hiện.

Ông cho biết: "Nếu bạn định nghĩa AGI là thông minh hơn những con người thông minh nhất, tôi nghĩ điều đó rất có thể sẽ xảy ra vào năm 2025".

Nói cách khác, theo suy luận của ông, AGI sẽ mất nhiều nhất là một năm rưỡi để đến. Tất nhiên, ông đã thêm một điều kiện tiên quyết, đó là điện và phần cứng có thể theo kịp hay không.

Lợi ích của sự ra đời của AGI là rất rõ ràng.

Điều đó có nghĩa là năng suất của nhân loại sẽ được cải thiện rất nhiều, và một số lượng lớn các vấn đề nghiên cứu khoa học đã làm chúng ta đau đầu trong nhiều thập kỷ sẽ được giải quyết. Nếu chúng ta định nghĩa bộ phận thông minh nhất của nhân loại là trình độ của những người đoạt giải Nobel, điều đó có nghĩa là miễn là có đủ năng lượng, sức mạnh tính toán và dữ liệu, chúng ta có thể có vô số người đoạt giải Nobel không biết mệt mỏi làm việc suốt ngày đêm để giải quyết những vấn đề khoa học khó khăn nhất.

Trên thực tế, người đoạt giải Nobel không phải là hiếm như một trong một trăm triệu. Hầu hết trong số họ đều ở trình độ giáo sư tại các trường đại học hàng đầu về năng lực và trí tuệ, nhưng vì xác suất và may mắn, họ đã chọn đúng hướng, tiếp tục làm việc và có được kết quả. Những người có cùng trình độ với anh ấy, những người đồng nghiệp xuất sắc không kém, cũng có thể đã giành được Giải thưởng Nobel trong vũ trụ song song của nghiên cứu khoa học. Nhưng thật không may, vẫn chưa có đủ những người là giáo sư tại các trường đại học hàng đầu và tham gia vào các đột phá nghiên cứu khoa học, vì vậy tốc độ đi qua tất cả các hướng đúng đắn của nghiên cứu khoa học vẫn còn rất chậm.

Với AGI, nếu năng lượng và sức mạnh tính toán được cung cấp đầy đủ, chúng ta có thể có AGI cấp độ người đoạt giải Nobel không giới hạn để tiến hành khám phá chuyên sâu theo bất kỳ hướng đột phá khoa học nào có thể, và tốc độ tiến bộ công nghệ sẽ nhanh hơn hàng chục lần. Sự tiến bộ của công nghệ sẽ dẫn đến sự gia tăng gấp trăm lần các nguồn lực mà hiện chúng ta coi là khá tốn kém và khan hiếm trong 10 đến 20 năm, chẳng hạn như sản xuất thực phẩm, vật liệu mới, thuốc mới, giáo dục trình độ cao, v.v. Chi phí để có được những thứ này cũng sẽ giảm theo cấp số nhân, cho phép chúng ta nuôi sống nhiều người hơn với ít tài nguyên hơn và của cải bình quân đầu người sẽ tăng nhanh chóng.

Biểu đồ xu hướng GDP toàn cầu, nguồn dữ liệu: Ngân hàng Thế giới

Điều này có vẻ hơi giật gân, nhưng chúng ta hãy xem xét hai ví dụ mà tôi đã sử dụng trong các bài trước báo cáo nghiên cứu về IO.NET :

-

Năm 2018, Francis Arnold, người đoạt giải Nobel Hóa học, đã phát biểu tại lễ trao giải: Ngày nay, chúng ta có thể đọc, viết và chỉnh sửa bất kỳ trình tự DNA nào trong các ứng dụng thực tế, nhưng chúng ta vẫn chưa thể biên soạn nó. Chỉ năm năm sau bài phát biểu của ông, vào năm 2023, các nhà nghiên cứu từ Đại học Stanford và Salesforce Research, một công ty khởi nghiệp về AI tại Thung lũng Silicon, đã công bố một bài báo trên tạp chí Nature Biotechnology. Họ đã tạo ra 1 triệu protein mới từ đầu thông qua một mô hình ngôn ngữ lớn được tinh chỉnh dựa trên GPT 3 và tìm thấy 2 protein có cấu trúc hoàn toàn khác nhau nhưng đều có khả năng diệt khuẩn, dự kiến sẽ trở thành một giải pháp kháng khuẩn bên cạnh thuốc kháng sinh. Nói cách khác: với sự trợ giúp của AI, nút thắt trong quá trình tạo protein đã bị phá vỡ.

-

Trước đó, thuật toán trí tuệ nhân tạo AlphaFold đã dự đoán được gần như toàn bộ 214 triệu cấu trúc protein trên Trái Đất trong vòng 18 tháng. Thành tựu này lớn hơn hàng trăm lần so với công trình của tất cả các nhà sinh học cấu trúc trong quá khứ.

Sự thay đổi đã và đang diễn ra, và sự ra đời của AGI sẽ đẩy nhanh quá trình này hơn nữa.

Mặt khác, những thách thức mà sự ra đời của AGI mang lại cũng rất lớn.

AGI không chỉ thay thế một số lượng lớn lao động trí óc mà cả những người lao động chân tay hiện được coi là ít bị ảnh hưởng bởi AI cũng sẽ bị ảnh hưởng khi công nghệ robot phát triển và chi phí sản xuất giảm do nghiên cứu và phát triển vật liệu mới mang lại. Tỷ lệ công việc bị thay thế bởi máy móc và phần mềm sẽ tăng nhanh chóng.

Vào thời điểm đó, hai vấn đề trước đây có vẻ rất xa vời sẽ sớm xuất hiện:

-

Vấn đề việc làm và thu nhập cho một số lượng lớn người thất nghiệp

-

Trong một thế giới mà AI ở khắp mọi nơi, làm thế nào để phân biệt giữa AI và con người

WorldcoinWorldchain đang cố gắng cung cấp một giải pháp, đó là sử dụng hệ thống UBI (Thu nhập cơ bản toàn dân) để cung cấp thu nhập cơ bản cho công chúng và sử dụng công nghệ sinh trắc học dựa trên mống mắt để phân biệt giữa con người và AI.

Trên thực tế, UBI, nơi cung cấp tiền cho mọi người, không phải là lâu đài trên không nếu không có thực hành thực tế. Các quốc gia như Phần Lan và Anh đã thực hiện thu nhập cơ bản phổ quát, và các đảng phái chính trị ở Canada, Tây Ban Nha, Ấn Độ và các quốc gia khác đang tích cực đề xuất thúc đẩy các thử nghiệm liên quan.

Ưu điểm của việc phân phối UBI dựa trên mô hình nhận dạng sinh trắc học + blockchain là hệ thống có tính toàn cầu và bao phủ một nhóm dân số rộng hơn. Ngoài ra, các mô hình kinh doanh khác có thể được xây dựng dựa trên mạng lưới người dùng được mở rộng thông qua phân phối thu nhập, chẳng hạn như dịch vụ tài chính (Defi), mạng xã hội, crowdsourcing nhiệm vụ, v.v., để hình thành sự hiệp lực kinh doanh trong mạng lưới.

Một trong những mục tiêu tương ứng cho hiệu ứng tác động do sự ra đời của AGI mang lại là Worldcoin – WLD, có giá trị thị trường lưu thông là $1,03 tỷ và tổng giá trị thị trường lưu thông là $47,2 tỷ.

Rủi ro và sự không chắc chắn trong suy luận tường thuật

Bài viết này khác với nhiều báo cáo nghiên cứu về dự án và theo dõi trước đây do Mint Ventures công bố. Việc suy luận và dự đoán về câu chuyện này mang tính chủ quan cao. Vui lòng coi nội dung của bài viết này là một cuộc thảo luận khác biệt chứ không phải là dự đoán về tương lai. Suy luận về câu chuyện trên phải đối mặt với nhiều điều không chắc chắn, dẫn đến những phỏng đoán sai. Những rủi ro hoặc yếu tố ảnh hưởng này bao gồm nhưng không giới hạn ở:

-

Năng lượng: Nâng cấp GPU dẫn đến giảm nhanh mức tiêu thụ năng lượng

Mặc dù nhu cầu năng lượng cho AI đã tăng vọt, các nhà sản xuất chip như NVIDIA đang cung cấp sức mạnh tính toán cao hơn với mức tiêu thụ điện năng thấp hơn thông qua các bản nâng cấp phần cứng liên tục. Ví dụ, vào tháng 3 năm nay, NVIDIA đã phát hành thế hệ card tính toán AI mới GB 200 tích hợp hai GPU B 200 và một CPU Grace. Hiệu suất đào tạo của nó gấp 4 lần so với thế hệ trước của GPU AI chính H 100 và hiệu suất lý luận của nó gấp 7 lần so với H 100, nhưng mức tiêu thụ năng lượng cần thiết chỉ bằng 1/4 H 100. Tất nhiên, bất chấp điều này, mong muốn của mọi người về sức mạnh từ AI vẫn còn lâu mới kết thúc. Với sự suy giảm mức tiêu thụ năng lượng của đơn vị, khi các kịch bản và nhu cầu ứng dụng AI mở rộng hơn nữa, tổng mức tiêu thụ năng lượng thực sự có thể tăng lên.

-

Dữ liệu: Q* có kế hoạch đạt được dữ liệu tự tạo

Luôn có một dự án Q* được đồn đại trong OpenAI, được đề cập trong một thông điệp nội bộ do OpenAI gửi cho nhân viên. Theo Reuters, trích dẫn nguồn tin nội bộ của OpenAI, đây có thể là bước đột phá của OpenAI trong quá trình theo đuổi trí thông minh siêu việt/trí tuệ nhân tạo tổng quát (AGI). Q* không chỉ có thể giải quyết các vấn đề toán học chưa từng thấy trước đây bằng khả năng trừu tượng của mình mà còn tự tạo dữ liệu để đào tạo các mô hình lớn mà không cần cung cấp dữ liệu thực tế. Nếu tin đồn là sự thật, nút thắt cổ chai của việc đào tạo mô hình lớn AI bị giới hạn bởi dữ liệu chất lượng cao không đủ sẽ bị phá vỡ.

-

Sự ra đời của AGI: Những lo lắng tiềm ẩn của OpenAI

Liệu AGI có xuất hiện vào năm 2025 như Musk đã nói hay không vẫn chưa được biết, nhưng đó chỉ là vấn đề thời gian. Tuy nhiên, với tư cách là người hưởng lợi trực tiếp từ câu chuyện về sự ra đời của AGI, mối quan tâm lớn nhất của Worldcoin có thể đến từ OpenAI, sau cùng, nó được công nhận là "mã thông báo bóng tối của OpenAI".

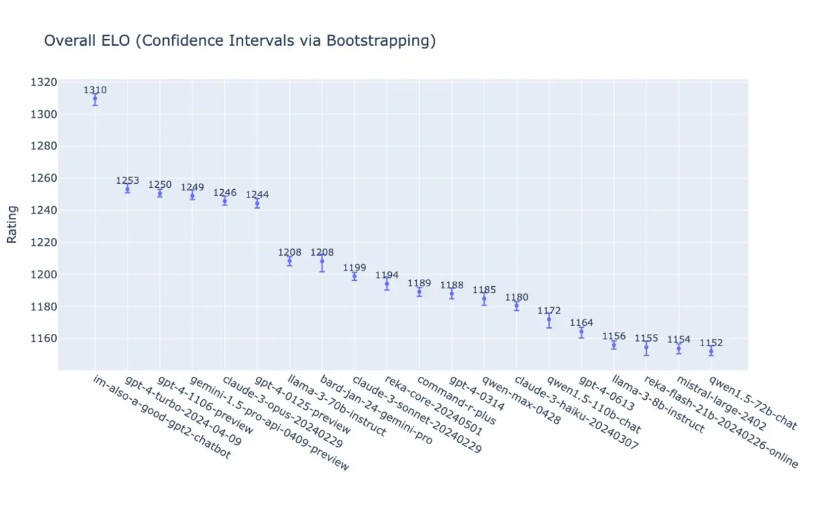

Vào sáng sớm ngày 14 tháng 5, OpenAI đã trình diễn hiệu suất của GPT-4 o mới nhất và 19 phiên bản khác nhau của các mô hình ngôn ngữ lớn trong điểm số nhiệm vụ toàn diện tại hội nghị ra mắt sản phẩm mới vào mùa xuân. Chỉ xét riêng từ bảng, GPT-4 o đạt 1310 điểm, về mặt trực quan có vẻ cao hơn nhiều so với một vài điểm sau, nhưng xét về tổng điểm, nó chỉ cao hơn 4,5% so với GPT 4 turbo đứng thứ hai, cao hơn 4,9% so với Google Gemini 1.5 Pro đứng thứ tư và cao hơn 5,1% so với Anthropic Claude 3 Opus đứng thứ năm.

Chỉ hơn một năm đã trôi qua kể từ khi GPT 3.5 gây chấn động thế giới khi lần đầu tiên được phát hành, và các đối thủ cạnh tranh của OpenAI đã bắt kịp rất sát sao (mặc dù GPT 5 vẫn chưa được phát hành và dự kiến sẽ được phát hành trong năm nay). Liệu OpenAI có thể duy trì vị trí dẫn đầu trong ngành trong tương lai hay không dường như đang trở nên không rõ ràng. Nếu lợi thế dẫn đầu và sự thống trị của OpenAI bị pha loãng hoặc thậm chí bị vượt qua, thì giá trị tường thuật của Worldcoin với tư cách là token bóng tối của OpenAI cũng sẽ giảm.

Ngoài giải pháp xác thực mống mắt của Worldcoin, ngày càng có nhiều đối thủ cạnh tranh tham gia vào thị trường này. Ví dụ, dự án ID quét lòng bàn tay Humanity Protocol vừa công bố vòng tài trợ mới trị giá $30 triệu với mức định giá $1 tỷ. LayerZero Labs cũng thông báo rằng họ sẽ chạy trên Humanity và tham gia mạng lưới nút xác thực của mình, sử dụng bằng chứng ZK để xác thực thông tin đăng nhập.

Phần kết luận

Cuối cùng, mặc dù tác giả đã suy ra câu chuyện tiếp theo của đường đua AI, đường đua AI khác với các đường đua gốc tiền điện tử như DeFi. Nó giống một sản phẩm của sự lan tỏa của cơn sốt AI vào vòng tròn tiền tệ hơn. Nhiều dự án hiện tại không thành công về mặt mô hình kinh doanh và nhiều dự án giống như meme theo chủ đề AI hơn (ví dụ, Rndr tương tự như meme của Nvidia và Worldcoin tương tự như meme của OpenAI). Người đọc nên xem chúng một cách thận trọng.

Bài viết này có nguồn từ internet: Làn sóng suy luận tường thuật tiếp theo trong lĩnh vực AI tiền điện tử: các yếu tố xúc tác, lộ trình phát triển và các mục tiêu liên quan

Bản gốc|Odaily Planet Daily Tác giả: Azuma Cuối tuần trước, Blast đã chính thức công bố thông tin chi tiết về việc phân phối Điểm vàng giai đoạn 2 (Blast Gold) và thông báo rằng họ sẽ phân phối tổng cộng 10 triệu Điểm vàng cho 70 dự án sinh thái trong tuần này. Là một chỉ số đánh giá đóng góp lớn khác độc lập với hệ thống điểm thông thường đang ngày càng bị thổi phồng, vì Blast trước đây đã tuyên bố rằng 50% cổ phiếu airdrop sẽ được phân bổ cho những người nắm giữ Điểm vàng, nên Điểm vàng cũng được coi là có giá trị nhất trên Blast. So với giai đoạn đầu tiên của các cơ hội phân bổ, tổng số Điểm vàng được phân bổ trong giai đoạn này (10 triệu) không thay đổi, nhưng số lượng dự án được chọn đã giảm một nửa (140 trong giai đoạn đầu tiên) và Blast đã sử dụng…