Dữ liệu cho thấy: Liệu lý thuyết đầu tư tiền điện tử “mua mới, không mua cũ” có còn hiệu quả không?

Bản gốc | Odaily Planet Daily

Author | Yan Chen

Recently, the market has been hotly discussing that under the pressure of interest monopoly groups such as VC and CEX, the project team launched the top CEX with the highest possible FDV in order to provide sufficient exit liquidity to early investment institutions and insiders, leaving small and medium-sized investors to become bag holders.

Haseeb Qureshi, managing partner of Dragonfly, responded in VC Perspective: What is the reason for the decline of high FDV, low circulation tokens? and provided data support. The core point is that the general poor performance of low circulation/high FDV tokens is a process of market self-correction. The founder of Ambient expressed his point of view from the perspective of ETH standard : denominated in ETH, the FDV of newly issued tokens is not much different from the past .

What is the actual situation? Based on the research of X platform user @tradetheflow_, Odaily Planet Daily updates, supplements, classifies and interprets the data, and compares the two bull market cycles, and concludes that buying new coins on the top CEX is no longer a good investment.

Data support (from tradetheflow_viewpoint)

Looking back at all newly listed tokens on the largest CEX, Binance, over the past 6 months, we noticed that more than 80% of them saw a drop in price since the day of listing.

The few exceptions are:

$MEME : a meme coin

$ORDI : fair launch, no participation from Tier 1 VCs

$JUP : Strong support for the Solana ecosystem

$JTO : Also a strong support for the Solana ecosystem

$WIF : Another meme coin

A brief overview of recent Binance new coin statistics

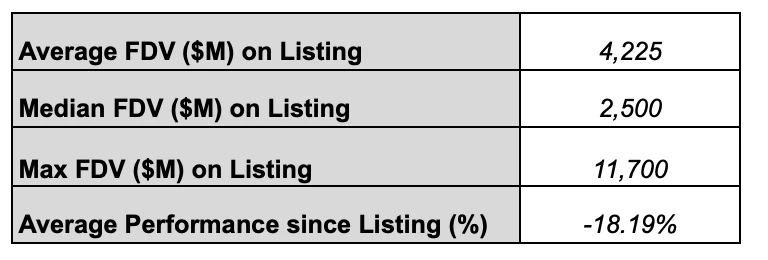

Most of the newly listed tokens on Binance are backed by top VCs and listed at crazy valuations. The average FDV of these tokens on the day of listing on Binance is over $4.2 billion, and some new coins even have ridiculous FDVs of over $11 billion. But these projects usually don’t have real users or strong community support.

FDV related data

Doing a simple backtest, if you held a portfolio whose strategy was to invest the same amount in every new Binance listing, you would have lost more than 18% over the past 6 months.

So the conclusion we have reached is very clear, the new coins launched on Binance in the past six months are no longer good investments – all their upside potential has been pre-empted . Instead, these new coins represent exit liquidity for insiders who take advantage of the fact that a large number of retail investors cannot get high-quality early investment opportunities.

In many ways, the current mechanism for issuing tokens is rigged and not good for cryptocurrencies.

Crazy listing of new coins with high FDV will only lead to market bleeding and loss of trust, which will eventually make new coins the sword of Damocles hanging over the market. But more importantly, this path is unsustainable and will damage the reputation of the entire crypto industry.

Retail investors are tired of being the exit liquidity for insiders. Slowly, retail investors are beginning to realize that this is ridiculous. The current status quo needs to change, otherwise our industry will pay a long-term price for these short-sighted market abuses.

Our extended viewpoint:

Most of the tokens issued so far are taking advantage of bullish sentiment to drive up prices, and will inevitably be sold off eventually (when the market cools).

One of the reasons why this happens is that founders set very short timelines for cashing out to investment institutions and other early angel investors, provide investors with false and inflated indicators, and focus on marketing hype rather than finding real users. Worse, scientists bots and market makers will seize the dominant ecological niche in the secondary market. Cryptocurrency urgently needs a new way to issue and distribute tokens.

Everyone has made a lot of attempts, and investors hope to participate in this market in a fair manner. This also explains why the BRC 20 token, which innovates in the asset issuance method (Fair Launch), is popular.

It seems that everyone has forgotten CZ’s wise advice a few years ago – he set the price of BNB very low so that more investors would participate in the community building of BNB, so that he would have a very active and high-quality community.

From another perspective, it is true that in the bull market many projects have the demand for VC profit delivery and coin issuance, but can the current liquidity really support Binance to list a new coin almost every one or two weeks for many months?

Some tokens (such as NFP and ACE) have completed a bull-bear trend of many tokens in just a few months. Under the premise that the funds in the market outside BTC have not increased significantly, the final outcome of high FDV and low market value tokens is that the mud and the sand will be mixed.

In this cycle, it is particularly correct to speculate on old coins instead of new ones. Compared with the high FDV new coins that are waiting to be unlocked in large quantities in this cycle, the profit and loss ratio of gambling on the unlocked old coins (AR, NEAR, etc.) is more ideal.

Our data supports:

Binance New Coin Statistics

The opening market capitalizations of the 14 Binance Launchpool new projects in the last bull cycle (January 14, 2021 – September 19, 2021) are similar to the opening market capitalizations of the 15 projects in this bull cycle (October 31, 2023 – April 17, 2024). We divide the table into two areas to observe the changes in the market capitalization and FDV of new projects in the two cycles.

If we refer to the trend of new tokens listed on Binance during the statistical time period in the previous bull market, shorting any new token on Binance within the first week of opening will generate returns of more than 80% within two years.

This only captures the new tokens on Launchpool, and does not include Binance’s newly launched tokens that have been listed on other exchanges (such as WIF, METIS) and initial coin offerings (such as TNSR, W, etc.).

This article does not discuss in detail the ultimate questions such as whether exchanges (and project parties) should be responsible for the price trend of coins, whether the timing of listing fails to balance the interests of institutions and small and medium-sized investors, and whether a more effective price is reached after listing on large exchanges and being fully traded.

But obviously, Binance has also paid attention to the discussions in the market.

Binance’s response to the above voices

On May 20, Binance released a báo cáo summarizing that the unlocking of low circulation and high FDV tokens may trigger selling pressure, and it is expected that $155 billion worth of tokens will be unlocked from 2024 to 2030; VC continues to play an important role in the crypto industry and can work with project teams to ensure fair supply distribution and reasonable valuations.

On the evening of May 20, Binance issued an announcement in response to doubts: Binance will take the lead in supporting small and medium-sized cryptocurrency projects. We sincerely invite high-quality teams and projects to apply for Binance listing projects, including: Direct Listing, Launchpools, Megadrops, etc. We hope to promote the development of the blockchain ecosystem by strengthening support for small and medium-sized cryptocurrency projects with good fundamentals, organic community foundations, sustainable business models and industry responsibilities. Launching tokens with high fully diluted valuations and low circulation will lead to huge selling pressure when they are unlocked in the future. Such a market structure is not good for ordinary investors and loyal community members of the project. Binance is committed to reshaping this trend and creating a diverse market environment for our users and all market participants.

This article is sourced from the internet: The data speaks: Does the crypto investment theory of “buy new, not old” still work?

Có liên quan: Các nhà phân tích tuyên bố Bitcoin đã đạt đỉnh và có thể giảm xuống $42.000

Tóm tắt Bitcoin kiểm tra phạm vi $63.000-$61.000, có nguy cơ bị phá vỡ. Các nhà phân tích dự đoán giá có khả năng điều chỉnh xuống $42.000. Sự quan tâm của các tổ chức tăng lên có thể ổn định giá. Các phân tích gần đây từ các chuyên gia tiền điện tử hàng đầu cho thấy Bitcoin, hiện đang dao động trong khoảng từ $63.000 đến $61.000, có thể chuẩn bị cho một đợt suy thoái đáng kể. Các nhà phân tích này cảnh báo về một đỉnh thị trường tiềm năng có thể dẫn đến một đợt điều chỉnh giá mạnh mẽ. Tại sao Bitcoin có thể sụp đổ xuống $42.000 Nhà phân tích kỹ thuật DonAlt bày tỏ lo ngại về các đợt kiểm tra định kỳ của phạm vi giá hỗ trợ $63.000 - $61.000, có thể làm suy yếu. “Bitcoin đã trở lại mức cũ giữa $63.000 và $61.000. Càng được kiểm tra thường xuyên thì khả năng bị phá vỡ càng cao. Tôi nghĩ ngay cả những người đầu cơ giá lên cũng muốn có một đợt giảm giá dưới mức này tại thời điểm này,” DonAlt giải thích. Ông dự đoán rằng ngay cả những người đầu cơ giá lên…