Phân tích vĩ mô SignalPlus (20240417): Thị trường khởi động lại câu chuyện hạ cánh mềm

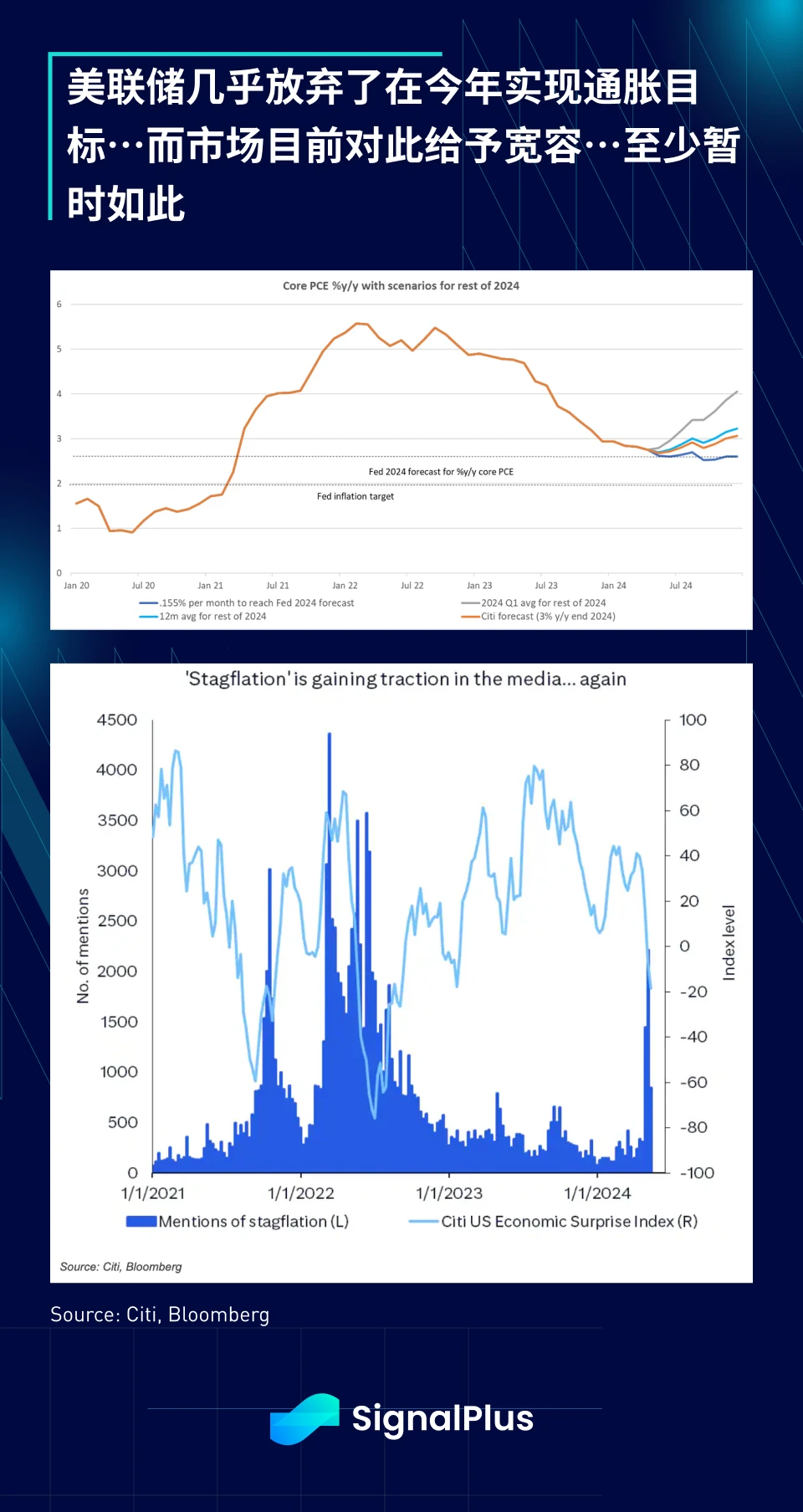

Over the past week, slowing economic growth and falling inflation expectations have once again triggered the narrative of a soft landing. This is not the first time we have seen this happen. The most natural reaction of the market at this time is the FOMO sentiment of stocks, buying credit instruments, collecting fixed interest rates, shorting volatility, and earning arbitrage returns. This is almost the standard script since the last FOMC meeting, and in the absence of any significant variables, this trend shows no signs of slowing down.

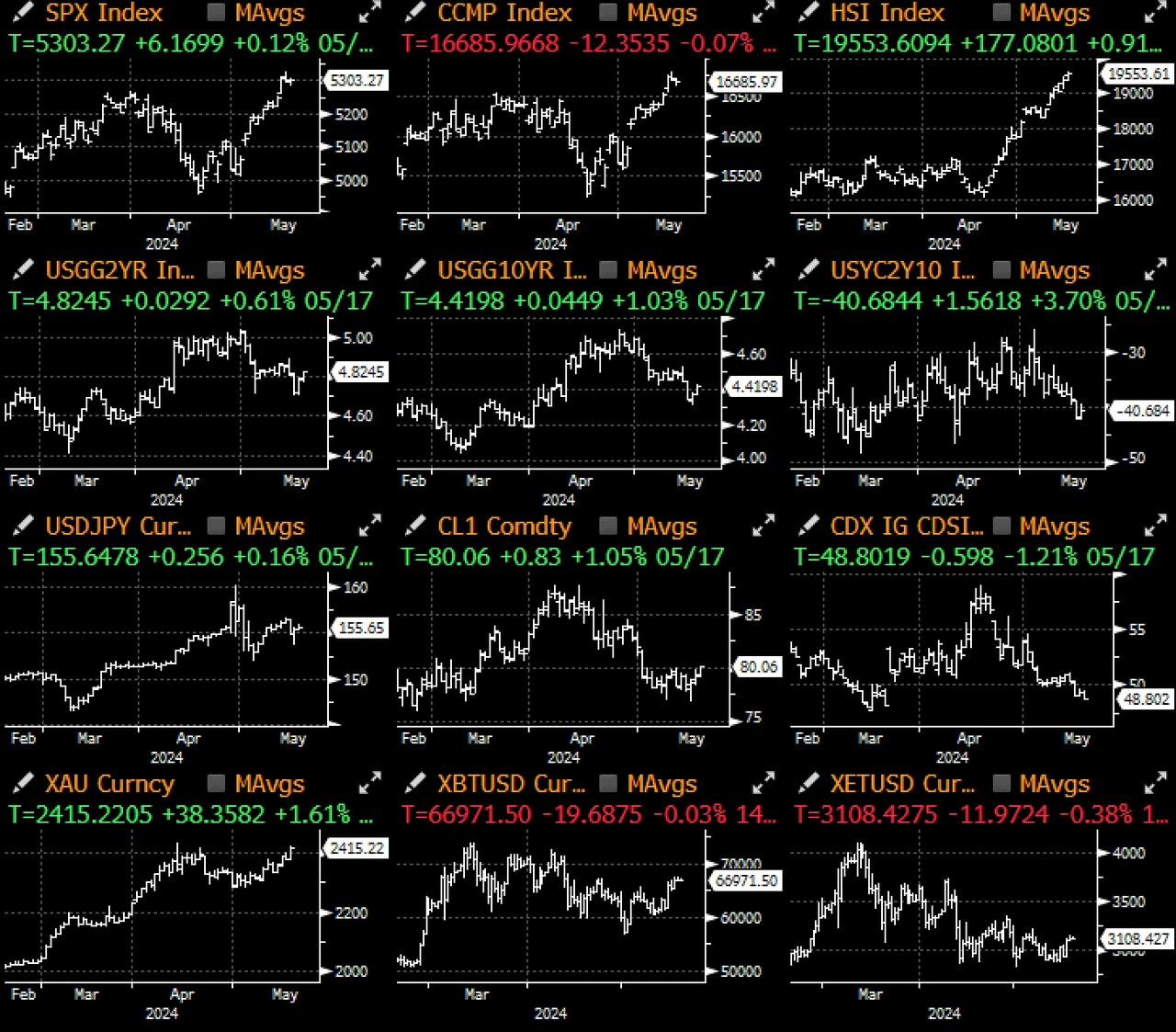

Stocks hit new highs last week, with the SPX up 1.5% to break 5,300, with automakers (+4.4%), technology (+2.9%) and real estate (+2.5%) performing particularly well in a friendly financial environment. The 10-year Treasury yield fell 8 basis points and is now 27 basis points lower this month, while oil (+2%), gold (+2%) and copper (+8%) have also had nice rallies this month. As the Wall Street Journal article says, whats not to love about the current investment environment?

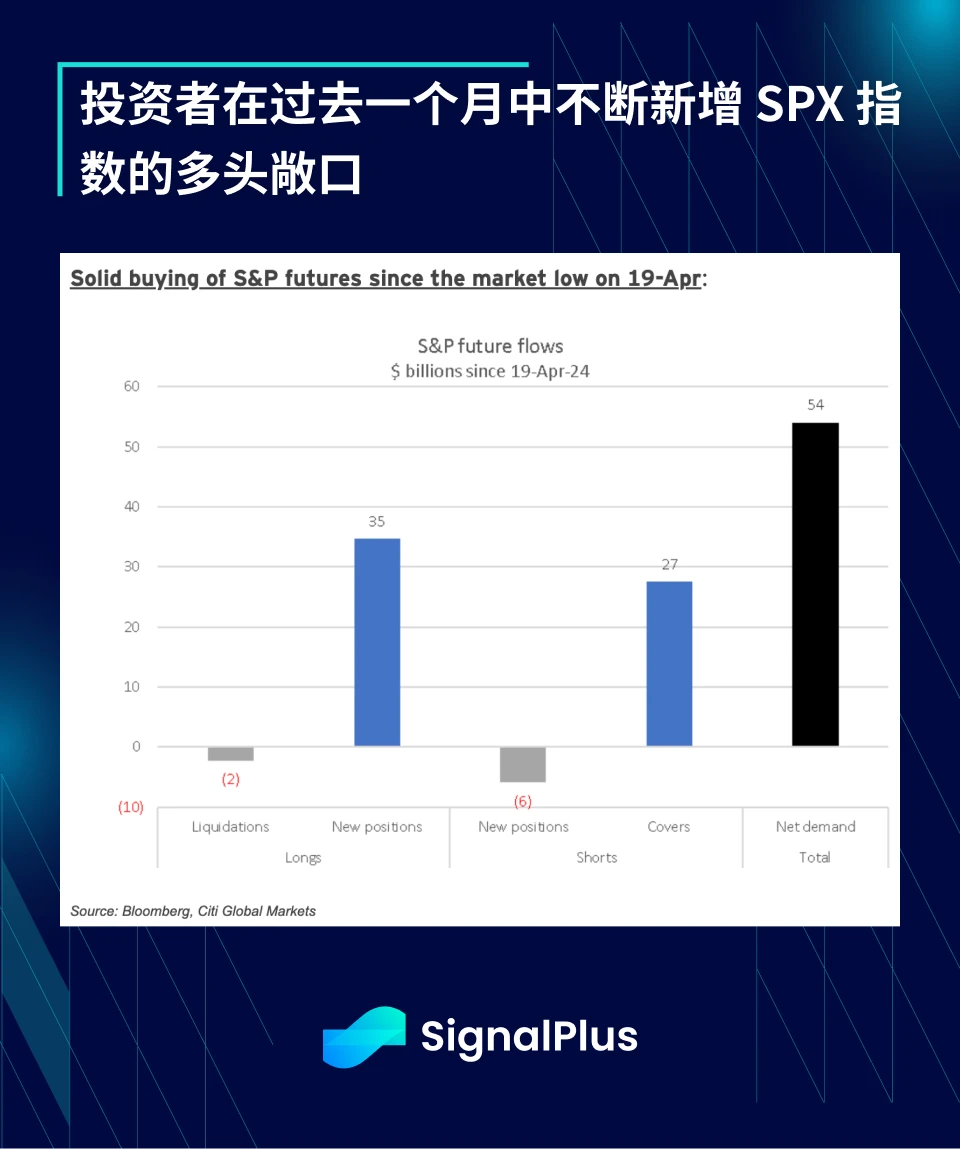

Additionally, Wall Street traders believe the recent stock market rally has shifted from pure short covering to new long positions, with Citi estimating more than $50 billion in new SPX index futures over the past month, while ICI reports more than $20 billion in domestic equity ETF issuance since the beginning of the month as retail investors take profits in this rally.

Equity options flows also point in the same direction, with binary options pricing reflecting a 25% chance of a further 10% gain in SPX by year end. In addition, the call/put ratio for 0 DTE options has risen again during this rally, with about 56% of volume going to calls.

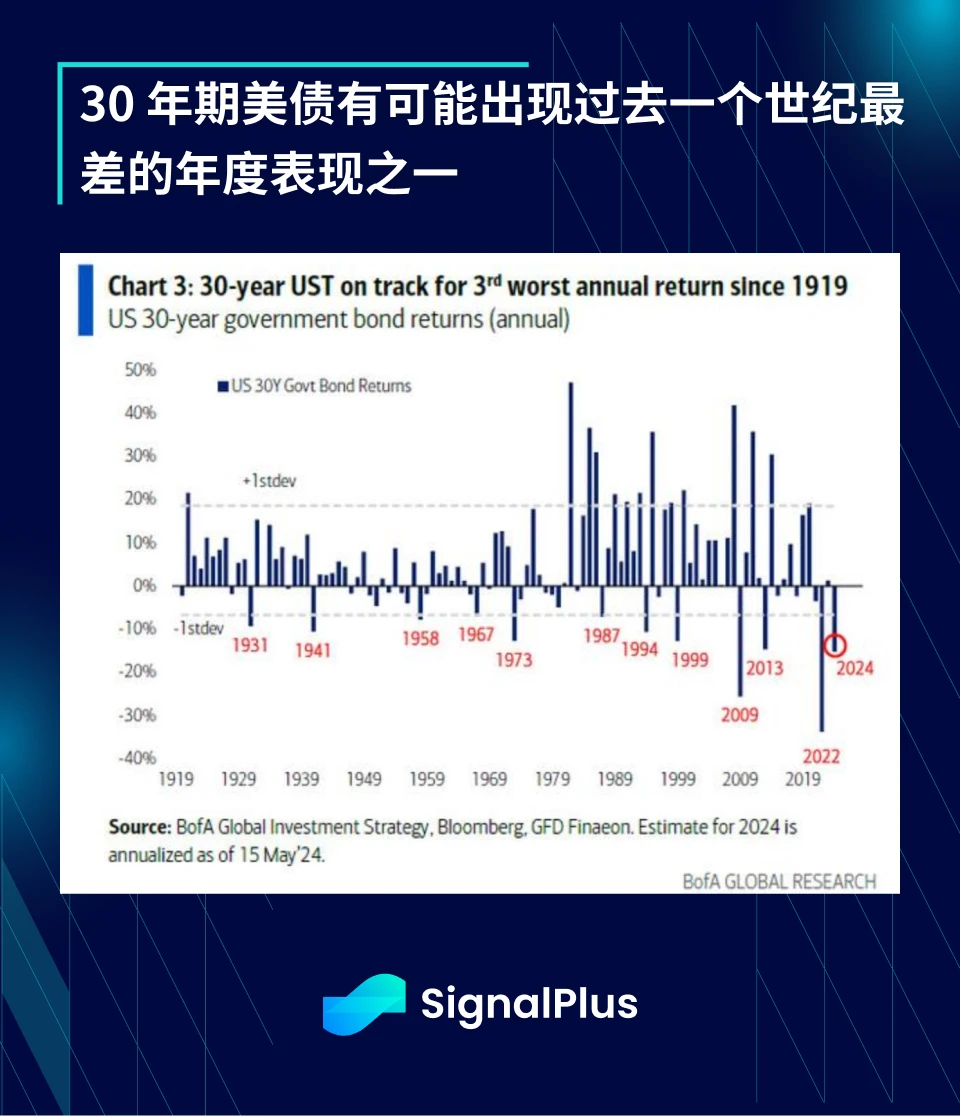

Interestingly, behind all this frenzy, 30-year bonds are behaving like an outlier. According to BoA estimates, 30-year bonds are heading for the third worst annual return in a century. Loose government spending, out-of-control budgets, overly loose financial conditions and an inflation-tolerant Fed (where is the inflation target?) are having a negative impact on long-term interest rate tools. Generous fiscal policy will eventually be paid for through higher real interest rates and/or a weaker exchange rate, but the time has not yet come…

There isn鈥檛 a lot of interesting data this week until Nvidia reports, and then it鈥檚 back to holiday mode again before the non-farm payrolls and FOMC + CPI for the first two weeks of June. Based on Nvidia鈥檚 weighting in the SPX and the volatility implied by Nvidia options, the company has a +/- 0.4% impact on the SPX on earnings day, and positioning in the stock doesn鈥檛 seem as concentrated as it was at the beginning of the year.

There is not much news to watch on the crypto front. BTC price is trading at its highest short-term correlation with the Nasdaq since Q3 2024, and price action is positive, with native investors looking to challenge all-time highs again in the coming weeks. Nothing can change sentiment more than price, and nothing can affect crypto prices more than stocks right now. Everyone became a rates trader in the first half of 2023, and now every macro asset class is a disguised Nasdaq day trading tool? Hopefully the temporary market pause will give everyone some much-needed breathing room!

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

Trang web chính thức của SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240417): The market restarts the soft landing narrative

Related: SignalPlus Volatility Column (20240513): Strong Start

Last Friday, the US macro data performed poorly. The one-year inflation rate expectation in May rose from 3.2% to 3.5%. The University of Michigan Consumer Confidence Index showed weakness, falling to 67.4, offsetting the positive impact of the recent weak employment data on market risk sentiment. The US 10-year Treasury yield once returned to above the 4.5% mark, and the two-year yield, which is more sensitive to interest rate policy, rose to 4.853%. Risk assets performed relatively steadily, and the three major US stock indexes rose and fell. Among them, the Dow and SP closed slightly up 0.32%/0.16% respectively, and the Nasdaq fell 0.03%. This week, the markets focus will be on the CPI data released on Wednesday, which may become a key driver of medium-term price trends. Source: Investing…