بیس اوپر ہے، بی ایس سی نیچے ہے: بیس اور بی ایس سی کے درمیان آن چین گیپ پر گہرائی سے بحث

Source: CapitalismLab

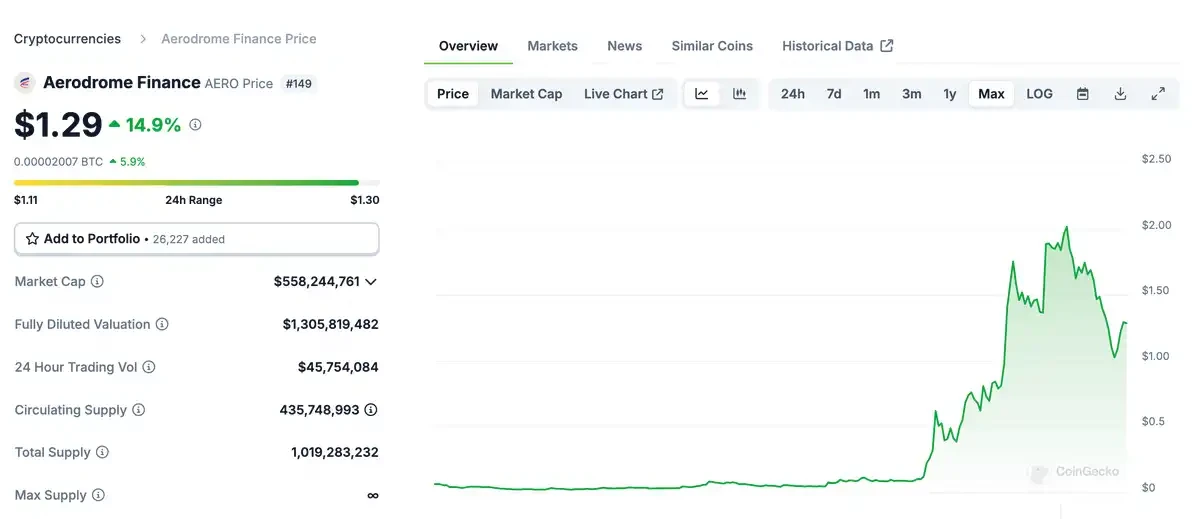

Aerdromes price has gone through a round, and Base has single-handedly supported the peak 1 B Mcap, 2B FDV, a hundred times coin, showing off its muscles. The positive externalities it brought also further revitalized the Base ecosystem.

On the other hand, BSC has not made any progress even after the shoe dropped this round. Where is the gap? This thread will use this as a starting point to discuss and comment on the gap between the two CEXs on the chain in this round.

The reason why Coinbase pulled Aero is very simple. As shown in the figure below, in the past, projects incentivized DeFi miners with direct incentives. For example, for a project token worth $2, a miner might get an additional $1 from the DEX transaction fee, for a total of $3.

In the Ve(3, 3) DEX system like Aero, the $3 is used to bribe veAero, which votes to allocate $Aero tokens (with a higher value, such as $9) to miners.

In the end, the project owner still paid $3, veAero (Aero locked) obtained a real profit of $3, and the miners received an incentive of $9, which doubled the incentive.

The higher the price of Aero, the higher the incentive value issued, the higher the incentive that the Base ecological project can enjoy, and the fundamentals of the ecological project will be strengthened. The value of the bribe token that can be given to Aero will also be higher, and Aero鈥檚 income will be higher, and the price will be more optimistic about forming a flywheel.

In addition, if Base directly incentivizes on-chain projects, on the one hand, it will easily become off-chain relationship building, and on the other hand, it is not easy to publicly incentivize those local dog and meme projects. These projects have traffic, and by supporting Aero, it is to achieve permissionless incentives for the on-chain ecosystem, because any project can further amplify the incentive effect through Aero. This approach brings benefits to ordinary developers that cannot be compared with official incentives.

Looking back at BSC, are there any similar products? Not only do there are, but they can be said to be a level stronger than Base in terms of both developers and products.

Thena can be considered as an enhanced version of Aerodrome, supporting V3 centralized liquidity.

Pancake + Cakepies dual-wheel drive can exert a stronger flywheel effect and has a higher ceiling.

Although we complained that the Cake War organization was far inferior to the Pendle War (suspected of self-promotion), the subsequent iteration of Pancake was also relatively slow, which delayed the construction of the flywheel. In addition, instead of learning from the advanced ve (3, 3) transaction fees to voters, the team took a small part of the voting rights and intervened manually (who would be willing to let go of the taste of power?).

However, in horizontal comparison, although it is not as good as the best, it is more than enough compared to the worst. For example, Camelot, the leader of ARB, has been calling for voting incentives on the voting gauge for a year but has not yet been implemented.

The Cakepie/Magpie team is very rare in BSC, and their subDAOs are also very successful on other chains. Although Thena has not yet proven itself on other chains, its products are faster and better than those of Velo/Aero.

Since BSC has better product and developer foundation, why didn鈥檛 it achieve similar results as Base? Even Mantle鈥檚 ve(3, 3) DEX Moe was able to make some splashes this round, but BSC couldn鈥檛?

If you do a little research, you will be surprised to find that Binances support for this is not zero but negative… negative…

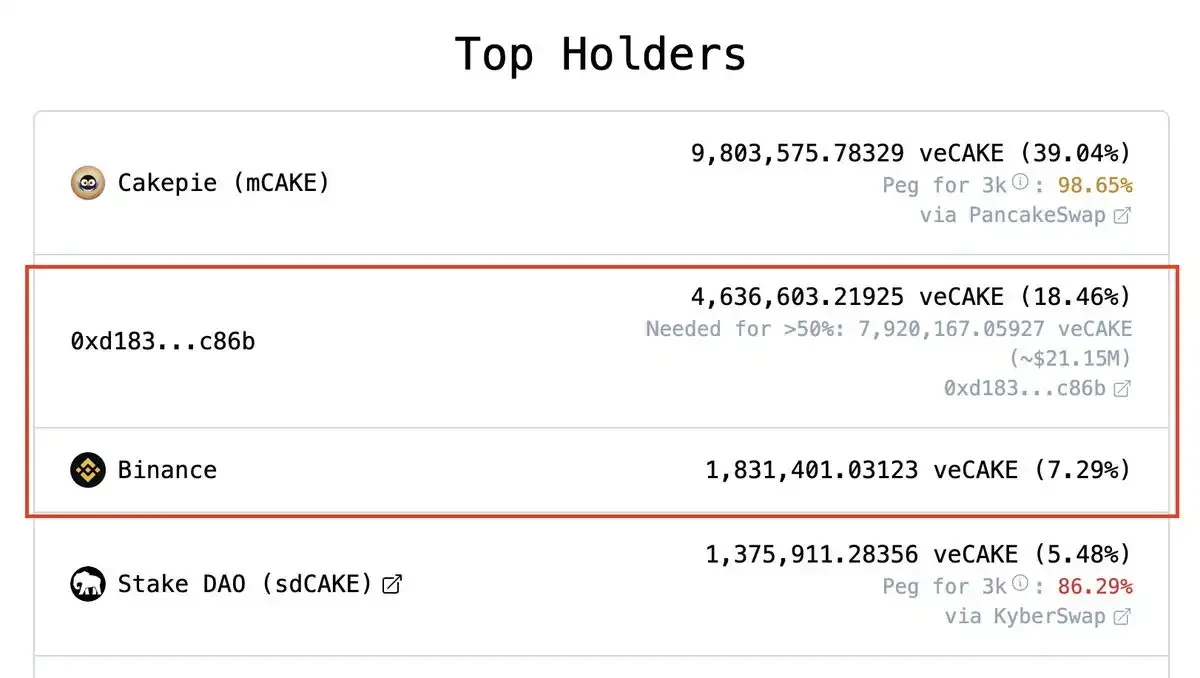

Yes, on the one hand, the above projects did not receive the investment and listing support from Aero, on the other hand, as shown in the figure, the address marked as Binance and another suspected Binance address (inferred by the Cake community) have locked up 26% of veCAKE in total, directly competing with ecological projects. After all, the dividends and incentives in each round are limited, and the more Binance gets, the less ecological projects get.

The Pancake team gets a small half of the voting rights, and Binance gets another small half. The effect is greatly reduced. Usually, this is injected into ecological projects for support. Here, Binance not only does not support the ecology but also directly steals money from the ecology. Binance should not lack this Pancake income dividend…

Is ve(3, 3) difficult to understand? But in the last round, whether it was the Curve War between Yearn founded by AC and Convex, or Terra/Luna buying CVX to control Curve governance to support UST, they were all focus battles. This can be said to be basic common sense for veteran Web3 players.

Pendle and Aero, the hundred-fold coins in this round, also adopted this model. Even Cake relied on this to stop falling and rebound.

Are the resources that Binance invested in BSC going to better projects? What is the difference between NFP/Cyber/ID/Hook and other BSC projects that have received investment and listing support and Aero?

Putting aside the poor quality of the projects, which have long been criticized, these projects lack positive externalities and are relatively isolated. CBs one cent for Aero turns into three points of ecological incentives, while Binances ten cents are directly wasted, and it is easy to form a reverse screening for developers.

In fact, reverse filtering is already in effect, and developers have already started jumping ship.

The Thena team focuses on Bases new project IntentX, and Magpies new subDAO also focuses on the ETH system. Although a large portion of the subDAOs profits will eventually flow back to MGP on BSC, how can the main DAO stay on a chain that lacks synergy with other new subDAOs for a long time?

In summary, the main difference lies in

1. Coinbase has invested resources in projects that have positive externalities for the Base ecosystem. Every penny spent has a three-point effect. Resources are spent on high-quality developers to continue to attract high-quality developers to join.

2. Binance invested resources in the BSC project with no positive externalities, which wasted ten cents of money. Instead, it did more harm than good to the ecological projects with positive externalities, showing that it did not understand web3, causing high-quality developers to jump ship.

This article only uses ve(3, 3) DEX as an example to illustrate the problem. However, the problem reflected is representative.

Base does not issue its own coin. BNB has outperformed the market recently due to its frequent listings. However, the price increase of this coin still depends on imagination. If the chain can be made more flexible, BNBs room for growth can be further opened up. We will continue to evaluate and observe subsequent changes.

This article is sourced from the internet: Base is up, BSC is down: In-depth discussion of the on-chain gap between Base and BSC

متعلقہ: ٹرون (TRX) تجزیہ: یہاں ہے جب بحالی ریلی ہو سکتی ہے

مختصراً Tron کی قیمت کچھ عرصے سے $0.121 سے اوپر بند ہونے کی کوشش کر رہی ہے، اور مارکیٹ کے وسیع تر اشارے ایک ریلی کو متحرک کر سکتے ہیں۔ MACD اور ADX دونوں فی الحال ممکنہ آنے والی تیزی کا مظاہرہ کر رہے ہیں۔ فنڈنگ کی شرح نے گزشتہ 24 گھنٹوں میں ایک اضافے کو نوٹ کیا، جو امید پرستی میں اضافے کی تجویز کرتا ہے۔ Tron's (TRX) قیمت ممکنہ طور پر آنے والے دنوں میں مارکیٹ کے وسیع تر اشارے اور سرمایہ کاروں کی تیزی سے بڑھے گی۔ سوال یہ ہے کہ آیا TRX ریلی کو دیکھنے کا انتظام کرے گا یا یہ آدھے راستے پر رک جائے گی۔ ٹرون کے سرمایہ کار $0.118 پر ممکنہ ٹرون کی قیمت کی تجارت کو دیکھتے ہیں، بنیادی طور پر سرمایہ کاروں کی طرف سے کئی تیزی کے اشارے ملتے ہیں۔ یہ اثاثہ کی فنڈنگ کی شرح سے ظاہر ہوتا ہے۔ کرپٹو میں فنڈنگ کی شرح سے مراد مارکیٹ میں توازن قائم کرنے کے لیے تاجروں کے درمیان ادا کی جانے والی فیس ہے۔ مثبت…